My last post on Opendoor resulted in more than a few emails and messages, and I’d like to thank those who emailed and messaged. I wish more of you would just comment on the posts, but seeing the domains from which your emails come from, I completely understand why you emailed me directly.

One of the most interesting counterpoints is that I don’t take the bear case against Opendoor seriously enough. I read that as my not taking the bear case against market maker iBuyers seriously enough, since I don’t know that Opendoor the company won’t fuck things up. (I’m long OPEN only because it was the one pure market maker play until OPAD went public recently. By then, I was already long OPEN, so I didn’t feel the need to load up on OPAD as well. My bet is a show of conviction in the market maker iBuyer business model.)

If I understand the arguments well enough, they all go something like this:

- Opendoor has never been tested in a down market where housing prices are declining, never mind rapidly collapsing.

- Housing prices are about to go off a cliff, because mortgage rates make homes less affordable, thereby driving demand down.

- Lenders won’t be lending to Opendoor on favorable terms when the collateral (i.e., the houses they’re buying) is decreasing in value; Opendoor will have to use more of its cash or equity, and it doesn’t have anywhere near enough.

- Opendoor has very thin margins, so when the money dries up, it’s doomed.

I think it’s worth really taking these objections seriously. I’m going to try something here, which I learned in law school. I’m going to pretend that I’m a judge ruling on a motion to dismiss against Opendoor. That means accepting all allegations as true, and giving benefit of the doubt to the one moving to dismiss, then seeing how things shake out.

Untested Model in a Down Market

It is true that Opendoor has not been tested in a real down market, as we had in 2008-2011. So it’s entirely possible that Opendoor will completely implode when home prices stop going up 15% YOY, as it did in 1Q2022, and start going down 15% YOY.

My question, I suppose, is… who would you point to as a company that has a model tested in a down market?

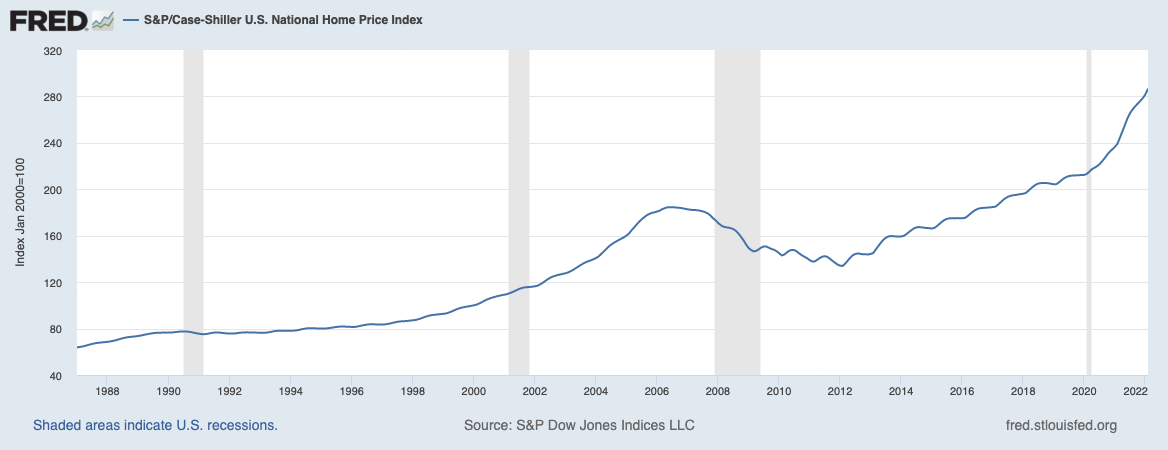

Here’s the Case-Shiller Home Price Index from 1988 through most recent 2022 data from FRED:

The only period we can charitably call a “down market” is from 2006 to 2012. During that period, roughly from the peak in July of 2006 to the trough in February of 2012, the HPI went from 185 to 134, which comes out to a 27.5% decline over a slightly more than 5-1/2 years.

Those who are knocking Opendoor and the iBuyer model need to point to someone as a company that has been tested in a down market. So who are we using?

Of the companies in real estate that are currently publicly traded, here are the ones who were around in 2006:

- Realogy

- RE/MAX

- Zillow

- Redfin

Who are we selecting as the Champion of the Down Market? Who do Opendoor bears think will see revenues, profits, and cash flows improve when the market goes south?

