As most of you know, I am a big giant iBuyer bull, which means I am a big giant Opendoor bull. I am long OPEN and remain long OPEN. I have a lot of faith in the company, in the business model, in the value to consumers, and in the team at Opendoor.

And even I had to pause when I saw the numbers from Q3. It just isn’t everyday that you see a billion dollar quarterly loss, not from a company whose market cap was only $1.6B just prior to reporting. That this came after a relatively upbeat Q2, when they cautioned about a slowing market, but said that they were making adjustments, and that they had a “fortress balance sheet” with $2.5 billion in cash is what was so surprising.

After poring through the shareholder letter and the earnings call transcript, I’m feeling… odd. On the one hand, I feel better about Opendoor. Opendoor isn’t going anywhere, the balance sheet does look strong, and they’re making adjustments fast and pretty well. Q4 will likely be a disaster numbers-wise, but they do have the balance sheet to withstand the storm.

On the other hand, the pivot to 3P Marketplace (Third Party Marketplace) is a big deal. And it is a reveal to those of us who were not privy to Opendoor’s early years as a startup raising VC money. Turns out, Opendoor’s true end goal was to become a marketplace for real estate. That is not the company I thought I was evaluating from an industry perspective.

Not that Opendoor the Marketplace instead of Opendoor the Market Maker is a bad thing; it’s just a different thing. And I’m not sure I feel about it.

So in order to discover how I feel about that, I’m writing this. Warning in advance: this is going to get long. LOOONG, even by my standards, but it’s because I’m trying to work through what the pivot means for Opendoor and the rest of the industry.

The Numbers

I’m sure you’ve already seen all of the numbers from Q3, but here they are summarized from the press release:

- Revenue of $3.4 billion, up 48% versus 3Q21; with 8,520 total homes sold, up 42% versus 3Q21

- Gross (loss) profit of $(425) million, which reflects an inventory valuation adjustment of $573 million, versus $202 million in 3Q21; gross margin of (12.6)%, versus 8.9% in 3Q21

- Net loss of $(928) million, versus $(57) million in 3Q21

- Adjusted Net Loss of $(328) million, versus $(18) million in 3Q21

- Contribution (Loss) Profit of $(22) million, versus $169 million in 3Q21; Contribution Margin of (0.7)%, versus 7.5% in 3Q21

- Adjusted EBITDA of $(211) million, versus $35 million in 3Q21; Adjusted EBITDA Margin of (6.3)%, versus 1.5% in 3Q21

- Inventory balance of 16,873 homes, representing $6.1 billion in value, down (3)% versus 3Q21

- Purchased 8,380 homes, down (45)% versus 3Q21

- Ended the quarter with 2,259 homes under contract for purchase, down (64)% versus 3Q21

For what it’s worth, the Q3 Gross Profit is down 310% YOY, and the Net Income is down 1,528%. Those are just… unreal numbers, even if we recognize that 2021 was a once-in-a-lifetime hot market, and 2022 is turning into a once-in-a-lifetime cold market.

The purchase numbers and under contract numbers look like falling off the cliff to me; basically, the operations are half the size from a year ago.

Yes, revenues being up is nice, but not at a gross loss of $425 million; that amounts to losing $50K per house sold in Q3.

There’s just no real good way to dress up these results. It was a bad quarter. A terrible, horrible, no good, very bad quarter.

Speed Kills

The explanation, of course, is that the market changed way faster than anybody had expected. In the Letter to Shareholders, Eric Wu mentioned interest rate hikes not seen in forty years, and the resulting “once-in-forty-years market transition.” I get it. Most other real estate and housing and mortgage companies mentioned the incredible aggression of The Fed in raising rates, which absolutely hammered housing.

