A while back, I put up a short little tweet with just pure data, because I found it interesting:

Robert Hahn on Twitter: “2022 might come in at 5.12 million existing homes sold (July data, seasonally adjusted). At the end of July, there were 1.58 million REALTOR members of NAR.In 2000, 5.04 million existing homes were sold. At the end of 2000, there were 766K REALTOR members of NAR. #Hmmmm / Twitter”

2022 might come in at 5.12 million existing homes sold (July data, seasonally adjusted). At the end of July, there were 1.58 million REALTOR members of NAR.In 2000, 5.04 million existing homes were sold. At the end of 2000, there were 766K REALTOR members of NAR. #Hmmmm

My initial #Hmmmm was just thinking about why REALTOR numbers have doubled but the actual number of homes sold remained relatively flat over 22 years. I was thinking about technology advances that improved efficiency, like the internet and email and digital signatures and such.

But that tweet got a bunch of responses, most of them doing things like pointing out that because home sale prices were dramatically different in 2022 vs. 2000, the increase in membership made sense. It didn’t make sense to me, but that’s hardly the point now. The responses did, however, get me to think further and dig more and see if I did in fact have a point.

I do now, partly thanks to one of the commenters pointing me to this study from a couple of scholars with the National Bureau of Economic Research — you know, the folks who declare a recession. Plus, The Butters Report (which I uploaded here) has several pages on the issue of social waste as well… from the 1970s. So this is not a new problem.

We’re going to get into the weeds. Normally, something like this is VIP – only because of the work I had to do getting the data, reading the paper, etc. etc. but I’m going to make an exception because the issue is of such wide importance and relevance to the residential real estate industry as a whole.

For the TL;DR crowd, I’ll give you the bottomline. The number one way to benefit REALTOR members is the reduce the number of REALTORS. So many of our problems as an industry is because of social waste from too many people becoming real estate agents. Accordingly, I am now of the opinion that (some) REALTORS should embrace and look forward to the coming disruption to commissions from lawsuits, the DOJ and the FTC. The main beneficiary of those changes might actually be the REALTORS themselves.

Let’s get into it.

The Data

We begin with the data. Everything in here is from public sources, such as NAR, HUD, and the Census Bureau. The original spreadsheet can be found here in case you want to do your own analysis.

