Three years ago, I wrote a post titled, “The Case for iBuyer Becoming the Default.” It came up in my social media feeds, thanks to the hard work of my social media manager. And the timing couldn’t have been better, since I’ve been thinking that I need to reassess iBuying as a category in light of the meltdown of Zillow Offers.

I have to admit that my faith was shaken.

But Opendoor has reported Q3 earnings (not to mention the two quasi-market makers, Redfin and Offerpad). We have heard about Project Ketchup, which I wrote about. Now we know more.

So my faith in iBuying as a category has been restored. What’s more, if I need to be the defender of the faith, I’m happy to rise up to do battle.

The cynics and the skeptics are all wrong. Time will prove them wrong. iBuying in all its forms is here to stay, and furthermore, it will dominate how homes are bought and sold in a few years’ time.

The Original Belief

Let me reiterate why I wrote my original 2018 post. I thought then and I still think now that iBuying is not about buying houses and selling them. It’s actually not about houses at all. It’s about pain:

I’ve pointed this out time and again when talking about iBuyer, but real estate agents and brokers often forget just how annoying and painful and uncertain it is to buy or sell a home in America today. And that pain has nothing to do with the real estate agent. You could have the most wonderful, most professional, most knowledgeable REALTOR on the planet, but that doesn’t change the mortgage process, doesn’t change staging a home, doesn’t change having to update the home, keeping it clean, enduring showings, etc. etc. and so on and so forth. Your amazing REALTOR can’t make the bank approve the loan for the buyer, while you wait and wait hoping and praying that the buyer gets the Clear to Close, because boy it would suck to have to relist the home for sale and go through that whole process all over again.

Maybe the rich and famous can’t understand why a company like Opendoor and Zillow and Redfin would take on balance sheet risk and get involved in buying and selling houses, because buying and selling houses is just such an easy, breezy, simple thing for them: find a house, buy it, move in, sell the old one. What’s the problem?

Speed, convenience, certainty — that’s what the iBuyer programs are all about. In a way, it’s giving the average consumer the experience of what it’s like to be a super rich guy like Jim Cramer and Marc Chaikin.

This is one reason why I have often taken great care to point out (including in my August 2018 Red Dot Report) that “iBuying” comes in two flavors: market making, as Opendoor does and Zillow did, and bridge loan, as Knock, Flyhomes, and Opendoor under its “power buyer” program does. Both models are fundamentally about using the power of cash to circumvent the pain of the transaction.

