One of my favorite economic and finance analysts is a green chicken. Yes, I’m referring to Doomberg, a team with strong backgrounds in energy and heavy industry, who started writing in May of 2021. They’re funny, super insightful, and filled with insider knowledge about commodities, energy, manufacturing, and finance. Their newsletter was free until recently, but I think it’s worth every penny. I recommend it very highly.

One of their most recent posts on crypto shows why the green chicken is so on-point.

For the TL;DR crowd: the crypto space is burning, and it should burn. This is what needed to have happened to global finance back in 2008, and we will hopefully see what creative destruction looks like. So please, please, please do not try to help me and other crypto investors.

Wen Bazooka?

The article is titled “Wen Bazooka” and it’s brilliant.

Doomberg starts by briefly summarizing the horrible precedent of government bailouts of the banks. Remember “Too Big to Fail?” Doomberg goes over that and concludes:

Conflicts of interests aside, the dangerous precedent was set. Over the next decade, authorities merely postponed a true (and necessary) financial reckoning, blew giant holes in the nation’s fiscal and monetary balance sheets, planted the seeds of the epic bubble currently deflating in the markets for risk, and shattered the belief – however tenuous it might have already been prior to that fateful week – that the American financial system was fair with risks accepted by those that take them. This belief was firmly decimated by the fact that only one top banker went to jail as a result of the global financial crisis of 2008-2009. By the time the 2019 repo crisis unfolded, the Federal Reserve didn’t bother with the need for pesky legislation to assume they could bail out Wall Street once again. This time, even the names of which institutions were saved by the funds have largely been kept from the public. Nothing shall stand in the way of socializing Wall Street’s losses. That genie is well and truly out of the bottle.

They then correctly point out that these bailouts of financial institutions by governments around the world, but especially the United States, led to Satoshi Nakamoto creating Bitcoin.

Doomberg then jumps ahead to the current crises in the cryptoverse: the collapse of Terra, the troubles at Celsius, the bankruptcy of 3AC and Voyager. Then Doomberg makes the bombshell claim (at least for crypto people):

When will the crisis pass? While impossible to say for sure, it seems to us that the crypto coast won’t be clear until the Tether issue is finally and fully dealt with.

It’s difficult to get into why Tether is such a big deal if you don’t know much about the cryptoverse. Suffice to say that Tether (USDT) is one of the earliest stablecoins, and the first to pioneer the “fiat-backed” stablecoin. The USD in USDT means that 1 USDT = 1 dollar, because each USDT is backed by 1 dollar’s worth of deposits. Think of it as a way of digitizing US Dollars without relying on the traditional banking system, which digitizes the US Dollar normally.

Most of the crypto swaps, investing, etc. would be very, very difficult to do without stablecoins and Tether is the largest USD stablecoin, followed by USDC and BUSD.

The trouble with Tether is that its holdings, you know, the actual US Dollars or equivalents (think short-term bonds and such), that are supposed to be backing USDT have never been audited. So Doomberg is absolutely correct to call it out.

But it’s the ending that is truly illuminating:

Despite the massive regulatory lapse on display and the significant damage being done to institutional and retail investors alike, the lack of publicly funded bailouts is the one bright spot that could eventually lead to interesting opportunities in the future. When crises are allowed to run their course, what rises from the ashes of destruction is battle-tested and deserving of a close look. We are the first to admit there are thousands of brilliant people working in the crypto space, interesting projects are underway, and the finance industry is ripe for significant disruption. This is also precisely why the stink of grift associated with the space is so frustrating. Until the fraud is cleaned up, the good stuff will be impeded from reaching its full potential.

Wen bazooka? If we want to see what long-term value truly lies at the heart of crypto, we should be glad none is forthcoming.

This is absolutely, 100% correct.

Please, please, please do not help us poor investors in crypto. We knew what we were doing, and if we didn’t, then we deserve everything the free market hands out to us.

