And when he had opened the fourth seal, I heard the voice of the fourth beast say, Come and see.

And I looked, and behold a pale horse: and his name that sat on him was Death, and Hell followed with him. And power was given unto them over the fourth part of the earth, to kill with sword, and with hunger, and with death, and with the beasts of the earth.

Revelation 6:7-8 KJV

In part 1, we covered legal and regulatory issues coming down the pike for the industry. In part 2, we looked at money printing and why it must go on. Then in part 3, we examined the war on wages brought on by first, the devaluation of the dollar, and second, the Fed response which is driving the economy into recession. So we come at last to part 4, the fourth horseman of the apocalypse which the Bible verse names as Death.

It’s not quite so dramatic in our case as the Bible, but it might be, as the fourth horseman of the housing apocalypse is political turmoil.

On a Pale Horse: Political Turmoil

Ray Dalio, whose video I embedded in part 2, points out that every empire goes through a period of internal and external conflict. Let’s go ahead and watch that video again:

Principles for Dealing with the Changing World Order by Ray Dalio

I believe the world is changing in big ways that haven’t happened before in our lifetimes but have many times in history, so I knew I needed to study past changes to understand what is happening now and help me to anticipate what is likely to happen.

Dalio believes, based on his research, that growing gaps between the haves and the have-nots inevitably leads to internal conflict between the rich and the poor. He says this happens when there are large wealth, values and political gaps. That leads to political extremism on both the left and the right, which he terms populism.

Eventually, chaos comes to a head and there is either a revolution or civil war to force redistribution of wealth and systemic change.

Were we in the ancient days of say 1990 or 2000, Dalio would sound like a crackpot. We all would dismiss him and wonder what had happened. In 2022, does any of this sound like crackpot conspiracy theories to any of you? Do we really need to spend any time on wealth gaps, on value gaps, and political gaps in the United States circa 2022?

Our cultural institutions, our schools, our corporate press, and our dominant political parties do their very best to focus on the value gaps because holy shit, what if they didn’t? In the U.S., the dominant narratives of conflict are around race, gender, sexual identity, and every fractional interest instead of the wealth gap which is Dalio’s major theme. Even the socialists talking about the wealth gap in America somehow have to make it about race and ethnicity and sexuality and whatever. It’s Black Lives Matter vs. Blue Lives Matter without once acknowledging that there are Blue Lives who are Black Lives and that cops also depend on a paycheck and cops can’t afford to buy a house either. Economic realities don’t care about your race or sex or gender or whatever ideology you hold sacred. Gas still costs what it costs. Laid off is laid off.

The major fear amongst our rulers is not Black vs. White or Straight vs. Gay or even Socialists vs. Conservatives. It’s the Non-Elites vs. the Elites. Yet, that is the coming conflict, as it has been for six hundred years. Dalio’s work provides the evidence.

Dalio notes that this revolution can be peaceful, but it is most often violent. FDR’s New Deal, he cites as an example of a peaceful revolution. Most other revolutions involve a great deal more shooting, burning, bloodshed, and chopping off of heads.

We’re not quite there yet. But we’re not that far off either and housing is a big part of that story.

Necessary Goods and Revolutions

I have a theory. Nay, let’s call it a hypothesis, which is just a fancy word for a guess. I think that revolutionary sentiments do not emerge simply from a wealth gap or a value gap or even a political gap. I think they emerge when the 90% non-elites find that they can no longer acquire basic essentials for life.

I do not believe anyone will take to the streets because they can’t afford Gucci purses even though the Elites can. They won’t start looting and burning because they can’t buy the latest iPhone even if the Elites can. Not even what some people in society say are necessary goods, such as a free college education, will get the head-chopping and the store burnings going. I think it takes the inability to acquire fundamental goods to do that. The list of fundamental goods is a pretty short one:

- Food

- Healthcare

- Energy

- Housing

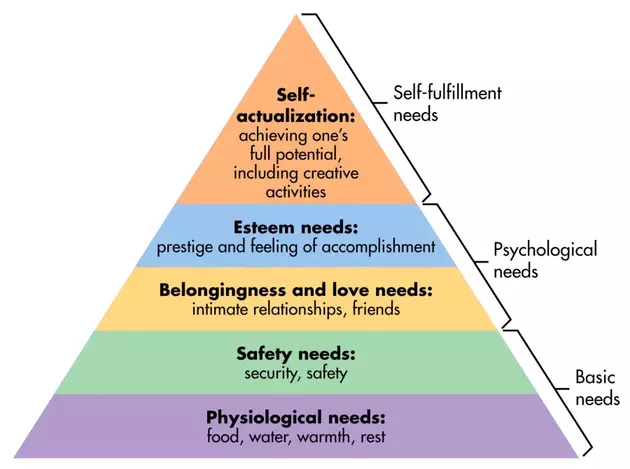

You can add “Jobs” to the list, because usually, that’s what you need to have the ability to acquire any of these four basic essentials for life.  Those four things correspond to the lowest level of Maslow’s hierarchy of needs.