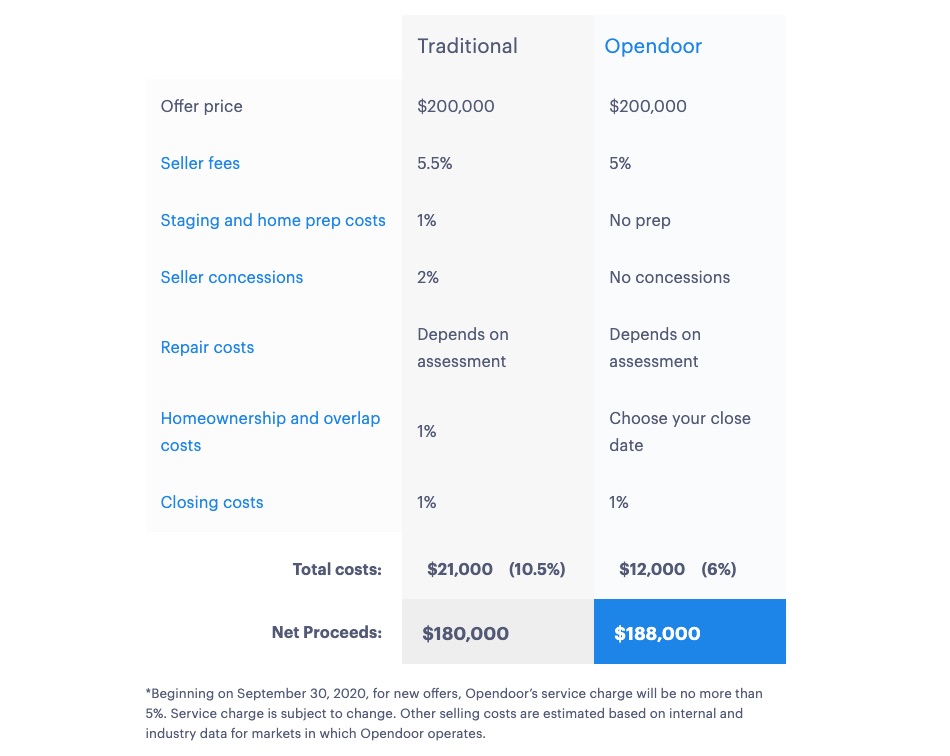

I then thought that the cost of iBuying will drop with time as the providers scale up. That has happened. When I wrote that article, the fees for market maker iBuying was around 12% on average. It is now at 6%, at least for Opendoor:

Furthermore, I thought that market making was always ultimately about the mortgage. And in my 2018 post, I quoted extensively from Spencer Rascoff, then-CEO, talking about that angle.

Being able to reduce the price of the home (which market makers can do, because it’s their house) for getting the mortgage through them would help in attach rates. Which in turn makes the transaction even more competitive than traditional processes.

And finally, I thought that market making would throw off seller leads which could be monetized.

None of those things have changed.

The Critics Slay Strawmen

All of the loudest voices after the collapse of Zillow Offers, including in the comments to my posts here, focus on various straw men to burn up.

The three most common I’ve heard and read are: algorithms can’t price houses, home flipping is too risky, and margins suck ass.

Hell, even Rich Barton said in the fateful earnings call as Zillow exited the business that they couldn’t price homes accurately, that the risk to the balance sheet outweighed the rewards, and the margins were too skinny.

Except that we now have quarterly results from three separate iBuyers (even if I consider two of them not to be market makers) that show these three arguments to be wrong.

Opendoor, Redfin, and Offerpad’s results show that in fact, algorithms can price homes accurately — especially when augmented with human input. And it turns out that “home flipping” isn’t too risky either.

Opendoor’s revenues were up 91% sequentially to $2.3 billion, with $202 million in gross profits. Yes, they posted net losses, because they’re continuing to pour money into growth, like any new company would. They purchased 15,181 homes and sold 5,988.

Redfin’s Properties division grew revenues 1,144% to $232 million and sold 76 homes while buying 720. And they weren’t trying that hard, because as Glenn Kelman said during the earnings call, “The answer is that Redfin isn’t an iBuying company at all. It’s part of what we do, but it’s not who we are.”

Offerpad, which is truly more like a house flipper than a market maker, grew revenues by 190% YOY to $540 million in its first quarter as a public company, selling 1,673 homes while buying 2,753. Offerpad generated $53 million in gross profit, almost a 10% gross margin. Again, as a startup, it posted losses. Big deal; Amazon posted losses for years. Tesla too.

Perhaps the only valid “criticism” is that the margins aren’t great in market making. Sure. If that’s the complaint, before these companies have fully developed out all of the revenue lines like mortgage, title, escrow, and seller leads… I guess that’s something. Investors may look elsewhere, I suppose, but fact remains that a thin gross margin still means that the companies are making money running market making iBuyer businesses.

It turns out that what happened at Zillow had nothing to do with algorithms, with balance sheet risk, or with thin margins. It had to do with human screwups because of Project Ketchup. Read my post on that if you want more.

And as I wrote there, if after choosing to ignore what the algorithms said, choosing to overpay for houses accepting losses in order to gain market share, and choosing to alienate contractors… Zillow only had to write down $304 million from an inventory worth $3.8 billion… that doesn’t strike me as overly risky. It’s a hella lot less volatile than Bitcoin whose value swings 10% or more on a weekly basis, and somehow, Michael Saylor’s MicroStrategies keeps on hodling.

