I had planned on my second post about Redfin to be its potential impact on Associations, MLS and maybe tech vendors. But you know, this whole Redfin thing is sorta big news in certain circles — tech and finance journalists as an example — and there have been a couple of interesting articles on Redfin recently.

Plus, I managed to find myself a Deep Throat of sorts who reached out to me and pointed the way towards even more interesting tidbits of information. So I thought, let’s do a follow-up before continuing to the speculations about the impact of Redfin, post-IPO.

Misplaced Skepticism

One of the articles I read was… well, a bit confusing. Its title is “Why Redfin’s IPO Matters So Much to Other Real Estate Tech Companies” over at The Real Deal. But the article is rather sparse on those reasons and rather heavy on skepticism of Redfin. For example:

As of March 31, Redfin had an accumulated deficit of $613.3 million. It filed initial papers for the IPO last month in a bid to raise $100 million in additional cash. While its annual revenues jumped from $125.4 million in 2014 to $267.2 million in 2016, the company is still in the red – its losses last year totaled $22.5 million. The company has not been profitable since its launch, meaning its IPO valuation would be based on potential future earnings.

Then the article goes on to talk about how much cash Redfin has burned through, how its investors have lost money so far, etc. etc. That’s all cool, and undoubtedly true. But knocking tech-based companies on the internet for not being profitable is… well… can you say Amazon? And I seriously doubt that anybody is getting laid off at Tiger Global for 15% in losses; it’s kind of their whole business model to bet on multiple companies and hit it big with one.

In any event, the most interesting paragraph comes at the end:

Skeptics, however, say in-house technology at traditional firms is catching up and that Redfin’s model underplays the significance of the real estate agent to a transaction, relegating them to the role of simply a “shower.”

Uh, who are these skeptics? And what in-house technology at traditional firms are they pointing to? Because I’m pretty sure I know most of the in-house technology at traditional firms, though certainly I’m not privy to details, and there’s no one whose job isn’t to do PR or marketing for said in-house technology who thinks any of them is catching up to Redfin.

Uh, who are these skeptics? And what in-house technology at traditional firms are they pointing to? Because I’m pretty sure I know most of the in-house technology at traditional firms, though certainly I’m not privy to details, and there’s no one whose job isn’t to do PR or marketing for said in-house technology who thinks any of them is catching up to Redfin.

First of all, traditional firms don’t have “in-house technology” unless you’re Realogy — in which case, please see my comment about Zap in my last post: it sucks. They buy technology from vendors, like Moxiworks, Lone Wolf, dotLoop (Zillow), etc. But usually, they cobble together a hodge-podge solution from a variety of vendors. For example, Contactually for CRM, Docusign for e-signatures, Backagent for an intranet, Transaction Desk for transaction management, and so on.

Second, even if we posit for the moment that the best of breed of these vendors like Boomtown are catching up to Redfin, are they still going to be catching up when Redfin increases its tech spend from $35 million a year to $70 million? How?

Go take a walk through the trade show floor of any major real estate conference and count how many of those companies have over $250 million in revenues. You can probably do it sipping your cup of Starbucks because I doubt you’ll need both hands. The real estate tech industry is made up of dozens and dozens of tiny little companies (reason for that, I’ll address in a future post) who do good work with what they’ve got, but c’mon now, they don’t have $35 million in annual budget for technology development. They’re certainly not going to have $70 million or $100 million.

Be skeptical of Redfin if you want — there are valid reasons for skepticism. But not making a profit yet isn’t one, and having so-so technology isn’t one.

Redfin Is Not A Brokerage, Part 2

The other line of thinking is around Redfin’s valuation. Will Wall Street value Redfin like a technology company (like Zillow?) or will it value Redfin like a brokerage (like Realogy?). I’ve already said in my first post on Redfin that it will be as a technology company:

Because there is no way in hell Redfin is going public at brokerage valuations. Nobody who matters thinks Redfin is a brokerage. Look at the coverage in the media — they all mention Zillow. They don’t mention Realogy and Re/Max and HomeServices of America. Goldman Sachs doesn’t agree to underwrite Redfin’s IPO, if they think Redfin is a real estate brokerage. The VC firms backing Redfin don’t allow Redfin to IPO at brokerage valuations.