Those four things correspond to the lowest level of Maslow’s hierarchy of needs.

Not even the “art is my life” Zoomer is going to go start throwing Molotov cocktails because he can’t achieve his full creative potential.

Prestige, honor, love and friendship will make people do a lot of stupid things. But they don’t make them go out looting.

Security and safety are critical, of course, but folks live in extreme dangerous cities today without forming revolutionary brigades.

What does start revolutions is when people can’t get food. People facing starvation have historically gone hard for food riots, which lead to revolutions. When people get sick and can’t get healthcare, they tend not to give a shit about quaint concepts like “democracy” and “civility.” When they can’t get energy, whether that’s wood to burn to keep warm or gasoline for their cars or electricity that powers modern life, people don’t give a damn about what’s trending on social media.

And housing is a fundamental good that everyone needs. I don’t mean the ability to buy a house, but the ability to have a roof over your head and four walls to keep the wind and the rain out are kind of important to most people.

Let us, then, consider the parts 2 and 3 in light of this idea of lack of basic necessities leading to revolutionary conditions.

Financialization, Inflation, and the War on Wages

The financialization of the economy takes on a different significance once you start to think about fundamental goods.

Our economic system is based on fiat money created out of thin air by the Federal Reserve. We have or are close to reaching the point where the Fed has no choice but to keep printing money to keep the national government going.

Trump, with a Democrat House and a Republican Senate, decided to print trillions of dollars in 2020 in response to COVID. The decision was bipartisan, and the blame will also be bipartisan. But the Fed went along with the shenanigans by buying up all of the Treasury bonds necessary to suddenly have a couple trillion dollars to give out as fiscal stimulus.

Well, that created historical inflation, which drove up the cost of everything real: food, healthcare, energy, and housing. The May 2022 print of 8.6% was a shock to the financial system, to say the least.

In response, the Fed is trying to curb inflation via monetary policy — raising rates and quantitative tightening. That in turn brings on a recession. Lord knows that trying to curb inflation via fiscal policy — cutting government spending and deregulating businesses — is verboten in the modern political context, so it has to be done via the Fed.

Said recession is not a bug but a feature of Keynesian economics since the whole point of making money more expensive is to reduce aggregate demand, which lowers prices. How do you reduce aggregate demand? Put companies out of business, create joblessness via layoffs, and create economic uncertainty, so people spend less.

So the recession suppresses wages further, increases unemployment, and generally makes life harder for those depending on a paycheck to survive. Again, this is not a bug. This is not an unintended consequence. This is very much a feature of fighting inflation once you think it’s not about money printing, but about aggregate demand and supply chain disruptions.

So, who might these people who depend on a paycheck to survive be?

The answer: vast majority of American workers. Even some of us in the laptop class will be affected, but those who are blue collar, who are working class, who are unskilled labor? They’re fucked.

There is a dimension to the impact of recessions and layoffs that needs to be explored further: they hit younger people especially hard.

Generational Conflict

A war on wages brought on by stagflation (high inflation plus recession) is not likely to devastate 50 year olds with decades of work experience, deep networks, and real assets. Sure, we’ll get hurt a bit, our stock portfolios will crater, and our incomes will suffer. But the impact of the recession will fall heaviest on younger workers who don’t have much work experience and are easier to replace.

There have been studies showing that young people graduating into a recession have serious economic problems, even years later. Read this abstract, but here’s the money graf:

The Great Recession had an impact on the careers of recent graduates that was larger than what would have been expected given the trends observed in earlier periods, even after taking into account the greater severity of the Great Recession. Young people fared particularly poorly between mid-2007 and late 2009. In studies that we conducted separately we find consistent evidence that the impact of the Great Recession on new graduates was significantly larger in earnings and employment rates than previous recessions would have predicted. [Emphasis added]

Well, judging by the latest economic data, the kids graduating college in 2022 are heading into a frozen wasteland, economy-wise. What they’re facing will be worse than what the Millennials faced in the Great Recession, because the Great Recession didn’t happen with the national debt over $30 trillion, Fed options completely limited, and sky-high inflation. (Not to mention you know, war, pandemic, slowing global trade, depopulation, and civil strife the likes of which we have never seen.)