It can’t be Realogy, Zillow or Redfin, whose revenues are closely tied to real estate commissions, which are tied to both home prices and transaction counts. A down market means bad news for these three guys. RE/MAX boasts the most stable fee-based revenue model, but some of its revenues do come from real estate commissions, and more importantly, in a true down market (as we had from 2006 to 2012), the number of real estate agents drop off the cliff as well. Don’t kid yourself into thinking RE/MAX was raking it in during those years.

I was working at Realogy from about 2004 to 2008. Brokers weren’t making money during that period. There were layoffs galore across real estate. There was real widespread fear and barely contained panic. A lot of companies simply went out of business, and others got gobbled up. Sure, Realogy survived that period, but if by “tested in a down market” you mean, barely survived after battening down the hatches… well… I guess? Seems to me Opendoor has just as good a chance of barely surviving by the skin of their teeth as anybody else.

So yes, if the point is that iBuying is not tested in a down market, that’s true. If the point is that traditional brokerages thrived during down markets, I got news for you: they most certainly did not. SaaS model tech companies did not thrive during down markets. No one thrived during down markets, except maybe payday lenders and divorce attorneys.

Now, investors generally might/could/will rotate out of real estate sector altogether and put their money into companies with “proven” performance in a down market. That’s a whole different question and one that they need to be talking to their financial advisors about. But I just look at fundamentals of real estate companies, and I think Opendoor has just as good a chance of barely eking out survival.

Housing Prices Are Going to Collapse

Probably the most compelling argument is that home prices, which many consider to be bubblicious already, will collapse now that the Fed has started to raise rates and tighten. We’re already seeing signs of slowdown, and falling buyer demand.

The argument goes, Opendoor bought thousands of homes at the top of the market; when they have to sell into a falling market, they’re going to get murdered. They’ll lose tens of millions of dollars and go belly up.

As some of you know, I’m a contrarian who thinks home prices will not go down anytime soon because home prices haven’t gone up at all. Rather, I think the dollar has been devalued through money printing, so it’s a very different economic problem we’re facing. But nonetheless, whatever the true cause, fact is that fewer and fewer people will be able to afford the down payment or qualify for a mortgage as rates keep rising.

The Fed has raised rates by 75 bps so far, and is poised to raise more. Mortgage rates are north of 5% so far, and we might see 8% rates before year end. That means buyer demand will fall off a cliff, and Opendoor will be sitting there holding thousands of houses and losing their ass. (I do need to point out, however, that 5% mortgage rates in a 8.5% CPI environment means the bank is still paying me to borrow money… but that’s a whole different discussion.)

For the sake of this discussion, I’m going to accept that home prices will fall due to falling demand.

Question 1: How Much Will Prices Fall?

The first question to ask then is just how much home prices will fall. The easy answer is, nobody knows. But we can look at some historical data to get some ideas, right?

