I’m on the road, so blogging may be light. But I thought the announcement of the new RealSure Sell and RealSure Mortgage programs deserved some brief initial commentary. I didn’t feel like waiting for Friday’s Quick Takes and then writing up a giant post on this.

Inman News has further coverage of the announcement, but details are thin. And that is kind of the problem: details are thin.

What we can glean from the announcement and the coverage is that these are two separate but related programs. At first glance, both programs suffer from the essential problem of all brokerage iBuyer programs: they put the agent first, and then the consumer as an afterthought.

Let’s get into it.

RealSure Sell

The first program is being billed as a “revamp” of the cataLIST program that Realogy launched with Home Partners of America (“HPA” hereafter) last year. From Inman:

Realogy is revamping its year-old iBuyer platform to give sellers more security as they go to market, and give agents an offer benchmark to beat for their clients.

So what is this revamp?

We know that cataLIST, the original Realogy-HPA partnership “iBuyer” program, was something more like what RedfinNow is: take the cash offer, or list with an agent.

Within five days after receiving the cataLIST Cash Offer, the homeowner has the choice of accepting the offer or marketing the home for sale through the traditional listing process. If the sellers accept the cataLIST Cash Offer, the closing can generally occur in as few as 10 days, subject to obtaining clear title to the property. If the sellers do not accept the cataLIST Cash Offer, the offer will be automatically withdrawn, and the home will be marketed through the Coldwell Banker marketing program.

I have written previously on cataLIST, suggesting that it really wouldn’t make much of a difference:

And cataLIST itself is fundamentally an agent-centric program rather than a consumer-centric program. The name alone should betray the true intent behind Realogy’s so-called iBuyer program: it is really meant to be a listing tool, not a consumer-convenience tool. And as Schneider makes clear, Realogy’s iBuyer program is about making the agents more money, not making the consumer’s life easier.

As a variation of the old “purchase guarantee” program that brokers and agents have been running for decades, Realogy’s iBuyer program is more or less a bait-and-switch on consumers. Those programs have not changed the fortunes of traditional brokerages. There is no reason to believe that Realogy’s cataLIST would have different results.

Maybe the fact that Realogy and HPA revamped cataLIST within one year suggests that it really wasn’t doing much at all? Or am I being unfair here? You tell me.

Enter the new RealSure Sell:

RealSure Sell offers sellers with qualifying properties a compelling cash offer immediately upon listing. The cash offer is valid for 45 days, and during this ‘peace of mind’ period, the seller has assurance their home will sell by having a cash offer in hand while the home is marketed by a trusted real estate advisor in pursuit of an even better price, giving the seller unmatched control and flexibility.

I had to read this paragraph a few times to try and figure out what it means. Then I had to look at Inman for more information:

The new platform, renamed RealSure, builds off the company’s existing partnership with HomePartners of America to give sellers a cash offer on their home that’s good for 45 days. The seller can accept the offer after a 30-day waiting period – that Realogy calls a “peace of mind” period – giving them the security of knowing just how much they could get for their home.

Yes, the press release calls the entire 45 days “peace of mind” period, while Inman says there’s a 30-day lockup on exercising the put option. Let’s assume Inman is correct, as it is more detailed.

Okay, so unless I’m completely misunderstanding something here, what RealSure does is:

- Seller signs a listing agreement with a Realogy agent (length and cost unknown).

- “Immediately upon listing” the seller is given a cash offer from HomePartners of America.

- This cash offer is valid for 45 days, but cannot be exercised for at least 30 days. I am amused that Realogy is calling this 30-day lockup period a “peace of mind” period. So, in effect, the seller has a 15 day window to accept the cash offer.

I have many questions.

First, is the 15-day put option provided to the seller (because that’s what this cash offer is) at market value (presumably the list price) or at a discount to the market value?

If the cash offer is at the list price as determined by the listing agent in order to list the house in the first place, then what we have is a guarantee: either the agent can sell for more than list price, or the seller gets the list price from HPA. That’s truly unique and groundbreaking. No other brokerages anywhere is willing to put its money (or its partner’s money) where its agent’s mouth is. The list price becomes the floor: the seller is guaranteed at least that much. Giving the agent a 45-day window to do better than the list price is a no-brainer for the consumer.

If, on the other hand, the cash offer is at a discount to market price (aka, the list price), then this program is even lamer than I had originally thought. It’s far worse than all of the other brokerage-sponsored “iBuyer” programs that are actually investor-front programs. At least in those other programs, the offer is valid the minute it is made. There is no 30-day lockup period, and the seller receives the offer in lieu of signing a listing agreement. Here, RealSure says it makes the offer “immediately upon listing.” So no listing agreement, no offer. That’s a sucker bet.

Furthermore, if the cash offer is at a significant enough discount to market price, then making that the “floor” is basically meaningless. If HPA will give you 70 cents on the dollar, any newbie agent could beat that simply by pricing the home at a 20% discount, then claiming, “I got you the most money!”