Imagine now that you’re a 22 year old freshly graduated from college, with your degree in marketing or liberal arts. (For the record, the top three majors today are 1. Business, Management, Marketing and Related Support, 2. Health Professions and Related Clinical Sciences, and 3. Liberal Arts and Sciences, General Studies and Humanities). You can’t find a job, and even if you could find a job, you’re getting offered $40K a year as an entry level marketing admin… because there are a dozen people with 3-5 years of experience who got laid off at some tech company who would do that job for $45K a year.

Meanwhile, everything is far more expensive than you had ever imagined. Food is expensive, cars are unaffordable, rent it out of control, health insurance is unimaginable, and of course, buying a house is the American Dream… because it’s just that: a dream.

Why in the world would you support the economic system you find yourself in?

#GenerationScrewed

I’ve been writing about #GenerationScrewed now for over ten years. The first post I could find is this one from 2010:

Lower your sights, young man. That New Urbanism looks fantastic, and it’s the lifestyle you really want, but sadly, all you can afford is a $200,000 fixer-upper somewhere in the shadows of Giant Stadium with a 45 minute commute to your not-so-grand job in some corporation you used to rail against as a college student as evil, greedy corrupter of the environment.

A dozen years later, we now know that the $200K crappy fixer-upper in the shadows of Giant Stadium is more like $500K. If that young man of 2010 had bought that crappy $200K condo, he’d be in a far better place today. But chances are, he didn’t and he’s still renting lo these many years later.

Over the years, I have tried my damnedest to sound the alarm about Millennials and their plight in the housing market. I’ve written a giant report showing that the real estate industry’s view of Millennials is skewed by the fact that real estate agents tend to interact only with the Elite Millennials who have money, are married, and often come from wealthy families.

In that report, I cited extensively from FML, a multimedia story/experience from Huffington Post. You should go check it out if you haven’t already. But here’s the section I quoted:

We’ve all heard the statistics. More millennials live with their parents than with roommates. We are delaying partner-marrying and house-buying and kid-having for longer than any previous generation. And, according to The Olds, our problems are all our fault: We got the wrong degree. We spend money we don’t have on things we don’t need. We still haven’t learned to code. We killed cereal and department stores and golf and napkins and lunch. Mention “millennial” to anyone over 40 and the word “entitlement” will come back at you within seconds, our own intergenerational game of Marco Polo.

This is what it feels like to be young now. Not only are we screwed, but we have to listen to lectures about our laziness and our participation trophies from the people who screwed us.

But generalizations about millennials, like those about any other arbitrarily defined group of 75 million people, fall apart under the slightest scrutiny. Contrary to the cliché, the vast majority of millennials did not go to college, do not work as baristas and cannot lean on their parents for help. Every stereotype of our generation applies only to the tiniest, richest, whitest sliver of young people. And the circumstances we live in are more dire than most people realize. [Emphasis added]

FML was written/created four years ago, you guys. This isn’t a new post-COVID phenomenon. But of course, the COVID panic and the lockdowns have made things far, far worse for everybody.

But I’m an old man now. I’m GenX and 50 and have a son about to enter college and I don’t even have a TikTok account. I don’t know shit about what it’s like to be young in 2022. So don’t listen to me.

Listen to them instead:

No Title

Fed officials and economists are warning that the ongoing housing bubble could burst soon as new evidence emerges. Research backing this warning shows that house prices are increasingly out of balance with market fundamentals. Ana Kasparian and Farron Cousins discuss on The Young Turks. Watch LIVE weekdays 6-8 pm ET.

In case you were not aware, The Young Turks is one of the top politics channels on YouTube with over 5.1 million subscribers. You can hate them, disagree with them, or think they’re fools… but you can’t say they’re not influential. You cannot dismiss them. They are enormously influential, especially on the Left, and their viewers and subscribers tend to be younger progressive types.

The Young Turks use the dysfunctional housing market to attack capitalism. And why not? If you were that 22 year old college graduate with no hope for the future, why support capitalism? Who gives a shit about the free market if the free market is just screwing them over?

Young Socialists of America

I think there’s a reason why Democratic Socialists of America is the fastest growing party among younger voters, growing by 1,400% from 2015 to 2021. There is good reason to believe that DSA and socialist activists have outsized influence within the Democratic Party (similar to the influence of the Christian Right in the Republican Party) as four congresscritters are formally affiliated with the DSA, along with dozens of local and state legislators. Here in Nevada, for example, the DSA took over the Nevada Democratic Party in 2021.

I think our broken housing market is a primary reason why so many Millennials and Gen-Z are embracing socialism. Again, don’t take it from me, an anarcho-capitalist GenXer old dude. Hear it directly from the horse’s mouth:

Why Are So Many Young People Becoming Socialists?