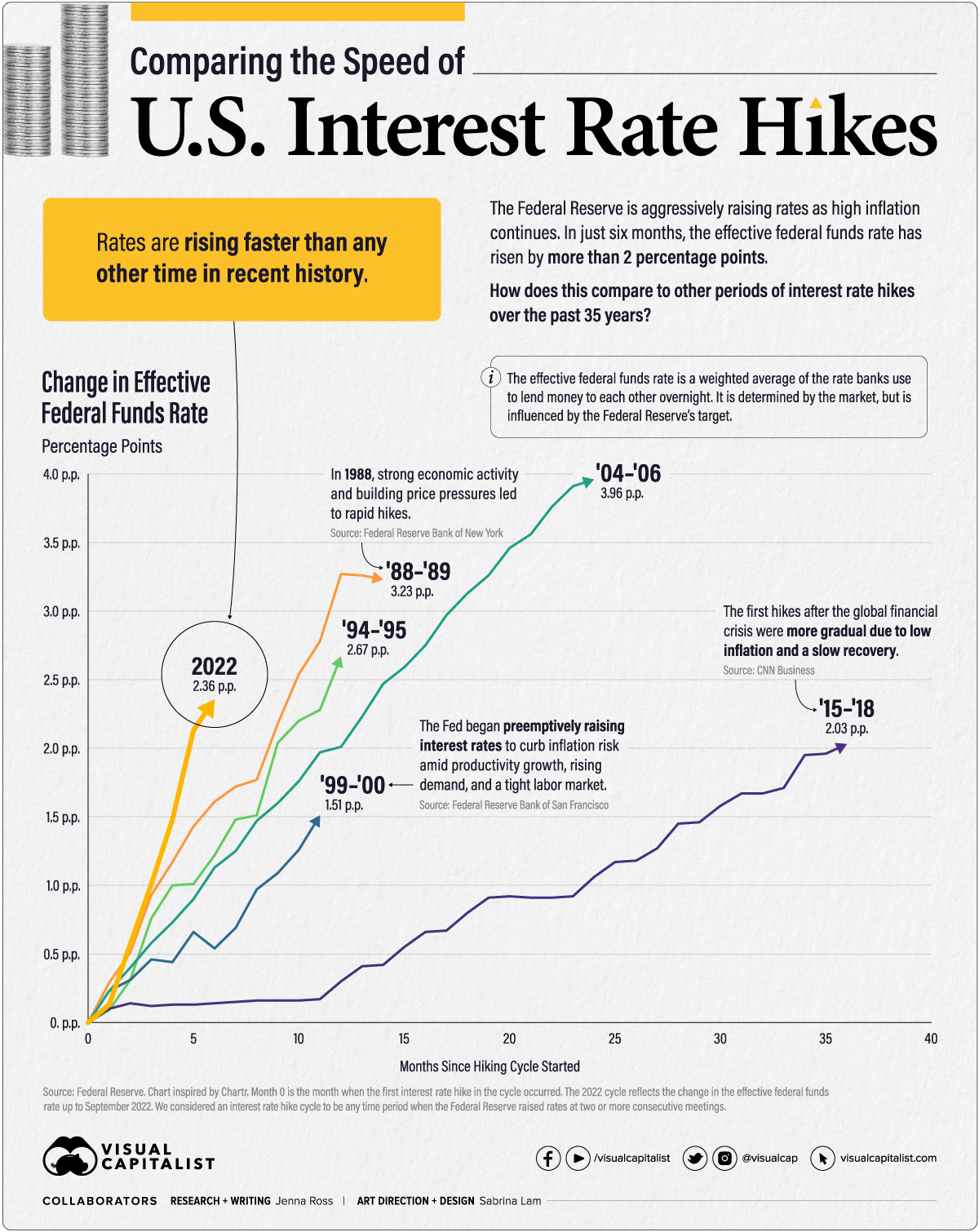

Here’s a useful visualization from Visual Capitalist:

We have had bigger rate hikes, but not as fast as the one we’ve seen in 2022. That chart above was published in October, so prior to the latest rate hike taking the target to 3.75%-4%. So the rate hikes hurt Opendoor, but it was the speed of the hikes that really fucked them over.

A contributing factor, for sure, was Opendoor’s decision in Q2 to not cancel its purchase contracts:

However, given how quickly our spreads increased, and the time lag we have between making an offer and when an acquisition closes, we saw a gap between spreads that offer versus close time for specific cohorts of homes during the quarter. We made the decision to close on those homes and not to reprice or cancel contracts. We believe that this is a critical brand investment that will pay dividends for years to come.

It was a courageous decision. Time will tell whether that was the right thing to do, or a horrible mistake that will end Opendoor’s dreams for good.

But the decision makes sense in the grand scope of things. You’ll see.

iBuying Isn’t Dead Precisely… But Turns Out, That’s Not Important

Everything in the earnings call and in the shareholder letter suggests that while Opendoor’s core iBuying isn’t dead, it might be on life support. 45% fewer purchases, resulting from Opendoor’s (correct) decision to offer less to sellers, and a 64% drop in homes under contract suggest as much. Opendoor is still buying homes for cash from sellers who want the convenience and speed, but its offers will not be competitive compared to consumer buyers who aren’t thinking about reselling that home in 90 days.

Look at the list of key areas for the core iBuying business (which Opendoor renamed as 1P business for “first-party”):

- Selling through existing inventory in a disciplined and expeditious way (“Gotta dump what we have.”)

- Ensuring healthy new acquisition cohorts (“Have to buy new inventory at far lower cost.”)

- Executing on operational changes to improve unit economics (“Spend less money and less time fixing things up.”)

- Reducing our cost structure (“Layoffs and less marketing.”)

I’ve added translation to plain English after each bullet point.

It is clear that these are not permanent business model changes; they are merely short-term things Opendoor has to do in order to survive. Eric Wu and team believe (rightly so, I think) that the market will turn eventually, and that when it does, they can come back leaner and meaner.

But once again, iBuying turns out not to be the real point. It’s actually not about making money on buying and selling houses; that’s what we have been missing all along. It’s about something else entirely.