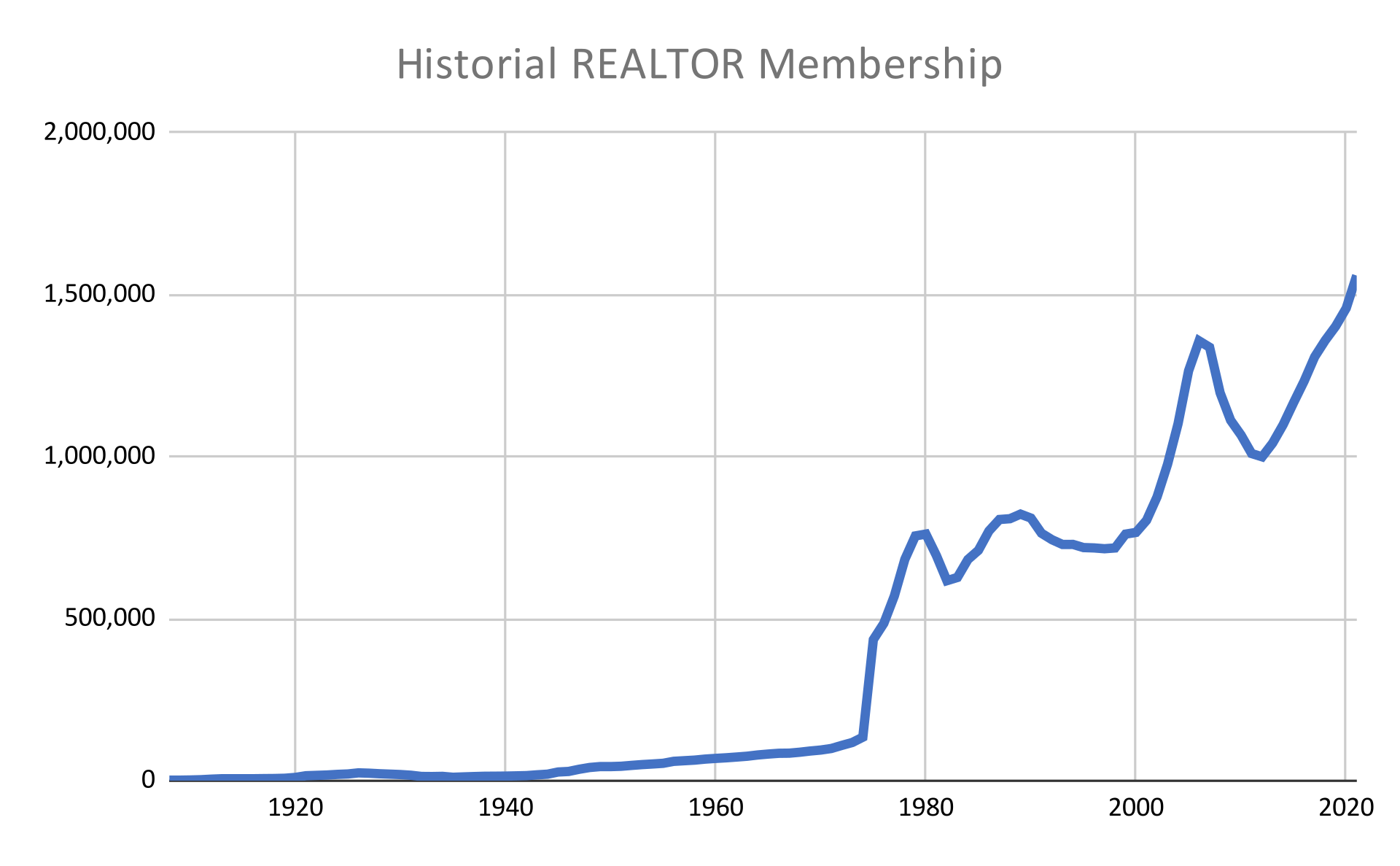

Let’s start with a simple chart: number of REALTOR members over the years.

I know it’s a bit difficult to make out, but that’s all right. I’ll have the numbers for you below.

What we see is how flat the growth was for most of NAR’s history — to be precise, up until 1975. But there is a good explanation.

NAR did not allow salespersons (agents) to become REALTORS until 1973, and the new policy was really put into place in 1974. Prior to that date, only principals (broker-owners) could become REALTORS. (I do not know if agents affiliated with that broker had any status with NAR, but if you do, please let us know in the comments.) So the jump from roughly 130K REALTORS in 1974 to over 430K in 1975 is likely attributable to that single change: allowing agents to become REALTORS.

The next big leap in membership numbers occurs from 2000 to 2006, when NAR membership nearly doubled from 766K to 1.4 million. We all know why: the Bubble was inflating during that time, and it was a gold rush into residential real estate. Fed money-printing post-9/11 and the Dotcom Crash resulted in the housing market going absolutely nuts. We all saw the movie, read the book, and many of us lived through those years.

The ensuing collapse resulted in the Global Financial Crisis and drove REALTOR numbers down from the high of 1,357,732 in 2006 to 999,824 in 2012. The real estate market recovery from 2011 onwards, bringing more and more people into the industry once again, gives us today’s membership numbers of nearly 1.6 million REALTORS.

One result, of course, is that NAR is the most powerful trade organization in the country if not the world. It is a perennial power player in Washington DC, and REALTORS are political powerhouses in state capitols and city halls.

The Downside of Numbers

The downside is pretty simple and straightforward: productivity suffers. Only so many homes are sold in the United States in a given year. And home sales numbers are driven by macroeconomic factors more than anything else. So let’s look at that data:

As you can see, existing home sales remained between 2 million and 4 million from 1975 to 1995, with an average of 3.25 million. That’s 20 years. From 1996 to 2021 (25 years), which includes the Real Estate Bubble, existing home sales ranged between 7 million in 2005 to 4.1 million in 2008, with an average of 5.25 million.

In 2021, a record-setting hottest of the hot housing market year, there were 6.12 million homes sold, a 147% increase over 1975. What’s more, the median home price in the U.S went up in real dollar terms (1975 dollars) by 116.4%, resulting in a per-REALTOR Sales Volume 585% more than in 1975 in nominal terms.

The problem is that there were also 1.6 million REALTOR members in 2021, a 258% increase from 1975. So the average REALTOR did 7.8 transactions in 2021, versus 11.4 in 1975.