Defender of the Faith

I figure now that Zillow Offers has gone down in flames, the ignorant and the vested interests will spend much time and energy trying to knock down the entire business model of iBuying. Good luck with that.

Because combining the four companies for Q3, I see that they purchased somewhere in the neighborhood of 25,000 to 30,000 homes. (If Zillow said how many they bought in Q3, I couldn’t find the data, but they supposedly bought some 16,000 in the first three quarters combined.)

They bought that many homes in the hottest seller’s market we have ever seen, with every real estate agent telling everyone who will listen that this is a wonderful time to sell and that she can get top dollar, way more than these iBuyers are offering. Even with that, tens of thousands of homeowners chose to sell to an iBuyer. They did that in the absence of real marketing and advertising for iBuying. That means word of mouth and web search were how the practice spread.

What does that tell you, if you’re not vested in telling yourself pretty lies?

It tells me that nothing has changed in terms of consumer pain. The traditional transaction remains just as uncertain, just as painful, and just as time-consuming as it has ever been. That hasn’t changed one bit, no matter how hot the market is for sellers. All of the agents dancing on Zillow’s grave and making fun of algorithms have no answer whatsoever for consumer pain. They can talk about local knowledge and local expertise, but they have no answer to consumer pain. They can and do talk relationships and loyalty and love you like family, but they have no answer to consumer pain.

And in the end, consumer pain will win the argument. Once you have taken an Uber, it’s awfully hard to go back to taxicabs. Once you have booked a reservation with Opentable, it’s awfully annoying to have to telephone a restaurant and be told, “Please hold!” and sit there for ten minutes. Once you have plugged your Tesla in at home, it’s awfully hard to go waste time in a gasoline line at Costco.

Technology that offers a solution to consumer pain always, always, always wins in the end.

Now throw in the bridge loan type of iBuying (what some folks call “power buying”). How many of those were done in Q3? We don’t know since all of those companies are still privately held, but the word on the street is that Knock, Orchard, Flyhomes, EasyKnock, and others are doing booming business.

All of these guys are getting better and better by the day at the core practice of buying, renovating, and then selling houses. Plus they’re competing, which means prices will drop. The fall of Zillow Offers will provide all of them with important lessons on what not to do: ignore the algorithm, and screw over your contractors. And they will all develop ancillary revenue streams, including the all-important mortgage channel, that secures the business model for good.

Yeah, But Balanced Market Will Kill Them

Finally, let’s address those who constantly harp on how the model is flawed, and how it will completely fall apart once the market turns to a more balanced one, or a buyer’s market. Obviously, Zillow Offers falling apart because home price appreciation slowed down is fantastic evidence for them.

If you read my post on Ivy Zelman’s take on housing, you’ll have picked up on a couple of things.

One, residential real estate is the prettiest girl at the dance, because real inflation is at 15-20%, not 6%. Institutional investors are piling into this space as a hedge against dollar devaluation. That’s no longer just me speculating; that’s Ivy f’ing Zelman confirming.

Two, dollar devaluation shows zero sign of stopping anytime soon, and the Fed like all central banks are caught in a completely bind. Stop printing money, and the Federal government goes belly up. So the Fed will keep printing money, keep rates artificially low and kick the can down the road. Which means negative real interest rates for as far as the eye can see.

The combination means that we are not likely to see a buyer’s market again. At least without currency collapse, but then I think we’ll be worried about much bigger things than iBuyer survival rates. We’ll be worried about our own survival rates.

For that matter, I’m not sure we’ll ever see a “balanced market” absent major currency reforms since every investor can make a strong case to overpay for houses. When they can borrow billions of dollars at negative real rates, and housing demand isn’t going anywhere since people have to live somewhere, why not overpay? Overpay by 30% and in cash; no individual buyer can compete. Within two years, home prices will have increased by 30%, since true inflation is 15% a year. There goes the “overvaluation” right there, and the institution will have collected two years of rent in the meantime, while getting paid 13% a year or so (negative real rates, remember?) for taking out the loan to buy the properties in the first place.