Lack of Regulation in Crypto

In an earlier post, titled “Wen Fahrenheit?”, Doomberg called out the utter lack of regulation in crypto leading to chaos and losses:

In the crypto universe – and especially in the decentralized finance (DeFi) space – we are seeing in real time why regulations are crucial for properly functioning financial markets, and proof that regulators act far too slowly to prevent petty schemes from growing into systemically risky collapses. As we type this, tens of billions of “dollars” of investor capital are being pilfered or otherwise torched by blatantly obvious scams. With regulators scandalously absent from the arena, bad actors with questionable histories don’t even need to be creative – timeless fraud strategies wrapped in modern jargon seem to be working just fine. We are in the middle of an epic but predictable unwinding of some of the fastest-growing DeFi operations, and “investors” are discovering they are the marks in these dramas with precious few options for recourse. The most recent fiasco with Celsius puts the fate of one of the biggest names in the sector in jeopardy.

The post itself was a more in-depth excoriation of Celsius, the crypto lending platform that has imploded. But the above sentiment is both correct and in light of Wen Bazooka? somewhat irrelevant.

Remember Enron?

Well over a decade ago, my then-wife and I had a debate about careers. She thought that the smart thing to do was to get a job with a great solid company because of stability. I reminded her that at one time, Enron was the 7th largest company on the Fortune 500 with $111 billion in revenues. I reminded her that Lehman Brothers was one of the so-called bulge bracket banks at the top of the global financial system. Getting a job at either company was once the height of stability and success. Until it wasn’t.

My take then (as now) is that there is no such thing as stability in a job, unless the employer happens to be you, in which case the issue isn’t job security but straight up poverty.

Yes crypto is largely unregulated. So what?

Enron was not a failure of regulation. Enron was a publicly traded company subject to all of the numerous securities regulations, as well as a company working in the heavily regulated energy sector. As Doomberg said right at the top of the Wen Fahrenheit piece, quoting Warren Buffet, “You can’t make a good deal with a bad person.” Enron was a case of fraud and accounting shenanigans perpetrated by bad people.

Remember Bernie Madoff? He worked his entire career in a heavily regulated industry and ripped people off using heavily regulated securities instruments. Was that a failure of regulations? No. Did his victims get their money back because of regulations? No.

What about the Great Financial Crisis brought on by the collapse of the American Housing Bubble? Was that because housing and mortgage banking were not regulated or not regulated enough? I just rewatched The Big Short, and it seems to me that the problem had little to do with regulation and a whole lot more to do with (a) bad people, and (b) stupid risks.

Let’s Talk About “Investors”

Speaking of The Big Short… remember this scene?

The Big Short – The Scene With A Stripper

The movie that basically explains why 2008 recession happened.

I think we are supposed to know that this stripper lost all her money when her adjustable rate mortgages reset and she couldn’t afford payments on the five houses and a condo that she owned. She was a real estate “investor” during the Bubble years.

And just like Doomberg put the word “investors” in quotes above and calls them “marks in these dramas with precious few options for recourse,” that stripper was also a mark in the housing drama with precious few options for recourse. Banks got bailed out; “investors” like her did not. She just wasn’t Too Big to Fail.

Thing is… she lied on her mortgage applications, took on far, far too much risk, and chose to gamble. I suppose you could say that’s an “investor” but only if we torture the term beyond recognition.

In some of my recent posts and podcasts, I talked about how I’m invested in crypto. I haven’t even looked at my positions recently, but I’m sure I’m down probably 50% at least. But as I said in those posts and podcasts, I chose to put money into crypto that I knew I could afford to lose. I live in Las Vegas and I don’t hit the casinos, so crypto is my version of gambling. Plus, all my losses are paper losses and I haven’t used any leverage so… HODL works just fine for me. My investment theses remain solid.

If someone chose to put money they couldn’t afford to lose into crypto… I guess I’m wondering why that’s any different from putting money they couldn’t afford to lose on the roulette table at Caesar’s Palace.