For decades the United States has been a bastion of free market ideology and extreme individualism, but in the last few years we’ve seen a major resurgence of socialist ideas. In this episode, we’ll take a look at why so many young people are attracted to socialism, and why, to many, capitalism is no longer seen as a viable path forward.

This YouTube channel has 1.26 million subscribers, and this video has been viewed over a quarter million times. I imagine that the other million subscribers didn’t bother to click on this video, because they are already socialist and don’t need to have socialism explained to them. The creator admits that he is a socialist, and is explaining both his view of what socialism is, and why he and so many of his peers (and younger) are socialists.

What I took away was his point that for Millennials and older GenZ, they don’t have a “good old days” that they look back at with fondness. There is no nostalgia for these generations. The first concrete memories they have are of disaster: 9/11 attacks, war in Afghanistan and Iraq, and critically, the Great Recession. Which was brought on by the housing bubble.

Watch from about 4:95 on. The narrator vividly remembers how stressed and unhappy his parents were trying to save their home. Millions lost their homes to foreclosures. Millions of families lost everything. Then, as he points out, the bankers and investment funds involved in the housing bubble got bailed out. Yeah, I think I too would consider socialism if that’s my formative experience with the capital markets and the financialization of the home.

You don’t have to agree with him, and you don’t have to like it. You can think he’s a loon, and that America will never be socialist. Fine, but don’t close your eyes to the fact that he is sincere in his beliefs, and there are over 1.25 million people who subscribe to his channel.

With the coming recession, I think DSA is about to see huge increases in membership. Why wouldn’t it? If you were the 22 year old college student above, what exactly would make you want to support the economic system you find yourself in? If capitalism is screwing you over, why wouldn’t you screw capitalism over? It doesn’t matter at all that some libertarian type tries to explain that what we have today in the modern West is not free market capitalism, but the kind of heavily-regulated, not-at-all-free-market corrupt crony capitalism whose purest expression was… oh my… Italian Fascism. Or perhaps the modern variant: Chinese state capitalism. Why would it?

Your wages are falling, inflation is out of control, recession means layoffs and unemployment, and the things you need to live like food, energy, healthcare and housing are all financialized, seemingly controlled by big banks and corporate interests. And now, all of those things are becoming unaffordable. Do you give one shit what kind of capitalism that is? No, you’ll give socialism a try.

Not Just Socialists

In 2008, a pseudonymous user on an online cryptography message board posted a 9-page white paper talking about a new kind of digital money called Bitcoin. And the world as we know it changed forever.

What is less well known is that the very first block minted in Bitcoin, in January of 2009, contained this message:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

The housing bubble, and more precisely, the government bailout of the banks involved in the housing bubble motivated the creation of Bitcoin. Too Big To Fail, crazy money printing and taxpayer bailouts of banks, while families were losing their homes and everything they owned, were why Satoshi Nakamoto wanted to create a money free from government control.

In 2021, when Coinbase went public, it paid tribute to Satoshi Nakamoto by including this message in its block:

NYTimes 10/Mar/21 House Gives Final Approval to Biden’s $1.9T Pandemic Relief Bill

No one knows who Satoshi Nakamoto is in reality, but you can’t argue that Bitcoin is some kind of a socialist enterprise. Bitcoin is possibly the least socialist thing ever invented, and it has become a pillar of libertarian and anarcho-capitalist movements in the U.S. and abroad. No one would argue that Coinbase is a socialist company, being at the center of the cryptocurrency economy.

In case you were under a rock, an enormous percentage of the crypto community of technology geeks, finance nerds, and investors in crypto skew heavily, and I mean heavily, towards small-L libertarian. They truly believe that Bitcoin will free society from the government by freeing money from government control. And most of them are young. You don’t find a lot of Boomers and even GenX in the cryptoverse. This is a world populated mostly by Millennials and GenZ.

Why?

Some young people have responded to the corruption of capitalism, most obviously seen in the housing market, by embracing socialism. Others have responded by gambling.

These younger people realize, perhaps only subconsciously, that they have no chance of ever achieving the American Dream by doing what they were told: work hard, stay in school, get a job, be a loyal employee, and you’ll be able to achieve that middle-class lifestyle that mom and dad had. Turns out, they were lied to for their entire lives.

Their answer was to go gambling, whether on meme stocks like AMC and GameStop, or on crypto. Quite a few of them, whom I got to know in my personal exploration of blockchain and crypto, eschewed the “blue chip” assets like Bitcoin and Ethereum because the triple digit annual returns were not attractive enough. They wanted 1,000% a week from some memecoin or some shitcoin. It’s not because they were stupid. If anything, these young men (and to be honest, they were all young men) were smart as hell. They reasoned that they could not make life-changing money by messing around with 200% annualized returns; they needed to gamble with shitcoins and get a 1,000X. “To the moon!” was the rallying cry.

