My friend Sam Debord, with whom I debate a lot as I do with most of my friends, recently published an excellent piece on what crypto, nfts, web3 and the rest mean for real estate. He’s a very thoughtful guy, and it’s obvious that he’s done his homework on this post. He tries to make sense of all the lingo and the hype “in a way that’s simple and pragmatic” and I do think he mostly succeeds.

His article did get me thinking further about what these things actually mean for real estate, to use Sam’s phrase, “in practice.”

The short answer is: nothing.

The longer answer is: everything.

Let’s dig in.

NFT and the Metaverse

I think it’s safe to say that Sam is mostly skeptical — and rightfully so — about the NFT craze and the Metaverse in general. He writes:

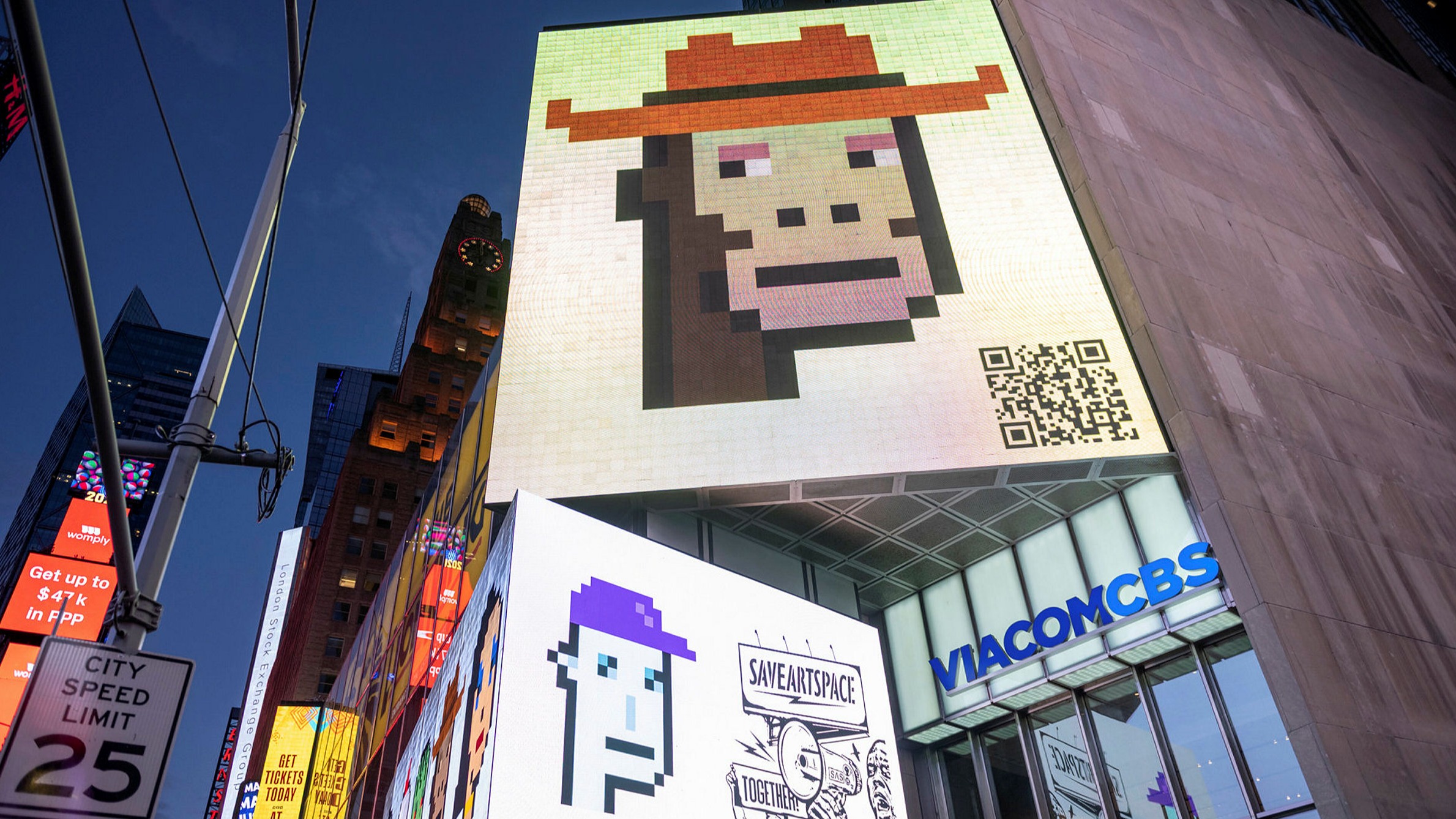

The news headlines are mystifying. People are buying digital property rights on the internet. They’ve paid over $1 million for items like:

- Blocky cartoon headshots of people smoking cigarettes

- Drawings of bored apes

- Virtual property in online cities

“The world’s gone mad,” you might say. But maybe it’s no madder than it’s ever been. Why would people pay so much for items which don’t exist in physical form? Potential profits, ego, excitement – is it all that different than a bet on a football game, the purchase of a vacation, or buying the bar a round of drinks?

I think the skepticism about the NFT craze makes all the sense in the world… but it is a bit unwarranted. People have been acting this way, still act this way, and will continue to act this way forever.

The art world, for example, where the insane prices are being paid for a piece of digital artwork, has always been a bit crazy. Yes, it’s “world gone mad” that people are paying millions of dollars for some NFT. But is it truly sane that people are paying millions of dollars for a painting?

Bored apes going for thousands and hundreds of thousands seems crazy… but those are collectibles. Collectors as a rule are crazy people. Someone on Ebay paid $511,100 for a Magic the Gathering playing card in 2021. You simply can’t apply rational financial thinking to collectors. Some fan paid $115,000 for a jar of Elvis Presley’s hair. Compared to those things, a collectible NFT that you can use to show off your wealth on social media doesn’t seem as crazy.

As to the Metaverse and virtual properties… Sam is exactly right that we’ve all been semi-living in the Metaverse already. We just didn’t call it that:

You have connections on Facebook and you share friendships and emotions with them. This is just one component of the metaverse, and it’s not new. What is new are the deeper and more immersive versions of metaverses that we’re seeing today.

These digital experiences are different from your fully physical experiences, but they’re still undeniably real. Whether it’s a full 3D virtual reality experience or a video call on FaceTime, you’ve been experiencing levels of what people are now calling the metaverse for a long time.

As I’ve said many times privately the last few months (ok … almost two years now), since COVID started, we’ve all been inundated with Zoom. That’s basically the Metaverse.

Title Transfers via NFT

Sam is also pretty sanguine about the biggest focus of attention in real estate today: title transfers via NFT on the blockchain. He writes:

But trading tokens that govern the ownership of real property is serious business. The environment is currently the Wild West, and the government will make its way into the conversation at some point. Remember that in most areas, property title transfer taxes on real estate sales are major funding sources for government projects. But there’s no government transfer tax guaranteed on an NFT sale. Uncle Sam’s going to come for his cut when he’s out of money to build roads.

But for now, there’s a lot of blue ocean in the viewfinder. New digital means to move property are, without question, preferable to today’s paper-and-stamp practices that still exist in many parts of the U.S.

I think he’s 100% correct… except for the Uncle Sam coming for his cut. There being no federal transfer tax (yet), I imagine it will be towns and states that come looking first.

Except that taking a government transfer tax implies government endorsement of on-chain title transfers via NFT… which essentially legitimizes such title transfers… which is revolutionary. It would instantly make all of those county clerk’s offices irrelevant.

My own opinion is that towns and states will think long and hard about how they want to handle title on-chain, so as to preserve as much power that they have today and to keep as many civil service jobs as possible.

As of today, the way that blockchain entrepreneurs are structuring on-chain title via NFT is smart and compliant with all existing laws and regulations. So I think the blue ocean will continue for a good while yet, until we have some local government movement on this issue.

Cryptocurrency

Where I think Sam could spend a bit more time on is on what’s happening with cryptocurrencies. He’s 90% of the way there, but that last 10% or so is important. He writes:

Cryptocurrency uses cryptography technology to create potentially valuable digital coins. They’re valuable today because people have created demand for them and will use “real” government-backed fiat currencies to buy them.

And he points out that governments haven’t really acted on crypto yet, which is surely coming, and:

The only people I personally know who spend cryptocurrencies regularly today are using them to purchase other crypto assets or evade government detection – no joke. They’re sending money back to their family in foreign countries and don’t want the government to take a slice.

That last 10% or so that Sam should investigate further are two things.