…

If Redfin is a brokerage, making $256 million in revenues and losing tens of millions every year… it’s worth zip. Zilch. Zero. Nada. If Redfin is a technology company that happens to make money from commissions… it’s worth $3 billion or so (or more!)

Geekwire quoted me (thank you John!) in its article on this very question. They also quote Nat Burgess, founder of Seattle tech advisory company TechStrat, who thinks Redfin will successfully convince investors to value them like Zillow instead of like Realogy:

“Long term, they can disrupt the traditional brokerage model and build a technology-enabled services company that generates profits,” said Burgess, adding that Redfin’s brokerage business will bring many advantages.

“Redfin will own the listing, own the customer and, potentially, the mortgage underwriting fees as well,” he said. “But Redfin is burning cash and will have to invest a lot more to get there. In order to be successful long term, they will have to be valued as a tech company today.”

I’ve already posted why I don’t look at Redfin as a brokerage. Because Redfin is in the business of helping people buy and sell homes, instead of the business of recruiting agents who help people buy and sell homes, Redfin is an agent team, not a brokerage.

People outside the real estate industry do not understand this important distinction, because… how could they? But those of us within it understand why that is such a big deal.

So to return for a second to The Real Deal story, which says that other tech-driven brokerages like Compass, will be watching nervously to see how Redfin’s IPO prices… sorry fellas, but if you’re a tech-driven brokerage like Compass whose business is recruiting and retention of agents, Redfin is not the comp for you. Realogy is. Bad news for you, I guess.

The company that should be watching Redfin’s IPO closely is Ben Kinney Companies, a super-team affiliated with Keller Williams, which is now in eight nine states (home state of Washington, Colorado, California, New Mexico, Oregon, Texas, Idaho, Georgia, and Alaska) and at least talks about its technology.

I’ll eat my shoe, however, if Ben Kinney Companies spends $35 million a year on technology and development.

Projecting Redfin’s Revenue Growth Some More

Now, this is the good stuff right here and the reason for the title: BooM!

In my last post, I projected out Redfin’s potential post-IPO traffic growth just using Zillow’s post-IPO traffic growth as a comp. If Redfin matches Zillow’s 11% quarter-over-quarter traffic growth from 2011 to 2014, then by 2021, Redfin should have about 84 million monthly uniques on its website.

Thanks to my Deep Throat, I found something super interesting online. Ah, the Web never forgets.

This is Glenn Kelman talking about Redfin’s revenue model and experiences at Naked Truth Seattle in 2009, an event that Redfin used to sponsor. Glenn speaks from 4:26 to about 8:30