Before You Make Fun of Crypto Investors…

Thing is, I’ve heard quite a bit of IToldYouSos from quite a few people about crypto. See, all that digital gobbledygook was just a ponzi scheme, they would say. Or something like, what did you expect when there is no inherent value to any of these coins?

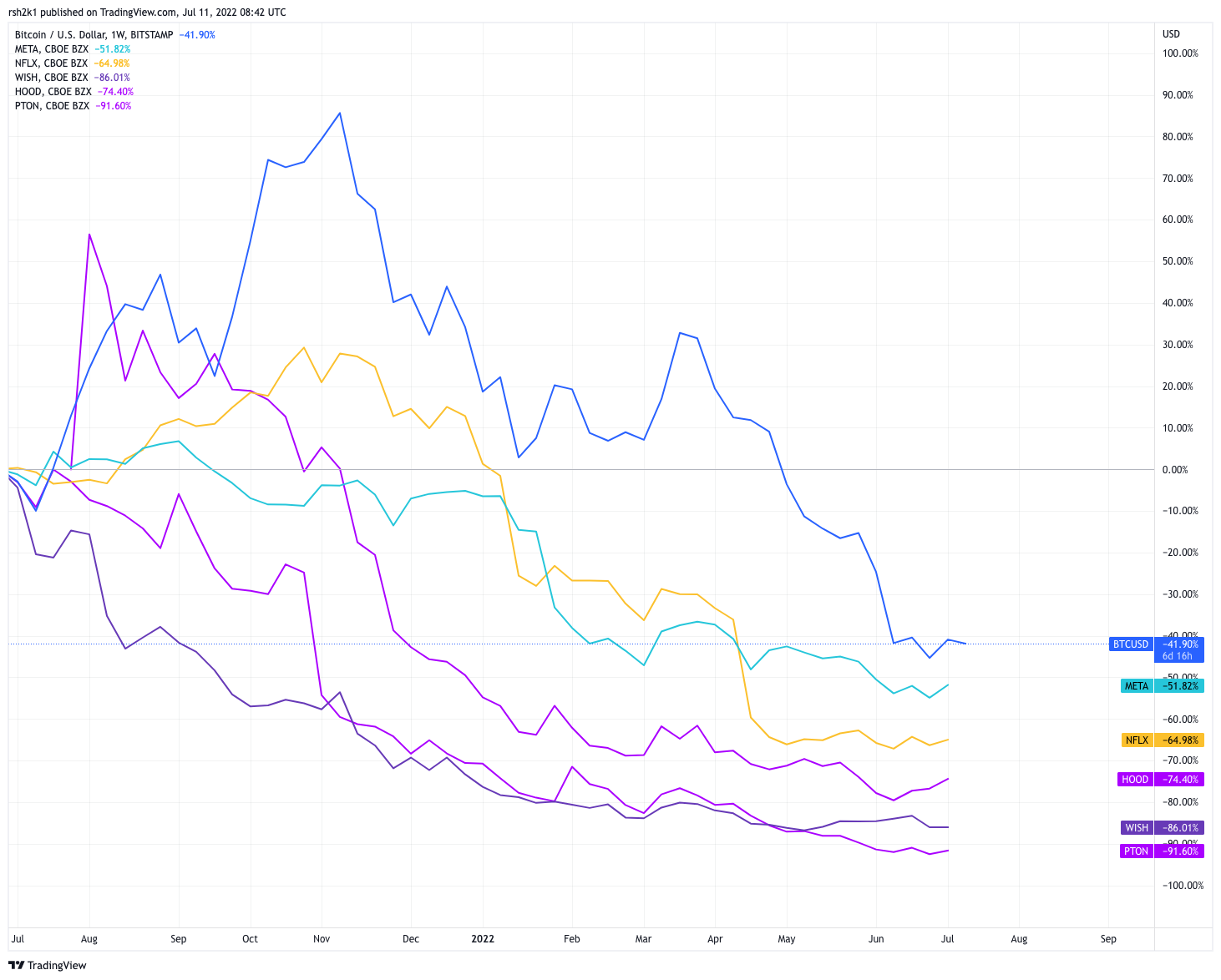

Before you go crowing in triumph however, consider this chart:

From July of 2021, BTC is down 42%. Because you know, it has no inherent value, and it’s just digital mumbo-jumbo. Strange then how such digital pile of bullshit with no inherent value has outperformed Facebook (Meta), Netflix, Robinhood, Wish, and Peloton isn’t it? I still know a dozen people or so who ride their Peloton bikes every week, if not every day, and thinks they’re amazing fitness devices. Down 92%.