The 3P Marketplace

By far the most important development is the launch of Opendoor’s 3P Marketplace (I’m calling it that, because lots of different terms are used, but for our purposes, I think this most accurately describes what the product actually is).

From the Shareholder Letter:

Today, we are officially launching that marketplace in Dallas-Fort Worth and Austin, under the brand umbrella of Opendoor Exclusives.

Now our sellers can connect directly with our buyers to transact without the hassle and complexity of a traditional listing. Earlier this year, we announced the launch of the buy side of the marketplace, our e-commerce experience to directly buy an Opendoor-owned home – and we are now opening up this platform to our home sellers. What underpins our conviction is years of being one of the largest buyers and sellers of homes and the capabilities that we’ve built, which enable us to bring together hundreds of thousands of our home sellers with unique homes and our growing base of home buyers.

…

Outside of significantly improving the consumer experience over a traditional listing, we believe this marketplace will reduce our inventory exposure, capital intensity, and macro risk. It will also expand our target audience from sellers within our buybox that will accept our price to all sellers who are looking for a better alternative than what exists today. Furthermore, it will give buyers and investors a differentiated reason to shop with Opendoor, which is our access to thousands of unique homes that can be easily purchased directly. [Emphasis added]

Back in July, I wrote a piece called “On Opendoor Exclusives” where I reacted to a great article by Dr. Tyler Okland, the Stanford-educated surgeon who is behind Datadoor.io. You can read the whole thing if you’d like more background. The point is that I was dead wrong in that post when I wrote:

And once Opendoor starts operating what is effectively an MLS, all of the MLSs that Opendoor belongs to will look for reasons to stop having Opendoor belong to them. It isn’t clear what methods the MLS will use, and it isn’t at all clear whether those methods would or would not be legally copacetic, but like Zillow, Opendoor doesn’t really want to find out what the MLS will do to them in response. They have much bigger fish to fry, and operating an MLS is just a low-reward, high-risk game.

There is a reason why Zillow has never tried to start an MLS. The juice just ain’t worth the squeeze.

Turns out, Opendoor thinks the juice is worth the squeeze. In fact, it turns out that squeezing that particular orange was Opendoor’s goal from the beginning.

Bold move, Cotton. Bold move.

Details on the 3P Marketplace

So what is this 3P Marketplace? From the shareholder letter:

For home buyers, we are building the experience they deserve, and what we believe as a far better way to help future homeowners accomplish their goals. Each of our homes comes with transparent, buy-it-now pricing and an Appraisal Price Match Guarantee, meaning if the home appraises for less, we’ll bridge the gap for buyers up to $50,000. On top of that, we are able to provide significant savings on every home. We believe these features dramatically simplify the process, give buyers more confidence around paying the right price, and make purchasing more affordable.

For home sellers, we’re aiming to make the sales experience just as easy as selling to Opendoor. Homeowners can request an offer from our network of buyers, on top of an Opendoor offer, and sell in minutes without the need for repairs, extensive home prep, or months of open houses or listings. The experience end-to-end is designed to put home sellers in control, with no upfront commitment, flexibility to close early, and certainty of close. [Emphasis added]

The key benefits for the buyer using the 3P Exclusives marketplace are:

- No-haggle Buy-it-Now Pricing

- Appraisal guarantee of $50K

- “Significant savings” on every home

The key benefits for the seller are:

- Sell in minutes without repairs, home prep, or months of open houses or listings.

- Close early, and certainty of close

One wonders just how these are to be done. More on that below.

In the earnings call, Eric Wu went into a bit more detail. He begins by noting that institutional buyers were the foundation of the exclusives marketplace, and in 2022, those institutions bought more than 10% of Opendoor’s inventory directly, “including 1,800 homes where we secured a contract to resell before we close with our sellers.” That is, Opendoor went under contract, then immediately found an institutional buyer for it, then sold it. That’s the classic market maker model.

What Opendoor’s 3P marketplace does then is to expand the buyer pool beyond institutional buyers with tons of cash.

He further clarified that “based on early tests, sellers are very excited to opt into the program. And that is above and beyond the pool of sellers that would have accepted an Opendoor offer.”

As I was writing this post, a friend sent me the updated Opendoor Exclusives website with a new FAQ on “Customer-Owned Exclusives.” Read the whole thing there if you’d like. From that, we get a few more details.

Customer Owned Exclusives are Listed by Opendoor… Kind Of…

First, we learn that these 3P Marketplace homes will actually be listed by a new entity: Opendoor Connect, a non-MLS member, licensed brokerage and its affiliated companies. The FAQ tells us that Opendoor Connect is a seller-only brokerage, and does not provide any buyer agency services.

The Significant Savings Comes from Opendoor Connect

Second, we learn that the buyers of Customer-Owned Exclusives save 2% because Opendoor Connect will make up that difference:

When you buy a Customer-Owned Exclusive with Exclusives, you will pay 2% less. Since we represent the seller, we can use our commissions to pass savings back!

