I had originally planned on the Four Horsemen series to be five parts: the four Horsemen, plus a wrap-up laying out the consequences for the real estate industry. But as I mentioned in part 5, a couple of you have asked for a slightly medium-to-longer term post-apocalypse outlook on the industry. Once the dust settles, what does real estate and housing in the U.S. look like?

As it happens, I’m quite white pilled about America and therefore about American real estate. I’m happy to give some high level thoughts, especially with an eye towards what contingency plans companies and organizations in and around real estate ought to make.

Having said that, the Four Horsemen series simply examined existing trends and data and extrapolated them slightly into the near future. Longer term predictions are more like prophecy. And you should know that most prophets throughout most of history were simply raving madmen on drugs — or madwomen if we’re talking about the Oracle of Delphi.

Plus, I’ve long said the apocalypse arrives by 2024. I’ve already discussed what happens in the immediate aftermath of the housing apocalypse in Part 5. So there isn’t much of a need to talk about say the 12-24 months after the apocalypse, since that will be the immediate aftermath. So we’re talking about maybe 2026 to 2030. That’s science fiction territory, as we all should know. So much could and will change over the next 4-8 years.

Which means that these thoughts are particularly speculative. They’re speculation-squared, or maybe cubed. Maybe they’re just my hopes and wishes masquerading as projections. You have been warned.

Let’s get into it.

A New Heaven and a New Earth

Revelations ends not with eternal darkness, but with a new heaven and a new earth. For our purposes, that means thinking about what the residential housing industry looks like after everything settles down.

Post-apocalypse, I expect a few things to have come to pass in the larger society and economy:

- A new monetary system that is far more stable than fiat currency.

- An economy based on producing and trading real stuff, instead of financializing all kinds of stuff.

- Politics in the U.S. becoming populist.

- A society that is far, far more decentralized than it is today.

These four things will necessarily lead to entirely new institutions or new institutional setups to reflect the new world order (a la Ray Dalio).

For the moment, I’m not going down the rabbit hole of the post-American world order, which is some truly dark stuff. If you’re interested in that kind of doom porn, I recommend reading The End of the World Is Just the Beginning: Mapping the Collapse of Globalization, the new book from Peter Zeihan. But in a nod to Zeihan’s predictions, let us simply assume that the United States (with its closest trading partner Mexico) will manage to escape the worst consequences of deglobalization and decivilization.

And for the purpose of this essay, I’m going to go with the most optimistic variations of each of the above, because the less optimistic versions all involve a lot of blood, head chopping, and the like. Real estate really won’t be much of a concern in that kind of a transition.

Also, please note that each of the above topics is a book or a series of books by itself. Which means I’m not going to go into them in any depth whatsoever. If you’re interested in learning more, contact me and I’d be happy to share a list of books and resources that I used to come to my conclusions.

New Monetary System

I take it as a given that we will have a new global monetary system, after the USD collapses. That collapse is inevitable given the balance sheet of the Fed, the structural fiscal deficits of the United States government (which means they are not subject to normal politics), and what’s happening with food, energy, and global markets.

The most optimistic scenario for a USD collapse is something like Bretton Woods or perhaps the Nixon closing the gold window, i.e., no major wars. Major economic powers of the world get together, and in order to avoid total disaster, come to some sort of agreement that hurts everybody, benefits everybody, and leaves some kind of a way out.

International trade has to continue in some fashion. Which means the world has to agree on a new medium of exchange before Saudi Arabia will send oil to China, or Vietnam will send shoes to the United States.

There aren’t that many alternative to the US Dollar. Certainly, no other country’s fiat currency will replace the Dollar. For example, who in their right mind would trust the Chinese? Most of The Olds think gold is the only possibility, because it has always been gold before Bretton Woods. So perhaps we return to a gold standard. The Dollar doesn’t go away; it just gets pegged to gold. Repeat for all major currencies in the world, just as it was back in the 19th century.