An investor who put his life savings into Netflix — I mean, NETFLIX, the dominant streaming platform in the world — lost more than did the investor who put his life savings into Bitcoin. Neither should have put their life savings into either Netflix or Bitcoin, but… that’s how things have shaken out so far.

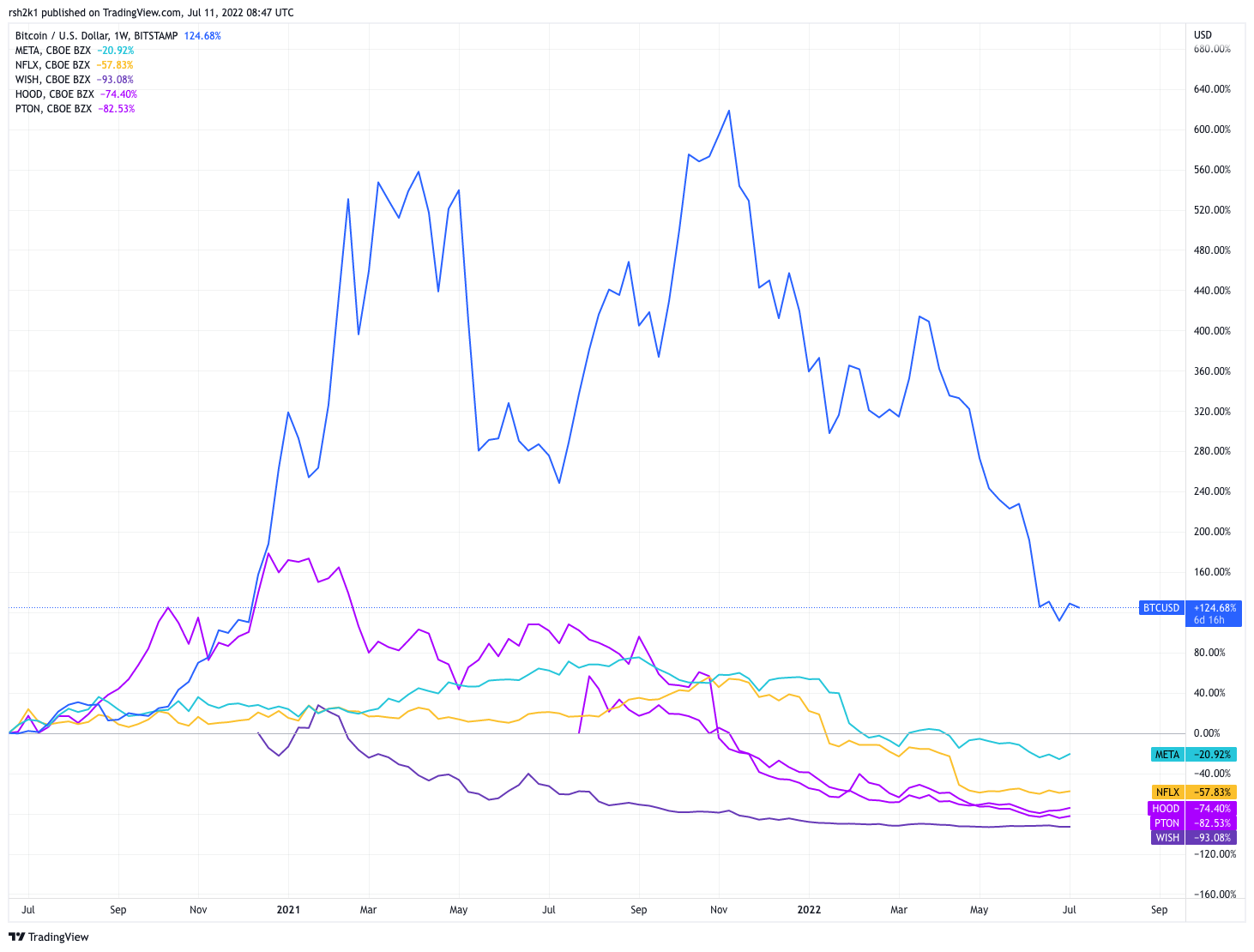

Zoom out one more year, to July of 2020:

Over a two year period, our lifesavings-into-Bitcoin investor is up 125%. All of those smart investors who put money into solid Fortune 500 companies like Facebook and Netflix are down huge.

Over that same period, S&P 500 went up 30%, meaning Bitcoin with no inherent value outperformed the S&P 500. What about bonds? If you had invested in VBMFX (Vanguard Total Bond Market Index Fund) then you lost 15.4%. Those are as safe as safe investments get.

The idea that regulations somehow protect investors is not borne out by the evidence. The idea that regulations will bring order and prevent fraud is not supported by history. Bad people will do bad things, and regulations neither prevent them from doing bad things nor recover losses for the “investor” who gets taken advantage of. Regulations might punish bad people who get caught, but they’re just like cops who show up too late to prevent your murder. Sure, the cops will arrest the murderer, but that’s precious little comfort for your friends and family.

There is no doubt that the cryptoverse has a ton of bad people doing bad things, and that a whole lot of “investors” are going to lose everything. There are precious few options for recourse.

But what are your options for recourse if you lost your ass on Netflix? What are they if you lose your life savings on Peloton?

Let It Burn

The only upside to the current crises in crypto is that as far as anyone could tell, there is zero appetite from governments to bail out these crypto firms or funds that have gone and lost billions in the name of “investor protection.” Because crypto is not big enough to pose a systemic threat, there is no Too Big to Fail in crypto. Not even Tether is Too Big to Fail. Let it burn. Let it all burn.

