Welcome to yet another edition of the Seven Predictions, sure to be wrong or your money back. This is one of my favorite annual traditions around this time of year, and whatever the changes in focus to the blog, I’ll have to keep this one up. For those keeping track at home, I just published my results from last year’s predictions, and my lifetime average is .374.

As longtime readers know, each year has a different musical theme. I’ve done Boy Bands, Country, Hair Metal, The Rat Pack… etc. etc. over the years. It got a bit difficult picking a theme for 2022.

Then last week, I get into my car and open up Spotify. Right up front, I get presented with a Your Top Songs 2021 playlist. Turns out, I listened to a lot of reggae. Specifically, I listened to a ton of the new sound of reggae coming out of Jamaica, mostly related to the singer/producer Protoje’s In.Digg.Nation collective. This is a pretty good overview of this new sound of reggae:

“[Lila and Sevana] can do something for Jamaican music that can widen the definition of a Jamaican artist,” he told AFROPUNK. “They can do that, just like what Koffee has done. Koffee has changed what it means to be reggae or dancehall. She is why everybody is confused as to what to call stuff.”

Naturally, my Seven Predictions post had to be themed accordingly. These seven artists and seven songs are from my personal list of the top songs for 2021 according to Spotify. I hope you enjoy them as much as I did, and I hope you enjoy these predictions as much as I did writing them.

1. Rich Barton Retires Again; Susan Daimler Named As CEO of Zillow 3.0

In April of 2019, after Zillow’s first earnings call with Rich Barton back as CEO, I wrote a Red Dot titled “The Return of the King.” In it, I made the case that Barton had come back because he was finally able to do what he had always wanted to do:

Rich Barton, in contrast, was the original visionary behind Zillow. He had started Zillow to change the world, or at least the real estate industry. I think he might have put Spencer in charge and left to do other things because it became clear that Zillow could not truly disrupt real estate. Now he’s back, because he thinks it can.

That disruption was Zillow Offers. And I quoted from Rich Barton’s interview with Stratechery:

So this “turn on the lights” thing was a lookback strategy attribution, ok? That was a symptom of what we were really trying to accomplish which was fundamentally changing the way homes are rented, bought, and sold, and make it radically easier for us, our family and friends, everybody we knew. [Emphasis added]

Well, that dream has now been dashed on the rocks of Project Ketchup. Zillow rocked the industry, rocked Wall Street, and rocked its employees with the announcement that they were completely shuttering Zillow Offers. I wrote about that pretty extensively here.

Whatever the reasons and motivations, it is now clear that Zillow 3.0 will be centered around its profitable Premier Agent business. Zillow Offers was a disaster that wiped out almost 60% of the market cap of Zillow, took its stock price from a 52-week high of $212 to $60 (as of this writing), and cost Zillow its air of invincibility and inevitability.

What comes next?

Nobody knows, but I am predicting that what comes next is the retirement of Rich Barton (again) since it is now pretty clear that Zillow won’t be “fundamentally changing the way homes and rented, bought and sold.” Barton left the first time because he didn’t particularly want to spend his time and energy operating a portal that sells leads to real estate agents. I can’t imagine why he’d stay for Round Two of that.

Which is why I am also predicting that Susan Daimler, who was one of my 2020 Seven Most Interesting People, will be named as the next CEO of Zillow.

For one thing, she’s been kicking ass and taking names. Just in Q3, her division grew revenues by 16% YOY to $480 million, and Premier Agent is up 20%. She’s operating a nearly $2 billion business already. Since she took over for Greg Schwartz in November of 2019, 2020 and 2021 YTD are her results alone. And they’re staggeringly good. In 2020, IMT did $1.45 billion in revenue, and $263 million in earnings. In 2021, through 9 months, Daimler’s segment posted $1.8 billion in revenue and $553 million in earnings. That kind of track record will get noticed in the boardroom.

Plus, her relationship with Rich Barton goes back to 2007, when Expedia acquired her startup, SeatGuru. She has known Barton for going on 15 years. Since he and Lloyd Frink are the primary owners of Zillow, it seems like a safe bet that he’d hand the reins to Susan Daimler.

The fact that naming a woman as CEO of Zillow Group would result in plaudits and applause from the Corporate Press and social media is a nice bonus as well, as Barton quietly exits the role.

So that’s my prediction: Barton retires, Daimler takes over. They switch it up. We’ll have to see what Zillow 3.0 looks like under her leadership.

2. An Explicitly Conservative Real Estate Brand Launches

In 2021, it became clearer than ever that we live in two Americas. After the awfulness that was 2020, 2021 kicked off with January 6th, which some people think was an insurrection and others think was a setup. Throughout 2021, it has become ever more clear that we not only disagree on what should be done, we disagree on what actually is. As pundits have said, we’re watching two different movies.

Within the real estate industry, perhaps nothing crystallizes this division more than the Brand Huber case going on in Missoula. I wrote about that whole situation in my Seven Most Interesting People post, noting that there is no win here for NAR, for MOR, for Montana REALTORS. For that matter, I don’t think there can be a National Association of REALTORS when there is no nation.

However, it is extraordinarily difficult to change large institutions. NAR for all of its faults is a national organization with a hundred year history and 1.5 million dues-paying members. There are hundreds, if not thousands of people who have real financial interests, political interests, and business interests in maintaining that system going. It isn’t easy to disrupt such an organization.

Basically, it takes either a Black Swan event or a larger institution (like the government) to step in. That is what is happening to NAR of course… but anyhow….

It is far easier to disrupt smaller institutions even if they are large, relatively speaking. That’s where this prediction comes in.

