Happy (?) Bloody Monday. Seems that as of this writing, the Dow is down over 630 points, NASDAQ down 273 points, and the S&P500 is down 90 points. The stock market is tanking like a mofo, and Gold is up $7.80 per ounce. (Though Bitcoin, which should be digital gold, is down sharply as well.) So like many of you, I’m following, reading, and listening to some of my favorite analysts.

The basic thesis is that the stock market is tanking because of the Fed announcing that it will be raising interest rates, tapering bond purchases, and even selling some bonds (aka, tightening). One analyst I saw this morning thinks the stock market is essentially “calling the Fed’s bluff” by tanking. The idea is that the Fed can’t raise rates without bringing about a major recession (if not a global depression) so the market is sending a political signal to the Fed and to the Biden Administration not to mess with the easy monetary policy.

On the other hand, inflation hit 7% in December, and it is becoming black humor jokes all around the country with “I Did That” stickers popping up everywhere. Politicians know they can’t get reelected if inflation continues, so they’re pushing the Fed to do something about inflation.

On the third hand, politicians can’t get reelected if the economy tanks and people lose their ass in the markets, so….

But this whole situation got me wondering what, if anything, would happen to the housing market if the Fed really did tighten monetary policy to fight inflation.

Please note: none of this is investment advice, I’m not an investment advisor, and this is just speculation for fun and education.

Home Prices Have Not Gone Up

Let me reiterate something I’ve been saying for over a year now: home prices have not gone up. The housing market is not hot. There is no housing bubble. What we have, instead, is dollar devaluation — or, inflation. I thought this chart might be suggestive of that idea:

The blue line is the S&P 500. The yellow line is the M2 money supply. Orange line is the Case-Shiller Index, and the teal line is rent for primary housing from FRED.

What I found interesting is how the chart clearly shows the market crash from COVID restrictions in March/April of 2020, the subsequent money printing by the Fed, the rebound of the stock market to eventually surpass the M2 line, and the rise of home prices. More interesting for me, I suppose, is that home prices started skyrocketing precisely one month after the Fed did the massive injection of liquidity, in July of 2020.

While the blue S&P 500 line is kind of all over the place, since (1) equities are more volatile, and (2) there’s a lot more granular data, what is striking to me is the near-identical slopes of the M2 money line and the Case-Shiller Index line. They’re going up more or less matched. And at least according to FRED (Federal Reserve of St. Louis), rent is much, much flatter. (Yes, I think FRED is wrong on this, and have no idea where they’re getting rental data from, since those of my audience involved with rentals and property management tell me quite a different story.)

These lines validate (to me) the idea that we really haven’t seen a red hot housing market, like most people believe. What we’ve seen instead is a devaluation of the dollar, which feels like the housing market has gone insane since houses are denominated in dollars.

Let’s Say the Fed Tightens

So let’s assume for shits and giggles that Powell and the Fed are serious about fighting inflation. They’re going to invoke the spirit of Paul Volcker, strap on a political suicide vest, and tighten until inflation is beaten. They don’t care about any politician’s political future; they will be immune from pressure from literally everybody holding any kind of elected office across the country, in both parties. They just don’t care, and they’re going to hammer inflation into submission whatever the cost.

Let’s say that happens.

What happens to housing?

Housing Market Tanks

Hypothesis #1, which I think is kind of the dominant narrative today, is that such tightening will result in a collapse of the housing market. The “Housing Bubble” will burst, and we will find ourselves back in the buyer’s market circa 2010 or so.

This makes all kinds of sense, right?

First, mortgage rates will go up in lockstep with Fed’s interest rates hikes. Redfin recently released a blogpost quoting its chief economist, Daryl Fairweather, and says that rising rates will “stabilize demand and reduce the risk of a bubble.” So home price appreciation will slow, and we’ll ease into a more normal market.

Second, Fed action will tank the stock market, will result in companies closing their doors, and will result in far higher unemployment. Recession is all but guaranteed, which further “stabilizes demand” since unemployed people don’t buy houses.

So the combination of higher mortgage rates and fewer people with jobs means home prices will tank. The market will turn, and from the most insane seller’s market in history, we will go to a buyer’s market or maybe, just maybe, a “balanced” market, whatever that means.

This seems straightforward: higher rates, lower demand, etc. and prices will moderate.

Housing Market Skyrockets

Hypothesis #2, which is kind of mine and therefore against the conventional wisdom, is that in contrast, the housing market will continue to skyrocket. Home price appreciation might slow, but not significantly so, and things will actually get worse for homebuyers.

Let me try to explain my thinking here.

The stock market tanking means people institutions are selling their stocks. Maybe they’re taking losses, but the point is that they are selling their shares of Tesla and Netflix and whatever for cash, for US Dollars.

What are they going to do with all these US Dollars? They can’t eat them. They can’t power electric power plants with them. They have to put the money somewhere. But where?

