Last year I published a special Red Dot on CoStar after its entry into residential real estate. I subtitled it, “The Rising Sun” for a few reasons. One of them was that CoStar was the most serious entrant into residential real estate in recent memory… perhaps ever. Even Sears or Merrill Lynch (who had entered real estate back in the 70s and 80s, only to exit) were not as significant an entity as CoStar in my judgment. I thought CoStar’s entry signaled the dawn of a new era in real estate portal wars.

Well, we’ve heard very little from CoStar in the intervening months. Sure, there was the big party in San Diego with a Keith Urban concert, but those were the heady days of 2021! Yes, CoStar acquired Homes.com but ignored that; Homes.com was such a distant laggard in the portal race that it would have been roughly the same thing if CoStar had acquired some small brokerage website.

What most of us thought was that CoStar Group was a tough competitor, a giant company with billions of dollars in cash, market cap around $26 billion (at the time), a long record of success, and a well-earned reputation for ruthlessness. But they were trying to take the crown from King Zillow, which had so utterly dominated online real estate for a decade or more. It was the single most powerful company in residential real estate with the best technology team, the healthiest balance sheet, best management talent led by the visionary Founder & CEO Rich Barton, a cash cow business model in Premier Agent fueling the Next Big Thing in Zillow Offers.

CoStar was a strong contender, but Zillow was a mighty champion.

How things change in just one year.

As companies start to report 3Q results, it feels as if the world has been turned upside down.