Inman News recently reported about Windermere’s reaction to the Brandon Huber situation:

“What we would like to make clear is that Windermere believes it is important that the public, and all those who choose to affiliate with our name, understand our values as a company,” Windermere CEO Geoff Wood said in an emailed statement to Inman while clarifying his team became aware of the lawsuit mid-November. “This includes being an inclusive organization that has zero-tolerance for discrimination in any form.”

“Not only do we support the LGBTQ+ community but count many of its members as some of our most valued agents, franchise owners, management and staff,” Wood added. “We fully embrace the LGBTQ+ community as part of our own, and as a company, we celebrate the progress that has been made in recent years to secure the rights and the recognition of that community.”

Wood said Windermere has made donations to the Missoula Food Bank and the LGBTQ+ Real Estate Alliance, the latter of which has been lobbying for MOR and Windermere to remove Huber from its ranks. “We fully believe in putting our money where our mouth is, and everyone can expect that Windermere’s actions will align with this long-held value,” the statement read.

In the story, Windermere points out that Huber is an independent contractor with an independently owned and operated franchisee in Missoula. He doesn’t work for Windermere itself, so Windermere can’t terminate him.

At the same time, it should now be clear to everybody that Windermere’s values and Huber’s values do not align. I mean, that’s kind of the whole point of the statement and the donations. Windermere is putting their money where their mouth is.

Seems to me that nothing much is holding Huber (or frankly, his broker who is the franchisee) to Windermere. But they keep paying Windermere for the privilege of using the brand and whatever resources Windermere makes available. I imagine they can’t be too happy about that. Sure, the franchisee has a franchise contract with Windermere, but why would Windermere want to hold on to a franchisee whose values are so diametrically opposed to its own? They know the damage that such a franchisee can do to the brand.

The solution is for those whose values align with Windermere’s values to go with Windermere, and those whose values do not align with Windermere’s values to go with someone else.

Thing is… there isn’t anyone else today for them to go with. There is not a single national or large regional brand with an explicitly conservative or Christian bent. Go ahead and try to find one. Keller Williams comes the closest, with fairly deep Christian roots, but Gary Keller bent the knee to BLM in 2020 and there isn’t anything explicitly conservative or Christian about KW as a brand today. RE/MAX with a CEO who is a former SWAT commander supported BLM, but not Back the Blue. In fact, look through the Top 20 Franchise Brands in real estate and see if you can find a single instance of any of them making any public statement or taking any public action to support a cause or an issue on the Right.

At the same time, we are starting to see the rise of conservative brands in the wider economy.

Black Rifle Coffee Company, 5.11 Tactical, Grunt Style, Altar’d State, Sweet Salt and a few others come to mind. Their products have nothing to do with politics. They’re marketing things like coffee and t-shirts and jeans to a right-leaning customer base. It just makes business sense in a hyperpoliticized world to differentiate your brand.

We are starting to see this filter into services. For example, there are now a few explicitly conservative investment advisors launching ETFs:

The former JPMorgan Chase & Co. banker is betting that the 74 million people who, like him, voted for Donald Trump are mad about it, too—mad enough to buy shares of his company’s exchange traded funds, which invest in companies Grant and his colleagues deem unwoke. That means they lean right politically or are at least neutral in their activism and donations. Grant is chief executive officer of 2ndVote Advisers, a small group of politically conservative money managers pushing against what they see as a stampede toward left-leaning, socially conscious investing on Wall Street.

2ndVote Advisers joins Point Bridge Capital and Ridgeline Research. And they are tiny still, with less than $35 million in AUM. But they exist.

I think asset management and investing is probably not the right industry for explicitly political brands for a variety of reasons. For one thing, when it comes to asset management, what people care about is making money. An asset manager who refuses to invest in Google or Apple because of politics is not one I care to use.

And it isn’t as if BornPrimitive will dethrone Nike or Lululemon anytime soon because Nike and Lululemon have better products or lower prices or both. That’s how scale works in manufacturing. There are real differences in the actual product, politics be damned.

But… real estate brokerage? That’s something else.

Now we’re talking about an industry with near-zero differentiation at the brand level. If we’re not talking about unique brands like Redfin or Homie, all of the differentiation is in the individual agent who might be great, or might be terrible. Brokerages and brands make all kinds of promises about support, technology, training or whatever to agents but I’m just not seeing any evidence that those things make a difference in the market. And the price is the same to the consumer whether he uses a pink-haired Progressive or a right-wing Alex Jones fan.

So when we’re talking about undifferentiated services at the same price, then something weird like political affinity might make more of a difference. I’m betting that some entrepreneur somewhere will decide that political affinity might be important to at least some of the 74 million people who voted for Trump in 2020. I’m betting that some entrepreneur somewhere will take a chance on recruiting only those Christian, conservative, and libertarian REALTORS who find that their values don’t align with the values of the brands they carry on their business cards.

Therefore, I am predicting the rise of an explicitly conservative, Christian, and anti-woke brand in real estate in 2022. They will seek to take advantage of the disillusionment and distaste of those REALTORS who are suddenly finding themselves on the outs as deplorables and decide that they don’t need to be paying royalties to franchise owners and brokers who hate them.

It seems an obvious if unfortunate outcome of the hyperpoliticized, hyperdivided, tribal environment of the 20s. Yet, here we are.

3. Opendoor Launches a FSBO Service

With Zillow’s exit, Opendoor now reigns as the undisputed champion on the iBuyer world. Sure, they have to watch their backs against competition like Redfin and Offerpad, but without a doubt, Zillow was Opendoor’s biggest threat.