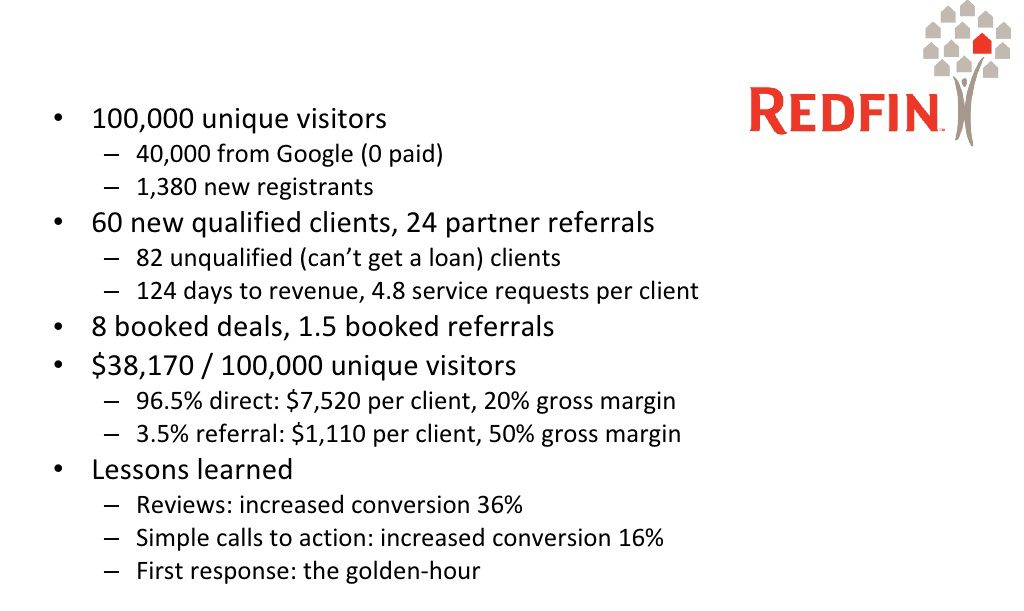

And here’s the slide that Glenn was referring to during his talk:

So in 2009 — right in the middle of the Housing Collapse, which Glenn talks about — for every 100K in unique visitors, Redfin was getting 60 new qualified clients. 8 of them turned into actual transactions, generating $7,520 per client. (Yes, the slide and Glenn sort of contradict each other, because the slide says $38,170 per 100,000 unique visitors, but Glenn says $60,000 per 100,000 unique visitors.) And Glenn mentions that they were sitting at around 20% gross margins, which is “terrible” in his words. For a brokerage, that’s amaze-balls; for a tech company, that sucks ass.

So in 2009 — right in the middle of the Housing Collapse, which Glenn talks about — for every 100K in unique visitors, Redfin was getting 60 new qualified clients. 8 of them turned into actual transactions, generating $7,520 per client. (Yes, the slide and Glenn sort of contradict each other, because the slide says $38,170 per 100,000 unique visitors, but Glenn says $60,000 per 100,000 unique visitors.) And Glenn mentions that they were sitting at around 20% gross margins, which is “terrible” in his words. For a brokerage, that’s amaze-balls; for a tech company, that sucks ass.

Anyhow, in its S-1, Redfin claimed 20 million monthly uniques, and gross profit of $82.7 million on revenues of $267 million, for a gross profit margin of 30.9% overall. (Redfin claimed 34.5% gross margins in their 2006-2008 market cohorts, 28.9% in their 2009-2013 cohorts, and 19.4% in their 2014-2016 cohorts.)

Furthermore, in the 3 months ending March of 2017, Redfin had these metrics according to its S-1:

- 20.1 million in average monthly unique visitors

- 5,692 Brokerage Transactions, averaging $9,570 in revenue per

- 2,041 Partnership Transactions, averaging $1,911 in revenue per

If you work that out per month, it translates to 12.78 transactions per 100,000 unique visitors (9.4 brokerage transactions and 3.4 referral transactions).

Also, if we assume that Redfin’s conversion to “new qualified clients” is similar in 2017 and beyond as it was in 2009 (60 per 100,000 unique visitors), then we can extrapolate from that as follows:

- Q1 of 2017, Redfin generated 36,292 “new qualified clients” from its 20 million average monthly unique visitors.

- In 2018, Redfin will generate over 231,000 leads

- In 2019, Redfin will generate over 348,000 leads

- In 2020, Redfin will generate over 524,000 new qualified clients

Got it? So if we assume that Redfin’s traffic growth will be similar to Zillow’s post-IPO traffic growth, and we hold its per-transaction revenues same as in Q1 of 2017 (which is quite unlikely, but for this kind of math, it’s fine)… Redfin’s revenue growth would look like this:

| (in thousands) | Q2 | Q3 (IPO) | Q4/Year 1 | Year 2 | Year 3 | Year 4 | |

| Zillow Avg. Uniques/Mo | 20,759 | 24,238 | 23,507 | 34,535 | 54,358 | 76,713 | |

| Redfin Avg. Uniques/Mo | 20,126 | 22,333 | 24,739 | 37,245 | 56,073 | 84,420 | |

| Redfin Revenue | 59,868 | 64,660 | 71,623 | 372,397 | 560,655 | 844,083 |

Incidentally, Zillow did $644.7 million in revenue in 2015, after going public in 2011. If Redfin actually does $844 million in 2020 after going public in 2017 as projected above… uh… watch valuations go through the f’ing roof.