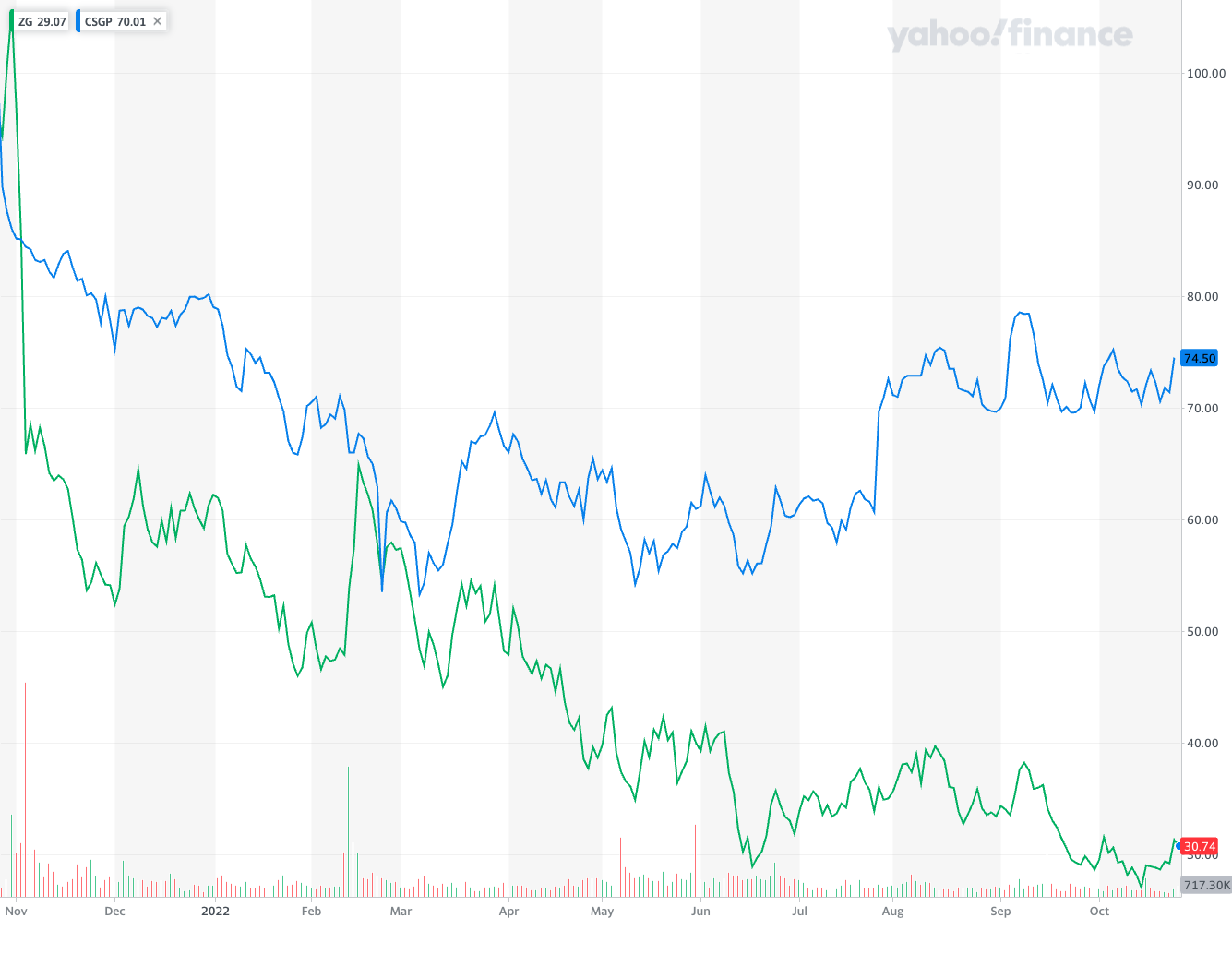

Zillow and CoStar were evenly matched a year ago. A year later, Zillow stock is down almost 70% YTD and showing no signs of recovery, and while CoStar did lose 25% or so of its stock price, it’s been on a steady (if slight) upward trajectory, especially after July.

One result is the the market cap of the two companies has diverged significantly. A year ago, they were more or less at parity. Today, CoStar’s market cap is over $32.5 billion at time of writing, while Zillow’s market cap is about $7.4 billion. CoStar is now valued at more than four times what Zillow is valued at by the market.

One result is the the market cap of the two companies has diverged significantly. A year ago, they were more or less at parity. Today, CoStar’s market cap is over $32.5 billion at time of writing, while Zillow’s market cap is about $7.4 billion. CoStar is now valued at more than four times what Zillow is valued at by the market.

And CoStar’s 3Q22 results are astonishingly good in an astonishingly bad macro environment. Everybody is getting hammered between inflation, high interest rates, impending (or already raging) recession, global economic turmoil, supply chain issues and even war. Everybody that is, other than CoStar apparently.

But there were two or three details from the earnings call that are worth highlighting, and thinking about. Since that’s what I do, let’s do just that.

The Numbers, Very Briefly

From the press release:

- Revenues up 12% YOY to $557 million

- EBITDA of $129 million

- Net income of $72 million

Andy Florance had every reason to be jubilant:

We delivered outstanding results across all of our business lines in the third quarter, with Apartments.com leading the way” said Andrew C. Florance, Founder and Chief Executive Officer of CoStar Group. “Net new bookings totaled $76 million in the third quarter of 2022, up 62% over the third quarter of 2021. Year-to-date our sales results have already exceeded the net new bookings for the full year 2021, and we still have one quarter left to go. Both revenue and profit in the third quarter of 2022 were at or above the high end of our guidance range and we are raising our forecast for the year.

Put simply, CoStar had a great quarter and is having a great year so far.

Now, CoStar’s core business is in commercial real estate where it is the dominant firm as the de facto MLS for commercial real estate in the U.S. with significant international market presence to boot. So most of those results are from commercial business, including multifamily and rentals, but they did talk a bit about their nascent residential business:

- Q3 revenue of $19 million

- 958K registered agents on Homesnap Pro and Pro+

- Traffic to Homes.com up 52% YOY (albeit from a fairly low base)

It’s doing fine, and Florance stated that he was happy with where traffic growth on Homes.com was as it is tracking where Apartments.com was after launching under CoStar.

Oh… and a final note… CoStar is now part of the S&P 500. #wow

The Strategy

What I found more interesting is a bit more time spent by Florance on the overall strategy for CoStar Residential:

As we communicated before in previous earnings calls, our residential product strategy is centered around a Homes.com marketplace that advertises the home as opposed to just advertising agents. We believe consumers that search for properties for sale in a marketplace like Homes.com have higher intent to consumers who are served home-for-sale ads randomly across social media or the Internet.

