It appears that Opendoor has preemptively caved in to the Federal Trade Commission, agreeing to a consent order. As is usually the case, the Complaint was filed along with the Consent Order agreement earlier today.

I initially thought, “Oh wow, this is bad for Opendoor.” Then I read the Complaint and the Consent Order, and while I do not pretend to know every detail, I think I have a decent picture of what happened, what this settlement means for Opendoor, and where Opendoor (and iBuying) goes from here.

Let’s put it this way: Opendoor is day drinking at the Wildcats, sucking real bad at Mariah Carey-oke.

The Complaint & Consent Order

You can find the Complaint here, and the Agreement Containing the Consent Order here.

In summary, the FTC is alleging that Opendoor lied about a bunch of stuff. There is only one count in the Complaint for “False or Unsubstantiated Claims.” Under that claim, there are basically two big items:

- Opendoor did not make market value offers; and

- Opendoor overcharged for repairs and kept the difference.

The blogpost/press release from the FTC says that an FTC investigation uncovered the truth, but that doesn’t say how long the FTC has been investigating Opendoor, so I have no idea how long they’ve been at it. Nonetheless, what the FTC sets out (and Opendoor agreed to) is a bunch of evidence that Opendoor did screw up, and knew it.

The heart of the accompanying Consent Order is as follows:

IT IS ORDERED that Respondent, and Respondent’s officers, agents, employees, and attorneys, and all other persons in active concert or participation with any of them, who receive actual notice of this Order, whether acting directly or indirectly, in connection with the advertising, promotion, offering for sale, or provision of a Real Estate Service, must not:

A. Misrepresent, expressly or by implication, or assist others in misrepresenting, expressly or by implication:

- that consumers will receive more money using a Real Estate Service than they would using a different good or service;

- that consumers will save money;

- that consumers will receive a price for their homes equivalent to what they would likely receive by listing their homes on the market;

- the amount of repair costs consumers will pay;

- that consumers will save money on repair costs;

- that any offer to purchase a consumer’s home is an accurate and unbiased projection of that home’s market value; and

- that the person or persons offering any good or service do not expect to make money from reselling homes;

B. Make any representation, expressly or by implication, or assist others in making any representation, expressly or by implication, regarding the costs associated with listing a home for sale traditionally, including agent commissions, home overlap costs, closing costs, seller’s concessions, repair costs, staging, or prep-work costs, unless the representation is non-misleading, and, at the time such representation is made, Respondent possesses and relies upon competent and reliable evidence to substantiate that the representation is true; and

C. Make any representation, expressly or by implication, about the costs, savings, or financial benefits of any Real Estate Service, including representations about the amount of money a consumer will receive from using a Real Estate Service, unless the representation is non-misleading, and at the time such representation is made, Respondent possesses and relies upon competent and reliable evidence to substantiate that the representation is true.

Of course, the headline that the corporate media will highlight is the $62 million fine to be paid to the FTC. That’s not the important thing in this Settlement, but it gets the attention.

So, What Happened?

Since the Agreement stipulates that the “facts alleged in the Complaint will be taken as true,” I’m going to assume that Opendoor will not contest the facts. Perhaps additional information will come to light at some point, but for the purpose of this analysis, I have to go by what the Complaint alleges.

Opendoor Made Lowball Offers

First up is what may be the biggest problem: Opendoor did not make market value, but below-market value offers. The most damaging perhaps is the fact that Opendoor made offers below what its much-vaunted valuation algorithms came up with. As the FTC put it, “Opendoor took various steps to reduce offers below what their internal valuation system deemed to be a home’s market value.”

The FTC brought receipts.

In 2018, Opendoor put a policy into place to lower the offer to cover anticipated repair costs. That is on top of what Opendoor asked for repair concessions (more on this below).

In an exact opposite of Zillow Project Ketchup woes, Opendoor employees manually adjusted offers to be lower than what the AVM suggested.