Incidentally, Zillow did $644.7 million in revenue in 2015, after going public in 2011. If Redfin actually does $844 million in 2020 after going public in 2017 as projected above… uh… watch valuations go through the f’ing roof.

If Redfin can hold on to its 31% gross profit margin, we’re looking at gross profits of $115.4 million for 2018, $173.8 million for 2019, and $261.7 million for 2020. What they choose to spend on technology, marketing, or whatever else will dictate whether Redfin produces a net income or not.

Incidentally, in 2020, that’s projecting to be 82,307 transaction sides. Given that there are roughly 5 million homes sold in the U.S. in any given year, we’re only talking about 8% market share or so. I did some calculations making some conservative assumptions (e.g., Redfin’s buy-side commission is only 2.5%, listing side is only 1%, etc.) and came up with the following Sales Volume calculations:

- 2018: $25.2 billion

- 2019: $38.0 billion

- 2020: $57.3 billion

What that suggests is that Redfin would be the third largest brokerage by volume on the RealTrends 500 list by 2020, after Realogy and HomeServices of America. And it wouldn’t be a close contest between Redfin and the fourth place brokerage, Douglas Elliman based in New York City, which in the last two years has posted $22.2 billion and $24.5 billion in volume.

But I’d be willing to bet that Redfin’s profit margins would be many times that of Realogy or HomeServices of America, unless the latter two companies make dramatic changes. After all, in their Q1/2017 earnings call, Realogy executives said:

NRT commission splits increased to 112 basis points year-over-year as we stated on our year-end call. Our current estimate for 2017 is that splits will increase to between 69.5% and 70%, as we continue to strategically invest in strong sales agents.

If the average NRT commission splits increases to about 70%, the commission splits for the top tier agents who bring in the bulk of the revenue will be far higher than that — maybe closer to 90% or 95%, just so the NRT can remain competitive with the likes of Keller Williams and the 100% shops that are encroaching on their agents.

In any event, I know I’ve made a lot of assumptions in projecting forward like this, but I think they’re pretty conservative assumptions. And based on that, Redfin is going to be an absolute monster if it keeps its traffic growth up.

The key takeaway for anybody reading this ought to be that Redfin calculates its revenues on the basis of traffic, rather than on the basis of agent count or number of offices or whatever it is that traditional brokerages use. And since they stand poised to grow traffic post-IPO from (a) expanding into more markets, (b) better technology, and (c) better/more marketing… Redfin’s revenues will also grow.

If you can come up with a rational scenario under which any brokerage or agent team (Ben Kinney Companies included) generates that kind of qualified leads, that kind of deal flow, and that kind of revenue from 2018 to 2020, I’d love to see the logic and the math.

Maybe It’ll Price; Maybe It Won’t

None of the above means that Redfin will price as a tech company instead of a brokerage, of course. Who knows what the market will do?

But when Redfin itself analyzes revenue as a function of its web traffic, and has grown its “booked deals per 100,000 unique visitors” from 8 (and 1.5 referrals) in 2009 to 9.4 (and 3.4 in referrals) in 2017… well… you draw your own conclusions however you wish.

And be skeptical all you want of Redfin; I have no dog in the fight. I don’t own any Redfin shares, I don’t work for or with Redfin in any way, nor do I work (anymore) for any of its competitors.