What is more problematic is that the REALTOR of 1975 did 11.4 transactions on average with none of the time-saving technology we enjoy today. There was no internet in 1975. No fax machine. No one but scientists had computers; Microsoft was founded in April of 1975. The MLS was all in printed books. Lockboxes didn’t even exist; agents picked up keys from the listing office. Those REALTORS likely didn’t even have FedEx, since that company was founded in 1971. There was no Zillow, no Realtor.com. Newspaper classifieds, geographic farming, and yard signs were the kings of lead generation. And yet, with those limitations, the average REALTOR did 11.4 transactions a year.

The REALTOR of 2021 with all of the technology, all of the time saving tools, with online leads, with CRM tools, and all of the other innovations did 7.8.

But… the past is a foreign country. It might be unfair to compare 2021 with 1975. The rules were different in 1975; you could do things then that you cannot today. Society was different. The world was different. Except… here’s an excerpt from the 1983 FTC report on the residential real estate industry, “The Butters Report”:

Rather, statistics on licensing trends indicate a tremendous growth in the number of brokers and salespersons in the industry, and suggest that the average broker may be handling fewer successful transactions per year.

Brokerage productivity, measured as transactions per licensee per year, declined through 1980 as a result in large part of an influx of new entrants….

Inefficiently high brokerage commissions may have serious consequences both for consumers and for the industry.

Maybe the past isn’t that foreign a country for us, because we really haven’t changed as an industry all that much since 1975.

Nonetheless, to completely eliminate ancient history from the analysis, let us look at the past ten years, from 2011 to 2021. The additional advantage of looking at just the past 10 years is that we avoid the weirdness that was 2001 to 2011: the Real Estate Bubble and the ensuing Collapse.

2011-2021

By 2011, modern real estate as we know it today was in full bloom. Many of us were working in real estate in 2011. Some of the innovations we have today, such as iBuying, did not exist in 2011 but none of us would have found the world of 2011 a strange old world. Buyer agency existed (it did not in 1975), all of the post-Bubble regulations on mortgage existed, the CFPB existed, etc. etc. The practice of real estate really has not changed that much in ten years. So what do the numbers look like?

What we see in contemporary real estate over the past ten years is a story of recovery from the Bubble. There were 4.26 million homes sold in 2011 as the housing market recovered. And of course we know about the craziness that was 2020 and 2021, which ended with 6.12 million homes sold at the highest median sales price ever.

Adjusting for inflation, we see that homes in American got far more expensive over the years. In 2011 dollars, the median home went from $166K to $290K, an increase of 75% over the ten year period. Accordingly, Sales Volume per REALTOR went up by 63% over the ten years in real terms, which means that GCI per REALTOR also went up 62.7% over the ten year period. Those are solid gains by any measure.

Trouble is, REALTOR numbers also went up significantly over the ten year period, going from just over 1 million to almost 1.6 million, an increase of 55% over ten years. The transactions per REALTOR trend bumped up for first three years, then steadily headed down.

Look across that table. What numbers can the real estate industry actually control?

Not home sales — those are strictly a function of macroeconomic forces, as we all are learning oh so personally and oh so painfully in 2022 as the Fed hikes rates to crush inflation, and pushing housing into a recession if not worse.

Not home prices — those are also a function of macroeconomic factors, as well as homeowner willingness and home buyer demand. We control neither, although one could argue that maybe some agents are so talented as to talk a homeowner into selling when he wasn’t thinking about it. Maybe, but I kind of doubt that.

Looking across the table, it turns out that the industry only controls two factors: Commission Rate, which influences GCI, and the number of REALTORS. And frankly since there are huge antitrust concerns especially these days around the commission rate, and NAR has a history of actually setting commission rates (see, United States v. NAREB, 339 U.S. 485 (1950)), I really don’t think the industry wants to get in the business of trying to control commission rates, even if it is to drive them lower. Any such effort is likely a violation of the Sherman Antitrust Act. Quoting from the decision just cited:

Price-fixing is per se an unreasonable restraint of trade. It is not for the courts to determine whether in particular settings price-fixing serves an honorable or worthy end. An agreement, shown either by adherence to a price schedule or by proof of consensual action fixing the uniform or minimum price, is itself illegal under the Sherman Act, no matter what end it was designed to serve.

So the only thing the industry actually controls, specifically the only thing that NAR actually controls, is the number of REALTORS.

Given that, let me present three alternative scenarios for 2011 to 2021.

