As I’m sure you all know by now, headline inflation rate for March came in at 8.5% resulting in predictable corporate media coverage. CNBC gives us a pretty representative take, making sure to interview only experts who want to downplay the significance and talk up how “core” inflation might have peaked.

Me, I just saw this and wondered WTAF:

Shelter costs, which make up about one-third of the CPI weighting, increased another 0.5% on the month, making the 12-month gain a blistering 5%, the highest since May 1991.

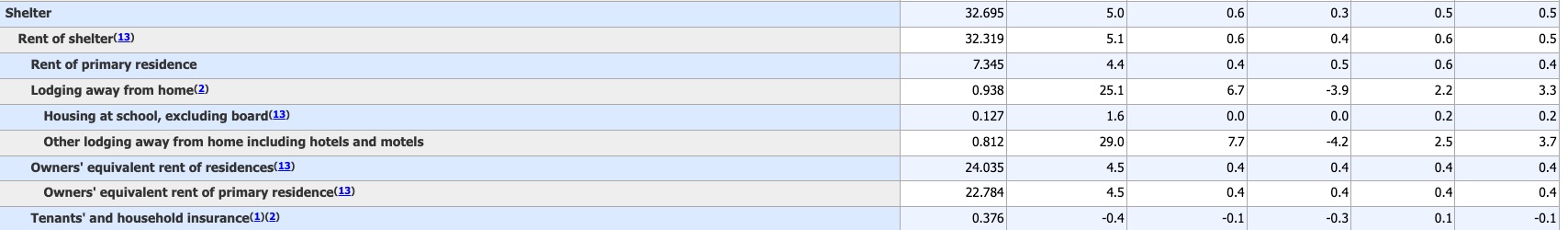

Shelter costs up 0.5%? In the detailed table, we find this:

I couldn’t copy the headings, but the second column is the March of 2022 vs March of 2021, unadjusted. And this CPI report is based on the “data” that rent went up 4.4% YOY in March of 2022. I don’t know if they were using data from Kazakhstan, Senegal or perhaps war-torn Ukraine to come to this conclusion, but if they were using data from the United States… there’s no way this is even remotely close to reality.

Athens CEO cites a report showing YOY rent increases of 19.4% from March of 2021.

Multihousing News says nationally, rent is up 14.8% YOY. In the top five cities — Miami, Orlando, Tampa, Las Vegas and Phoenix — rents are up well over 20% YOY.

So wherever this market is that showed a 4.4% increase in rent of primary residence, it isn’t in the United States.

And we don’t have to go too much into detail about this bullshit “Owners’ equivalent rent of residence” thing… since we already know that home sales prices are up double digit percentages. Realtor.com says 13.5%. Here in Las Vegas, try 26.7% YOY. But okay, “owners’ equivalent rent” is up 4.5% unadjusted.

Who needs the metaverse for fake housing prices, when the shelter component of the CPI exists!

Ergo, given the importance of the “Shelter” component to how the CPI is constructed… I’ll go out on a limb and suggest that the 8.5% CPI print is likely too low by quite a bit.

-rsh