I’m just calling it like I see it because the impact of Redfin post-IPO is all kinds of interesting for all segments of the real estate industry, but most of all for brokerages (not agents, not brands, but brokerages) who are going to be facing annihilation in the not-too-distant future.

[Sales Pitch] Unless you call me, that is. [/Sales Pitch]

So…you’re saying buy? 🙂

While there are a lot of assumptive correlations, you make a great case for a huge valuation. Is there a point where traffic continues to grow, but conversions per unique user start dropping because consumers who are loyal to other agents become a larger portion of Redfin traffic (but not clients)? 2020 is only 3 years away. Redfin has a big opportunity with first-time buyers, but a huge number of agent-client relationships will be exactly the same in 3 years.

It’s worth considering (in these hockey stick projections) that the consumer who accepts a production line style of agent representation and has no current loyal relationship with another agent is a growing, but not unlimited slice of the buying/selling public. Or, maybe the technology will rewrite traditional consumer preferences, and only 7DS clients survive the coming annihilation. 😉 It’s always thought provoking.

“While there are a lot of assumptive correlations, you make a great case for a huge valuation. Is there a point where traffic continues to grow, but conversions per unique user start dropping because consumers who are loyal to other agents become a larger portion of Redfin traffic (but not clients)? 2020 is only 3 years away. Redfin has a big opportunity with first-time buyers, but a huge number of agent-client relationships will be exactly the same in 3 years.”

Excellent question, and one that we really won’t know until we see actual results from operations.

My current gut feeling guess is that Redfin won’t hit that point of “loyalty resistance” until they get to maybe 15-20% market share. At 8% market share or even 10% market share, I feel like they can poach enough Millennial/Gen-X tech-centric buyers/sellers who aren’t all that loyal to an agent. I have nothing to back that up; just a feeling. But you know and I know that if Redfin really gets to around 20% market share, they’re challenging Realogy’s NRT for the top spot.

So the real question is, how many agents will be able to nurture that “client-agent” relationship and build a wall of loyalty around themselves? And how will they do it with the tools they have at their disposal today?

By buying, borrowing, or creating something that no one else has. Then if it’s good enough clients will seek them out diminishing their need to create loyalty.

#everyonehasthesamestuff

?

Thanks,

Brian

Consumers aren’t loyal to agents because agents aren’t very good at delivering acute value or keeping in touch. I don’t see either of these things changing. But a brand could step in and ‘own’ that relationship.

On this whole is Redfin a technology company of a brokerage saga

I think Redfin is closer to a tech company than a brokerage. Fundamentally, how they use and value tech is a lot different than other brokerages. Whats their secret sauce? Its their website. That’s technology. The traditional brokerages rely on their website leads a lot less than Redfin. Redfin’s website is driving most of their buy side and sell side leads. That website delivers so many customers/leads that they are actually turning down some business- if its at a lower price point or if all their agents are overloaded at that moment, they send those leads to their partner agents. So, when their website and their in house built technology (CRM’s, software that agents use, transaction management tools etc) is the key to their whole volume based model, then they are closer to a tech company. Another reason I think they are closer to a tech company is that my gut feeling is that once they go public, I wont be surprised if they sell some of that in house built technology to traditional agents. So, that platform and tech has some value.

Also, I see some of their in house built lead generation tools/tech also playing a huge role in their mortgage, flipping, escrow, title business, and many other arms that they might develop in the future. They might be a brokerage right now, but long term I dont think they are “just” a brokerage and a middleman that helps people buy and sell homes. Just like Uber does not want to be just a middleman that connects drivers and consumers. If Redfin vision is to be more than a middleman in the future, they are a tech company at heart.

I worked for Redfin as a team lead for 18 months and have since gone out on my own with my own brokerage.

There’s a lot that Redfin’s doing that puts them at a huge advantage over traditional brokerages; and as has been said here and elsewhere, there are still a lot of unknowns for Redfin’s model at this point in time.