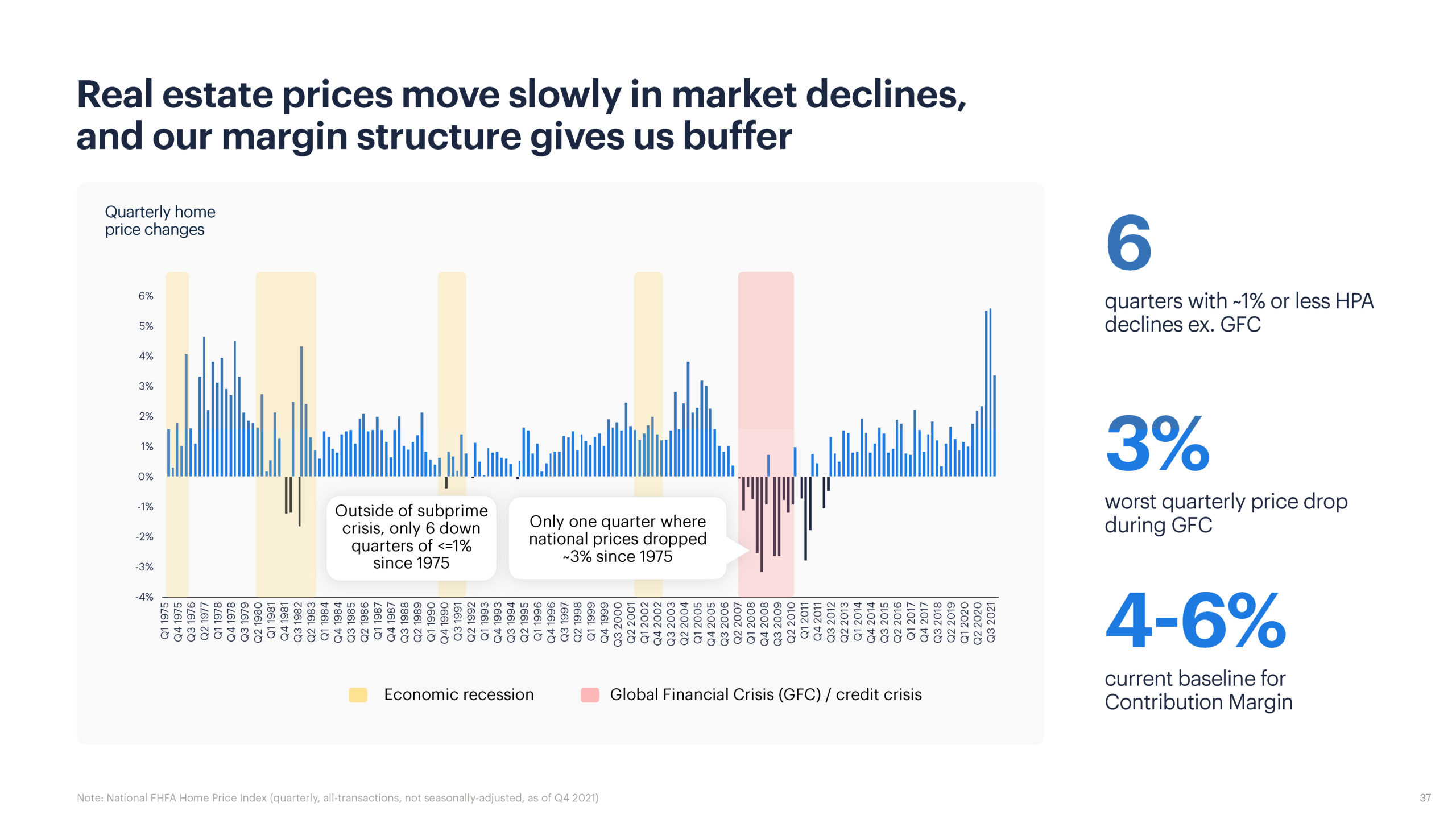

Opendoor itself published an investor deck, and addressed this concern:

The Case-Shiller chart I posted above shows a 27.5% decline, but that was over 5-1/2 years. Best I can find is that in March of 2007, national median price fell 6% from the peak in July of 2006. So absent other data, I’m going to go with Opendoor’s numbers, that the worst quarterly drop in home prices was 3%. Maybe that’s too low, but it also doesn’t look like the worst quarterly drop was like 30% either.

Now, real estate being local, some markets will suffer more. I found this story from May of 2008 claiming that California and Nevada showed an 8% drop in home prices. No doubt Las Vegas was hit hard during the Bubble.

So let’s terrify Opendoor bulls like me and say that home prices will drop by 10% in one month. We’ve never seen anything like that before, but who knows? There’s always a first time.

Question 2: Won’t Opendoor Do Something in Response?

As of its 1Q22 report, Opendoor had $4.7 billion in inventory on its balance sheet. Let’s say they lose 10% of that in a single month. Again, that’s never happened before, but we’re doing a worst-case horror story.

That’s a $470 million loss. At that rate, Opendoor can keep going for about five months, with its $2.3 billion in cash in the bank, assuming they can’t offset that $470 million loss in any way shape or form. So it’s a straight burn rate.

Carrie Wheeler and Eric Wu aren’t stupid people and will make adjustments. Say they dump their entire $4.7 billion in inventory in that one horrible month and lose $470 million. They have some $1.8 billion in cash left. When they go to buy houses in that horrible month, they’re buying for 10% cheaper since Opendoor isn’t the only seller to have to panic sell and take the 10% hit.

The reality is that Opendoor is constantly feeding data into its pricing engine, and adjusting for things like “how fast prices are falling” and making projections. So if they think that June was horrible, and the data is showing no slowdowns in plummeting prices, and they know that they have to hold on to these houses for longer now because buyer demand has evaporated… is it not eminently logical to think they’ll bid 30% below list price, knowing they have to weather the 10% per month drop in prices for three months?