How in the world is Realogy going to police its agents to make sure they’re not engaging in such shenanigans? Because those are lawsuits that Realogy will be buying right there as sellers realize they got bamboozled by the shiny discount-to-market-value offer and then duped by the unethical agent who knows he just has to beat that lowball offer to claim a victory, even if the seller ends up selling for below market value. I can think of a few ways to prevent such abuses, but good luck getting 1099 independent contractors to follow such processes.

Second, how long is the listing agreement that the seller must sign in order to get the offer? Most typical listing agreements I’ve heard of are 90-days. But the put option is only good for 45 days (and there’s a 30-day lockup). That’s… lame as well. The seller will be enticed to execute a 90-day exclusive listing agreement in order to get a cash offer that provides “peace of mind.” If that cash offer happens to be 70 cents on the dollar, well… even after that offer expires, the agent has another 45 days to try and get you 90 cents on the dollar. Yay?

Problem is that there are hints that the cash offer will be at significant discount to market value. From Inman:

NRT CEO Ryan Gorman said early experiments into iBuying convinced Realogy to create a solution he described as being the best of both worlds, allowing owners to “sell their home for the highest and best price in the shortest period of time but with the assurance of having a cash offer at the beginning of a listing period.”

…

At the same time, the offer number creates a specific dollar amount for agents to beat, with the offers they are able to drum up for each home.

Yes, whether the “specific dollar amount for agents to beat” is fair or not depends entirely on whether the cash offer is at market value or not, but… let’s think about this. This isn’t Realogy’s money that the agents are spending; it’s HPA’s money. What exactly is HPA’s incentive to pay market for a house that, if it doesn’t sell, HPA would have to buy, then repair, maintain and rent out? How does that pencil out if HPA is paying market value?

And if that’s the program, how does HPA ensure that Realogy’s agents don’t simply inflate the list price to “buy the listing” and leave HPA with the bill if the multiple bids scenario that the agent thought he could pull off doesn’t materialize?

It’s too much risk. I see no way that HPA agrees to pay list price for all homes in RealSure.

So… we have an “iBuyer” program which is not just an investor-front, but is worse than all other investor-front programs out there, since those at least give the seller a choice: list with the agent, or take the cash offer. This one requires the seller to list with the agent in order to receive a put option that is sure to be at a significant discount to what your agent just told you your house is worth.

RealSure Mortgage

Let us turn to the second program, RealSure Mortgage. It is described as a way for the seller to buy the next home before their old home sells:

RealSure Mortgage allows a seller, who is enrolled in RealSure Sell, to confidently make an offer on their next home before their current one is sold by leveraging their RealSure Sell cash offer. The ability to secure a mortgage on a new home eliminates the stress many Americans face when having to sell a home while simultaneously trying to buy another.

Okay, so… this is like Knock then? Kinda sorta? Inman compares RealSure Mortgage to Homeward, which is a worse version of Knock since Homeward involves paying rent to Homeward while your old home is on the market whereas Knock does not. (At least the last time I spoke with Sean Black, there was no rent.)

No, not really.

Again, unless I’m missing something, RealSure Mortgage doesn’t make a cash offer on the seller’s next house. It “leverages the RealSure Sell cash offer” somehow. I gather that it’s meant to be something more like Flyhomes’s Guaranteed Offer:

Cash Offers are true cash offers. Flyhomes purchases a home outright from the seller on a buyer’s behalf in as few as 2 days, and sells it back at the same price to the buyer on an agreed upon closing date.

When a Flyhomes Cash Offer is not available and/or when the program does not make sense, Flyhomes’ Guaranteed Offer program helps clients put their best foot forward. For the Guaranteed Offer program, Flyhomes guarantees the seller that the home will close, and if it doesn’t, Flyhomes will then buy the home for the same terms.

Except that Flyhomes says to the target new home’s current owner, “If buyer can’t close on your home at this price for whatever reason, we will buy it from you at that price.” There is no suggestion that RealSure will buy the home if the RealSure client cannot.