Specifically, once you’ve gone into contract with the seller, we’ll use our commissions to give them a 2% refund in the form of a seller closing credit. For example, if you purchase a home for $200,000, Opendoor Connect would add a credit for 2% of the final purchase price ($4,000) in favor of the seller. This ultimately makes your offer more competitive, because the seller gets more while you pay less.

So this is basically a commission of 5%, then a 2% credit back to the seller with the buyer taking 2% off the price of the home? Seems like it.

Buyers Can Work with an Agent…

But buyer agent compensation is your problem:

Opendoor Exclusives is designed to be a self-service product and enable buyers to purchase directly. If you choose to work with Opendoor directly, you’ll have access to our specialists 7 days a week to answer your questions about the process. You can call us at (512) 706-9938, email us at exclusive@opendoor.com, or chat with us on the Exclusives website 7 days/week from 8am-8pm local time.

If you prefer to work with an agent, you can do so. However, any commissions paid to your agent would be your responsibility.

I suspect that we are about to find out what percentage of buyers feel perfectly comfortable buying a home without representation, when “specialists” are available to answer any questions… even if said specialists work for the seller. I’m gonna guess it’ll be an uncomfortably large percentage.

Question Time

Given what I had written back in July, my mind immediately went to a few questions. Let’s go through them.

Opendoor Connect is a Fiduciary of the Seller

So, Opendoor Connect is the listing broker for every 3P Marketplace home.

It’s clever to use an affiliated but non-MLS member brokerage for this, since Clear Cooperation Policy would force Opendoor Brokerage to enter all of them into a local MLS.

However, I have some questions on what sorts of fiduciary duty Opendoor Connect would owe to the sellers utilizing the 3P Marketplace. Because that has nothing to do with MLS membership and everything to do with agency law.

A bedrock of fiduciary duty is that the agent must “subordinate his self-interest to that of his principal.” If I’m a seller who utilized the 3P Marketplace, taking the no-haggle pricing advice from Opendoor Connect, and then decide afterwards that I could have gotten more money from either a traditional sale or something else… I think I have a pretty good claim for breach against Opendoor Connect. Did Opendoor really put my interest over their own on that deal?

That’s gonna get real sticky if the seller is 80-year old widow Johnson selling her family home after her husband of 45 years passed away and the buyer is Bigass NYC Hedge Fund who has purchased 3,000 homes from Opendoor over the years.

Multiple Offers

The FAQ makes clear that although 3P Marketplace uses “no-haggle” price, if there are more than one offer at that price, then Opendoor will let buyers increase their offer.

Okay, so… what’s the timeframe here?

We know that with the Opendoor-owned Exclusives, it’s a first-come, first-served deal. If you’re the first buyer to say Yes, then that house is yours, even if someone else comes along and offers more. Cash or financed, it doesn’t matter.

With the Customer-owned Exclusive, it is equally obvious that it is not a first-come, first-served deal. So how much time do buyers have to submit these offers? The FAQ simply says, “limited period of time.” Is that 2 days? 3 days? 14 days? What?

If an offer comes in one day after the “limited period of time” ends, doesn’t Opendoor Connect — a fiduciary of the seller — have to present that to the seller? How does that work?

MLS Relationship?

This will likely be a source of contention between Opendoor and the many MLSs that it belongs to. Most Participant Agreements I’ve seen over the years have terms that say that the Participant agrees not to compete against the MLS.

The obvious answer is that Opendoor Connect is not the Participant; Opendoor Brokerage is the Participant. The parent company, Opendoor Inc., is an iBuyer who buys and sells homes on its own account. Opendoor Brokerage is not competing against the MLS; a sister company is.

Of course MLS executives, Boards of Directors, and other Participants are not fools. Such a fig leaf will be seen for what it is: a fig leaf. There will be reactions. I don’t quite know what those might be, but it seems silly to think there won’t be reactions.

Which brings us to….

No Haggle, Buy-It-Now Pricing

How will sellers on the 3P Marketplace have buy-it-now pricing?

Since they are clients of Opendoor Connect brokerage, one assumes that they will be advised by Opendoor Connect on pricing.

How will Opendoor Connect, a brokerage that belongs to not one MLS, be able to provide pricing guidance?

I assume that Opendoor Connect will use the best-of-breed pricing engine of the parent company, Opendoor, to help the seller set the no-haggle price. I’m not sure how else Opendoor Connect will be able to do any kind of price guidance; they don’t have access to CMAs (which come from the MLS). The pricing has to come from the pricing engine, which is at the heart and soul of Opendoor itself.

Three questions come to mind here.

One, as Eric Wu suggests in the earnings call, many of these 3P Marketplace sellers are those who rejected Opendoor’s 1P (First-Party) offer. So if Opendoor’s pricing algorithm gave them one price if Opendoor is the buyer, why would they trust the pricing algorithm if somebody else is the buyer? This is a variation of the problem that Redfin ran into with its iBuying.

