I’ve been extraordinarily busy with the final edits on the inaugural issue of The Red Dot, my new premium newsletter offering. It should ship tomorrow to all subscribers, so they can be ahead of the curve and avoid the $225 million lawsuit landing on their doorsteps. /salespitch

So blogging has been a bit light. Future issues, I hope, will not be as disruptive to my schedule… but we’ll see.

In any event, now that I’ve had a chance to peep out from under my rock, I noticed a news story on Inman today: “Half the cities on Case-Shiller are seeing all-time high home prices.” Key graf:

Bespoke Investment first pointed out the milestone over at the financial blog Seeking Alpha. The index as a whole showed a 6.3 percent year-over-year gain for home prices in February, released earlier this week. Home prices, according to the index, showed no sign of slowing and were similar to rising home prices in the 15 years before the financial crisis.

When you break those numbers down from the national to the regional level, the all-time highs are now standing in half of the real estate markets — reaching or exceeding levels seen before 2008.

But, we’re not in a bubble! Or so every economist related to real estate says, according to KCM Blog.

So fine, let’s say we’re not in a housing bubble. It’s all just supply-and-demand, no matter that the average worker can’t afford a median-priced house in 304 of the 404 counties (68% of the housing market) according to Attom Data Solutions.

What I’m curious about is this: What does it look like when the market finally shifts?

Keep in mind we’re talking about something that is as natural to real estate as beauty and seductiveness is to Grace Kelly. (I wrote that sentence just so I can use this photo by Howell Conant.)