In June of 2019, Opendoor instituted “risk-based pricing” policy to reduce offers based on what they thought the risk of resale was, but failed to disclose that to consumers:

Consumers had no reason to know that Opendoor had reduced their offers through the means described in paragraphs 33-36. Opendoor promoted the offers as “market value,” its price comparison chart showed the same price for Opendoor’s offers and market offers, and Opendoor did not disclose these reductions thereby masking its higher costs compared to market sales and competitors.

And the FTC goes on to list a number of Opendoor’s internal analyses and internal emails that show its offers were below market. Perhaps the fatal paragraph:

The company also understood more generally that its offers were below market. A presentation in 2016 noted that “[s]ellers that [sic] reject OD offers make more on the open market than their OD offer.” In 2019, another internal communication stated bluntly, “We don’t offer a fair market value to our customers.”

Opendoor’s Problematic Repair Demands

In addition, the FTC found that Opendoor charged for repairs that sellers would not have needed to make in a traditional sale (please note that the original document was redacted, so the “XX” represents the redacted text):

44. Opendoor has almost always demanded consumers make or pay for repairs. Although its marketing has suggested that the company may not require any repairs, as of February 2020, Opendoor had demanded repairs for XX percent of homes on which Opendoor had made an offer. Opendoor’s internal study of sellers who withdrew after receiving repair demands showed that those who sold on the market did so without making all the repairs that Opendoor demanded.

45. As part of the repair process, Opendoor has sent consumers a list of required repairs with the cost it would charge consumers if they agree to deduct the costs from their sales proceeds. The list of repairs has been typically well beyond what consumers would be responsible for in a market sale. Opendoor has routinely requested upgrades to, or replacement of, functional heating and cooling systems, flooring, and roofs. It has also frequently demanded cosmetic changes such as repainting and replacement of items that could be repaired at far lower cost.

46. According to Opendoor’s own internal study, as of March 2019, Opendoor demanded repairs that cost, on average XXXXXX. The same study concluded that, in a traditional sale, consumers spend less than XXXXX, with an average of XX or less than XX percent of the average purchase price. A separate internal study found that Opendoor’s “repair ask” is XX percent of the purchase price. Another internal survey examining consumers who cancelled after learning of Opendoor’s repair assessment found that over XX percent of them sold their homes without paying for any repairs and concluded that Opendoor’s “repair asks are NOT in line with market.”

47. Unlike traditional sales, Opendoor demanded that consumers make or pay for all demanded repairs, even though Opendoor’s own studies indicate that the parties to a market sale typically share these costs. The repair demands were not subject to negotiation.

Even worse, Opendoor implemented an “Estimated Repair Credit” in making offers and then kept the money if repairs ended up costing less than the estimate:

49. In or around August 2018, Opendoor implemented an “Estimated Repair Credit,” which surreptitiously reduced offer prices to cover some of the repair costs. Opendoor never disclosed this “credit,” and continued to describe its offers as representing the company’s best estimate of market value without any adjustment.

50. Opendoor encourages consumers to authorize it to perform the repairs and to deduct the costs from the net proceeds of the sale rather than arrange for the repairs themselves. The company has emphasized the convenience of deducting the repair costs and, as described above, suggested that the proposed repair costs are discounted and therefore less than what the consumer would pay on the open market.

51. If the consumer decides to authorize Opendoor to complete the repairs and deduct the estimated costs from the sale proceeds, Opendoor completes the repairs after it acquires the property. If the repairs cost less than the amount deducted, Opendoor retains the excess as profit, including the undisclosed Estimated Repair Credit that Opendoor deducted from its original offer. One internal study found that for XXXXX of Opendoor’s purchases, its deductions for repair costs were greater than Opendoor’s actual costs, thereby “taking away XXXX of seller equity” in each of those sales.

Not good. At all.

From these two core wrongdoings (and there are other smaller problems, like claiming thousands on staging and prep work) flow the rest of the misrepresentation that the FTC went after.

Water Under the Bridge?

