Happy Friday, everybody. Recently, a reader sent me this Inman article from last week in which celebrity real estate broker Ryan Serhant predicted that 50% of all transactions will be done on the blockchain:

In his annual letter to clients, the luxury broker and star of Million Dollar Listing New York sang the praises of blockchain technology and its potential role in real estate, and hinted that his technology team is looking into ways to get more involved in this space.

“I see a world very soon in which 50 percent of all real estate transactions are done with crypto, and where contracts are recorded on the blockchain and ‘signed’ as NFTs (non-fungible tokens),” Serhant wrote in his annual end-of-year letter to clients.

“Our agents are currently working on many wallet-to-wallet crypto transactions now, both in NYC and Florida — a trend you’ll read a lot about in 2022 as wealthy crypto holders look to diversify into hard assets,” Serhant added.

The comments were interesting, and mostly negative. Because for some reason, many REALTORS are seriously anti-crypto. Then again, many REALTORS are very, very excited about selling homes to crypto millionaires all over the place… though today, “all over the place” means Miami, aka, Bitcoin City USA, with its own cryptocurrency, MiamiCoin.

I think both sides have a point. I side with Serhant from a futurism standpoint. I side with his critics around the phrase “very soon.” It might be very soon, but it probably isn’t all that soon… and Lord knows I’m usually the guy predicting things way too early.

In Defense of Ryan Serhant

First, as you know, I’ve had my Road to Damascus moment as it comes to crypto and blockchain technology early last year. So I’m fully admitting to my bias. Having said that…

I agree with Serhant’s general take, that real estate transactions are recorded on the blockchain, signed as NFTs, decentralized, and many transfers will happen wallet-to-wallet. Home transactions will be faster and more secure, with fewer closing costs “tied to middleman services.” All of that and more will happen. Eventually.

At some point.

And that’s the trouble. Even those of us who are big believers in the potential of blockchain and crypto have to acknowledge that the future is not merely around the corner. It’s a bit of a ways down the block.

Thing is, you have to understand where Serhant is coming from. He’s based in New York City, and he spoke about his agents in NYC and Florida (aka, Miami) working with wealthy crypto holders diversifying into hard assets. NYC and Miami are the two cities currently competing to be CryptoCity USA. The two cities are also home to a very large number of wealthy individuals, some of whom will be wealthy crypto millionaires.

So for him and his luxury agents, it probably isn’t all that unusual to talk to clients about converting some of their crypto wealth into housing by way of NFTs and on-chain transactions.

It’s a bit reminiscent of how things like anti-lock brakes or lane departure sensors and the like were once the province of high-end luxury cars… to then make their way downstream to mainstream products. The nature of technology is to start at the peak of luxury, high-end, bespoke, unique… then filter its way down to the rest of us.

The wealthy millionaires and billionaires of NYC and Miami are today clearing the path that the rest of us will travel… someday. Eventually. At some point.

But not today.

Just How Many Wealthy Crypto Holders Are There?

One reason, of course, is what Inman brings up: there just aren’t that many wealthy crypto millionaires who want to convert their digital wealth into hard assets. Inman quotes an NBER study showing that 0.01% of Bitcoin holders have 27% of the Bitcoins in circulation.

A more useful set of data comes from Statista and Bitcoinist.

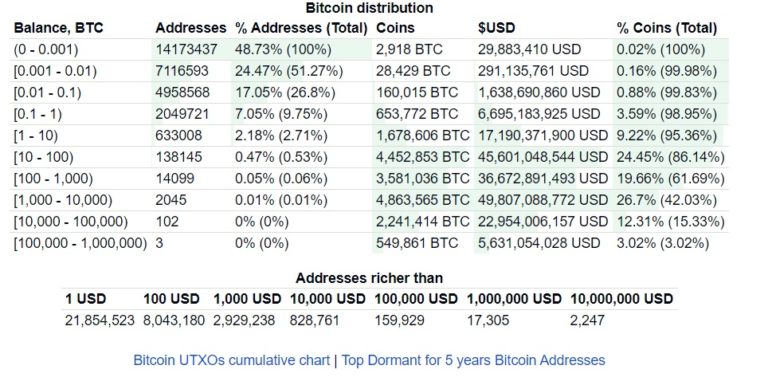

Statista shows us the overall growth rate of Bitcoin ownership:

As you can see, there are some 80 million Bitcoin wallets worldwide in January of 2022. Just two years ago, in January of 2020, there were 45 million Bitcoin wallets. That’s quite a growth rate.

But it’s still only 80 million Bitcoin wallets worldwide. How many are in the United States?

According to Exploding Topics, some 46 million Americans owned Bitcoin in 2021, or 22% of the US adult population. I think that number is way high, by a lot, especially when a bit further down, the article tells us that only 89% of American adults had even heard of Bitcoin, only 27% would consider investing in it, and 13% already had.

I’m willing to bet that most of the 13% did not invest in Bitcoin; more than you’d think likely invested in things like Dogecoin or Shiba Inu instead. Because Bitcoin is rather expensive.

How Many Significant Crypto Owners Are There?

Perhaps more interesting for our purposes, since our industry deals in the purchase and sale of the most expensive thing that most people will ever own, is asking how many people own enough Bitcoin for it to matter.

Bitcoin as of this writing is trading at around $43,000 each, down from a high of about $69,000 hit in 2021. So how many Wholecoiners (people who own at least one full Bitcoin) are there?