Our objective is to partner with the 1.5 million agents in the United States in support of “Your Listing, Your Lead” approach and enable consumers and any agent to collaborate digitally throughout the home buying or selling process. We’re focused on building complete coverage of residential listings throughout the United States, as well as developing unique proprietary content by leveraging the skills and capabilities of our awesome nationwide research organization. Overall, we’re making great progress developing Homes.com across all these strategic areas, and are looking forward to showcasing a number of our agent-focused product features at the upcoming National Association of Realtors Convention in early November.

In fact, I believe we have a big product release Thursday or Friday of this week, if you want to check out some of the incremental upgrades at the end of the week. With rising interest rates and a rapidly cooling residential property market, I believe now is the perfect time to invest in a marketplace that’s designed to help consumers and their agents advertise and sell properties faster and at a higher price. Deteriorating market conditions may well create a tailwind for our business model. [Emphasis Added]

Not a lot of this is new, but the parts I’ve highlighted are worth thinking about more.

The point about advertising the home as opposed to just advertising agents feels like a slap at Zillow, which does advertise homes, but its business model is really about getting leads to Premier Agents. CoStar likes the seller paying to advertise listings more (Loopnet, Apartments.com, and REA Group which Florance cited approvingly in the past). Of course this is the key reason why the BPP-Homesnap marriage fell apart, as the MLSs would not give CoStar the right to do Promoted Listings.

The point about building complete coverage of residential listings, and the “unique proprietary content” is an important one. It is one I have discussed multiple times in the past, and most recently in this post. I have long believed that CoStar will leverage its experience and expertise with real estate copyright to gain a competitive advantage. In that post, I quoted from the 2Q earnings call:

Our research efforts are off to a good start as we build proprietary content for Homes.com around playgrounds, neighborhood, schools and other features that are important to consumers. From a standing start, we have successfully engaged over 1,000 photographers, writers, editors, voice talent and video editors across the country.

What’s new in 3Q is this statement from Scott Wheeler, CFO:

We are leveraging more of our existing internal research teams to build out our content, resulting in higher quality content.

We are now hiring full-time residential research teams, not contractors, which results in lower investment spending levels this year.

Hmm. Some of those 1,000 photographers, writers, editors, voice talent and video editors are now full-time employees of CoStar. Not only does that result in lower costs for CoStar, it also lets CoStar manage them much more tightly to be more productive. It also ensures that all of the photo and video copyrights belong to CoStar, which is important if you’ve read my previous posts on the topic.

They’re pretty goddamn serious about this.

Finally, the note about deteriorating market conditions providing a tailwind for CoStar’s Promoted Listings-based business makes sense on its face. Listing agents and sellers are more likely to spend money to promote a home for sale as buyer demand falls off a cliff, which it has and which it will continue to do. But it’s also a subtle jab at Zillow, since most of the Wall Street analysts on the call probably also cover Zillow, whose buyer-lead based business model is going to suffer as buyer demand drops.

Florance Mentions Antitrust Issues

What I found even more interesting is that Florance in his prepared remarks talked about the commission lawsuits:

There is a potentially interesting development in the residential industry I want to briefly mention. We’re closely monitoring ongoing antitrust litigation involving residential listing associations, or MLSs, and one that’s currently pending in the Western District of Missouri. A class of home sellers allege that NAR and brokerage [indiscernible] created enforced anti-competitive rules that require home sellers to pay a nonnegotiable commission to the broker representing the home buyer, resulting in inflated buyer-side brokerage commissions. To date, the planners have had some success to feeding a motion to dismiss and succeeding class certification. The case is scheduled for trial in February. If the plaintiffs in this case or other similar cases succeed, this could have a significant adverse effect on residential marketplaces that rely primarily on broker sharing commission revenue models.

Our residential sales strategy should not be impacted as we are focused on a property advertising model. I do not believe that judgment for the plans would significantly adversely impact most residential agents because most do both seller and buyer representation, and the judgment would just shift fees from the buyer representation business to the seller representation business. More on that in February.

Since I have always believed that CoStar’s strategy in residential involved waiting for these antitrust lawsuits — or the associated government action by the DOJ or FTC — to completely reset the board for residential real estate, I thought it interesting that Florance finally mentioned the lawsuits in an earnings call.