My own bet is Bitcoin, because gold just results in instant wars of conquest. For example, Uganda just discovered an enormous gold deposit, maybe as much as 320K metric tons of refined gold. Which is more gold than has been discovered and refined throughout all of recorded human history. That much gold in a gold standard world justifies some military adventurism. Uganda is next door to Ethiopia, which is more than double the population, more than triple in size of active military, and significantly better armed. Ethiopia is not a rich country. But Ethiopia is unlikely to be the conqueror, because China already has a mine setup in Uganda, and Egypt is the far stronger regional power.

Bitcoin can’t be acquired through military conquest. So there’s very little to gain from invading some country to take its Bitcoin stash. The entire concept of “taking Bitcoin” doesn’t work.

Whatever happens, though, the most important impact for us is that a commodity-backed currency cannot inflate more than the production of the underlying commodity. So if the global supply of gold is growing at about 1.5% a year (2019 numbers) then inflation cannot be more than 1.5% a year. If the new reserve currency is Bitcoin, then it cannot inflate at all and will in fact deflate slowly over time as people lose keys to their wallets.

A Real Economy

The implication of a fixed stable global non-fiat currency system is that the economy of every country has to be based on real economic growth or real economic decline, rather than nominal growth or nominal declines. That means the economy will be about real stuff, not numbers on a spreadsheet. Countries will have to produce real things, whether commodities like oil and gas or wheat or pork bellies, or manufactured goods, or real services that lead to producing real stuff. Think construction, rather than mortgage banking.