So where does Opendoor go from here?

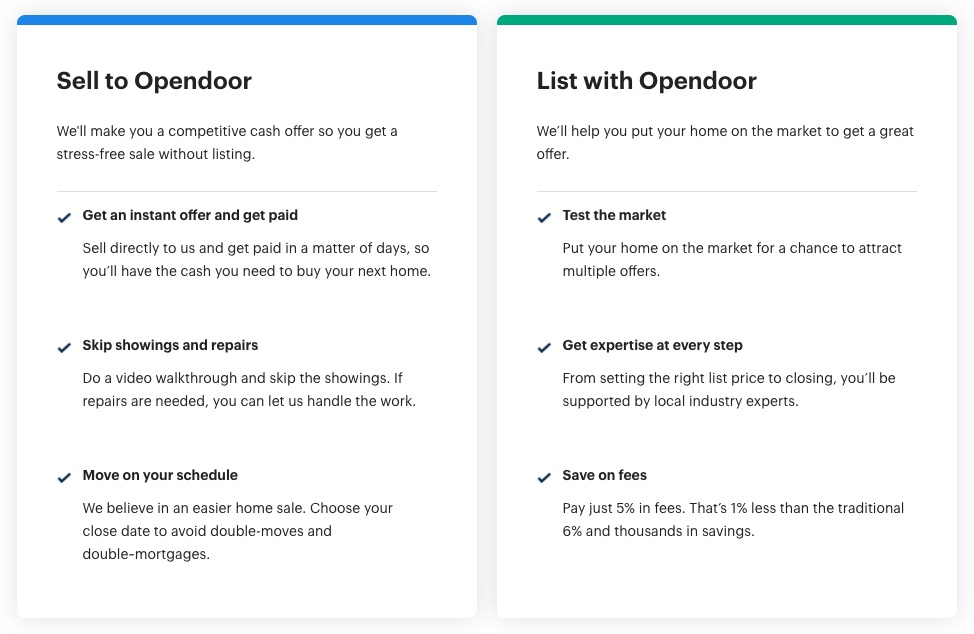

We already know that Opendoor offers a seller just about every possible way to sell a house. He can sell the house directly to Opendoor. In 2019, Opendoor introduced “Buy with Opendoor” which is the bridge loan model in which Opendoor buys the home for cash, then settles up with the buyer after he gets a mortgage. Opendoor has had “list with Opendoor” for quite some time now.

What is missing is a For Sale By Owner (FSBO) option. And I think Opendoor starts offering that in 2022.

Why?

First, unlike traditional brokerages, Opendoor has W2 employee agents. They don’t have to deal with the same kind of internal revolt from their agents as other brokerages would should they start to offer Assisted FSBO services.

Second, given the technology that Opendoor has built, it would not be difficult to repurpose that for FSBO. Consider some of the difficulties with going FSBO:

- Pricing the home for sale

- Getting the home ready for sale

- Marketing the home

- Dealing with showings

- Dealing with the closing

Opendoor built its systems to be able to do all of that for its own company-owned properties. The algorithms price the home with assistance from human inspections. The legions of contractors do the minor repairs and maintenance to get the home ready for sale. Opendoor is a participant brokerage, so all of its listings go into the MLS and get syndicated out everywhere, and it does marketing on top of that. Opendoor does showings via mobile app; buyers can tour Opendoor homes pretty much whenever they want. And Opendoor has a wholly-owned closing services division as well as a mortgage brokerage.

With the exception of the “self-tour” thing, Opendoor can help a FSBO homeowner take care of everything else. If the homeowner is willing to vacate the house for a month or two, Opendoor can even do the “self-tour” thing. Of course, Opendoor would charge a fee for all of these services, but still, whatever the FSBO owner wants done, Opendoor can do it. It would be the ultimate in assisted FSBO to date. (Note, Redfin can probably offer the same if they wanted to.)

Third, should the FSBO owner gets tired of the whole thing, why, there’s Opendoor right there waiting to either (a) buy the home outright, or (b) list with Opendoor for a traditional full-service sale, or (c) get referred out to Opendoor Partner agents for a fat referral fee. There are a lot of revenue opportunities from the entry point of Assisted FSBO.

Fourth, a FSBO homeowner still needs to live somewhere. So why not take advantage of Opendoor’s Buy With Opendoor program? That gives Opendoor some buy-side commission opportunities, the possibility of marketing Opendoor inventory to these FSBO homeowners, and a shot at getting the mortgage. Win-win!

Fifth and finally, offering a FSBO platform allows Opendoor to bring in property data that is not in the MLS. With the known unknowns on the horizon as to what the DOJ/FTC might do (see below), it makes sense to start preparing for alternative data entry technology. With the hunger that data tech companies have for data, especially unique data, the risk-reward to Opendoor from offering a way for homeowners to enter data directly into Opendoor’s system is pretty high.

Since Opendoor is not hated like Zillow is, and Opendoor has never tried to make money on its partner agents (in fact, Opendoor has a history of paying real estate agents over and above the norm), I think the industry won’t get anywhere near as upset at Opendoor for including FSBOs in its offerings as it would if Zillow were to do so. Most folks in the industry know that the weirdos who go FSBO are a tiny percentage of the total, and most weren’t going to be their clients anyhow. You can try to make an issue of it, but it doesn’t have anywhere near the same traction with Opendoor as it would with Zillow.

It makes sense to do for a company that has finally made it to the top after much turmoil and struggle. I predict that they do just that, cause they made it. They made it.