Opendoor released a brief statement about the settlement. The only real relevant part is this:

Importantly, the allegations raised by the FTC are related to activity that occurred between 2017 and 2019 and target marketing messages the company modified years ago. We are pleased to put this matter behind us and look forward to continuing to provide consumers with a modern real estate experience.

I think Eric Wu and team will need to explain the various ways in which this messaging and these practices — like manually modifying suggested pricing — are in the past. Eric Wu in particular can’t blame a predecessor, so he’s got some explaining to do.

It does look as if Opendoor has been cleaning up its messaging, as if they knew this was coming from the FTC. For example, you can’t find the phrase “market value” or “market price” on the current Opendoor website. Instead, you get, “competitive offer” or “competitive price.”

Another example, which I find relevant because the date of the article is December 8, 2021, is from the FAQ on comparing the traditional sale to selling to Opendoor:

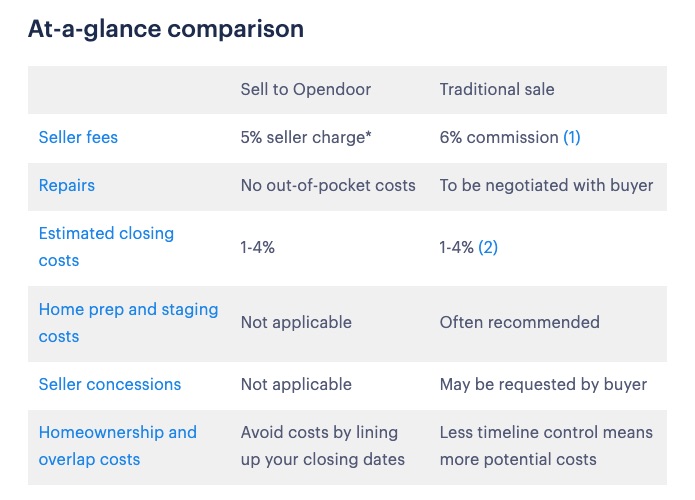

In the older comparison chart cited by the FTC, Opendoor put 6% for agent commissions, 2% for seller concessions, and 1% for overlap. The FTC took them to task for those, so now Opendoor puts in references to those and puts in a range, and says seller concessions “May be requested by buyer.”

So yeah, this might be Opendoor paying a $62 million ransom to .GOV to put the headache behind them, since they have already moved on from the problematic messaging (aka, false claims, aka, lying).

Resale Gains

Far more problematic for Opendoor is the fact that it often sells homes it buys for more than it paid.

Under “Is Opendoor a home flipper?” in the FAQ, we get this:

Rather than a buy-low, sell-high investment strategy, our business model is fee-based. Our service charge takes into consideration how long we predict it will take to resell your home. We take on the risk and holding costs of owning the home so our customers have the certainty of a competitive offer and the flexibility to move when they’re ready. Currently, our service charge is a flat fee of 5%.

This was an area that the FTC homed in on:

Opendoor claimed that it did not make money from “buying low and selling high,” but from “charging a fee for [its] service.” But gains from selling homes for more than its offer price are a key contributor to its revenue. A 2019 financial analysis broke down revenue from Opendoor’s fee and from “net resale gain” and reported over XXXXXXX in resale gains in 2018 and XXXXXX in projected resale gains in 2019. Presentations to investors touted “resale gain” as a significant contributor to Opendoor’s revenue per home.

Please note that #7 of the Consent Order specifically says, “the person or persons offering any good or service do not expect to make money from reselling homes.”

The problem is that analysts from yours truly to Tyler Okland at Datadoor.io, to Mike Delprete all have noted the spread between Bid and Ask: the price at which Opendoor buys homes, and the price at which it sells them. Delprete, for example, noted in June that Opendoor’s spread fell from 17% in March to 7.3%. But for the FTC, the fact that a spread exists at all could be a problem.