One thing that almost no one talks about is that Redfin’s inability to attract enough agents is and will remain a significant risk factor. Redfin is aware of this, at least to some degree, as it lists this among its potential risks in its S-1. But that paragraph is almost a sidebar in length comparaed to other risk factors it discusses.

If you live up to Redfin’s production requirements (typically 36+ transactions per year), you can make decent money relative to other professions, especially when you consider the comprehensive health coverage, reimbursement of expenses, etc. But on a per transaction basis, that’s awfully low compared to an independent contractor producing the same volume. In fact, as an independent contractor, you’d likely only have to produce about half the volume to make the same money or more, benefits included.

And not only that, but you have to work *all the time* to meet Redfin’s production requirements to make that money, with your compensation being beholden to consumer surveys and your performance being measured in every conceivable way, just as you’d expect a tech company obsessed with data and analytics would. Sure, any agent producing at that volume is working a lot, but as an independent contractor the monetary reward is probably 2-3 times higher, and you have a lot more independence when it comes to making that money. For a lot of people, the constant state of near exhaustion is worth the compensation you get with Redfin. For most, I suspect, it is not.

When people get into real estate, they do so for all sorts of different reasons. With Redfin, as a salaried, employee-agent, you get almost none of those benefits. What you do get is a corporate-structured job, which is what most people are looking to leave when they get into real estate.

If Redfin can figure out how to make an agent’s work-life balance better in the scales, coupled compensating them much better, that, to me, is when we should really start to worry.

Such an interesting point, thank you Wayne. The same analysis could apply to those people who are joining agent teams as buyer agents.

I do wonder what the true comparison looks like between an independent vs. a Redfin agent in terms of actual money-in-pocket analysis. In other words, you’re undoubtedly correct that a traditional agent doing 18 transactions vs. 36 minimum for Redfin agents, to make the same money. But what would the expenses be for that agent to generate the leads and to have the systems to do 18 transactions?

Well said Rob. I am watching this and the most interesting thing is how Redfin and other tech related Brokerages count total commissions as revenue if got to do that my revenue from just my Washington Brokerages would be over 120 million but I don’t count total commissions just the amount I keep as the brokerage cap. I could covert them to employees and then pay them all the same splits and try and file for a IPO and I would be massively profitable compared 🙂

We will have invested about 10 million just this calendar year in our tech companies so luckily no shoe taste to spit out. A few years and be careful with that statement unless you like leather 😉

I love your writing, honestly, and research. Keep up the good work and I will see you at the next event or sooner.

Thanks Ben.

So, why not follow not just Redfin but also Realogy and report your total GCI as Revenue, then include your splits as Cost of Revenue? Your company dollar = Gross Profits.

Plus… dude, convert your agents to employees and file for an IPO… we need more public companies in this space.

Ben, Rob, SEC (GAAP?) requires revenue to be reported as revenue. Commissions are revenue even if it’s quickly paid to a contractor.

Rob, this is a good analysis. Thank you.

Thanks Galen. I did not know that.

And rob I think about that and cheese burgers every night.

So look. Long shots exist in every business. But based on what has or has not been accomplished to date, this one may have exhausted its options. Think about this. Even if you could bet on a horse after it was out of the gates and the race was nearly over, you might bet on the horse in last place if the odds were to increase more and more as the race progressed. It all depends on the odds. Watch what is happening in this “race” and what is not happening folks. So it’s $600MM “invested” to date or it’s another $100MM invested, who cares. What are the odds of winning? In this case, there will still be some investors that will bet on a “horse” that is running last in the race but is gaining slightly on the horse that is next to last. Hoping for some incredible breakthrough or that last spurt of energy fueled by another $100MM as the race approaches its completion. That’s life. So, I can almost hear it now. As that closing bell rings on Wall Street and a sole trader looks upward and loudly proclaims . . .

Look, up in the sky!

It’s a bird!

It’s a plane!

No it’s Redfin!

Faster than a streak of lightning,

More powerful than the pounding surf,

Mightier than a roaring hurricane.