These non-socialist young people claim to adore entrepreneurship. I don’t think it’s because they adore entrepreneurship, because entrepreneurship sucks ass. More people and companies fail every year than succeed. Entrepreneurship is a high-risk, high-reward gamble. Yet, young people clamor for it.

I think it’s because they know that they won’t make it as an American sarariman, no matter what The Olds have told them.

These people are not socialists; they are far from socialists. But they too see the corruption of the system, and they’re reacting accordingly.

Now, with the crypto market imploding, many of these young men (and a few women) have lost everything. They gambled, and lost. And the Olds like Charlie Munger and smug Gen-X investor types are waving fingers at them telling them, “I told you so!” The Elites who already have what they want will be telling these young people that they deserved to lose because they took foolish gambles… without once asking why they felt they had to take foolish gambles.

Think these crypto-bros will nod in agreement and start investing in 60/40 diversified 401(K) plans because of the tsk-tsking? Or do they become prophets of rage?

Populists of the Right

Socialist meetings and crypto conventions are not the only place where we find disillusionment with the financialized corrupt capitalism of 2022. We find it increasingly on the “conservative” Right.

The author and venture capitalist J.D. Vance splashed onto the national consciousness with his memoir, Hillbilly Elegy, which details growing up poor and white in the rust belt. He recently won the Republican primary for Senate in Ohio, with Trump’s endorsement and against the GOP establishment. He is a strong favorite to win in the general election as well.

That Vance is a regular on Tucker Carlson’s Fox News program should not be a surprise to anyone paying attention. What would be a surprise to most people is the idea that Tucker Carlson is no longer a conservative as we have long understood the term. He wrote a book in 2018 named Ship of Fools: How a Selfish Ruling Class Is Bringing America to the Brink of Revolution. That is no traditional conservative.

Carlson, together with Vance, Josh Hawley, Blake Masters in AZ, and others in the new National Conservatism movement are populists of the Right. Its most prominent member is, of course, Donald Trump… though it is difficult to ascribe any principles or ideas or movements to Trump at all… but there is no question that Trump rode a populist wave into the White House.

Vance owes his victory to constantly hammering on the corruption of the elites in American society. He owes his victory to talking about real policies to help the poor and working class families who are struggling with joblessness, opioid addiction, alcoholism, and all of the social ills they bring. He personally comes from such a family and knows the issues first hand. Here he is in 2016 on a TED Talk:

America’s forgotten working class | J.D. Vance

No Description

Vance and others like him came to my attention a few years ago as they were arguing for tariffs on China and Canada. They were arguing for government control of private companies like Facebook and Twitter. They were arguing for industrial policy that benefits the working class at the expense of the laptop class.

These are not your father’s Republicans. These are not free market absolutists. They do not worship at the altar of Wall Street or of the capital markets. They do not believe in free trade for the sake of free trade. In that, they go against decades of Conservative economic orthodoxy crafted by none other than my hero Milton Friedman. The new populist Right has broken with the conservative tradition and with the Republican establishment.

If you listen to what they’re proposing, it isn’t clear what the difference is between what they want to see and what the socialists of the DSA want to see. They differ only in how to get to the same end-goal.

To the extent that there is any energy in the Republican Party, or in the conservative side of the aisle, it’s coming from these younger populists much like how the energy in the Democratic Party is coming from the younger DSA and similar populist Left activists. Clear the way for the prophets of rage.

What Unites the Younger Voters

Here’s a fun fact: there was a large overlap between Bernie voters and Trump voters, enough that analysts think that the Bernie Bros gave Trump the win in 2016. Which means, the two sides will go to war over social issues like gender identity, but be united in their belief that the current corrupt economic system is fundamentally broken. It would hardly be the first time that left populists and right populists unite against the common foe: the Elites whom they see as corrupt.

What I see over and over and over and over again is that populism from the left and the right finds common ground when it comes to fundamental goods, the necessities of life. They both think the healthcare system is fucked up and hijacked by corporate interests. They both think the energy policies of the elites are fucked up and only hurts the working class. The most recent example is Sen. Stabenow dismissing gas prices because she drives an EV:

Debbie Stabenow: ‘Didn’t Matter How High’ Gas Is Because I Drive Electric Vehicle

Sen. Debbie Stabenow (D-MI) talks about her electric car. Stay Connected Forbes on Facebook: http://fb.com/forbes Forbes Video on Twitter: http://www.twitter.com/forbes Forbes Video on Instagram: http://instagram.com/forbes More From Forbes: http://forbes.com

Whether you are on the Left or on the Right, when the cheapest Tesla is $48,440 and the fucking Chevy Bolt is $31,000 and if you own either one, you need to rewire your garage for a charger… assuming you have a garage because you own your own home or rent from a really super duper nice landlord… that kind of dismissal from the wealthy elites is going to piss you off.