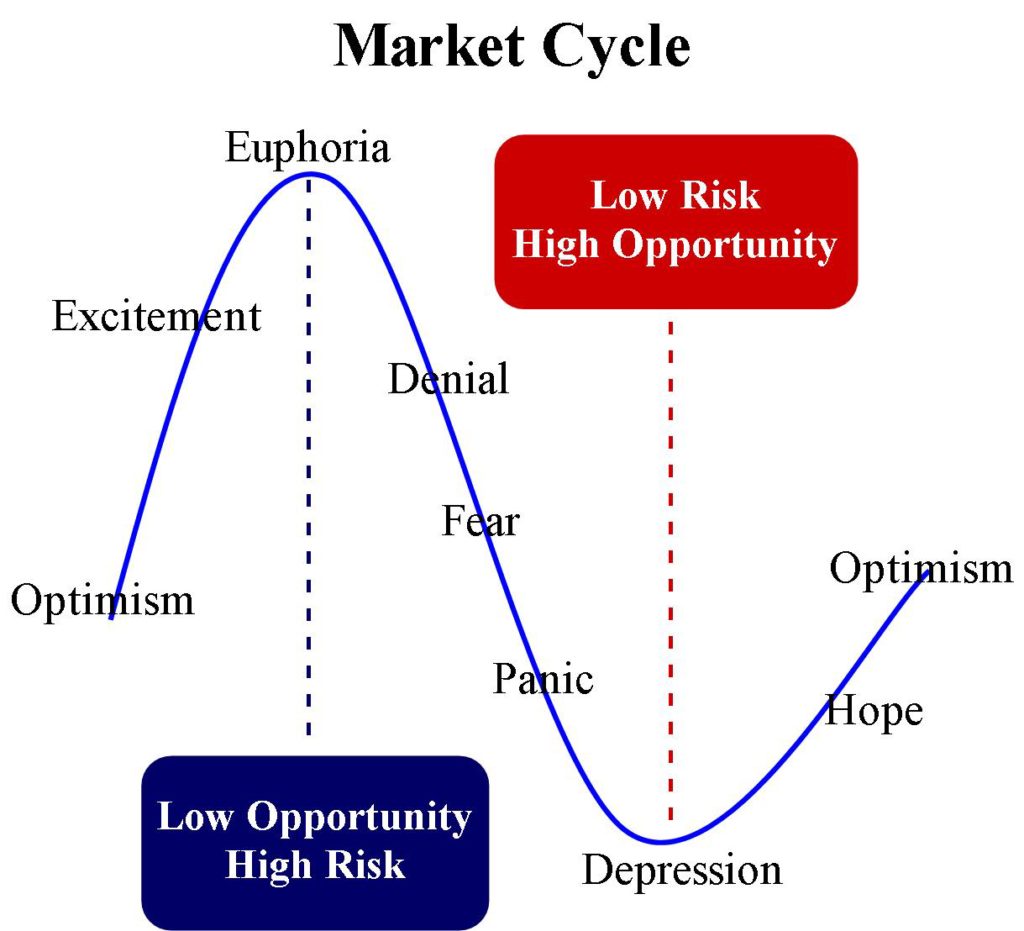

Markets go up, and markets go down: the cyclical nature of the housing market has been a constant since Thog the Neanderthal tried to sell his cave in Mammothville. A strong seller’s market eventually turns into a buyer’s market — sometimes, that’s with a giant crash (as we saw most recently in 2008), and other times, it’s with a graceful decline and glide and turn.

We all know that the market will shift. I mean, think about how many recent conversations in real estate goes something like, “Yeah, well, it’s great that so-and-so startup is doing bangup business doing XYZ, but wait until the market turns!”

So what does it look like when the housing market finally turns, and we go into a buyer’s market for a change?

I have been thinking about the market for a while, and then had some great conversations at Inman Disconnect in the Desert a few weeks ago on this topic. I figure, why not have the conversation with you all?

Assuming We’re NOT in a Bubble…

So for the sake of discussion, let’s just agree that we are not in a housing bubble. Sure, most people in roughly 70% of the markets can’t afford a median-priced house, but guess they’ll just rent or live in trailer parks or whatever.

What does a “market turn” look like then?

In the Disconnect in the Desert conversation, one person (can’t rightly recall whom, since we were a few cocktails in by that point) suggested that the “market turn” simply means flat growth. That is, no more 11 and 12% year-over-year price jumps (like Las Vegas and Seattle respectively have seen) — more like 0.5% growth, or maybe a slight negative (-1% year over year) or something like that.

So, the idea is that just keeping prices steady = the market has turned.

I don’t know… does that strike anybody else as wishful thinking on the one hand, and not really a market shift on the other hand?

Prices not increasing anymore from Q1/2018 numbers still means those cities are at all-time highs (even higher than where they were at the height of the Actual Real Estate Bubble of the past decade). Unless salaries and wages are also at all-time highs in those cities, or increasingly at 11 and 12% year-over-year, I’m not seeing how that means we’ve gone from a seller’s market to a buyer’s market.

Do you?

Doesn’t a Buyer’s Market Necessarily Mean Drop in Prices?

I’m not an economist, nor do I play one on TV, although I do look like one, so forgive any ignorance here but… doesn’t a buyer’s market necessarily mean that home prices have to drop?

It might not drop in nominal dollar terms, but doesn’t it have to drop at least in inflation-adjusted dollar terms?

That is, let’s say that the stay-flat scenario happens. So this 2BR/2BA, 848-sq.ft. beauty remains at $2 million after the market has turned:

I know Silicon Valley pays its engineers a lot of money, but $2 million is real money, even to them. The median income in Silicon Valley is $137K a year, after all, which leaves people making $350K a year saying they’re “middle-class.” Note that the above house is 5.7 times what that “$350K-a-year-and-middle-class” family makes. So yeah, they have a point.

So if prices stay flat, doesn’t the $350K-a-year family have to make more like $500K-a-year to be able to afford that house comfortably? If they are, then salaries and wages are way up… which implies inflation… which means that the $2 million isn’t really $2 million.

Follow? Staying flat in an inflationary environment = price drop.

So Let’s Say Price Drops… How Much?

Assuming then, possibly with bad economic reasoning, that a market shift necessarily means home prices have to drop… how much does it have to drop before the market turns from a seller’s market to a buyer’s market?

Not being an economist, but having been in the industry during the trough of the last market, I think of this in a far less sophisticated way.

Buyer’s market = lots of inventory, so buyers have the luxury of choice.

See, I remember when agent friends of mine were talking about having a strong qualified buyer, which meant that they could take their time looking at the hundreds of houses on the market and negotiate firmly with the seller. If one seller says no, well, there are six other homes in that price range that are also on the market — some of them for months.