I also think Florance would be well-served by speaking to people more informed about the reality of residential real estate. It is simply not true that most residential agents do both seller and buyer representation; the majority do no business at all. Most MLSs will show that half of the membership do zero transactions in a given year. The top 10% or so focus on the seller representation business, since the received wisdom (proven by history and experience) is “List to last.” Those agents between the bottom 50% (who do no business at all, or do them on a team) and the top 10% do mostly buyer representation sprinkled with seller representation.

An adverse judgment, therefore, would not simply shift fees from buyer business to seller business. It would result in depopulation of agent ranks, with somewhere between (educated guesses now) 30% and 50% simply leaving the business completely, and somewhere between 20-30% additionally forced to join larger agent teams.

As it happens, the stated business model of Homes.com would not suffer much, if at all. Listing agents would pay for upgraded packages (as commercial agents do today on Loopnet and CoStar) and some homeowners would agree to pay for listing promotion because they want to sell their homes in a buyer’s market. Zillow, Trulia, Realtor.com, Redfin on the other hand would get crushed. Any business model dependent on referring buyers would face real headwinds. The MLS system, built on the principle of cooperation and compensation, would be facing serious disruption.

And since the topic is fresh on my mind from writing about BPP 2.0 recently, the whole value proposition of “Fair Display Guidelines” or even “Your Listing, Your Lead” that CoStar is so focused on goes away. If the law mandates “Your Listing, Your Lead” for all intents and purposes, then who cares if your internal policy is the same?

Tantalizing Hint of Something Big

Finally, there was a remarkable exchange during the Q&A portion. I’m going to quote the exchange in full.

Ashish Sabadra, RBC

I wanted to focus on the M&A pipeline, particularly with the $750 million of equity raised. I understand it was opportunistic, but also should we assume that was that something is imminent? And then obviously, you’ve shown intent in the past to do some transformational deal on residential side. Is that an area that you would continue to focus on?

Andrew Florance

Yes.

So we obviously have a great balance sheet now approaching $5 billion in cash on the balance sheet and continue to be strongly cash flow positive.

So our primary new initiative is residential.

So we are looking at all the opportunities out there in the residential space. And right now, we’re in an environment where things are shifting very rapidly to a buyer’s favor. And the question is, how rapidly and when is the right time to move on certain things.

So we’re very active in looking for M&A opportunities, but we’re also monitoring market conditions and want to get the best results for the shareholders moving at the right time. Not being too greedy, but trying to observe a rapidly shifting environment right now to our favor.

Usually, when a public company CEO is asked about M&A in an earnings call, he says something noncommittal like “We’re always looking at opportunities” or “There are always deals that we would consider” or some such. He does not usually respond with, “Yes.”

Florance here not only says that something is imminent, not only affirms that he intends to do some transformational deal, but further confirms that CoStar’s primary focus is residential. Then he further adds that they are “very active in looking for M&A opportunities” but that the deals he’s getting pitched are overpriced. He’s waiting for sellers to get more desperate so he can pick up companies on the cheap.

So obviously, the question is… what M&A deal could CoStar do that would be “transformational” on the residential side given the war chest of $750m raised for the purpose and a total of $5 billion in cash, plus some unknown amount of purchasing power that a $32 billion company on the S&P 500 would have?

Your speculation is as good as mine. But I’ll throw two out there for the purpose of entertainment.

Black Knight + CoStar?

One is Black Knight, which entered into a definitive agreement to be acquired by the giant financial tech company Intercontinental Exchange (“ICE”) in May of this year. That deal is under antitrust review, and because of the market share implications, it isn’t actually clear that they would get regulatory approval to proceed.

Plus, when ICE agreed to acquire Black Knight in May, the residential mortgage market was just entering the downward spiral. It is now October and clear to everybody and his aunt that residential mortgage is in big, big trouble. Maybe that $13 billion price tag looked good in May; it doesn’t look so good in October. Or November. Or 2023 when the world will likely enter a ginormous recession if not depression.