As I wrote in my longer Opendoor analysis, Wheeler makes it perfectly clear that they know how to adjust offers downward in response to market conditions. Eric Wu straight up says they’ve been dropping their offers in recent months, with zero impact on conversion rates — i.e., homeowners willing to sell at that lower offer price. Why do the bears think they’ll completely forget to do this, if home prices plummet?

The counter to this is something like, “If Opendoor raises its seller fees, or offers less money, then that makes selling to Opendoor less attractive to homeowners, so they’ll be able to buy fewer homes at below market prices.” The idea here seems to be that if Opendoor is offering 30% below list, then more sellers will just list with an agent and opt for the traditional process.

What I wonder about is… if home prices plummeted by 10%, and the data is telling Opendoor to bid 30% below list… are other buyers somehow stupid or ignorant or just… more hopeful? Are they not advised well so that they would overpay and then suffer when the housing market keeps going down? I’m just trying to understand where this buyer demand is coming from that would pay more for a house than Opendoor would.

The one very good counterpoint here is that it will take time for seller mindsets to adjust to the new reality. @Zelretch42 on Twitter made this point today, and it’s a good one. I’ll address this below.

Question #3: All these No-Longer Buyers Are Living Where?

Finally, let us accept as fact that when mortgage rates spike even higher, fewer and fewer families will be able to afford to buy a home. This is entirely true. Buyer demand collapses, bringing on the collapse in home prices.

What no bear seems to be able to answer is just where these people will lay their heads. They can’t buy a house; we’ve established that. Whatever the ultimate cause of not being able to buy, they’re no longer able to buy. Cool. Are they all becoming homeless? Living in a van down by the river? Don’t they all have to live somewhere?

Since the answer to that question is obviously a Yes, they have to live somewhere, then the clear corollary is that those people have to rent from someone else who does own a house. Unless I’m missing something, dramatic declines in buyer demand should mean a dramatic rise in renter demand, which leads to a dramatic rise in rental yield for those who own these properties. Which makes those properties more attractive to people who have money and would like to see their money have little baby monies.

We all know that enormous fortunes were made during the Great Financial Crisis years of 2006 to 2012. If home prices fall off a cliff, even greater fortunes would be made by people who already have money to invest in real estate, no?

Is the thinking of Opendoor bears that these investor types just hate convenience, touring homes with an app, and speed of closing by buying properties from a seller that has zero emotional ties to the house and would much rather have to deal with thousands upon thousands of real estate agents who have to beg/plead/cajole their seller clients into accepting the “lowball offer” because next month, it’s going to be even worse? Because that was exactly what happened in real estate during the 2006-2012 period, until sellers started getting more realistic about shit.

Loans Will Dry Up

Another point that bears will raise is that when home prices start to slide, lenders will stop making debt financing available to Opendoor, at least on such sweetheart terms as it enjoys today.

Again, despite Carrie Wheeler addressing this issue in the 1Q22 earnings call, let’s grant the bears their premise. Banks and big capital pools won’t be lending to Opendoor at 3% on sweetheart 80/20 LTV type terms. Cool.

One question I have there is, if these banks and investment funds aren’t lending to Opendoor… what are they doing with their money?

Headline CPI is 8.5%, which means that holding cash means losing 8.5% annually.

Real bond yields are negative across the board, even with the Fed raising rates. The 2-year Treasury is at 2.6% as of this writing; congratulations, big hedge fund, since you’re only losing 6% a year on your money. The 10-year Treasury is at a whopping 3%.

Equities? Have you seen what these higher rates are doing to the S&P 500, the DJIA, NASDAQ, Russell 2000, etc. etc.?

Opendoor wants money to buy and sell houses, not NFTs. These loans are secured against physical real estate, against housing, which we have already established is a fundamental need. People can’t live in a van down by the river (except in those vans that cost as much as a house). Possibly the only thing better than loaning money to Opendoor on a secured basis is to buy the properties themselves, invest in REITS that will buy the properties, buy Bitcoin (if you’re Michael Saylor), or buy commodities like oil and wheat.

I think it’s eminently reasonable to think financing for Opendoor will get more costly. But then we have Carrier Wheeler in the earnings call saying, “And perhaps more importantly, it’s important to understand that we pass on the full cost of interest to the customer via our spreads, our objective is we’re going to manage to contribution margin after interest to be neutral.”