Why in heavens wouldn’t you overpay if you’re a sovereign wealth fund?

But for the sake of argument, let’s say that a buyer’s market would actually develop. Home prices will stop growing at 15% a year. That’ll screw these iBuyers!

Except… here’s Glenn Kelman in the latest earnings call:

In March 2021, we began lowering RedfinNow offers, in anticipation of a summer deceleration in home-price increases. In June, we based our RedfinNow offers on a calculation that the homes we bought would decline in value by the time we could get them on the market. We continued to reduce RedfinNow offers through early September. These were good decisions. The sales closed in the third quarter have averaged 101.1% of the forecasted price. The sales RedfinNow has booked so far for the fourth quarter have averaged 100% of the forecasted price, the rate of those sales has been on pace with our expectations.

Seems to me that they’ll adjust pretty quickly to any changes in the market. If not, guess they’ll lose money. How much? I don’t know… but if screwing up everything and alienating contractors leads to a mere 10% in value decline, I imagine a mere market shift that they can see coming might do… 5%? 2%?

Oh my God! Short the stock, Jeeves!

iBuying Will Survive, and Thrive

So my original thesis from 2018 remains as solid as ever. The shocking news from Zillow… well, at first I was afraid. I was petrified. Everything that the critics like Jim Cramer said back in 2018 came back from outer space, and all of the naysayers were back to bother me.

More information since then came out, and well, now I hold my head up high. They thought iBuyer would crumble, that the business model would lay down and die. Oh no, not iBuyer. iBuyer will survive.

Then it will dominate in the years to come. Because solving consumer pain always wins. Always.

-rsh

I Will Survive

Provided to YouTube by The Orchard Enterprises I Will Survive · Gloria Gaynor I Will Survive ℗ 2009 Smith & Co. Released on: 2009-05-29 Music Publisher: PERREN-VIBES MUSIC INC Music Publisher: BiboMUsic Pub Inc Auto-generated by YouTube.

I always enjoy your insight. In my humble opinion, there is a flaw imbedded in these Ibuying models. When Opendoor said its algorithms were better, in looking through their recent filings it wasn’t just in buying better priced homes, was it was in derivative trading and rate locks. They have been on the right side of the trade, so far. However, like any trading desk, there comes a time when the trade is wrong, the timing is off or the options expire. Increasing inventory while sales have not increased as significantly during this same time? Investing such capital or even worse, using large scale leverage to accelerate large scale acquisitions with a business model that at best operates on low margins? On the hopes of fees of ancillary services to generate income? In the market we are currently, it easy to overlook these items. We can agree whole heartedly on the easing of consumer pain wins out, however if the business model is that of large spread speculation in a rising market with the ability to scale using technology, leverage a trading desk playing the derivative market… I would rather wait to see how they weather the storm they have not expecting, hitting.

Good comment overall. But I just don’t get the “flaw embedded in these iBuying models.”

Yes, sometimes you’re on the wrong side of a trade. Is there a flaw embedded in the business model of hedge funds?

Sometimes, car dealers have inventory increase while sales have not. New home builders sometimes have inventory sit, because the market turned while they were putting up the houses. Is that a flaw embedded in manufacturing or building?

The dumbest business idea I’ve ever heard, the one with a true flaw embedded in its business model, was one where you go out and buy a fleet of jets at tens of millions of dollars each, in order to deliver mail overnight at 100X what the US Postal Service charged for doing the same thing, just not overnight. Of course, today we know that flawed business model as FedEx.

Because it solved a consumer pain. Everything else is execution.

You’re entitled to your skepticism, of course. I am a defender of the faith based on the information we have so far.