Yes. It’s Redfin, strange visitor from another planet who came to Earth with powers and abilities far beyond those of mortal real estate brokerages. Redfin, who can change the course of mighty rivers, bend steel with its bare hands, and who, disguised as everything you could imagine in an industry, is a mild mannered company for a small metropolitan

real estate company, fights a never-ending battle for truth, superiority and the American way.

But wait, then there is this thing called kryptonite. Oops.

My last thought on this one? If I were Redfin I would save the pain and complication of the IPO and simply sell now to the Zillow Group. At least that way Zillow could right-size the company (they are both in Seattle), focus the business strategy (finally) and add Refin’s greatest asset, its really amazing Redfin web site, to contribute advertising value to its core offering to the general real estate brokerage industry. Seems to me to be a much better plan. At least that way, no matter where you place in the “race”, your owners at the Zillow Group will be sure to have at least one winning “horse.”

Onward!

Not entirely sure what you’re saying here Ken….

Redfin is the last place horse? Who’s the first place horse?

It’s tough to win a race with no finish line…especially when new fresh horses can be added to the field at any time ?

I would love to see where thst revenue per transaction number is comunv from, and most importantly, how much simply touches their accounts on the way out the door.

They are like those cssh box games at a sport event: lots of dollars swirling around a crazed fan trying to snatch what they can out of the air. Lots of excitment, precious little revenue kept.

Their technology does not have real revenue potential, at least not yet. Integrated on the broker side just scratches the surface. Until they or some other disrupter can bring the consumer to the door with title, legal and mortgage services, the big brokers in every market will continue to beat them like a drum.

Interesting read. I agree with you that the distinction between brokerage and tech company is important here. I lean in favor of your opinions with regards to those matters. Still, it’s providing a pretty big service piece outside the technology it provides, at this point requiring a lot of interaction between its employees and customers.

I think Wayne O. really makes a hugely underestimate point.

Its hard to argue that a companies talent is its most important asset. While there are some very hard working and talented agents working for Redfin they are usually developed from within. Drinking the kool aid from the start 🙂 Or at least being molded and trained as the company sees fit.

They typically start off as showing agents and then working up the ranks. Redfins model doesn’t attract already savvy successful agents, and when it does its likely those that have relocated and are starting over at square one using Redfin to fuel their next enterprise as solo agent.

I live and work in the Seattle area and have been around many Redfin employees in both professional and social settings over the past ten years. They ALL echo what Wayne says, but with a lot more F bombs and exasperation. They feel undervalued, not heard and absolutely dispensable. As such, they just don’t have the bandwidth to really give two sh*ts about the customer. They are driven by fear of reviews and # of sales, not about getting the most profits for their clients or having the kinds of ruff conversations that can be uncomfortable but need to be had. They don’t have any time to build relationships and don’t have the time to keep their eye on the whole transaction. In my view Redfin wants them to be as much an avatar as possible – with minimal time and emotion to give – Afterall, they want the person to remember Redfin, not John Smith at Redfin.

Its clear to me Redfin values its technology above all else, including their workforce. As such, I wonder if they would be best suited to sell the technology they have created to a company that values their people as their best asset, but also acknowledges the importance of the agent/client relationship.

Employees win, technology wins, end customer wins.

Best of both worlds, IMO…

“Driven by fear of reviews” and “not giving two sh*ts about the customer” seem to be in conflict. It’s possible that they do enough to get a good review while hating their “plight.”

Since top performers get stock options, I wonder if that will have any impact on employee mood.

This is a serious question – what is so special about their website? I have looked at it many times, and don’t really understand all the accolades. What am I missing? This is especially true if you want to dive into local information – that is something other than simply demographics.

20 million monthly uniques, for starters….

Exactly. That’s 10+ years to duplicate. How many re websites have 10 million visitors… Zillow, Trulia, Realtor.com, Redfin…that’s it, correct?