One scenario is one where NAR in 2011 takes a series of actions to keep membership numbers at the same level as in 2011. The second is one where NAR sets out to actually decrease membership by 2% per year through slow attrition. The third is one where NAR decides to get aggressive about membership, dramatically raising the bar to remove 5% of members every year. Let’s see what the effect of changing only the number of REALTORS is in each scenario.

The Steady As She Goes Scenario

Simply by keeping membership numbers static, we see that by 2021, the average REALTOR would have done 12.1 transaction sides, $3.5 million in volume in real inflation-adjusted terms, and perhaps most importantly, the GCI would have come in at $127,510 in nominal terms and $105,619 in real terms — an increase of 151% over the ten year period.

Slow Attrition Scenario

This next scenario assumes that NAR puts in place a series of policies and rules to slowly decrease the number of REALTORS over time, primarily through attrition and higher standards to become a REALTOR in the first place. It’s a tragic fact of life that all people must die, and most of us retire before we get to that point. So as REALTORS lay their lockboxes and cell phones aside, NAR simply refuses to recruit many more. On net, then, we look at decreasing membership by 2% a year over ten years.

The impact is that the average REALTOR by 2021 would have done 14.8 transactions, $5.2 million in Volume ($4.3 million in real terms), and made $156K in GCI ($129,265 in real terms). That is a 207.5% increase in income over ten years.

NAR would remain by far the largest trade organization in the country at over 825,000 dues-paying members and likely retain most of its political prowess.

Aggressive Bar Raising Scenario

Final scenario, the idea is that NAR decides to embrace an aggressive campaign of demanding far more from its members in terms of professionalism, ethics, and stewardship. It adopts a new culture of actively trying to remove bad apples from the REALTOR ranks and making it significantly more difficult for new licensees to join the REALTOR ranks. Maybe they adopt an apprenticeship requirement, as do appraisers, or a more stringent educational requirements, as lawyers or accountants might have. Or maybe both, like say… hairdressers. The end result is that NAR would shed 5% of its membership every year on net, removing many and allowing in few.

The impact is that the average REALTOR by 2021 would have done 20.1 transactions, $7 million in Volume ($5.9 million in real terms), and made $213K in GCI ($176,403 in real terms). That is a 320% increase in income over ten years.

NAR would still be a very powerful organization with over 600K members, although possibly less powerful than an NAR with 1.6 million members. But those 600K members would be averaging $200K in GCI.

Now… consider this… the average Redfin agent does over 30 transactions annually. Granted, Redfin has certain kinds of institutional support and technology systems that many other brokerages don’t have, but even with that said… is it really that unreasonable to think that the REALTOR of 2021 with all of the technology at her fingertips, all of the automation, all the support teams available from her brokerage or her team, could do 20 transactions a year?

I know of agent teams that require its team members do a minimum of two transactions per month, or get booted. Sunny had agents that did 40+ per year without an assistant or team. So I don’t think it takes some kind of superhuman effort to do 20 deals a year.

The NBER Paper: “Can Free Entry Be Inefficient? Fixed Commissions and Social Waste in the Real Estate Industry”

With the numbers out of the way, let us turn to the NBER paper mentioned above. Here we find opinions, but they are expert opinions by two economists from Princeton and UCLA respectively. The paper was published in 2003, so almost twenty years ago, when REALTOR numbers were still under 1 million.

The paper is filled with charts and graphs and formulae, most of which are beyond me. But the points made are easily understandable. From the paper:

The main argument of this paper is that if in fact commission rates are fixed, then the absence of barriers to entry results in socially wasteful entry by real estate agents in cities with high housing costs. Consider, for example, two cities—Boston and Minneapolis—that are similar in most dimensions except in the cost of housing. In 1990, the price of a typical house in Boston was roughly twice that in Minneapolis. With a fixed commission rate, the brokerage fee from selling a typical house in Boston was therefore twice that of a similar transaction in Minneapolis. If this is all there is to the story, real estate agents in Boston would simply earn twice as much as their counterparts in Minneapolis. Real estate commissions would simply be a transfer from home sellers and home buyers to real estate agents, and the deadweight loss from the fixed commission in Boston would probably be small, especially if the demand for real estate transactions is relatively price-inelastic.