So I think that even if we grant the bears their due on financing, it won’t disappear for Opendoor. It will just get more expensive, and maybe require more equity (“down payment”), but Opendoor would just pass that on to the seller. That seller will be far more desperate to sell since the market is tanking, which leads to question #2 above.

Opendoor Has Thin Margins

This is another case of, “You’re right!” followed by, “So?”

Opendoor’s gross margins in 1Q22 was 10.4%. That’s not earth shattering tech company margins, to be sure, but what are we comparing that to? Traditional real estate brokerages, who shit on Opendoor on the daily, average 15% Company Dollar and 3% Net Income margins. EXPI, which has been a darling thanks to skyrocketing growth, just posted 8.3% gross margins in 1Q22.

And more importantly, the fact that margins exist means the company is making money. I guess this matters a great deal to investors who could allocate their capital elsewhere, so I have no real opinion on that. Bear away if fat margins are your thing.

In my case, as my bullish outlook on iBuying has almost nothing to do with fat margins and everything to do with fundamental transformation of the broken transaction process, I’ll just go with “So?”

One Last Data Point to Consider

Before I leave this topic for the next round of debates, something to consider, again from history.

According to this Stanford study, in the 1970s, we saw a 25% drop in household wealth combined with a “20% portfolio shift out of equity into real estate.” And it turns out that there was a bit of a boom in housing prices in the bad old 70s. This article from 1981 talks about the “great Los Angeles housing boom” being over, but cites some data for us:

In the 10 years from 1970 to 1980, the price of the average house in Beverly Hills went up by a factor of almost seven. The average house in West Los Angeles, a region of by no means opulent homes, rose by almost six times. Houses in Malibu routinely doubled in value every year in the late 70’s. By the end of the decade, newspapers advertisted ”starter houses,” for families who had never owned before, in remote desert suburbs starting at $200,000.

What caused this boom in home prices during the stagflationary 70s?

The economics of housing inflation were such that for a long period, lenders made mortgage loans at rates substantially below the appreciation of the houses they were loaned upon and in some years, noticeably below even the trend line for inflation.

That sounds incredibly familiar in 2022.

I also found this author, Edward Thomas, who did some projections on home prices based on 1970s inflation, and he came up with something rather interesting: average annual inflation from 1973 to 1982 was 9% and the average annual home price appreciation was also 9%. Strange coincidence? Or is it evidence that home prices do not go up; the dollar simply gets devalued via inflation?

Nonetheless, here’s his conclusion, writing in 2016:

What would that inflation rate do to current US home prices, projected over the next 10 years? I took the most recent annual Median US Home Price from the FRED website (for 2016), and then estimated what the annual Median US price would be for 2017 by projecting the average percentage increase over the last seven years (5%) and projected that price for the current year. I then used the ‘70s inflation rate of 9% per year over the next nine years (2018-2026). The result? Home prices would more than double from 2017 to 2026, going from an average of $326K to over $700K. Depending on home prices in your area, the effect would be approximately the same – prices would be a factor of two larger in 10 years.

Seeing as how the 2020s are turning into a bit of a replay of the 1970s — runaway inflation, high energy prices, foreign war, stagnant economy, mortgage rates substantially below house price appreciation and even below inflation — I do wonder what will actually happen to real estate prices in the next few years. History suggests that until we get a new Volcker at the Fed, and a President willing to let said new Volcker raise rates to 18% a year or more and engineer a recession the likes which we have never seen, home prices aren’t collapsing anytime soon.

Of course, your mileage may vary. Let’s see what time and evidence brings in the months and years ahead.

On the Seller Mindset

As I said above, the point about seller mentality taking longer to adjust to the new market is a very, very good one. Lord knows, those of us who lived through 2007-2012 remember unrealistic sellers who think their special cupcake of a house is immune from the market.

I think things might be different this time — I know, I know, famous last words. But hear me out.

First, the last housing collapse featured all kinds of homeowners who were simply gambling, using not just free money but irresponsibly free money from banks to do so. Remember stated-income loans? NINJA loans? All those “wealth building seminars” that were sucking people in? The stripper scene from The Big Short is real, because I had that experience of sitting next to a gal on a flight to Vegas. She was a stripper from Los Angeles, who owned 25 rental properties in Las Vegas.