4. FTC Hands Down First of the Big Regulations

Two of the biggest events of 2020 have to be (a) the Moehrl and Sitzer lawsuits proceeding forward, (b) the DOJ coming after NAR. In both of those cases, the lawyers and the government went after NAR, and they went after NAR because of perceived issues with commissions. But those two have been eclipsed by the most important event of 2021 in terms of government action: Joe Biden’s Executive Order on Competition.

Most of the media and punditocracy have only talked about how this is an action against Big Tech. Here’s CNN for example:

The wide-ranging order aims to lower prescription drug prices, ban or limit non-compete agreements that the White House says impede economic mobility and cracks down on Big Tech and internet service providers, among several other provisions.

It turns out, “several other provisions” includes Section 5(h):

(h) To address persistent and recurrent practices that inhibit competition, the Chair of the FTC, in the Chair’s discretion, is also encouraged to consider working with the rest of the Commission to exercise the FTC’s statutory rulemaking authority, as appropriate and consistent with applicable law, in areas such as:

…

(v) unfair occupational licensing restrictions;

(vi) unfair tying practices or exclusionary practices in the brokerage or listing of real estate; and

(vii) any other unfair industry-specific practices that substantially inhibit competition.

As I’ve written and spoken about throughout 2021, this is quite a big deal. Because an Executive Order is not a suggestion. It is not a request, as happens from legislators asking the DOJ or FTC to look into real estate. This is an order. The FTC has to comply. And “encouraged to consider” is merely politeness. The FTC will regulate real estate.

Since the regulatory process is time consuming, I don’t think we see the full panoply of what is headed our way next year. But the DOJ and the FTC have been looking at real estate for quite some time now. I wrote this post in 2018, describing a day I had spent at a DOJ-FTC joint workshop on competition in real estate. And of course, the DOJ went through quite an investigation leading up to the lawsuit against NAR, which they withdrew from in order to investigate more. There is zero prohibition in two agencies of the same federal government sharing information with one another.

The FTC has enough information to do at least a couple of big regulations. I think we get at least one big one in 2022.

There are four candidates for big regulations, and my definition of “big regulation” is something that really disrupts the way the industry functions. The four things that the DOJ and NAR already agreed to in their canceled settlement are not big regulations under this definition. Display of commission data, no more searching or filtering by cooperating commission, can’t say buyer services are free, and lockbox access to non-MLS members are a given. What the DOJ almost did via litigation, the FTC can do via regulation.

So here are the candidates for Big Regulation:

- Eliminate cooperation and compensation: prohibit the practice of having sellers pay the buyer agent’s commission.

- Eliminate Clear Cooperation Policy: allow for brokers and agents to engage in unlimited off-market activity, with regulations to protect the seller.

- Regulate data sharing: eliminate the non-commingling rule, and regulate how real estate data must be shared.

- Eliminate the REALTOR requirement for MLS access: prohibit REALTOR-owned MLSs from requiring REALTOR membership for access to the MLS, or charging different fees for MLS-only access.

If I had to guess right now, I’m leaning towards #2 or #4.

I think #1 is the Big Kahuna prize for the FTC, so they’ll take their time on that one and promulgate that in late 2023 or in early 2024 in time for the Presidential Elections in 2024. #3 is possible, but the prospect of federal direct regulation of data would rile up other powerful forces who are already riled up: Google, Facebook, Amazon, Apple, etc. It’s better for the FTC to stay a bit under the radar, since corporate media is quite unlikely to cover federal regulation of the real estate industry in the same way it would cover federal regulation of Google. They likely bring that one forward in 2023 or 2024.

But if FTC brings down #2 and #4 together at the same time, that would significantly weaken NAR, the one organization that has seen fit to rebel against federal power by daring to bring a lawsuit against the government. The political backlash is likely to be quite small, since at least half of NAR’s members feel alienated and disenchanted with NAR, and many of the largest brokerages and many of the top producing agents would like to see Clear Cooperation Policy eliminated or weakened.

So that’s my prediction, sure to be wrong. The FTC promulgates at least one maybe two big regulations in 2022. The government cannot tolerate a separate power not under its thumb. The police and badboys try to rule the same place, and these streets, they don’t play.

5. CoStar Launches a MLS… in the Metaverse

CoStar’s entry into residential real estate by acquiring Homesnap (and bidding on Corelogic) is possibly one of the biggest events of 2020. But we need to think about things some more.

My theory on CoStar since the news was announced is that CoStar eventually intends to step into the vacuum left by the MLS when the United States government smashes the whole apparatus by killing off most of the underpinning structure: cooperation and compensation, Clear Cooperation Policy, REALTOR-only requirement, three way agreement, and the principal REALTOR rule. (See Prediction #4 above.) However, CoStar won’t do anything to threaten the MLS; in fact, it will ride in as a white knight to rescue the MLS once it is hanging on by a thread.

Thing is, CoStar has never operated an MLS. It operates the closest thing to an MLS in the commercial real estate world, but in residential real estate with all of the complications and different cultural norms from commercial, CoStar is a total novice. Before it can step in as a white knight, CoStar probably should know a thing or two about operating an MLS.

The Metaverse offers them the perfect opportunity to do so.

If digital land and digital buildings start trading, buyers and sellers and landlords and tenants will need a single place that has all of the inventory with some kind of verification of the property. We might even see the rise of digital real estate agents who specialize in helping buyers and sellers transact digital real property. (I kind of doubt that, but that’s a whole other speculative article.)

CoStar’s dominant position in physical commercial real estate gives it an edge for setting up the equivalent in virtual commercial real estate. They already know how to aggregate CRE data, have an enormous research team for physical CRE who make phone calls every day to get data, know how to merchandise data for sale, and how to supply data to landlords, tenants, buyers, sellers and their representatives. Providing lease and sale comps is something CoStar knows how to do very well indeed.