Think about it. Opendoor says, “We’ll offer you $300K for your house.” The seller says, “No thanks; that’s too low.” Then Opendoor Connect says, “Hey, we think the Buy It Now price on your home should be $400K.” Why would the seller trust that number, when the first number was too low to accept?

Two, does this pricing engine get any data from any MLS?

If it does, then Opendoor’s about to have a problem with MLS rules. All of them that I’m aware of prohibit derivative works. Opendoor Brokerage can use the data to do pricing for Opendoor Inc., a bona-fide client who is looking to buy and sell actual houses.

Since Opendoor Connect is not a Participant, however, if Opendoor Brokerage passes on pricing recommendations, even if those come from a computer algorithm, I’m pretty sure that’s gonna be a no-no. That sounds just like a derivative work, and Opendoor Connect is no kind of bona fide buyer/seller; it is, in fact, a non-MLS brokerage.

Opendoor would need two pricing engines: one for Opendoor Brokerage and Opendoor, Inc. and another for Opendoor Connect. The latter has to use non-MLS data; public records, social graph, Google, all the magic that Opendoor has put together, but no data from the MLS. I hope they have a line on really pristine property data, including photographs (which are necessary to do comparable analysis), that is as accurate and as timely as MLS data is.

Sell In Minutes, Without Hassle

In the 3P Marketplace, the seller owns the house. Buyers make no-haggle offers within a limited period of time.

So how is the seller actually selling this house without cleaning it, without updates, without staging, without any of the hassles traditionally involved with selling a home? To an institutional investor, sure, that makes sense. To retail buyers?

Let’s assume that part of the 3P Marketplace is that Opendoor’s field crews would do for the seller what they would do for an Opendoor house: clean, paint, update, etc. to get the property ready for sale. The 5% commission to Opendoor Connect covers this work. Does that mean Opendoor would then assume liability for any damages to the seller’s house, any mistakes, etc.? What about if the home fails to sell? Does the seller now have some kind of a claim that Opendoor’s contractors screwed things up and that’s why they didn’t get any offers?

More interesting, I suppose, is whether Opendoor’s 3P Marketplace is available for sellers who are living in the house.

In the 1P product, where Opendoor just buys the house, the seller doesn’t care about anything because he’s moving the hell out. If he’s using the 3P Marketplace, is he moving out instantly? Can he just leave empty pizza boxes on the dining room table and not give a damn about the weird smell in the basement?

I’m really quite unclear on how the 3P Marketplace works for sellers who are living in the house. Yet, not having the hassles and problems of the traditional process is the main selling point for 3P Marketplace. So, is this only for vacant properties? If not, how does that work?

Close Early, Close Certain

If selling direct to Opendoor, both of these things make all kinds of sense. They are the core value proposition of selling to Opendoor. Opendoor isn’t moving into my house at the start of the school year, and Opendoor has billions in cash. Opendoor can close when I want to close, and Opendoor isn’t worried about financing falling through.

When selling directly to a buyer, how are these things getting put in place? For this purpose, leave the institutional buyers out of it; Eric Wu thinks Opendoor can sell 20% of inventory (including the 3P inventory) to consumer buyers.

The certainty of close can be achieved by the buyer using Opendoor’s cash: the Buy With Opendoor program, which has been in place for a while. So I get that.

But how is the early close being accomplished? Sure, if the buyer can close early, that’s great. But if the buyer has a home sale contingency, or needs to move from out of state or what-have-you, how is Opendoor doing an early close? Is it a, “We’ll buy it ourselves (first-party) for four weeks while the buyer is getting his shit together” kind of a deal?

Not saying these can’t be done; just curious how Opendoor is offering these benefits to the seller is all.

This is The Original Vision

Finally, one thing I learned from Q3 earnings call was how important this 3P Marketplace is to Opendoor’s original vision. That was news to me; perhaps it shouldn’t have been, but I never got early Series A decks from the startup Opendoor. I had always imagined Opendoor was about fixing mortgage; it turns out, maybe Opendoor was about making the market work.

Launching a managed marketplace has been our plan since we founded the company.

And so if you look at our Series A deck, we stated our platform will be used to connect buyers and sellers, of which Opendoor would be one of many buyers. And our stated ambition is — and it remains the stated ambition is to enable every single home buyer and seller to be a participant and earn them as a customer. Transparently, I wanted to launch this in Q1 of 2020. And we knew we had a deep and large funnel of sellers. We’re unique in that. But we needed to build the demand side to ensure that we can successfully launch the marketplace.

Just having supply is not sufficient, obviously.

And so, we’ve made significant investments on the demand side, one, starting with our work with institutional investors, which has been a four-plus year endeavor for us [Audio Gap] building APIs the pathways to power those transactions against selling somewhere between 10% and 20% of those homes to institutional investors.