However, because there is relatively free entry into the real estate business, an average real estate agent in Boston does not earn twice as much as an agent in Minneapolis. Because the commission from selling a typical house is twice as high in Boston as it is in Minneapolis, there are more real estate agents in Boston seeking these high commissions, although the total number of homes sold each year is actually larger in Minneapolis. Consequently, the average real estate agent in Minneapolis is much more productive than a typical agent in Boston, selling 6.6 houses each year in Minneapolis as compared to an average 3.3 houses a year in Boston.

What the authors of the paper find is that the empirical evidence shows exactly this bizarre relationship between fixed commissions, low barrier to entry, and same work required: waste.

The empirical evidence confirms this prediction. In our most robust estimates that control for fixed differences in the difficulty of matching buyers and sellers across cities, we find that roughly two-thirds to three-quarters of the higher commissions in a city in which the price of land has increased is dissipated by socially wasteful entry. In turn, we find that an average real estate broker in a high-priced city is no better off than her counterpart in a city with cheaper housing. The outcome of a fixed commission is thus truly tragic: real estate agents are no better off in cities in which housing prices have increased, yet home owners and home sellers are clearly worse off.

…

If our interpretation is correct, then the higher commission fees in more expensive cities are dissipated by excessive entry of brokers. What is striking about this story is that increases in housing prices raise commission fees paid by consumers but do not raise brokers’ profits. In this sense, this story is different from the standard analysis of welfare losses due to a monopoly. Increases in housing prices translate into pure economic losses since brokers are not made better off but consumers are made worse off.

In light of the current antitrust lawsuits, the action by the DOJ and inevitable regulation by the FTC, these conclusions resonate even more. The narrative of the plaintiffs, of the DOJ, and of the FTC is that anticompetitive collusion by the industry — orchestrated by NAR and enforced through its rules — enrich REALTORS at the expense of consumers. The truth may be that whatever is happening does not enrich REALTORS, even at the expense of consumers.

That line about how increasing commission fees do not raise brokers’ profits resonated with me, since I know how thin a brokerage’s profit margins actually are. We all know and have known for years, if not decades.

The basic takeaway from the paper is that the combination of fixed commissions, low barrier to entry, and lack of real difference between selling more expensive houses vs. less expensive houses results in pure loss for the brokers and agents who are currently in business. Instead, we just get a flood of new entrants who are less experienced, less connected, and less capable — but the consumer does not benefit either from lower prices from less experienced agents.

The Alternative Scenarios in Light of These Findings

The numbers above tend to support the conclusion of this paper. If after 2011, the number of new entrants into the industry had been kept at 2011 levels (more or less), the average REALTOR would have made 54% more in 2021. If NAR had gone for slow attrition, we’re looking at 89% more for the REALTORS remaining in business. Go aggressive, and we’re looking at 158% more.

Now, as with all conterfactual scenarios, it isn’t absolutely clear that limiting REALTOR membership necessarily translates on a one-to-one basis. That is, it is possible that agents who are not allowed to become REALTORS would simply continue to do business without becoming a REALTOR as long as they could continue to get access to the MLS. So perhaps instead of having 1.6 million REALTOR members, there are 1 million REALTOR members and 600K non-REALTOR agents out there doing the same business.

Maybe — but if that’s true, we have whole different set of questions that need to be asked… such as the value of being a REALTOR at all. So for the sake of discussion, let us assume that the additional training, the Code of Ethics, the acceptance by the local brokerage community, and access to the MLS where that is limited to REALTORS mean that not being a REALTOR does really hamper the ability of these new entrants to take serious market share from brokers and agents already in the business.

If we assume that not being a REALTOR hampers the ability to do business, then we have to deal with a phenomenon about which the authors of the NBER paper wonder out loud. First, they go through the litany of questions on why commission rates appear to be so unaffected by standard economic forces, including potential collusion by the industry. Then they write:

However, none of these explanations are satisfactory. First, if the fixed commission rate is due to collusion by realtors, it is not clear why realtors collude in this manner instead of colluding to prevent new real estate agents from earning any profits. [Note “realtors” is not capitalized in the original paper.]

That is an excellent question. Why don’t REALTORS collude to prevent new agents from earning profits, for example, by limiting access to becoming a REALTOR — which is the only thing that REALTORS themselves control?

The Simplest Explanation is the Best Explanation

There is a principle known as Occam’s Razor, which broadly postulates that between competing explanations, the simpler one is the right one. The ancient philosopher Ptolemy said, “We consider it a good principle to explain the phenomena by the simplest hypothesis possible.” Let me do so now.