I expect that CoStar will be a player in digital CRE in the Metaverse; they have the expertise, the credibility, and the opportunity to become that.

It is a trivial matter, then, to extend that system to digital “residential” real estate as well. I’d guess that personal homes won’t be a huge thing in the Metaverse because… well… people don’t actually live in the Metaverse. But having been a longtime MMORPG fan, who owned a virtual house, furnished it with my trophies, had parties and Guild meetings there and so on… I’m fairly certain that at least some of the people of the Metaverse will want to own their own virtual “homes.”

This presents an opportunity for CoStar to build up some experience in operating an MLS of sorts in virtual real estate, getting a grasp on things like data compliance, offer and acceptance, and maybe even cooperation and compensation (although CoStar will recognize that practice is likely to be ended soon by the federales). CoStar can use the Metaverse to figure out the optimal data structure to represent residential properties, what fields are essential and what fields are not, and how to do data entry as well as data sharing in a way that protects its investment.

It’s not a perfect match for the MLS in the real physical world, just like the Metaverse is not the real physical world. But it’s a close enough representation, just like the Metaverse is, and it will provide much needed practice for the team at CoStar to ready fi dem for when the rules of the physical world changes.

I look forward to seeing CoStar’s entree into the Metaverse.

6. Realogy Debuts Property Management Business

If you’ve read my Seven Most Interesting People of 2021 post, you already know that I think Scott Brady is one of the most interesting people in real estate today. Because he is pioneering one future of real estate brokerage as part of a horizontally integrated business that combines property management with real estate sales.

As I wrote in that post, Sunny and I know of companies that have thriving brokerage practices because their property management business funnels buyers and sellers into them. My introduction to real estate was through commercial real estate where property management is offered in order to control the inventory. I’ve always been puzzled why we don’t see more of this in residential real estate.

Furthermore, since the United States and Canada are turning into #renternation societies, and commission compression is just over the hill, the greatest opportunities in real estate are not in selling more houses, but in property management and asset management.

Scott Brady doesn’t think big brokerages can make the pivot. I’m predicting that they can, and that they do, because the alternative is bankruptcy.

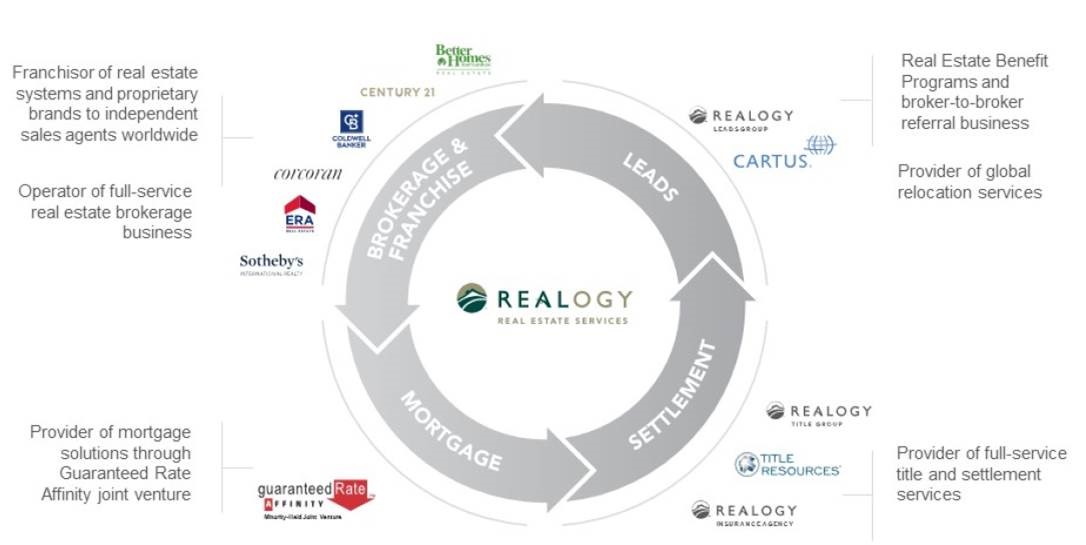

In particular, I think Realogy is the first to embrace property management as a business and launches a division — even if a small trial — in 2022 to test out how it would work within the framework. As I have said time and again in my reports on Realogy, one of the key concepts behind the Realogy story is the Value Circle:

Other companies have something similar (like HomeServices of America, Howard Hanna, etc.) or are trying to build something similar (EXP, Compass, Redfin, etc.) but Realogy has perfected the Value Circle over years of experience. It is central to the corporate identity and corporate practice.

Realogy also has some cash in the bank now — almost $700 million at the end of Q3. They can afford to make some big plays in the property management space. If I were them, I’d start by overpaying for Scott Brady’s company, bringing him on as President of the new Leasing Division, and then giving him a blank check to integrate property management into the national footprint of Realogy Brokerage… then following that up with deployment with the Realogy Franchise Group. But if Scott doesn’t want to bother, Realogy can find other capable property managers who know brokerage to do the integration. I’d still pay Scott Brady a hefty consulting fee to help set that up though, but that’s just me.

It won’t be an easy business to start. It won’t be an easy pivot to make. But if Realogy only knew ooh ooh ooh… if Realogy only knew ooh oh-a-yeah… if Realogy only knew ooh ooh just how much money can be made from picking up pennies and turning them into nickels, then applying some smart technology and processes to cross-train some of their REALTORS into property managers who can get regular income for part-time work and still keep developing their sales businesses… well… it just might help turn their fortunes around for good.