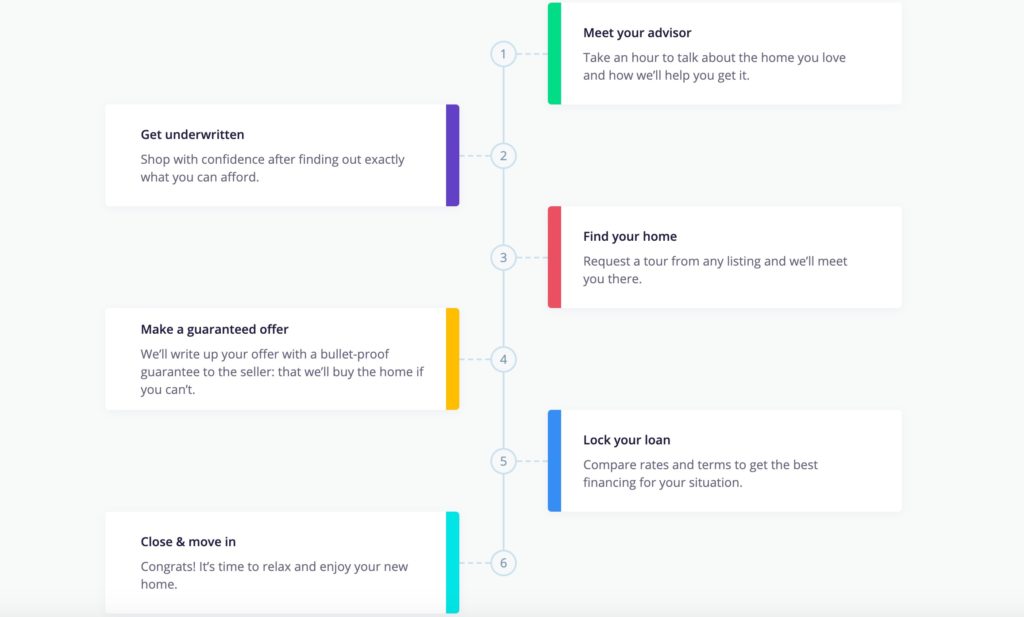

All that Realsure Mortgage says on its consumer-facing website is:

Use your cash offer to be in control of your next home purchase. Apply today to get qualified and see how you can streamline the selling and buying process.

What does that mean? “Be in control of your next home purchase?” How? All that the seller-now-buyer has is a put option at a discount to market price. How does that provide any level of control?

It is extremely telling that the call to action here is to apply for a mortgage.

What is different about the level of control for the seller-now-buyer if he were to go get preapproved with Rocket Mortgage? That there is no sale contingency on their offer? Except that removing the sale contingency involves selling their home for a discount to the market value… so… does that help or hurt?

Wouldn’t It Be Easier To…

Given the above, if I’m a seller, wouldn’t it be easier to just get an offer from Opendoor or Zillow and then go shopping? Both of those market maker iBuyer programs (a) pay close to market price (y’all are VIP subscribers and should have seen my research on this already), and (b) give the seller the option to pick his closing date up to 90 days later. If the seller can’t qualify for a mortgage with a Zillow offer in hand, and find a house to buy within 90 days… he needs to think about moving farther away, maybe out of that state entirely. That housing market suuuuucks.

In the alternative, wouldn’t it be easier to take Knock up on its offer? List your home with Knock, then have Knock pay cash for your next house, move in, then just wait for the closing on your old house. You’re not paying rent, you’re only paying one mortgage, and so on and so forth.

Even Flyhomes seems like a better deal to me; at least their Guaranteed Offer is pretty powerful for the new home’s current owner. Our guy will buy your house, but if something happens and he can’t close, WE will buy your house at the same price and terms. That’s peace of mind for the new home’s current owner.

All of these options strike me as better, easier, and/or faster than RealSure. What am I missing?

I Don’t Understand

Having thought through these two programs with you all — I follow the adage, “How do I know what I think until I’ve read what I’ve written?” — what I just can’t understand is why Realogy would launch such lame variations on the iBuyer program. Maybe the Q3 earnings results will have more information that will help me understand it. Maybe Realogy is so hurting that it has to put lipstick on the pig that HPA put in front of them.

But in Q2 of this year, Realogy generated $245 million in operating EBITDA, $147 million in free cash flow and paid down $113 million in debt. What if it had chosen to pay down $13 million in debt and devoted $100 million of its own money in offering a real value proposition via an iBuyer program? Wouldn’t that allow Realogy to really make some noise?

I mean, RealSure is only in two markets right now: Dallas and Denver. Why not spend the $100 million doing a Knock-style program in those two markets instead?

You still get the listing lead generation, but you get real value to consumers: move into your new home and start living there, while we sell your old home.

If those two markets show traction, well, you’re Realogy. Go raise some money and do that in 30 markets. Even in its weakened state, with its stock price in regions previously unseen, Realogy is fundamentally a pretty healthy company with strong cash flows, profitability, and enormous footprint. I’d bet you could find some investment bank to do a convertible bond offering for a few hundred million, especially if you have a proven program in two cities that is showing results. Plus, showing real results from an in-house program would lift Realogy’s stock price as well, which should ease the enormous pressure on Realogy today.

Am I offering too much free advice to Realogy here? Maybe I am, but I have a giant soft spot for Realogy and for many of its leaders, including Ryan Schneider, and I’d really like to see them turn things around. So there is that.

Maybe the Q3 earnings will clarify why Realogy is doing something like Realsure instead of doing something that would make a real difference to consumers, and therefore, a real difference to its agents, and therefore, a real difference to its bottomline. We shall see.

-rsh

2 thoughts on “[VIP] Initial Thoughts on Realogy’s RealSure”

ROB,

“I DON’T UNDERSTAND” – the most understood line in your post.

Seems to me like the iBuyers should be thinking more about making their offering simple – my eyes glazed over just trying to understand what the heck was being offered.

“We buy homes for cash” has gotten really complex. Now I’m not sure if the model is more hype than help.

We’ll see 🙂

Thanks,

Brian

I find it fascinating that on their primary landing page – https://www.realsure.com/ – there is not a single call to action. They expect consumers to call them w/ that number in the upper right? Good luck with that strategy.

Comments are closed.