I could see a scenario where ICE walks away or is denied regulatory approval, thereby opening the door for CoStar to step in. CoStar made a play for CoreLogic back in the spring that was about $7 billion, before withdrawing. The synergies that CoStar cited for the deal would remain roughly the same if CoStar acquired Black Knight instead and since CoStar is a non-player in the residential mortgage market, antitrust concerns would be far lower.

That could be a transformational deal.

Opendoor + CoStar?

The second one that comes in mind, especially since Florance specifically cited an environment shifting to a buyer’s market, is Opendoor.

Opendoor’s business model could and would work in a buyer’s market as well as in a seller’s market no matter what random REALTORS say. Its market cap has been hammered to below $1.7 billion at time of writing as the stock price plummeted from over $34 per share in February of 2021 to about $2.70 per share as of today. Investors are allergic to Opendoor in 2022. I feel pretty certain that Opendoor’s major shareholders would welcome a bid from CoStar.

The thing about Opendoor for CoStar’s residential strategy is that no matter what you think about the iBuying business model, you can’t ignore the fact that iBuying is a fountain of seller leads. Homeowners have proven time and again that they would like to at least get an offer from Opendoor even if they ultimately choose not to take it.

If Homes.com will be based on advertising properties, how much more attractive could that be if the only website providing a cash offer from Opendoor to increasingly desperate home sellers is Homes.com? And even in a buyer’s environment, List to Last will be the rule in residential. So if only those agents who have purchased some Silver package on Homes.com are able to offer their clients an Opendoor offer….

It goes without saying that all of Opendoor’s inventory would automatically get the highest Promoted Listing status on Homes.com as well….

Now, the tricky part of this speculation is the fact that Opendoor and Zillow are in a relationship:

Selling a home can be full of uncertainty for many consumers who would rather focus on their next chapter than on the stresses of moving. Potential sellers on Zillow apps and sites may request and view an offer directly from Opendoor and easily compare it to an open-market sale using a real estate agent. Opendoor offers will be available on Zillow, and customers will be able to use the service as a standalone offering or package it with other Zillow home shopping services such as financing, closing and agent selection. Additionally, Zillow customers will be able to work with a licensed Zillow advisor who will serve as a helpful guide in understanding these options.

What we don’t know is whether that multi-year exclusive partnership has provisions in case of change of control. One assumes that Zillow has outs that prevents an Opendoor owned by CoStar from making offers to Zillow users. But we don’t know if that partnership agreement gives Zillow any kind of right of first refusal or last bid or anything else that would make a marriage between CoStar and Opendoor impossible. At the same time, given how Zillow exited iBuying a mere year ago, it seems highly unlikely that they would go back into it by exercising any kind of right of first refusal for Opendoor. I don’t think their credibility could survive such a move. So Zillow marrying Opendoor feels like it’s off the table.

At the same time, we don’t know if Opendoor’s culture and CoStar’s culture could meld, plus another hundred factors. There are lots of reasons why that deal won’t happen. Just because Opendoor can’t marry Zillow doesn’t mean that Opendoor will marry CoStar.

What we do know, however, is that Opendoor’s shareholders would love to get out at $5 per share today. What we do know is that Opendoor as a subsidiary of a S&P 500 company is a different animal than it is today. What we do know (at least those of who are married) is that while dating might be fun, marriage is business.

Others

There are probably other transformational deals that CoStar could do. As Florance said, they are actively looking for deals. Investment bankers worldwide will be bringing one deal after another for Florance to look at. I assume it’s just a matter of time before we hear of a big blockbuster deal.

Wrap-Up

So that’s my take on CoStar’s 3Q/22 earnings. The results were fantastic, at a time when it seems like everybody else is just getting crushed (did you see what happened to Facebook/Meta? Holy shit!). CoStar’s strength in commercial carried them through while everybody in residential is getting utterly eviscerated by Wall Street.

Accordingly, the management is overflowing with confidence. I see no reason why they shouldn’t. Everything from operating results to macro environment to the legal and regulatory is kind of going their way. Their main rival in residential has been humbled, at least on Wall Street, and is laying off people while CoStar is hiring people into its new residential research team.

How things change in one short year. 2023 promises to be one of those interesting times we are cursed to live through.

-rsh