If we could have an alternate history where the governments do not bail out the Too Big to Fail banks from their mistakes, the Great Financial Crisis might have been worse and more painful… for a short period of time. Then once all of embers have cooled, we all would have started anew with a financial system worthy of trust and confidence. We might not have Bitcoin at all, and without Bitcoin, we might never have needed to have created blockchain and crypto technologies.

We certainly would not have some $30 trillion in national debt, global inflation running wild, and all of the associated problems of the early 21st century. If only we had let it all burn back in 2008.

Because the entire premise of Bitcoin (and some of the altcoins) is to stand outside the global financial system, to be money that is not under government control, to become a financial system that cannot be regulated no matter what you try, there is little chance that any public funds would be spent to bail out Celsius or 3AC or Voyager. Bad people who did bad things will suffer the consequences.

That means, however, that the good people doing good things, the “thousands of brilliant people working in the crypto space” will create and continue to create the next generation of finance. Some won’t make it, as collateral damage to the fires burning, but many will. And those who make it through the fire and flames will change the world for the better.

My only fear is that the government will try to help with regulations. As Reagan said, “The nine most terrifying words in the English langage are ‘I’m from the government and I’m here to help.'” Please don’t help us. That will help us far more.

-rsh

DragonForce – Through the Fire and Flames (Official Video)

🐲🎵 New album ‘Warp Speed Warriors’ OUT NOW! Order Physical Copy ► https://lnk.to/DragonForce-WarpSpeedWarriors 🌏 EU Tour Aug 2024 + special guest Nekrogoblikon 🎟️ Complete Tour Dates, Tickets & Limited VIP Upgrades: https://dragonforce.com/shows/ DragonForce Through the Fire and Flames is the platinum selling record of the album ‘Inhuman Rampage’.