Maybe bonds, since rates are going up, making them more attractive as investments. Except that they are then having to bet that ultimately, inflation will be brought down to below what the bond is paying out… and we’re nowhere close to that today, even on nominal fake-inflation numbers that are too low. Maybe gold. Maybe Bitcoin, especially since Bitcoin has been hammered along with the stock market… but that suggests that most investors think Bitcoin is like a growth stock. It is “risk-on” not a “risk-off” investment, and not a hedge against inflation.

Well, say hello to housing. The home price index nearly perfectly tracks US money growth, and in 2021, it was up over 10% YOY.

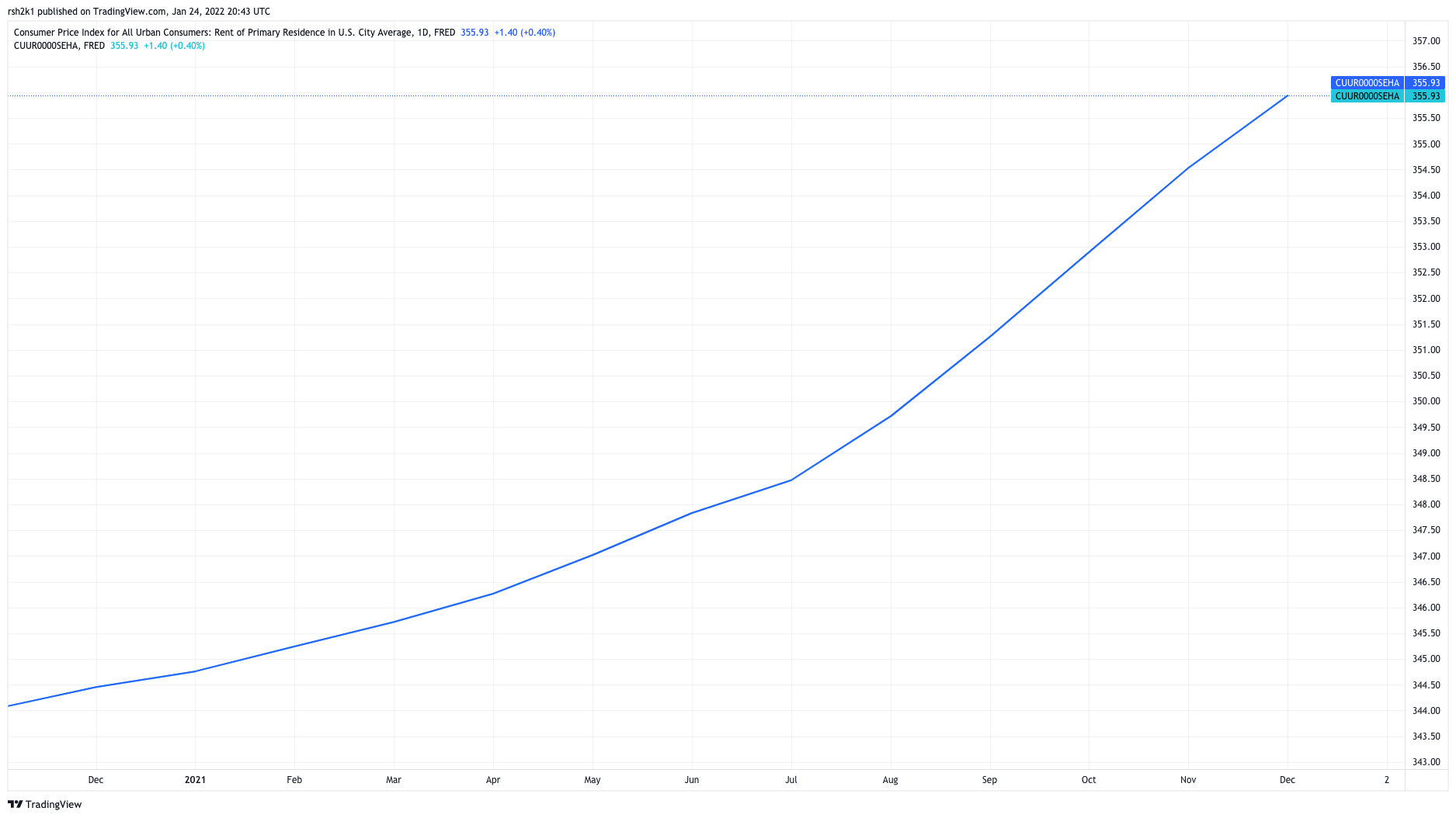

At the same time, even the too-low FRED numbers for rent show big increases towards the end of 2021. Here it is blown up for you:

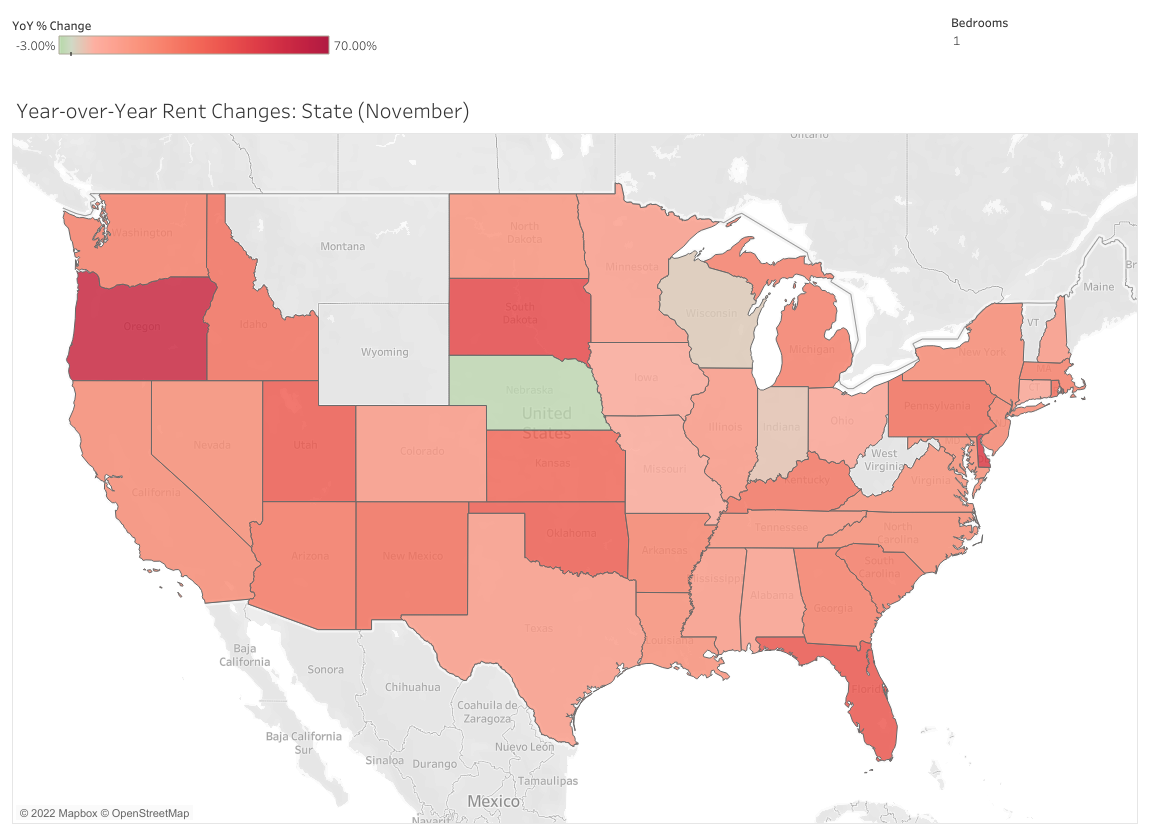

ApartmentGuide has a 2021 rental market report that paints quite a picture. Read the whole thing. And they’re showing 21.3% increase YOY for 1BR rent, and 16.7% YOY increase for 2BR rent. And 97.8% of the states are showing rents up:

So.

I think Redfin and the more mainstream economic forecasts about home price appreciation slowing, about demand dropping, etc. are all correct. If the Fed actually tightens, actually raises rates, then of course we’ll see consumer demand drop off a cliff. Many of them won’t have jobs, and the ones that do will have to pay for gas and groceries and such.

At the exact same time, there will be hundreds if not thousands of family funds, institutional money managers, and the super rich who just got the hell out of the stock market who need to put their money somewhere.

I think they all put it into one asset class whose price tracks US money supply so neatly, and which happens to generates better and better cash flows from higher and higher rents. Real estate is almost like an inflation-hedged bond at that point, no?

Yes, that sucks for regular consumers. Yes, that means we approach the end of homeownership society. So? It isn’t as if anyone is willing to do much about it today and it isn’t as if there are many options even if someone did.

Flight to Safety

That’s where my head is at today. I mean, I’m probably wrong, since I’m no trained economist, but… have you looked at the performance of trained economists lately?

If the Fed really does carry out its threats to raise rates and tighten monetary policy in order to fight inflation, then Powell & the Gang will be inducing a recession if not a depression. The pain will be significant and serious, and buyer demand will fall off a cliff.

Yet that won’t affect housing nearly as much as people imagine, because institutional money will step in to fill the gap. In fact, institutional money has already stepped in and is already out-competing family buyers using FHA or VA loans today. That situation can only get worse.

The question to be asked is, “If you’re a pension fund manager, and you can’t be in bonds, you can’t be in cash, and you can’t be in the stock market… where can you find any returns whatsoever to keep your job?”

If you listen closely enough to the wind of change, you can probably hear an answer.

-rsh

PS: I think this is one of the most bizarre combinations musically speaking that I’ve ever seen… and it kind of works, strangely enough.

Scorpions, Berliner Philharmoniker – Wind Of Change

Music video by Scorpions, Berliner Philharmoniker performing Wind Of Change. (C) 2000 Eagle Rock Entertainment Ltd. http://vevo.ly/LbBuZB

ROB,

Great perspective my friend!

Thanks for your insight.

Brian