The question is, Why don’t REALTORS collude in a way to prevent new real estate agents from earning any profits?

Some possible explanations:

- REALTORS never collude on anything, ever.

- The agent-centric model pioneered by REMAX prizes headcount above productivity, so brokers have an incentive to keep the barrier to entry low.

- REALTORS do collude to keep new agents from making money, but the state licensing authorities want to make licensing fees so they override that collusion.

- Brokers and agents would collude in a way to prevent new agents from making money, but Organized Real Estate benefits from low barrier to entry, so they override the collusion of brokers and agents.

#1 fails for the simple reason that REALTORS are human beings, and human beings always collude to their benefit. Period.

#2 might make sense, except that as early as 2003, academics were noticing that high commissions did not result in broker profits. Even today, the 100% commission transaction-fee brokerages have the same low profit margin as the high-cost 70/30 split brokerages. Furthermore, brokers are not the same as agents. The individual agent has no incentive whatsoever to prize headcount, nor to keep the barrier to entry low. Go on any social media group of real estate agents and you will find frequent calls to “Raise the Bar” and to make it harder for just anybody to become a REALTOR.

#3 would make sense, except that we can find no actual collusion that keeps new entrants from making money. Think about the NAR Code of Ethics, or any MLS rule or policy. Can you think of a single rule or Code that would make it harder for new agents to make money? I can’t.

The wide-open lack of barriers for real estate stands in stark contrast to other industries, even one connected to brokerage, such as appraisal. Go to professional organizations like the ones for lawyers, doctors and accountants (not to mention skilled trades like electricians and plumbers) and you’ll find all kinds of rules and policies designed to make things harder for newbies, not easier. Screw up, and the organization will look for ways to kick you out, not keep you in.

All of those rules and policies are on top of existing state licensing laws.

Not so in organized real estate. In fact, it is easier to find NAR rules and MLS policies that appear designed to make it easier for new agents to make money – they level the playing field for all REALTORS. Take as an example Clear Cooperation Policy. It forces REALTORS to share all of their listings with the entire MLS, including all of those newbies, instead of keeping them within the club of experienced current agents. (Of course, that kind of off-market stuff happens, but all of those are against NAR policy.) Collusion by brokers and agents to keep new agents impoverished would imply the opposite policy.

The only explanation that makes sense, and because it is the simplest explanation is likely the correct one, is that having huge numbers of REALTORS, low barrier to entry, and wide open ability to make money for the newest entrants primarily benefit the REALTOR Association and the MLS.

What that implies in turn is that the REALTOR Association and the MLS are hardly the bastion of traditional brokerages keeping new players out. In fact, given the numbers from 2011 to 2021, I don’t know that you can argue that the Association and the MLS work primarily to benefit their members. The failure to limit membership numbers has significantly limited the gains from good markets for existing REALTOR members, after all.

Look at Results, Not Intentions

Let me pause here to address the elephant in the room. You might be an Association Executive, or an MLS director, or one of the tens of thousands of volunteer leaders. You might be outraged and offended by the idea that your work does not aim to benefit your members. I’ve been in enough meetings, had enough drinks and dinners, and have spoken to many, many leaders to know that in your hearts, you are motivated by the desire to help other REALTORS, the industry, and the consumer. Sure, there are exceptions, but the vast majority of people I’ve worked with over the years truly have their hearts in the right place.

So this isn’t about your motivation. This is about the unintended consequences of your actions, which includes inaction.

Consider how Bob Goldberg, when he took over as CEO, famously proclaimed that NAR was now the National Association FOR REALTORS. Longtime readers know I have serious issues with that formulation, but what the data makes clear is that the results of Goldberg’s actions and policies have tended to hurt REALTORS, not benefit them.

Why? Because the data makes clear that the number one thing that Goldberg could have done to benefit REALTORS is to limit the number of people who can become REALTORS, who can enter the industry.

This may not be what Goldberg and his team over at NAR intended. It is, however, the result of NAR’s policies or lack of policies.

I can think of two examples of policies that came from good intentions, but ended up hurting existing members: fighting for independent contractor status, and the fight to keep cooperation and compensation.

Good Intentions, Bad Results: Fighting for Independent Contractor Status

As the NBER paper lays out, there are three key assumptions behind the situation we find ourselves in:

- Fixed commission rates

- Low barrier to entry

- No huge difference in effort between selling expensive houses vs. cheaper houses

You can do nothing about #3; that’s just how the work goes. There is literally nothing that NAR could have done to change how much work is required to sell a $500K house vs. a $5 million house.