Go on any Tesla forum or Facebook group and you will find people who live in apartments asking how to charge their $60K electric car when the building has two chargers… for a couple hundred units.

Young activists on the Left and the Right might be at each others’ throats over issues like guns, abortion, racism, sexism, someotherism, but if they ever took a break and started talking economics… about the war on wages that is our financialized system… about the World Economic Forum… about American involvement in foreign wars… about billionaires (pick whichever one you hate because of your tribe), about corporate control over everything… I’d bet they find a lot of common ground.

That should scare everyone who has a stake in the status quo.

The Future Voter Dictates the Future of Politics

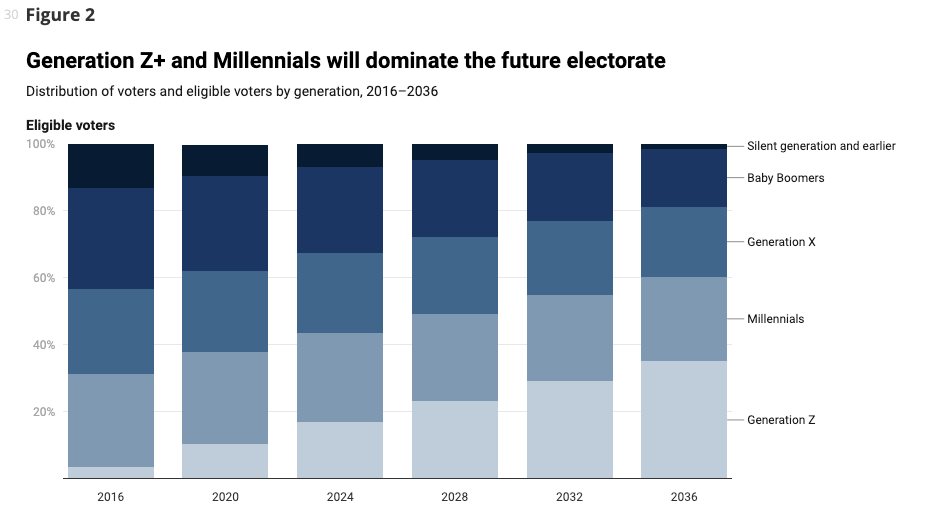

Oh, and can we point out that these younger voters, who are far more attracted to populism, make up the future of the American electorate?

The septuagenarians and the octogenarians who run both our major parties do everything they possibly can to somehow appeal to this youth vote (Democrats more successfully of course), but the future voter dictates the future politics. How can they not?

The septuagenarians and the octogenarians who run both our major parties do everything they possibly can to somehow appeal to this youth vote (Democrats more successfully of course), but the future voter dictates the future politics. How can they not?

This does not necessarily mean that Millennials and Gen-Z will automatically be leftist Democrats. It does mean that more of them than not are likely to be populists of the Right, a la J.D. Vance, rather than the civil-loser-Republicans of the Mitt Romney and Lindsey Graham varieties.

Politics, Populism and Housing

This future majority of voters of all political persuasions are finding it harder and harder to get the necessities of life: food, energy, healthcare and housing. But that last one, housing, has been a problem for them for a decade or more. Food and gas becoming unaffordable is news. Housing being unaffordable is old news.

Millennial homeownership in 2022 is still below 50%, more than 20% lower than GenX and 30% lower than Boomers. I discussed this in a recent Musings:

Ep. 58: Musings Live: Millennials, American Dream and Biden Housing Plan

An experiment in trying to do a musings via livestream, to see how it goes, and whether this would make me do more of these more regularly. I discuss Generation Screwed (which is Millennials), the new Biden Housing Plan and what we’re telling them about the American Dream through that plan.

And Millennials aren’t kids anymore. The older Millennials are in their 40s; most of them are in their 30s. If they’re not buying houses, I submit to you that it isn’t because they don’t want to. It’s because they’re not able to for all of the reasons we went over.

Gen-Z? Fuhgeddaboutit. I have not spoken to or met a Twentysomething in the last five years who thinks she will own a home one day. Correction: the only one I’ve met was investing heavily into crypto memecoins, because “That’s the only way I’ll ever be able to afford a home.” With the crypto crash of 2022, I imagine that young man won’t be in the housing market anytime soon.

They have been complaining about the fucked up broken housing market for years.