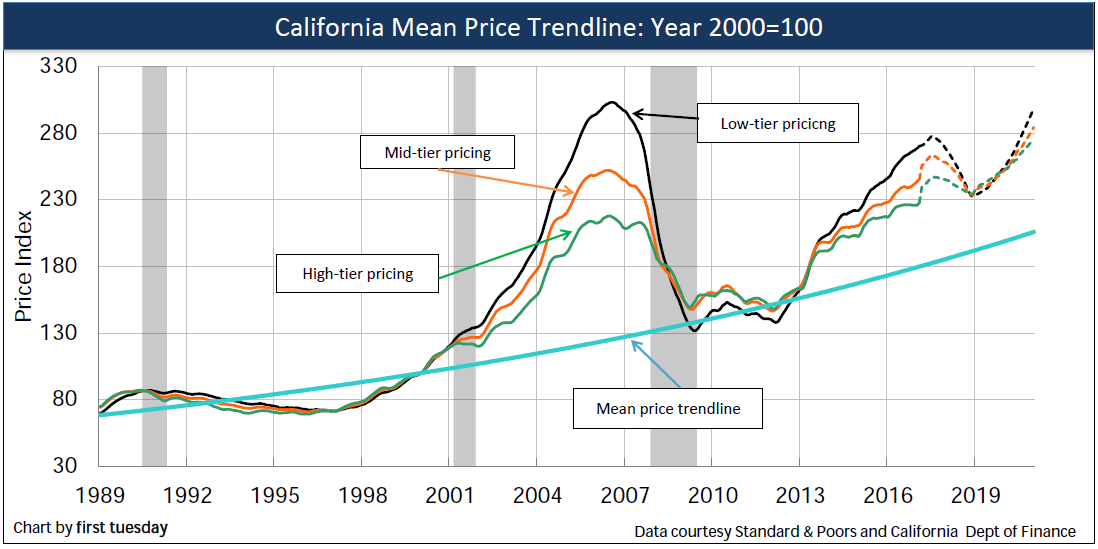

Look at this chart from May of last year from First Tuesday:

Now, we know from the Inman story above that there was no slowdown or decrease from 2017 to now. It’s more like giant leaps in price, so half of the Case-Shiller Index has high all-time highs.

Now, we know from the Inman story above that there was no slowdown or decrease from 2017 to now. It’s more like giant leaps in price, so half of the Case-Shiller Index has high all-time highs.

We also know that when the last Bubble collapsed, the Case-Shiller index dropped 34% from 2005 to about 2009.

Since we have assumed there is no Bubble right now, but just normal supply-and-demand pressure, a 30% drop in price seems too extreme. I mean, the last time, the global economy went into a tailspin and serious and sober people were legitimately afraid of a global financial meltdown.

So let’s say it’s not that high a drop. Fine. What doesn’t seem extreme then? 10% drop? 5%? 20%?

I don’t know. If the $2 million bungalow above drops to $1.6 million, does that make Sunnyvale a hot buyer’s market? I’m not sure I’m buying that — and I mean quite literally, as in I’m not buying a 2BR/2BA 848-sq.ft. house for $200K, never mind $1.6 million. But then, I don’t live in Sunnyvale.

So what do you think? How much do prices have to drop, before the market turns from seller to buyer?

What’s Different This Time

One of the more interesting aspects of a possible market turn this time around from 2008 is that the industry is different in very important ways.

Keep in mind that Zillow and Trulia were brand new baby startups when the market crashed last time. Things like iBuyer was a dream in Keith Rabois’s head.

In fact, one could argue (and I’ve long thought) that the collapse of the housing market is part of the reason why Zillow became the giant power that it is today. That is, at the depth of the housing recession, it was a buyer’s market like we had never seen before. If you were qualified, had either financing lined up or could buy in cash, then the market was your oyster. Brokers and agents didn’t even want listings in many cases, because they knew they couldn’t find buyers for them. It was amazing.

Fast forward to 2018, and now the real estate buying process begins on the internet. Zillow pretty much owns that audience, but think about who’s #3 and rising fast.

Redfin is going to make a freakin’ killing if the market flips to a buyer’s market. It’s going to be silly how much money they’ll make. Redfin’s making waves with something like 0.7% market share nationally. Realogy has something like 15% market share, and they’re the giant in the industry. Imagine Redfin with 10% market share in a buyer’s market.

Holy crap!