So while I fully expect to be wrong (or your money back!), I predict that Realogy launches a property management business in 2022.

7. Federal Ban on Investment in SFRs

It is no secret now that the housing market has gone parabolic. It’s actually insane. The numbers are simply unprecedented.

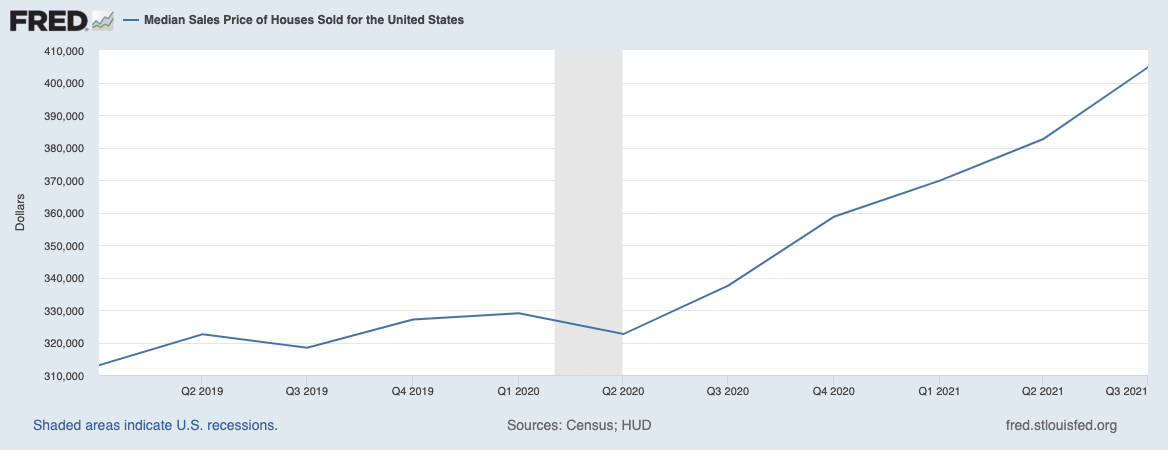

Here’s the latest according to FRED of the St. Louis Fed:

After a brief dip in Q1 of 2021 thanks to COVID, the median home price across the country has skyrocketed, from $322,600 to $404,700. Obviously, markets in high-demand like Boise, Austin and Provo are up even more.

The mystery, of course, is how this is possible. Governments at all levels — local, state and federal — and politicians from both parties have done everything they could to kill jobs and the economy. Don’t forget that 14 Republican governors ordered lockdowns, and Trump began the whole money printer go brrrr thing. This wasn’t a COVID paranoid Dems vs. freedom-loving Republicans thing at all. It was everybody, at all levels, except for a few notable holdouts like Kristi Noem in South Dakota. Even Desantis who is today making political hay locked down Florida from April 2 to May 4.

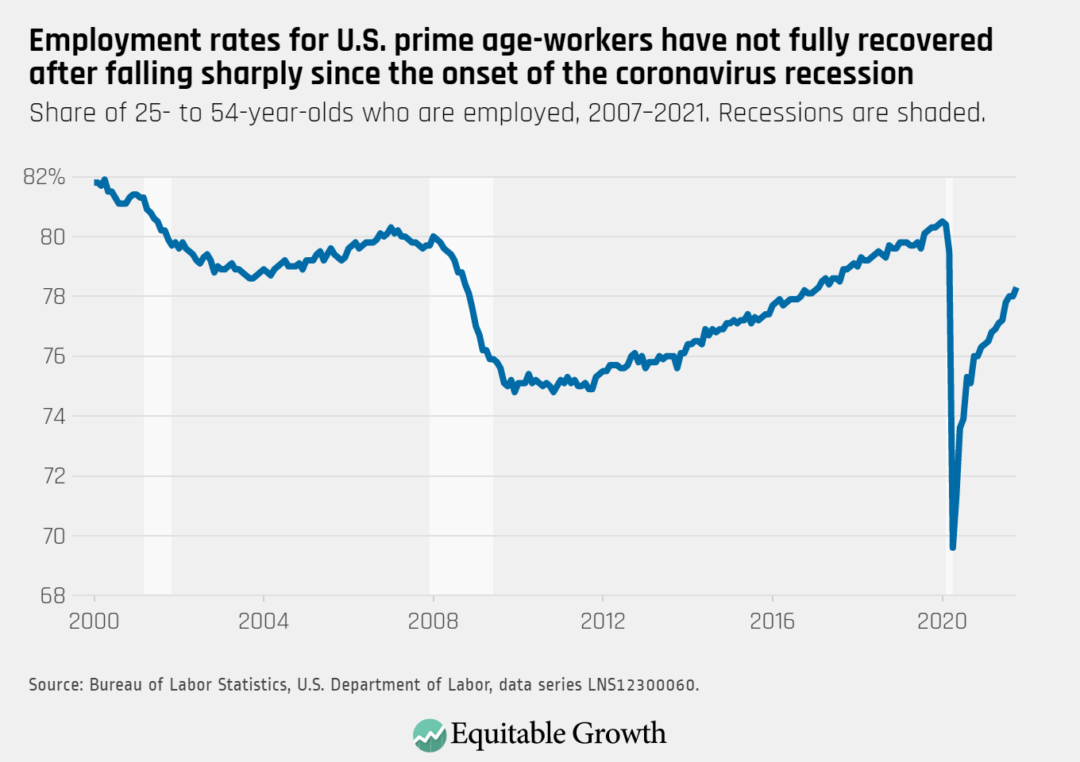

Accordingly, jobs fell off a cliff:

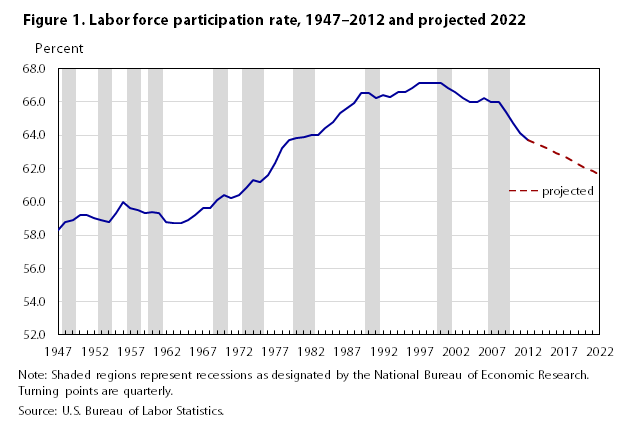

And the November jobs report was disappointing, to say the least, coming in at 210,000 vs. expectations of 573,000. Less than half of the expected jobs were filled. Which means we’re still not back to 2019 levels of employment. What’s even more amazing, businesses are desperate for workers… who aren’t interested:

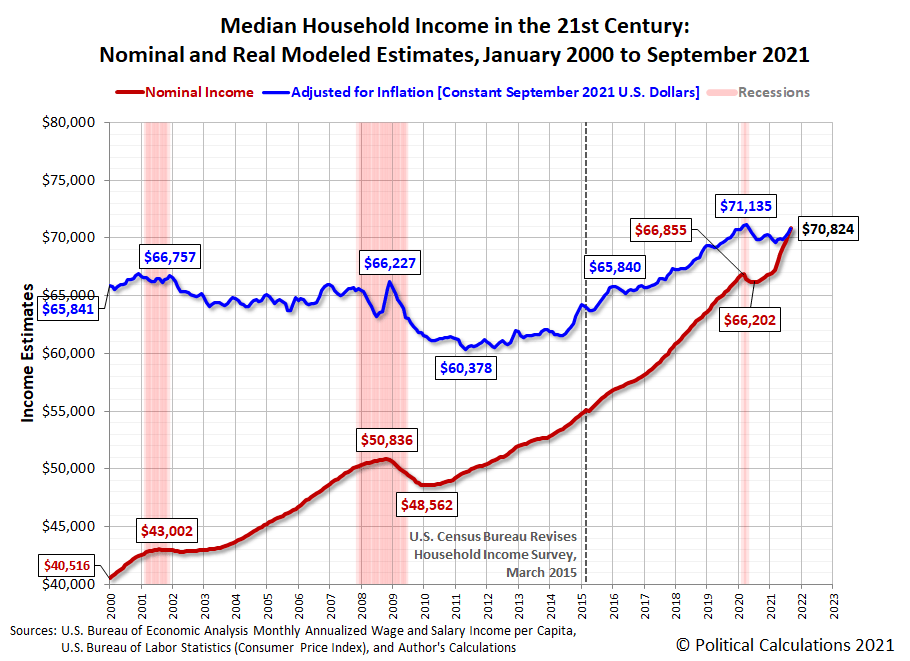

For those who have chosen to go back to work, their real household income actually fell: “Adjusted for inflation, median household income remains below the April 2020 peak of $71,135 in terms of constant September 2021 U.S. dollars.” And that’s if you believe the government’s numbers for inflation. If you don’t, then real income fell even more precipitously.

So how is it that in the midst of a wave of unemployment, and the Great Resignations going on, with fewer people working since the 80s, and wage growth nonexistent, we have the housing market going crazy?

I have my theories. In April, I wrote What Are Financial Investors Thinking? and said:

I think what is happening is that there are at least some investors now in the housing market who are not real estate investors as we traditionally think of them. These new financial investors are not as worried about rents and yield and cap rates as actual real estate investors are. They’re more concerned about real estate as a storehold of wealth, of buying power, in the face of devaluation.

As Dalio said, just buying something, anything that increases by the 2% a year of inflation is better than holding cash or investing in bonds. So how much better is it to put money into something that is increasing by 14% a year as American residential real estate is?

I think what we have learned since April tends to validate my hypothesis from back then. Investors both large and small fled out of bonds, out of cash, and poured into real estate. Some of the wealthier Americans who were renting decided it was time to buy; many of them moved out of high-priced areas into lower-cost cities and bought like crazy. A Californian moving to Las Vegas thinks he’s getting a bargain; the local Vegas resident thinks the Californian is overpaying like crazy. Both can be correct.

The grumbling from those who were shut out of the home purchase market is getting steadily louder. Now add to it the complaining from renters.

According to Multi-Housing News, the national average rent is up, way up:

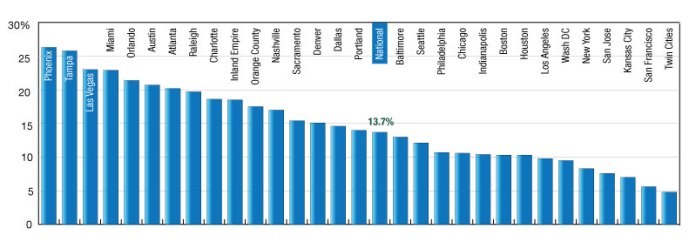

The beginning of the fourth quarter has registered new record growth in national multifamily fundamentals, according to Yardi Matrix’s latest survey: The national average rent rose 13.7 percent year-over-year through October, to a new high of $1,572, while the occupancy rate in stabilized properties rose 1.4 percent in the 12 months ending in September, to 96.1 percent, an all-time high. September also marked the closure of the historical occupancy gap between the two quality segments. Meanwhile, single-family rentals also maintained a robust performance, the average rent rising 14.7 percent on an annual basis.