First Rules of Economics and Politics

The great Thomas Sowell once wrote:

The first lesson of economics is scarcity: There is never enough of anything to satisfy all those who want it. The first lesson of politics is to disregard the first lesson of economics.”

We are about to see this dynamic play out in the United States.

Food prices are up 58%. Gas prices have doubled. Housing prices from 2019 to now are bonkers. Recession won’t make those prices come down, because those are required necessities for life, not optional purchases with lots of alternatives. You just got laid off, and have meager savings until you can figure something out. No vacations, no new clothes, and gotta keep driving that 10 year old truck. You still gotta eat. You still have to pay for gas if you want that old truck to take you to job interviews, to the grocery store, to pick up your kids from school. And you still have to live somewhere.

These goods are what economists might call “price-inelastic” where demand doesn’t respond to price changes as much as something like movie tickets or airline seats. We printed more money, but didn’t produce more stuff. So stuff is more expensive, and recessions and layoffs don’t change the demand for fundamental necessities.

Ergo, next step must be price controls.

Scarcity may be the first rule of economics, but the first rule of politics is to make all kinds of promises and pass policies as if there were no such thing as scarcity, only greed.

We already have Biden blaming oil companies for high gas prices, saying Exxon made more money than God. We have already had the White House blame four big meat processors for high food prices. We have had Elizabeth Warren blame private equity investors for high housing prices.

There is at least one bill that passed the House to “crack down on gas price gouging” and it’s making its way through the Senate as well. Once you start talking “price-gouging” then you’re a short step away from simply imposing price ceilings. FDR did it in 1942, but that was during World War 2 and it was done via legislation. Nixon did it in 1971 during peacetime via executive order.

The major lesson for economists from the Nixon price freeze was that it was a disaster and led to shortages and gas lines. The key lesson for politicians, whether Biden or congresscritters or Senators, is that the price freeze was extraordinarily popular with 75% of people polled supporting it and led to Nixon’s landslide win in 1972.

Ergo, price controls are coming.

Rent Control is Inevitable

I have already written pretty extensively on how investors are getting blamed for unaffordable housing. The latest post is here, in which I read through and watch the Senate Banking, Housing and Urban Affairs Committee hearing on institutional landlords. Back then, in February, I thought what might be coming are some relatively minor reforms so that politicians can say to voters that they’ve done something. And I wrote:

It is unlikely but not inconceivable that the more radical wing of the Democrats would want more than small tweaks that don’t really change anything. Removing institutional investors from the home purchase equation, or disadvantaging them significantly, in order to give “every family in America an opportunity to pursue the dream of owning a home” might be on the table.

That would in fact crash the housing market.

Higher mortgage rates, which is inevitable due to Fed tightening, means lower demand from consumers. Without institutional investors wanting to park their cash in real estate, we would in fact see a dramatic collapse of home prices.

It seems obvious that even more radical schemes like federal rent control or making evictions impossible or something similar would also render real estate a non-viable asset class for investors large and small. That crashes the housing market. Capital would still rotate out of bonds and cash, but into things like Bitcoin or commodities instead.

What worries me and should worry you is that the Democrat narrative is very powerful. The current polling suggests a red wave that would see Democrats lose both the House and the Senate this year. A powerful populist message that Democrats can send to those voters in the middle who can be convinced is just what the doctor ordered. “We’re protecting you from greedy Wall Street landlords!” is pretty damn compelling, while talking about GSEs and risk layering is compelling only to libertarian economics types.

Well, when I said it was unlikely but not inconceivable that we might see really hardcore policies like federal rent control and bans on investment into real estate, inflation wasn’t at 8.6%, Biden’s approval ratings were not quite in the toilet yet, and there wasn’t a recession on the immediate horizon. All three are true today.

And as I am writing this, Sunny is texting me stories on the front page of her Google home page, all of them having to do with horror sob stories about tenants getting driven out of their homes and apartments as landlords raise rents. I’ll post just one of them, from Yahoo Finance, which talks about how Millennials and Gen-Z in Austin, TX are complaining about soaring rent on social media:

Feeling the sticker shock, Texas-based millennials and Gen Zers have taken to social media to air their grievances and joke about higher rent. Last month, one TikTok creator, Kim Vega, posted a clip of someone asking incredulously “$30,000?” with a caption saying, “paying rent for a 1 bed, 1 bath, 750 sq ft apartment near downtown in Austin TX.” She also said she would be moving back in with her parents, but it was unclear whether she was serious. Vega did not respond to a request for comment.

The Fed action will crush home buyer demand, as I wrote in Part 3. That doesn’t crush housing demand. And as investors flee negative yielding bonds, the tanking stock market, the crushed crypto market and rotate more and more into real estate, rent will become the battleground in the very near future.