This is not a thing today. Dodd-Frank, CFPB, mortgage regulations, banking regulations… if anything, lending standards are too tight, not too loose.

Homeowners today are generally speaking not overlevered on 25 rental properties and HAVE to sell as soon as the market turns. They have enormous equity and if they have mortgages in the 3-4% range, they are literally being paid by the bank in a 8.5% CPI environment.

As a result, the only people selling in this environment, I believe (as I have no data to back this up, but I do talk to brokers and agents), are those who NEED to sell for some reason (death, medical expenses, new job, etc.), or those taking advantage of geographic arbitrage (i.e., sell in California, buy in Nevada), or those taking profits to invest in even more real estate.

That last group might take their time, but the first two? If you NEED to sell, then you NEED to sell. If Opendoor makes an offer, and they sit around for a couple of weeks to see what else they might get, and the buyers are not coming out of the woodworks (because buyer demand is trashed, see above)… they’re not taking months to decide. There’s as good a chance that they’ll opt for the speed and certainty of Opendoor, especially in a shitty economic situation, since buyers might go under contract and then the mortgage falls apart… and that happens more and more as the economy gets crappier and crappier.

This is what Eric Wu meant when he talked about how the value proposition of Opendoor grows in down markets.

If you’re doing geographic arbitrage, you’re looking at selling for $1m and buying at $500K. Do you really care about $10-20K on the sale price, especially if you can purchase for $10-20K less on the other side? Double especially if you can sell to Opendoor and buy from Opendoor on the other end?

This is why Opendoor launched Opendoor Complete. It’s about making the process easier, and folks with equity in their homes are more than willing to pay for that.

Second, if the past is any guidance, more and more listing agents will be leaning hard into their seller clients to sell to investors… including Opendoor when buyer demand dries up. Why? Because listing agents don’t get paid until there’s a closing, and a bird in hand is worth two in the bush. Very few agents will keep entertaining their seller client’s delusions about the market when their paychecks depend on the seller accepting an offer, any offer.

It’ll take time for the mindset to adjust, but I don’t know if it’ll take as long as some bears think it will.

The Bear Case, Summarized and Answered

As far as I can make out, the bear case against Opendoor comes down to expecting the housing market to collapse, which leads to Opendoor losing a shit ton of money, spending more on financing costs, compressing its thin margins even further, and… stock price gets hammered some more I guess.

I guess. I find it slightly amusing that OPEN’s market cap as of this writing is $3.74 billion when it has $2.3 billion in cash. I suppose the Street won’t stop until the market cap equals cash in the bank, thereby valuing the enterprise at zero? That seems illogical to me. But then, when has the market ever been logical, right?

Since the outcome of any downturn in housing is likely to be far short of 10% declines in prices in a month, and likely more in line with the historical record of perhaps a maximum of 3% declines in a quarter… I think Opendoor is going to be fine. There are risks, to be sure, and I’m not suggesting that Opendoor will sail through any real market disruptions without damage. I figure it will be damaged.

But its damage will be in line with everybody else in real estate. I think whatever damage Opendoor suffers will be significantly less than the damage that others like Zillow, Redfin, Realogy, EXPI, Compass etc. will suffer.

And that’s before we take something like the two-sided marketplace that Opendoor is building into account. I’ll have some more thoughts on that in the future.

I don’t know that I’m right. I’ve just tried to present the best bear case against Opendoor as I could. Since I’m not a bear, I don’t know if I’ve presented a steelman version of the argument, or a strawman version. Perhaps in a future podcast, I’ll be able to discuss this with a real bear who can present the strongest case possible against Opendoor.

-rsh

Depeche Mode – Shake the Disease (Remastered)

Music video by Depeche Mode performing Shake The Disease (Single Version) (2006 Digital Remaster).

It’s not so much that Opendoor has not experienced a down market it is that Opendoor has not experienced a market with constricted credit and rising interest rates. As these credit lines come due there may be financing available but at what rate / terms? How much with the VIE’s take out of cash flow. Their margins may be better than traditional brokerage firms, however they are still low. Highly leveraged companies with low margins in rising interest rate environments make for interesting case studies. We shall see….

Agreed. I do want to point out that Carrier Wheeler addressed the rising rates thing, and thinks it’ll be net 30bps increase over what they have today. Maybe that goes higher, maybe it doesn’t. But that doesn’t strike me as the kind of doom that others are thinking it is.