Since March, the average U.S. asking rent has risen by $179, which is nearly equal to the increase over the previous five years combined. Behind this outstanding growth is demand: Through September, some 475,000 units were absorbed nationally, already surpassing the all-time annual high.

Look at rent increases in places like Phoenix and Tampa: 25% YOY. More and more people are getting more and more pissed off. The Corporate Media isn’t helping, of course. Instead, they’re stoking the flames of resentment. Take this CNBC report I just ran across today:

If you’re feeling brave, read the comment section to that video. There are almost 1,500 of them. Those comments might give you a clue as to how people who have been shut out of the housing market and are now facing huge rent increases are feeling. The anger is particularly sharp among Millennials and Zoomer cohorts who have gotten royally screwed their entire adult lives.

Politicians being what they are, they will see that thar’s votes in dem hills. We’re already seeing action at the local level with Los Angeles looking to ban iBuyers and institutional investors from buying houses:

Amid a rapid arms race among high-tech corporations and private equity firms to buy up property and profit off a red-hot housing market, the Los Angeles City Council has voted to explore ways to ban such companies from purchasing single-family homes.

Never mind that institutional ownership is about 2% of the housing stock. Never mind that iBuyers are a paltry 1.2% of the market, and they’re not landlords. The talking points and the slogans for electioneering are too good to ignore: The Rent is Too Damn High!

It’s possible that we could see something more significant like national rent control, but most landlords are small-time mom-n-pop operations. Quite a few younger people are small landlords as well, as they climb the property ladder. Real estate investment is a major focus of retail investors; just ask BiggerPockets. We could see federal override of restrictive local zoning, but that has Constitutional problems in all likelihood, and even more problematic for politicians, it runs head on into NIMBYism, especially from wealthy liberals.

Plus, Wall Street and big real estate developers are major political contributors. You want to get elected, but you can’t piss off your donors like that.

Accordingly, I think what we see is a ban on institutional ownership of single family residential properties. This is narrowly focused enough to only piss off a few big institutional players like BlackRock and Tricon and so on and they could likely be paid off in some other way like big tax breaks, or getting grandfathered in. By tailoring the ban to only apply to large investors — say more than 4 units? — you get around the protests from family and individual investors. By applying it only to SFRs, you leave the condo market and actual multifamily wide open for institutional investors.

Housing will become contraband for institutions. Mark my words.

Of course, such a policy doesn’t actually solve the problem of skyrocketing home prices (which has more to do with money printing) and rising rents (which has more to do with money printing), but it has the great benefit of allowing politicians to say they’re champions of the little guy going against greedy Wall Street landlords. And despite not solving the problem, there will be plenty of votes in these here hills. Watch this video, which has the highest views I’ve been able to find on YouTube:

Then read at least some of the over 4,500 comments. See if you can spot the votes there, because I can, which means professional politicians most certainly can.

So I predict that we see this in 2022 as we ramp up for the mid-term elections. A lot of congresscritters are going to want to campaign on housing as an issue, especially in urban and suburban areas that have seen home prices up 20% and rents up 25%. To do that, they’re going to need to pass some legislation before November rolls around so they can take credit for it.

This will be kinda bad for housing, as some of the buyer demand has to slack temporarily until the big institutional money figures out a different way of getting into the housing market (floating rate loans for individual investors?). But I tell you what… this legislation will be a godsend for my crypto holdings.

Conclusion

2020 was the Black Swan year of pandemics and imprisonment. 2021 was the Grey Goose year of the longest 14 days to stop the spread ever, the Great Resignation, supply chain disruption and of course, “transitory” inflation.

Last year, I wrote that 2020 was terrible, but “it couldn’t possibly be worse… could it?” Um… yeah, I’ll take the L on that one. I will adjust and no longer be predicting that 2022 will be better than 2021, because it turns out, things could get worse. 2021 has proven that.

Still, it isn’t as if 2021 was just filled with disaster. There were more opportunities this year to see friends, colleagues, and to meet in person like human beings were meant to do. Restaurants were mostly open in Las Vegas, and I have learned to completely turn off the Corporate Media. Plus, turns out that Sunny likes hanging out with me, and I like hanging out with her. For days on end. Imprisonment isn’t so bad if you like your cellmate a whole lot.

Whatever happens, I know 2022 will be yet another interesting year to live through. I expect it to be even more interesting since it is an election year. And since all of these predictions are guaranteed to be wrong, or your money back, I look forward to going another 0-for-7 next year.

If nothing else, I hope these predictions have mostly entertained you and maybe even made you think about things. And at a minimum, I hope they have introduced you to a new sound coming out of Jamaica. If your idea of reggae is limited to Bob Marley and Snow, it might do you good to check out the crop of young artists coming out of the West Indies. They’re blending all kinds of musical trends from rap to blues to R&B to folk into a recognizably reggae tradition and I am finding a level of musicality in some of these artists that is hard to find. Plus, you can dance to it even if you can’t understand all of the lyrics.

So, see you next year and I hope to be asking, as Koffee, the amazing 21-year old Grammy winner, does: Where will we go, when di quarantine ting done and everybody touch road?

-rsh

4 thoughts on “Seven Predictions for 2022: Fresh Sounds of Jamaica Edition”

Comments are closed.