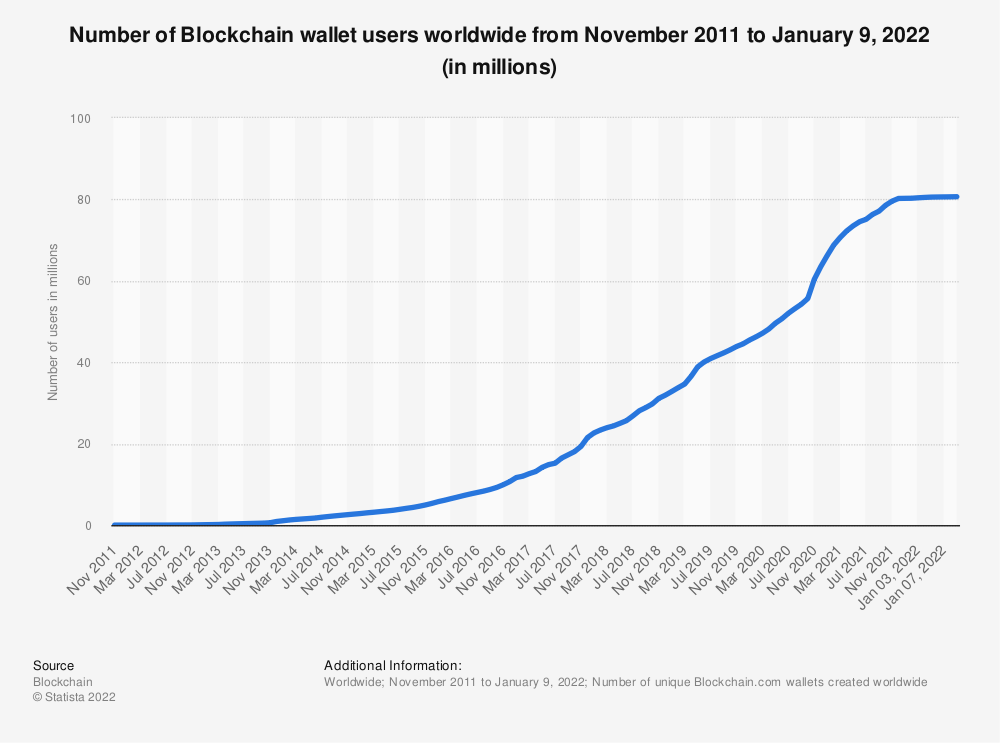

Most on-chain analytics show that only 2% of wallets have at least 1 Bitcoin. But for someone to want to convert Bitcoin into housing, he’d have to own more than 1 BTC worth $43K. $43K doesn’t buy you a whole lot of house. Plus, Serhant’s clients are looking at multimillion dollar properties. So what about wallets with more than $100K? More than $1 million?

Here’s the chart from Bitcoinist:

Only 17,305 wallets have more than $1 million USD in value. That doesn’t seem like a lot of money to be buying houses in NYC or Miami, where the median home price is around $740K and $515K respectively. And those median home prices include neighborhoods crypto millionaires wouldn’t be caught dead slumming in.

Only 17,305 wallets have more than $1 million USD in value. That doesn’t seem like a lot of money to be buying houses in NYC or Miami, where the median home price is around $740K and $515K respectively. And those median home prices include neighborhoods crypto millionaires wouldn’t be caught dead slumming in.

So think more like $3-5 million luxury condos and such. Now we’re looking at maybe 10,000 people who have that kind of wealth in Bitcoin, and most of them started way, way, way earlier than any of us Johnny-come-lately’s.

Then you have to think that some percentage of such wealthy individuals likely already own homes. No idea what percentage, but probably not zero.

Little to No Impact on Most Real Estate Today and Tomorrow

Point is that crypto is not likely to have an impact on most real estate agents and most real estate transactions. Not anytime soon. There just aren’t enough crypto millionaires who want to buy $400K starter homes in Des Moines to make a difference. Sure, you’ll have the one-off odd transaction where some crypto bro wants to buy a condo with XRP or something, but just about every single one of those transactions can be done by selling XRP for USD (or getting a crypto loan for USD).

Blockchain technology is indeed extraordinarily promising, and eventually it will deliver what Serhant says: faster, cheaper, more secure transactions. But no one in real estate tech is today implementing anything truly blockchain at wide scale. The projects that already exist cater to that tiny niche market that might not be super tiny in NYC and Miami… but kind of is everywhere else.

The Metaverse will be significant. One day. I’m a big proponent of it as the future. But very soon?

I don’t see that. One day. Some day. Sooner than you think, probably. But it’s unlikely to be very soon.

But Everything Changes in Real Estate

At the same time, I rise to defend Ryan Serhant’s position in the context of someday. The wealthy pioneers who are his clients will pave the way for on-chain digital transactions, using NFTs and blockchain technology, to make transactions something we can’t even imagine today.

It’s kind of like the national debt situation. We all know it can’t last. We know it can’t continue to go up and up and up forever.

Trouble is, none of us know when that whole situation will implode, or how it will implode. But implode it will.

Similarly, all of the signs are pointing to blockchain, web3, NFT, Metaverse and Crypto changing the world, which changes real estate in fundamental ways.

Trouble is, none of us know when things will change and how it will change.

So. The future of real estate will be written on the blockchain. Someday. Sooner than you think. But not tonight.

-rsh

Depeche Mode – But Not Tonight

Depeche Mode – But Not Tonight. (official music video) Pozdrowienia dla wszystkich fanów Depeche Mode z Bydgoszczy!

1 thought on “On Ryan Serhant’s Crypto Prediction”

Comments are closed.