Another example of this is that we have secured in north of 5,000 resell contracts from REITs before even closing with the seller.

And so logically, you would say, okay, we can make it possible to have those pathways connect directly as opposed to us closing twice on the home. And second investment was made more than 12 months ago, which was the key piece for us, which is we needed to build a product that attracted demand.

And so we invested in exclusive listings, again, the ability to buy from us directly with a very simple experience and features that aren’t offered by the current marketplace. And we’ve demonstrated that we can sell 20% of our homes directly to buyers on opendoor.com.

If you measure that in 14 days, if you measure vis-à-vis the market, say, MLS is representing the market, our 20% maps to — in our cities maps to something like 36% or 40% in the market.

And so we’re not — actually from a velocity standpoint, that too far behind what would be full distribution.

And so that gives us a ton of confidence that there’s product market fit and buyers love our product. [Emphasis added]

Wow.

Wow, wow, wow. Opendoor is selling 40% of a market via Exclusives? I don’t know how else to interpret “our 20% maps to 40% in the market.”

That’s news.

The fact that Opendoor always intended to create this managed marketplace where Opendoor would be but one of the many buyers who would make offers to a seller is significant. And “it remains the stated ambition to enable every single home buyer and seller to be a participant and earn them as a customer” said Eric Wu in the earnings call. That’s pretty important.

Opendoor: The Real Estate Marketplace

It turns out that the vision for the company has always been to become a managed marketplace that connects buyers and sellers directly, with Opendoor itself serving as an important player for the sake of generating the activity in the first place. From the earnings call:

And so the goal is to get a sizable portion of sellers and buyers come to Opendoor at the same time and providing a solution that works for all of them and then expanding that playbook to all of our 50-plus markets. I would say, also in the short term, both the 1P business, the first-party business and third-party business are essential and complementary in nature. The ability to get an offer in minutes from Opendoor attracts the hundreds of thousands of serious sellers. The ability to buy from us in a different way attracts the hundreds of thousands of buyers. [Emphasis added]

The point of Opendoor as an iBuyer then is not necessarily to make a bunch of money buying and selling houses, but to be the bait that brings buyers and sellers to the marketplace.

Offer sellers cash, and they come to Opendoor. That gets them a bunch of sellers.

Offer buyers houses to buy and they come to Opendoor. That gets them a bunch of buyers.

Once both sellers and buyers are there, extricate yourself from the mix and connect them up. Make 5% from letting sellers and buyers use your platform. Both buyers and sellers happily use the platform because it is easy, simple, convenient, timely, and cheaper than using a real estate agent.

It’s kind of brilliant, but brokers and agents and MLSs are not likely to appreciate the brilliance of the plan.

Revisiting the Zillow-Opendoor Partnership

In light of this, perhaps we can revisit the Zillow-Opendoor partnership.

Back in August, I wrote this post where I marveled at the announced deal terms of the Opendoor-Zillow partnership. I thought Opendoor got taken to the cleaners:

I ain’t gonna front: the one-sided nature of this partnership has me shook. This doesn’t feel like a partnership between two proptech giants, both of whom have leverage on each other, and force both sides to give up something. This feels more like the kind of “partnership” that a young startup makes with Big Daddy Zillow. Zillow gives up nothing, gains all kinds of opportunities, and then gets the icing on top of 6 million warrants.

With the new information about the Opendoor Marketplace, that deal takes on a completely different look.

Opendoor giving away ancillary revenues (mortgage) turns out to be a no big deal; in fact, Opendoor shut down its mortgage division last week.

Letting Zillow be the primary advisor might not be a big deal, if that Zillow’s advisor would mention to the homeowner who requested an Opendoor offer that if you don’t like the offer, you can either list with a Premier Agent or list it on the Opendoor Marketplace. In August I wrote:

What we don’t know today is whether the partnership agreement specifies that this licensed Zillow advisor will be required to push Opendoor’s services, sing its praises, point out is benefits, and try really hard to get the consumer who did after all request an offer from Opendoor to follow through. Maybe there’s some language like that, or some requirement that yes, Zillow will be the primary advisor and Zillow agrees to primarily recommend selling to Opendoor, then secondarily recommend talking to a Zillow Premier Agent.

Before we continue… remind me what Zillow’s referral fees are from Premier Agents on a Flex program? Oh yeah, about 35% of GCI. What is Opendoor paying Zillow if the seller sells to them directly? I think I saw 2% cited somewhere.

Now, I’m thinking the partnership agreement goes like this:

- Seller requests an Opendoor offer

- Zillow Advisor says, “Here’s the Opendoor offer.” If the seller takes it, then Opendoor pays Zillow 2%.

- Seller says no thanks, that’s a lowball offer. Zillow Advisor says, “Well, you can just list it yourself on the Opendoor Exclusives Marketplace, and see how that goes. It’s free to use, you’re not locked in, and it only costs 5% if you sell through that platform.” Opendoor would pay Zillow 35% of that fee, just like a Flex agent.