But independent contractor status of real estate agents goes directly to #2: low barrier to entry. If agents had to be paid as employees, and the brokerage take on all of the legal responsibilities of having employees, that would significantly raise the barrier to entry. It would not be enough for someone to pass the (stupidly easy) real estate license exam. She would also need to find a broker willing to pay her salary and benefits. REALTOR numbers would have plummeted… but the ones left standing would have been extraordinarily productive.

Let’s look at that scenario. In 2012, an agent named Ali Bararsani filed a lawsuit against Coldwell Banker claiming that he was “misclassified” as an independent contractor. That ignited a real panic in the industry. I wrote about it here and elsewhere. NAR, CAR and the industry went to war against having real estate agents be classified as employees in Bararsani, Monell v. Boston Pads, and others. Imagine for a moment that they did not. Imagine for a moment that REALTOR Associations decided to embrace having agents be classified as employees starting in 2013. What would have happened?

I think conservatively speaking, brokerages would have required that an agent do at least two transactions a month in order to justify getting hired. Even if agents were on the same commission-only compensation plans of today, the brokerages would have had to pay for benefits, SSI, unemployment, and cover business expenses. Knowing how many top agent teams require two closings a month to remain on the team, I think brokerages would have done that starting in 2013.

Here’s what that counterfactual looks like:

The number of REALTORS would go down and up depending on the market, which is kind of how every other industry in the world works. When things are good, you hire more people; when things are bad, you lay them off. REALTOR numbers would have plummeted in 2013, of course, but after that reset, it tracks the overall housing market as brokerages would have demanded 24 transactions a year to remain employed. But afterwards, the average REALTOR would have made significantly more in GCI. Looking just at 2021, the average REALTOR in this scenario would have done (all inflation-adjusted 2011 dollars) $7 million in volume and $209K in GCI — a 400% increase over 2011.

Even if the now-employer brokerages took 50% of the GCI in “splits”, the average REALTOR remaining in business would have take home pay of over $125K in nominal dollars — versus something south of $80K after splits and expenses.

Explain to me how this bad for the REALTOR member please. What’s the loss, exactly? Where’s the harm?

Good Intentions, Bad Results #2: Fight to Keep Cooperation and Compensation

This one is more difficult to model, but we can get a high-level look. Because eliminating the fixed commission rate for new entrants would go to the first factor cited in the NBER paper.

We know that NAR is engaged in several legal and regulatory battles today to keep cooperation and compensation in place. The practice of having the seller pay the buyer’s agent is at the heart of REALTOR culture and is the basis for the MLS as we know it today.

If that goes away, the thinking is that half of the commission pool simply disappears as buyers will refuse to pay buyer agents since most couldn’t afford it. There have been innumerable debates about what would actually happen, and my own stance (that things will go to hourly rates) is well-documented. But that’s difficult to model.

Instead, let us consider what the end-goal of the DOJ, FTC, academics, economists, and policymakers who are attacking cooperation and compensation is. Fundamentally, they all think real estate commissions are too high. They’ve been trying to figure out how to get commissions lower for at least 50 years, if not more.

So say NAR stops fighting, and embraces the elimination of the unilateral offer of compensation. As a result, the commission rate for real estate goes to 2% total — on par with other western developed nations, a fact oft-cited by opponents of compensation. Buyers would fend for themselves.

Most of us who have been in the industry for a while believe that at least half of the current agent population would simply find something else to do to make a living. Most of the newer agents and less experienced agents make money representing buyers, and if buyers are not paying, those REALTORS would need to get a job doing something else. In addition, most of the top listing agents are precisely those experienced veterans with networks and reputations and track records. Perhaps 20% of the REALTOR population (or less) are primarily listing agents.

Let’s be generous and say that 30% of current REALTORS would remain, as they are strong listing agents, but at a 2% commission rate. The number of transactions would be half what they are today, since buy-side transaction no longer generates a commission. In addition, because real estate is no longer all that attractive for new people to enter, the REALTOR numbers would remain more or less steady: new agents would replace retiring agents only.

Under those assumptions, here’s what 2011 to 2021 looks like:

Yes, REALTOR numbers would plummet even more than the W2 scenario. Overall GCI income would be cut in half as buy-side commissions go away. But even at the lower commission rate, the average REALTOR would make more money. By 2021, the average REALTOR under this scenario would have nominal GCI of $142K, versus the $82K that was the actual — a 72% improvement.