I don’t know that we’ll see federal rent control, but I do think state and local rent control are all but inevitable as 2022 progresses. The first rule of politics demands it.

Price Controls on Homes

Less likely, I think, are outright price controls on the purchase/sale of residential houses.

I think we see a ban on institutional ownership of residential real estate, except for large multifamily projects. That might happen federally, but it’s more likely at the state and local levels. We’ve already seen municipalities try to do just that. Here’s a recent example from Atlanta:

Bloomberg on Twitter: “Atlanta Mayor Andre Dickens says he wants the government to find ways to place restrictions on property investors who are contributing to a surge in the region’s home prices https://t.co/GiXEtH299s / Twitter”

Atlanta Mayor Andre Dickens says he wants the government to find ways to place restrictions on property investors who are contributing to a surge in the region’s home prices https://t.co/GiXEtH299s

Expect to see more such announcements, and maybe a few cities actually pass ordinances prohibiting investor purchases because these moves will be politically popular.

We might see a ban on individual or small investor ownership above a certain number of properties. Second homes, fine. Third and fourth investment properties? Maybe. Five or six investment properties? Not fine… unless those properties are in the “luxury” category and therefore out of reach for most voters.

In the same way that politicians are talking about empowering the FTC to go after energy companies for “price manipulation,” I think we see regulators empowered to go after homebuilders, landlords, and others to go after them for “price gouging.” It matters not one bit that any such actions will be counterproductive and lead to even worse problems.

These aren’t hard caps on home prices of course, but they are somewhat soft price controls nonetheless which are designed not to be effective, but to be popular. Because politicians gotta politick, which means making grand gestures that the corporate press will play up as doing something for the little guy, while making everything far, far worse.

The Shape of Politics to Come

This is getting way too long, even for me. Obviously, the topic of politics can fill millions of words, not just thousands. So let’s wrap up in preparation for part 5, where I look at all of the four horsemen and discuss the impact on the real estate industry.

In March of 2020, I wrote this post titled “The Shape of Housing Politics to Come“. In it, I pointed out that the intelligentsia have turned against housing:

I think based on that panel, as well as the documentary the panel was discussing, the global intelligentsia located mostly in our universities, think tanks, media, entertainment, and governments, have turned against property ownership. Perhaps to be more precise about it, I think they have turned against mass property ownership. They want public property ownership, and are likely fine with large institutional property ownership as long as the government controls and regulates that ownership, but average families owning their own home? I don’t know if they still think that’s worthwhile.

Here’s why I say that: the documentary, Push. It appears to be a well-done film. It has won multiple awards, albeit from left-wing “progressive” film festivals. The emotional content of the clips I’ve seen is intense. Take a look at this “sneak peek” clip:

A sneak peek of some footage from the film:

If you don’t feel something watching those people tell their stories, you’re not human. Of course you feel something. You feel terrible for them. You don’t know their stories, nor the stories of the landlords or the owners, but you naturally want somebody to do something to help these people who are clearly suffering.

I also pointed out the anger and despair among the younger people who are obviously the future voter.

In 2022, with massive money printing having led to sky-high inflation, which then leads the Fed to stomp on the economy in order to fight inflation, we are heading into some kind of a recession. The war on wages will continue, disproportionately impacting the poor, the working class, and the young.

The rise of populism on both the Left and the Right is all but guaranteed. Our current economic system is widely seen as corrupt on all sides, because it actually is corrupt. We have neither full-blown socialism a la Sweden nor free-market capitalism. We have the worst of both worlds where those who are closest to the money printer benefit at the expense of those who are farther away. Investors and asset owners — which significantly includes residential real estate — benefit at the expense of wage earners and workers.

It simply doesn’t matter what the economic reality is. It doesn’t matter that investors help keep the economy afloat, that they invest not just in Bored Ape NFTs, but into building new houses, starting new businesses, and financing farmers. It doesn’t matter from a political standpoint that free trade is the best policy, if free trade means opioid addictions and widespread death in your local town.

The shape of politics to come is populism vs. elitism. That’s the big struggle ahead of us. That might not be Death riding on a pale horse, but it’s not days of wine and roses either. We have ignored the prophets of rage for far too long.

Where do REALTORS fall in that struggle? How does the industry get affected by all of this? We cover those questions and more in part 5.

-rsh

No Title

Music video by Prophets of Rage performing Prophets Of Rage. (C) 2016 Prophets of Rage http://vevo.ly/HstQdp Best of ProphetsOfRage: https://goo.gl/sJwGft Subscribe here: https://goo.gl/DFHdjD