- Seller hesitates, and Advisor says, “If you don’t sell using the Opendoor Marketplace, I’m happy to hook you up with a Premier Agent who can knock it out of the park for you.” No referral back to Opendoor on those, because Opendoor doesn’t really care about them. Those sellers were not going to be participants on Opendoor Marketplace.

Wow. That’s a different cast to the deal now, isn’t it?

And the traffic and lead volume that Opendoor can expect to get for its 3P Marketplace from being Zillow’s exclusive iBuying provider are significant. Now the deal makes all kinds of sense.

Opendoor the Consumer MLS

Above, I mentioned that Opendoor might want to squeeze the MLS orange, because the juice is worth the squeeze.

There is one very important reason why Opendoor might want to go down that path, even after the fig leaf of Opendoor Connect the non-MLS member brokerage.

Under the rules today, Opendoor Exclusives — whether 1P or 3P — end up on Zillow’s second tab. Those are not agent listings sourced from an MLS via IDX feed. Zillow cannot display those homes on the main tab. That’s a big problem for sellers utilizing 3P Marketplace. If buyers don’t know about my home for sale, and certainly their buyer agent belonging to the local MLS isn’t going to tell them because the home is not in the local MLS, then how do I get any traction?

Opendoor can try arguing that Opendoor Connect is a licensed real estate brokerage, and its listings are agent listings belonging to the main tab. That is the exact argument being advanced by REX in the case of REX v. Zillow right now. We don’t know how that case will be adjudicated, but until it is, Opendoor Connect is just like REX.

The Opendoor-Zillow partnership can’t get around the rules imposed on Zillow by the various MLSs it gets data from, and Zillow isn’t gonna screw around with that for Opendoor’s sake.

However… if the 3P Marketplace is itself an MLS, then Zillow can display those on the main tab because it is being sourced from an MLS.

Relevant to this thinking is the fact that the term “MLS” is nowhere defined, other than in private industry groups’ own rules and policies. NAR defines what an MLS is. CMLS defines it. But if you’re not a member of NAR, what do you care what NAR thinks is and is not an MLS?

Sellers who list their homes on Opendoor’s 3P Marketplace will want those homes advertised on Zillow; that’s where all the buyers are. Opendoor is going to want them displayed on Zillow.

As of this writing, the easiest/fastest way for Opendoor to do that is to declare that its 3P Marketplace is in fact an MLS. Maybe after REX v. Zillow, that changes, but with appeals, with delays, with legal practice today… it ain’t gonna be all that soon.

It seems that the corporate structure makes clear distinctions between Opendoor Brokerage, who is a member of dozens of local MLSs, Opendoor Connect who is not a member of any MLS, and Opendoor, Inc. itself (who presumably owns and runs the Marketplace platform). I think Opendoor has a strong case against Opendoor Brokerage being shut out of local MLSs for “competing against them.”

Simply owning a competing MLS or being affiliated with a company that owns one is not enough reason for a local MLS to bar a brokerage from becoming a Participant. Why? Because numerous brokerages — I can think of Howard Hanna and John L. Scott off the top of my head — are at least part-owners of broker-owned MLSs. If a local MLS is going to make trouble for Opendoor Brokerage, then it’s gonna have to explain to the DOJ and others why it isn’t going after Howard Hanna.

If I can think of this, then I assume that the very smart people at Opendoor have already thought of it as well.

The Core Value Proposition Remains

Finally, the industry and the financial press and Wall Street are likely going to look at the billion dollar loss, write off Opendoor completely, speculate about when it’s going out of business, and loudly proclaim, “iBuying never made any sense.” Maybe they’re right.

But… here’s Eric Wu during the earnings call after he was straight up challenged on conversion rates now that Opendoor is lowballing the shit out of them (“higher spreads”):

What I’d say is that we’re observing conversion rates somewhere between 10% to 15% of true sellers, which is obviously lower than the north of 30% we’ve seen historically, but that is at fee — spread levels, we’ve never actually had in market.

So, to restate it, we’re at peak uncertainty in this moment, which results in us having to take a risk off stance, which means that we have the highest spreads in company history. And we’re still seeing somewhere between 10% and 15% of sellers saying, yes, and loving the experience and delivering a north of 70 NPS experience. The inputs for that really is as follows.

One is, there are a set of customers that really value the convenience of not having open houses and visitors and some combination of — to have kids or pets or the impact of COVID and the like. And so, they’re more price insensitive and really just this is coming.

And as it turns out, there’s also a set of customers that just really like the speed and certainty aspect of it. And what’s happened is that over the course of eight years, they’ve actually built up quite a bit of equity, and they’re still — and they’re valuing their time or convenience versus maximizing their equity in a backdrop of massive uncertainty.