How is this bad for the professional REALTORS left standing?

Conclusion: Fewer Is Better

I do not think this conclusion is actually all that controversial in some industry circles. I’ve done enough strat-planning exercises for Associations and MLSs to know that there is a very strong feeling out there that there are too many REALTORS, most of whom do not deserve to carry the brand nor be advising families on important financial decisions.

The NBER paper, together with actually looking at the effect of numbers not on society as a whole, or on consumers, but on the REALTORS themselves suggest that the number one way for an Association or an MLS to drive member benefit is to reduce the number of REALTORS and to make it more difficult for new entrants to immediately earn big commission checks.

The current lawsuits and government action are going to solve the big commission check problem for us. By eliminating the unilateral offer of compensation (something that Northwest MLS in Washington state has already done, and others are considering), it brings back a level of price signals to the industry. Better agents with more experience, bigger networks, better track records and professional reputations will not only not suffer, they will gain from reducing the herd. Subpar agents will be exited out of the industry, and new entrants will find it more difficult to get going. As per the NBER paper, that is not a bad thing as it avoid social waste.

The better and more experienced REALTORS should not be fighting the elimination of cooperating compensation, but actually support that elimination.

The commission lawsuits handle the problem of fixed commission rates identified by NBER scholars. What about the low barrier to entry issue?

NAR and the State Associations can, of course, lobby state licensing authorities to make it more difficult to get a real estate license. But they’ve been trying that for years to little effect, because state governments have very little incentive to actually raise the bar on licensing.

What Associations leaders can do, however, if they truly want to benefit their actual current members instead of potential future members, is to make it far more difficult to become a REALTOR. There is no shortage of policies and changes that they can put into place to make it harder to earn the REALTOR badge, and we as an industry have been talking about them for at least a decade, if not longer.

In 2022, if the Association does not take real action designed to stop the growth in REALTOR numbers, and actually reverse them to some extent (perhaps targeting that 2% per year decline through attrition)… then we are forced to draw the only conclusion possible: the Association doesn’t want to reduce the number of members, and doesn’t want to make it more difficult to become a member… even if that reduction benefits the membership today.

What the numbers above show is that even small changes in the number of REALTORS makes a big difference. Merely keeping membership at 2011 levels would have increased per-REALTOR GCI by over 150% in 2021 in real dollar terms. And nobody in 2011 thought there were too few REALTOR members at over 1 million. And no one could seriously argue that NAR would lose political influence with “only” a million members. That’s silly talk.

What truly hurts the competent REALTOR today is not the government, not the market conditions, not Zillow, not any bogeyman. What really hurts her is simpler than that: too many other REALTORs.

Fewer is better.

-rsh

Mos Def – Mathematics

Album – Black On Both Sides(Please Rate and Comment) Production By Dj Premier….

Amen! The low barrier to entry hurts agents, brokers and the consumer alike.

Please note, you mention NWMLS making these changes, but fail to mention NWMLS is a Non-Realtor, for profit organization. I can also say that you knew about the NWMLS forms changes before Washington Realtors Association announced them to their membership. NWMLS has the copyright for the “Statewide” forms provided by Washington Realtors to its membership.

I agree with your conclusion. Fewer is better, but until State licensing departments and NAR decide to stop increasing their revenue from more licensees, it will not change. Higher fees/dues and fewer members still nets those organizations he revenues they are currently at, or more.

Good points, John.

Good points. However, did you factor out of the NAR membership the percentage of members who are broker managers and licensed assistants both who don’t practice directly with actually closing units, but who only work in the office with those who do work transactions. And, then over the span of your decades Realtors moved from being individual practitioners to being a team; there was the growth of Teams, who again employ licensed members of NAR who don’t do individual transactions, but instead are assistants to those who do. Of the 1.6 million members of NAR there is a percentage that are strictly managers, assistants and team- member assistants. This portion I would like to see backed out of the total, and then calculate number of transactions sides per the actual practicing Realtors.

Or, am I missing something?….

No, you’re not missing anything. But NAR doesn’t provide that data, so… I can only work with what I’ve got. Maybe members like you can ask NAR to start publishing the data, breaking out those who are managers and assistants. 🙂 Happy to redo the numbers if the data is provided.