With recent 20% YOY price gains (and higher in some markets), the holding period between purchase and sale could account for a lot of that spread. The repairs that Opendoor does could also account for some of the spread. So there are reasonable, non-problematic explanations for why Opendoor generates gains on resale… but .GOV is not known for its perspicacity, understanding of details, or running profitable enterprises.

So at a minimum, Opendoor had best document that whatever they paid was a “competitive price” at the time they paid it to the seller and that any resale gains are the result of home price appreciation (over which Opendoor has no control) and possible repairs/improvements.

What the Settlement Means

On the one hand, the Settlement means very little. If the problems stemmed from before 2019, and Opendoor has already addressed them, then it’s a case of “pay off the bastards and get them off my back” situation. $62 million isn’t nothing, but it is 2.2% of the $2.8 billion Opendoor had in cash at the end of Q1.

Sure, Opendoor has additional regulatory burdens, has some reporting requirements, has some advertising/marketing requirements, and some annoyances to deal with… but they’re just that: annoyances. If the problems really are behind Opendoor, then this is a mere bump in the road, the marketers and advertising copywriters have additional work to do, and legal will be all up in their business about marketing copy.

Business goes on.

The stock might take a hit, but… today’s trading doesn’t suggest that. I found it amusing that Bloomberg wrote an article at 11:20am that Opendoor’s stock fell after being hit by the FTC, but by the time the article was actually published, the stock had regained all of the losses from the morning. We’ll see what the next few days, especially after Opendoor reports 2Q results, shows.

On the other hand… we now have the United States government saying “Consumers typically lost thousands selling to Opendoor.” That message will absolutely, with 110% certainty, be amplified by the traditional industry.

I kinda doubt things stop there. This feels a bit like when Zillow exited iBuying saying that their algorithms were inaccurate. Even now, almost a year after Zillow’s exit, you find people on social media saying Zillow can’t do math. In a way, the PR and brand hits were more significant.

Opendoor did agree with the government that at a minimum, from 2017 to 2019 (as Opendoor itself said), it was lying to consumers about pricing, about repair costs, and about not being a buy-low-sell-high flipper. Once you admit to telling lies, once you admit to making false and unsubstantiated claims, it’s going to be tough to shake that when every single one of your enemies is chanting “liar, liar pants on fire.”

Now, to be fair, Opendoor settled without admitting a damn thing, which is normal for these kinds of consent orders and for legal settlements in general. As Opendoor said, they “strongly disagree with the FTC’s allegations” but… to consumers, to agents, to bystanders… such strong disagreements without fighting and protesting one’s innocence doesn’t really play.

Perhaps it doesn’t matter since Opendoor has pivoted to “competitive offers” and they’re playing up the convenience angle much more in their marketing. iBuying has shown (indeed, Opendoor’s results to date have proven) that consumers are willing to pay for convenience. FTC’s outrage that consumers lost thousands of dollars by selling to Opendoor might fall on deaf ears, since most consumers who did sell to Opendoor likely knew they were giving up thousands of dollars, but didn’t care because they were getting certainty and speed. But it really sucks for Opendoor to admit to lying to consumers for two plus years.

Whither Opendoor (and iBuying)?

So where does Opendoor, and by extension iBuying, go from here?

As you likely know, I’m about the biggest Opendoor bull out there because I’m the biggest iBuying bull. Well, I might have lost that title to Tyler Okland now, but still… I’m very, very bullish on iBuying. I remain long OPEN and might add to my bag if the markets get skittish because of the FTC action.

Please keep in mind that this is from less than a day’s thought. Plus, I’m not a financial advisor so this isn’t financial advice of any kind.

I think this is a storm in a teapot. The FTC was ordered by President Biden to do something about real estate. It can now say that it did, and Lina Khan now has $62 million pelt on the wall. But if Opendoor has already pivoted away from the problematic messaging, then there can’t be any further consequences to the core business.

The allegations all have to do with how Opendoor sold its services. The restrictions all have to do with how Opendoor may sell its services…but if you read them carefully, they’re really not that big a drag.