First, what makes government-backed fiat currency “real”?

Second, how large a group are people who don’t want the government to take a slice, or know what they’re doing with their own money?

People like Saifedean Ammous and Robert Breedlove have and continue to hammer fiat currencies and government overreach. I’ll leave it to you to go hear what they have to say.

But the philosophy behind crypto (particularly Bitcoin) is that there is nothing “real” about government-backed fiat whatsoever, and that most of us really don’t want the government to know what we’re doing with our money, and most of us don’t like the government taking its slice. Those have nothing to do with technology, and everything to do with human nature.

Blockchain technology merely makes it possible for human nature to do something about it.

Big Picture: Decentralization, Government, Speculation

On the whole, Sam strikes the appropriate balance between wary skepticism and just-maybe that this entire space deserves. There are a lot of hucksters and scam artists, and there are also a lot of innovators and entrepreneurs.

Comparing virtual land in Sandbox with physical land in the real world is silly. Thinking that real estate agents will play the same role in Decentraland as they do in San Jose is a mistake. I wrote about that last year.

All crypto and virtual property investments are, at this stage, speculation. No one should be staking their retirement savings on Ethereum or Solana, no matter how much you believe. At the same time… you know what else is pure speculation? Building spec houses. Developing residential housing developments. Buying farmland in Iowa. Going long on Tesla.

We in the real estate industry like to think that real estate investment is not speculation. It’s the safest and best investment possible. But let’s not forget that 2008 happened. A lot of people, including many I know personally, lost everything when the real estate bubble popped.

Everything is speculation, to some degree. It’s just a question of risk vs. reward, of timing, of price, and of course, of luck.

What Does It All Mean?

Let’s return to the title of Sam’s piece, as well as the title of this one: what does all this mean in a simple and pragmatic sense to the day to day real estate broker or agent on the street? What does all this mean for the MLS executive, for the Association leader?

As I wrote in my piece talking about Ryan Serhant’s predictions, I think in the short-term, all of this means nothing to the average real estate agent, broker, or MLS executive:

Point is that crypto is not likely to have an impact on most real estate agents and most real estate transactions. Not anytime soon. There just aren’t enough crypto millionaires who want to buy $400K starter homes in Des Moines to make a difference. Sure, you’ll have the one-off odd transaction where some crypto bro wants to buy a condo with XRP or something, but just about every single one of those transactions can be done by selling XRP for USD (or getting a crypto loan for USD).

Blockchain technology is indeed extraordinarily promising, and eventually it will deliver what Serhant says: faster, cheaper, more secure transactions. But no one in real estate tech is today implementing anything truly blockchain at wide scale. The projects that already exist cater to that tiny niche market that might not be super tiny in NYC and Miami… but kind of is everywhere else.

The Metaverse will be significant. One day. I’m a big proponent of it as the future. But very soon?

I don’t see that. One day. Some day. Sooner than you think, probably. But it’s unlikely to be very soon.

But over a longer horizon, blockchain, NFT, web3, the Metaverse… these things will mean everything. Because the important thing is not the technology, but human nature.

Human nature wants faster, cheaper, easier. Human nature resents the government taking its slice. Human nature doesn’t want the commissars knowing what you ate for breakfast, or what car you want to buy. Human nature doesn’t love being told what to do, when to do it, and how to do it by the so-called authorities.

Those of us whose job is to tell other people what to do, when to do it, and how to do it probably should pay much closer attention to these things than those whose job is to actually do it. Those of us in strategic leadership positions probably should pay close attention to what these technologies enable, so we can adapt to the inevitable changes.

The important questions to ask are: “What does this technology enable me to do, that I want to do?” and “What does this technology enable other people to do, that I don’t want them to do?” The real meaning of the technology will come out in the competition between those two questions.

-rsh

Michael Jackson – Human Nature (Official Music Video)

“Human Nature” is an R&B song by American recording artist Michael Jackson. It was written by Steve Porcaro and John Bettis, and produced by Quincy Jones for the singer’s sixth solo album, Thriller (1982). Initially, Porcaro had recorded a rough demo of the song on a cassette, which was then given to Jones.

What an amazing blog! This is exactly what I needed to get all my doubts cleared about the latest updates of crypto, NFTs, and whatnot that is on the trending list. A must read definitely. Thank you for writing this Rob