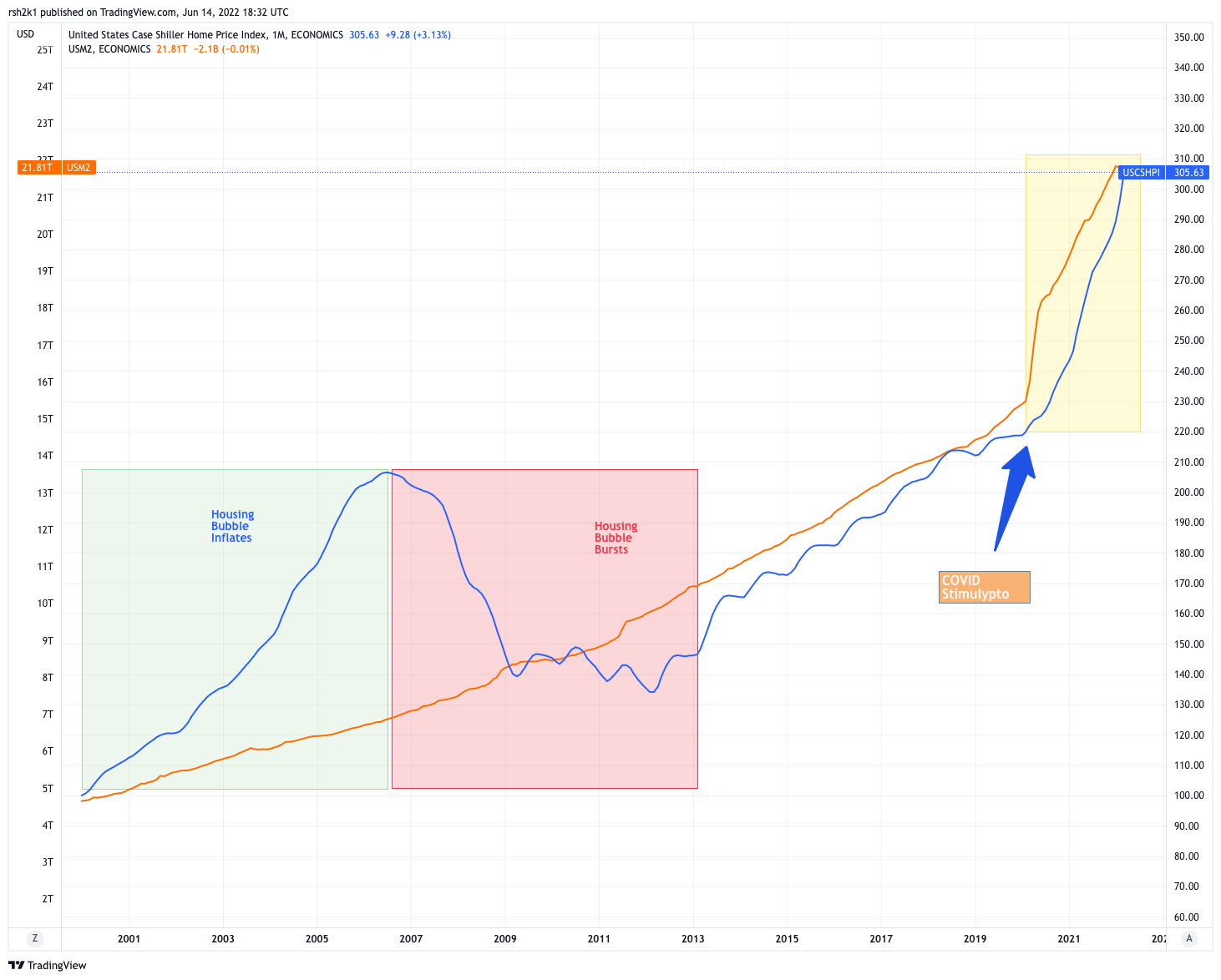

This chart from Part 5 can’t happen in that real economy:

The red line — the money supply — would remain basically flat and any home price movements substantially divergent is either a bubble or a weird recession in housing or something happening with actual supply and demand.

If homebuilders overbuilt a shit ton of houses, then prices would drop because the money is fixed. If they didn’t build enough houses, then prices go up because the money is fixed.

There are a few important corollary effects to this.

- The Cantillon Effect either disappears, or gets minimized. No printing press = no Cantillon effect.

- Bonds become attractive again.

- Equities become rather unattractive, and truly become risk-on assets, since you’re betting on the success of a business venture with money that can’t be printed anymore.

- Government spending becomes problematic. You have to actually tax your people to spend the money, since borrowing money (via Treasury bonds) means having to pay those back with money you can’t just create on a computer.

American Politics Turns Populist

I have already spent a lot of pixels on what’s happening in American politics in Part 4 and 5. Populism of the Left and the Right is where all of the energy, youth, and vision is.

We’ll see this really impact the U.S. in the 2024 Election. Whoever runs for office will have to sound a helluva lot more populist in order to have a chance. I mean seriously think about anybody in 2024 running for office siding with big banks, big corporations, big pharma, big energy, big anything. Even if they did side with the Elites in secret, they’d have to at least sound a whole lot more populist than they do today.

If the populist Left wins, then we’ll have something approaching democratic socialism a la Canada and Nordic states. If the populist Right wins, then we’ll see something approaching Korea and Taiwan: national industrial policy designed not for economic gain but for political stability. Neither is a great outcome, but then, those are the choices we have left today so it is what it is.

For real estate, the big conflict then will be between those who already own land, and those who do not. Land redistribution has been a feature of revolutions in every single human society that has ever gone through a revolution. Even if we have a largely peaceful revolution in the U.S. like FDR’s New Deal revolution, we can expect a significant effort to redistribute land, i.e., housing.

Society Decentralizes

By 2026, I expect that our society and country as a whole will be significantly more decentralized than it is today. A lot of it will come from divided values and divided politics, and quite a bit will come from technology continuing to march ahead.

Politics

On June 24, 2022, the Supreme Court released the Dobbs decision striking down Roe v. Wade. Instant protest and outrage. Somewhat lost in the emotional reaction is that Dobbs isn’t actually about abortion: it’s about federalism. The ruling doesn’t ban abortions; rather, it puts the abortion issue back in the hands of the state legislatures. Love the decision or hate it, what is clear about it is that it decentralizes the issue. Instead of one national Supreme Court, the issue now goes to 50 different states.

The political division in the U.S. is already leading to more and more variations between the states. We’ve seen this pre-pandemic, and that variation led to some of the geographic relocations. We already see it with gun laws, with COVID restrictions, with taxes, with environmental policies, and dozens of other examples where blue states and red states really differ from each other. I expect that trend to accelerate even more, leading to a natural pressure to decentralize.

At the same time, within each state, there is a great deal of conflict between town and country. Just about every state actually looks like a sea of red broken up by big blue dots. Think Austin in Texas, Miami in Florida, and Kansas City in Missouri. This urban vs. rural divide naturally leads to more decentralization pressure.

