From Prof. Anthony Sanders over at Confounded Interest, one of the best housing economics blogs out there, we get this story:

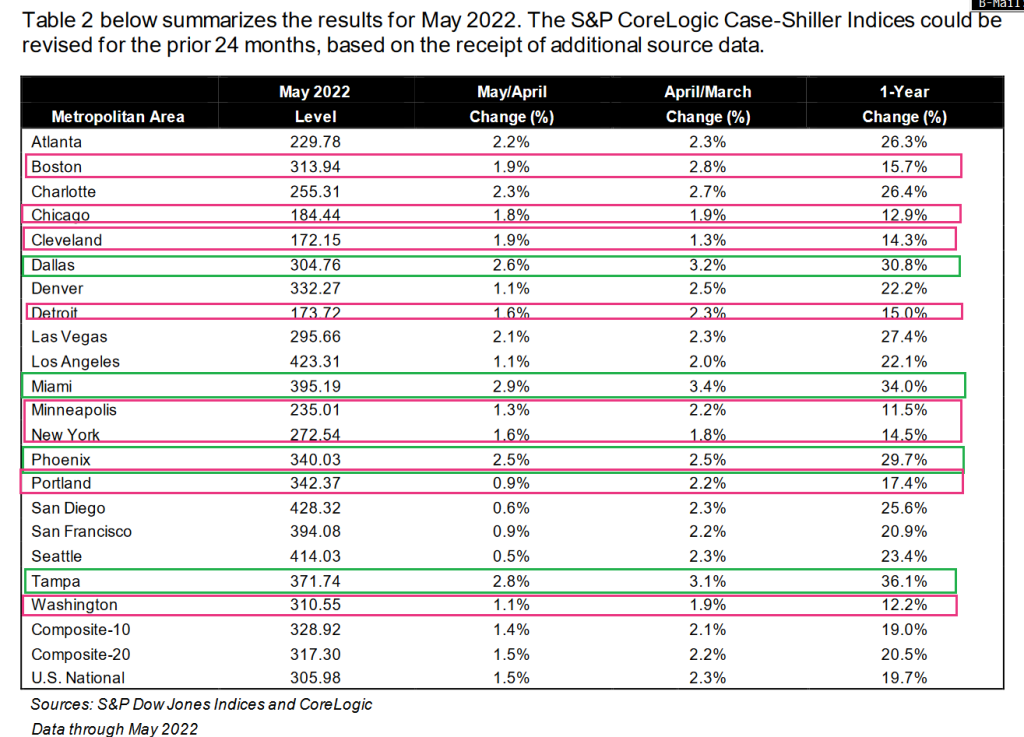

Miami, Tampa, Dallas and Phoenix (red states) are growing at over 30% YoY. Boston, Chicago, Cleveland, Detroit, Minneapolis, New York, Portland and Washington DC (blue states) are all growing at over 10% YoY. Cleveland is a blue city in a mostly red state while San Diego is a red city in an almost blue state.

And then we get this chart:

The green boxes showing 30% or more YOY price growth are all in red states. The red boxes showing half that, or less, in price appreciation are all in blue states.

We know why. I wrote about this in my COVID report back at the start of the pandemic, as real estate agents in relatively freer red states were noticing a flood of political refugees fleeing draconian lockdown measures in their blue states.

What I wonder is how long this will be allowed to go on.

One of the key metrics for housing affordability is Price-to-Income ratios. But the idea there is that you measure the median sale price of a home in an area and compare that to the median income of that area. One of the things that the Great Reshuffling has done is to throw that out the window. Now you’re taking the median sale price of a home in an area, but the median income of the buyer is likely from a far higher blue state/city.

For example, let’s take Tampa with its 36.1% YOY increase.

According to the Census Bureau, the median household income in Tampa in 2020 was $55,634.

From the same source, the median value of owner-occupied housing in Tampa in 2020 was $254,600, for a PTI ratio of 4.6. Not all that affordable (affordable is defined at 3x income) but not all that horrible.

In 2020, the median household income for Manhattan was $117,926. But that’s a bit misleading since young waiters in NYC restaurants aren’t making that kind of money. In the 25-44 year old demographic, the median income was $144,670. That makes Tampa’s Price to Manhattan Income ratio 1.75.

Is it any wonder that so many New Yorkers, who could afford to work from anywhere, fled to Tampa?

Now, according to Redfin, the median home sale price in Tampa today is $422,100. On 2020 median income levels, that is now 7.6 for Tampa workers, and 2.9 for Manhattan workers.

What that says to me is that the average working family in Tampa Bay area can no longer dream of buying a home in the city where they grew up, went to school, and had kids in. But the Manhattanite expat can still quite easily afford to buy a home in Tampa.

How long do you think the people of Tampa and the state of Florida will allow this to continue?

We’ve been seeing this sentiment in places like Idaho, Nevada, and Colorado for years now. “Don’t California my Nevada” is a common T-shirt you see around these parts. Supposedly it is inadvisable to have California license plates if you’re driving through parts of Idaho these days. All of that is mere grumbling today, but… politicians pay attention to local voters and their concerns. They wouldn’t remain politicians for long if they didn’t.

So that’s my question. Housing shows no sign of becoming more affordable. If you live in a less-expensive red state, you are quickly getting priced out in your own city, your own neighborhood, not by your neighbors but by carpetbaggers fleeing high-income blue states. That sort of thing tends to get people emotional. Then throw in the social and political divisions between red and blue.

Is there a Red Wall coming at some point? Unconstitutional or not, it seems illogical to think that locals wouldn’t start some shit to keep the wealthy “foreigners” out of their towns and neighborhoods. And that would pose a major dilemma for local REALTORS and their REALTOR Associations.

We live in interesting times.

-rsh

One of my fondest RE memories was being caught in the middle of a rolling gun battle while flying a drone over 5 acres in the “hinterlands” of the lowcountry. It was quite a spectacle, and I have long suspected it was staged to ward off the invading carpetbaggers. Can’t say I don’t sympathize.