Opendoor and the iBuyers are in a funny position. On the one hand, the inventory risk is there and they might get hammered on decline in value. On the other hand, can you imagine the position that someone like Opendoor with billions of capital on tap will be in if we’re in a strong buyer’s market?

Holy crap on a cracker, I say.

Finally, and this may be a topic for more exploration later, the biggest difference to me is psychological and sociological.

In 2008, getting foreclosed on was a big stigma. It was like filing bankruptcy was back in the day. Or for that matter, getting a divorce was back in the day. Respectable people simply didn’t do those things.

Today? We have an entire generation coming of age, many of whom watched mom and dad go through hell trying to save their home, only to see all that effort come to naught. They also saw the big banks who made those loans get bailed out by Uncle Sam, with taxpayer dollars. They then also saw a bunch of people who just didn’t pay, refused to move out, and just sat around for years in some cases living rent-and-mortgage free with the banks doing nothing about them because they didn’t know what to do with a bunch of houses.

Strategic default was starting to become a thing in America back then. Today?

I wrote a post in 2016 wondering if there’s still a stigma to foreclosure:

Sure, your credit takes a hit, but… it’s not clear that in 2016, that’s such a big deal. You can always claim that you were misled by evil mortgage bankers or some such thing, or that the bank refused to renegotiate with you, or whatever. And with a good job, going 12-24 months without a late payment isn’t too difficult. Plus, banks are bending over backwards to offer loans even to people with sub-par credit these days. Wait a few years post-foreclosure, and take all that cash you’ve saved up and do a 20% down conventional for the home you do intend to live in for the rest of your life. (Or better yet, move out of NY metro area to someplace like Kansas City, and pay cash for your next home.)

You could tell your friends and acquaintances that you did this, and not one of them might think badly of you. Indeed, they might think you’re pretty clever to have come up with a way to “work the system” as you did and wonder why they didn’t think of it themselves.

The moral sanction against foreclosure? I don’t know… does that still exist?

I wouldn’t count on buyers with 3% down payments in their $2 million 2BR/2BA bungalows choosing to keep making mortgage payments if the market turns.

I suppose we will find out eventually, since the cyclicality of the housing market is as eternal as death and taxes.

In any event, this got longer than I had thought. Let’s leave off there.

But if you’re a working broker or agent, tell me what you think it would look like when the market finally shifts away from being the crazy seller’s market we have today to a buyer’s market. Better yet, if you’re an economist, tell me how you see things playing out.

-rsh

2 thoughts on “What Exactly Does A Market Shift Look Like Today?”

Awesome article Lawrence! 🙂

The market absolutely needs a correction! However, it’ll likely be caused by an external force that’ll make more people sell or fewer people want to buy. It’ll probably a national/international incident, and it’ll probably be a large-scale catastrophic event. Or it could be an ill-conceived, poorly executed governmental intervention. Sorry to be a Debbie Downer, but my belief is based on your original statement that this is not a “bubble” but indeed Econ 101, supply/demand (which I tend to agree with based on my experience.)

I thought that “Boom Bust Boom” on Netflix was a good primer on the concepts, maybe a bit elementary. But the quote that stood out to me:

“Stability leads to instability. The more stable things become, and the longer things are stable, the more unstable they will be when the crisis hits.” – Hyman Minksky

https://www.netflix.com/title/80097490

Good stuff, Rob. Just wanted to add another couple thoughts.

How about the tendency of brokers, large and small, to gloss over or outright ignore recent history? I did a little research on my own and came upon this fact – most brokers seem to have forgotten the lessons of the last downturn when it comes to productivity.

http://simonsaysrealestate.com/2018/05/02/real-estate-2018-a-sign-of-things-to-come/

I think that this reduced broker productivity will have a pretty big negative impact on company dollar and contribute to a surge in new agent teams across the country. Does any one of these contribute to this market shift (“downturn”)? I don’t know. I do find it hard to believe that they have no impact on it. Maybe all of these just go hand-in-hand with half a dozen other factors in contributing to this next “downturn”? Like you said, maybe we just leave it to the economists to figure out.

But whatever you want to call it, it’s still interesting that such a large majority of brokers don’t appear to be focused as much this time around on their own individual profitability.

Simon

Comments are closed.