Opendoor can’t say the seller will net more with Opendoor. Okay, they stopped doing that a while ago.

They can’t say the seller will save money. I don’t think there’s a single person in the United States who ever sold to Opendoor thinking they were going to save money, when Opendoor’s fees were so high to begin with. Remember that for the entirety of Opendoor’s existence, agents have told people, “You’ll lose money by selling to an iBuyer; you pay for convenience.” And thousands of homeowners said, “Yep, I’ll pay for convenience.”

Opendoor can’t claim to pay “market value.” Okay, they’ve already pivoted to “competitive offer” — a term which means very little, but that’s kind of the point.

Opendoor can’t “misrepresent” how much repairs will be. I guess Opendoor can provide contractor estimates going forward? Don’t know how big a deal this will be. Can’t claim sellers will save money; is it that big a deal not to claim that? As far as I can tell, “You don’t have to do repairs” is pretty powerful enough for anybody selling to Opendoor.

The “big one” of the resale gains… it turns out, all that Opendoor has to avoid saying is that they do not expect to make money on the resale. So if Opendoor just says, “Hey, we’re gonna pay you this here competitive offer today, and we expect to make some money when we resell it a couple of months from now” then they’re in the clear.

Do consumers really care what the new owner does or does not do after they’ve cashed their checks from said new owner? I don’t know, but I kinda doubt it.

Nothing in the FTC’s order goes to the core operations of Opendoor’s business: buy at Bid, do some repairs and stuff, sell at Ask. Make tiny margins.

Yes, real estate agents and brokers got another talking point against Opendoor. But Opendoor really hasn’t been fighting agents and brokers. Opendoor historically has played nice with agents and brokers, paid them all on time, paid referral fees, joined the MLS from the beginning, etc. etc. They’ve not rocked the boat at all. And agents and brokers have been telling consumers, “Opendoor is rippin’ ya off!” for years now and those who want the speed and certainty do it anyway.

Ultimately, the focus on “how much money Opendoor made” or “consumers lost thousands of dollars” is just a distraction.

Opendoor from the beginning has been about fixing a broken transaction process. I maintain that it has always been about mortgage, not about market making. And we’re about to hear how Opendoor’s mortgage did in 2Q earnings. And the process has been so broken that most consumers who sold to Opendoor did so knowing they were leaving thousands of dollars on the table.

But good of the FTC to look out for their interests, LOL:

All money paid to the Commission pursuant to this Order may be deposited into a fund administered by the Commission or its designee to be used for relief, including consumer redress and any attendant expenses for the administration of any redress fund. If a representative of the Commission decides that direct redress to consumers is wholly or partially impracticable or money remains after redress is completed, the Commission may apply any remaining money for such other relief (including consumer information remedies) as it determines to be reasonably related to Respondent’s practices alleged in the Complaint. Any money not used is to be deposited to the U.S. Treasury. Respondent has no right to challenge any activities pursuant to this Provision.

$62 million is a lot of money. But it would likely cost Opendoor more than that just for legal fees to fight this. That likely drove the decision more than anything else.

Let’s see what Thursday brings. I think Opendoor is just straight stuntin’ ya, but we’ll find out if they really do it like that or not.

-rsh

Katy Perry – This Is How We Do (Official)

Get “This Is How We Do” from Katy Perry’s ‘PRISM’: http://katy.to/PRISM Katy Perry Complete Collection on Spotify: http://katy.to/SpotifyCompleteYD Katy Perry Essentials on Apple Music: http://katy.to/AMEssentialsYD Watch your favorite Katy videos on YouTube: http://katy.to/MusicVideosYD Follow Katy Perry: Website: http://katy.to/WebsiteYD Instagram: http://katy.to/InstagramYD Twitter: http://katy.to/TwitterYD Facebook: http://katy.to/FacebookYD Official video for Katy Perry’s “This Is How We Do” directed by Joel Kefali and produced by Jason Colon, Danny Lockwood & Danielle Hinde.