And so the combination actually has surprised us on the upside that we’re able to convert a meaningful amount of our customers with spread levels that we’ve never tested historically. [Emphasis added]

The reason why I was/remain an iBuying bull, and why I was/remain an Opendoor bull, is the simple fact that the transaction process is a pain in the ass and consumers will choose less pain in the ass ways if one is viable.

What we’re hearing is that even at crazy lowball offers (“highest spreads in company history”) 10-15% of sellers are like, “Okay, I’ll take that.”

One group is willing to pay not to have to deal with the pain and hassle of the traditional process. The other group made so much gains in the equity of their homes that taking a 20% cut is actually not that big a deal. I mean, if you bought at $200K and then over eight years, your home is “worth” $800K and Opendoor offers you $500K… that might be a horrible lowball offer… but you’re still up $300K aren’t you?

Combined with Carrier Wheeler’s confidence that Opendoor has plenty of capital to weather the storm, take huge losses on remaining Q2 inventory, then make money on the fresher inventory they bought super low, I know it’s hard to summon optimism for Opendoor… but I do think it staves off complete panic.

The core value proposition — certainty, speed and convenience — remains. Consumers will flock to Opendoor just to request an offer, even if 90% of them will reject it. Those consumers will now be offered the Opendoor Exclusive Marketplace. The margins on those deals will be significantly higher, and more important for Opendoor right now, there’s no capital layout like in 1P.

Does not look like doom to me.

I Can See Clearly Now

This got long. But it had to get long, I think. In the way of wrapping up, Q3 was eye opening for a lot of reasons. The numbers certainly widened my eyes; it’s hard to ignore a billion dollars in losses.

But more importantly, I learned what Opendoor’s real endgame is — the same endgame it has had since the beginning. That endgame is to become the marketplace for buying and selling houses, leveraging all of the technology that Opendoor built trying to become an iBuyer, and leveraging all of the sellers Opendoor brought on by offering cash, then all of the buyers Opendoor brought on by offering Exclusives. Opendoor has tested its processes, its technology, and its feature set by working with institutional buyers for years and now it is ready to open that up to retail consumer customers.

Turns out, iBuying was never the goal. Becoming a market maker, who provides liquidity into a marketplace, was never the goal. Building that marketplace was the goal, and if Opendoor had to become a source of liquidity in order to get unique inventory in order to get buyers to the marketplace, then that’s what they had to do. They have done that successfully for years now. I think they would have preferred to wait another year or so, but macro conditions forced their hand. So they’re launching that marketplace now.

It makes sense.

For what it’s worth, Opendoor claimed they have sold the equivalent of 40% of the market in the cities they’re in today. Expand that nationally, even at depressed transaction counts. Say 4 million homes sell in 2023. 40% is 1.6 million. Say the average transaction is way, way down to around $250K. The 5% fee that Opendoor would charge results in revenue of $20 billion, with a B, and they would have no capital risk with the Marketplace model.

It all makes sense now. I can see clearly now.

-rsh

4 thoughts on “[VIP] Opendoor 3Q/22: I Can See Clearly Now”

Rob,

I admire your work immensely-BUT- is it possible that this Post should be titled “Just Wishin and Hopin”?

I assume you are being a bit tongue in cheek, or “Blinded by The Light/Long position” in the last few pages- The company that just lost $1 Billion in one quarter is going to ramp up a “Marketplace” that will participate in 40% of USA transactions? The same company that totally fumbled the ball on pricing, presentation,answering the phone etc, when they had a fiduciary responsibility to their OWN shareholders to do so? And buyers and sellers will gather at this marketplace and gleefully arrange showings,etc. without the dreaded Real Real Estate Agents being helpful to the cause? Too funny. Now if you told me Zillow was going to do that, I might say well maybe..they could do 5% of the market.

I am sure they will figure some way to stay barely alive, maybe sorta sure. The number of 6 figure losses in the NOVA market in Q4 is increasing daily. It is the shithole houses that are getting battered, that describes most OPEN homes, they just don’t make any effort. When you buy a house for $736k, list it at $850k, sell it for $575k and now a flipper has it on at $799K, your AI needs tweaking, I guess. Sorry for the length!

Entirely possible, and entirely fair to be honest.

Hard to argue against actual results, you know? At the same time, I think my role is to tell you what I’m seeing from a strategic standpoint. Agreement is not and has never been a requirement.

If you think Opendoor will fuck it up, that’s your take on things and it’s a fair one given what’s happened. I think otherwise, but that’s what makes the world go round.

BTW, if you (or anyone) really thinks Opendoor is going to zero, then you guys should be short OPEN. I’m long OPEN, and my biases are I think pretty clear.

I am not saying that it isnt worth a flyer on the long side at 1.80ish, or wherever it is today. Too risky to short. I may have biases too, but their ability to pivot from failure in execution on the “we buy houses” side makes me pretty cynical about success in their marketplace idea. Respect your opinion.

Comments are closed.