What that means for us is that more and more decisions affecting housing and real estate will be made at the local and state levels, rather than at the federal level. The fact that the end of fiat money means national government spending power is significantly curtailed also leads to the local and state governments having a great deal more say.

Technology

At the same time, blockchain technology is here to stay. What most people equate with crypto is actually a fundamental change in technology that allows for distributed computing. The key innovation is not Bitcoin, but Ethereum. Let me also note that decentralized computing is in its infancy, which means we can’t know exactly how it will take shape. We only know the general direction and goal of the technology.

That general direction and goal of blockchain is to move away from giant tech monopolies where decisions are made by a small group of owners, Boards of Directors, or a powerful CEO. The tech itself will be dispersed among thousands of nodes, and decisions will be made by self-organizing communities. Instead of Google controlling the world’s information, think about tens of thousands of computers spontaneously coming together to do the same.

Jack Dorsey made news when he quit Twitter and said he’s devoting his life to web3. He recently came out with some announcements about web5 (skipping over web4, I guess). We don’t know what that will look like, but the general thrust of the technology movement is towards decentralization, not more centralization.

New Institutions

As I said, these four megatrends then lead to the necessity of either new institutions, or new arrangements within existing institutions. Perhaps Google doesn’t just go away; instead, it reinvents itself as a decentralized entity with decisions made by a DAO (Decentralized Autonomous Organization). We’ll still call it Google, but it won’t be the Google we know today.

Similarly, we’ll see new institutions, or new arrangements within existing institutions, or both across the political and economic spheres. Maybe we’ll have the Constitutional structure of the 50 states and one national federated government, but we might also see numerous autonomous urban areas that are self-governed in really significant ways. These autonomous zones are not unknown in world history; indeed, they’re not unknown in today’s world.

Housing After Things Settle

We’ve already covered what things look like immediately after the apocalypse. With the five speculations above, let’s tackle what residential real estate and housing look like after the dust settles.

Housing: No Longer an Investment

The first place to start is the fact that housing is an essential good. Everyone needs a roof over his or her head. Period.

The second point, however, is that in a non-financialized world, it is not at all obvious that houses make good investments. If money stops inflating at the whim of central banks, then the value of existing money increases pretty dramatically. Real estate has long been a hedge against inflation, but what happens if inflation is no longer a thing? If anything, we might all care more about deflation, where money becomes more valuable over time.

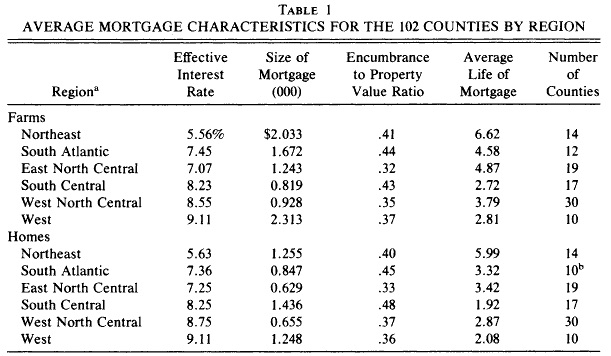

It is entirely obvious that we will not have mortgages like we do today: 30 year fixed rate loans, guaranteed by the Federal government via GSEs, with MBSs fueling the funding for American homes. If the world returns to a gold standard (or embraces the Bitcoin standard), we can expect that lenders will start to behave as they did during the 19th century when the world was on a gold standard.

According to Mortgage Rates and American Capital Market Development in the Late Nineteenth Century, there were mortgages for homes in the 19th century:

Note both the interest rates and the LTV (48 LTV is the max) and the average life of the loans. That’s what makes sense as a lender if the dollar goes up in value over time, or doesn’t change much in value over time. It goes without saying that the price of real estate in the 19th century was not what it looks like post-FDR. In 1853, a new home in Brooklyn, NY cost $2,500 at a time when a NYC blacksmith made about $2 per day. With 3.5 years of wages, that blacksmith could buy a home in Brooklyn; a 6 year mortgage at 40LTV paying 5.63% doesn’t seem ridiculous with those numbers.

The third point is that with American politics turning sharply populist, I do not expect laws and regulations to be all that friendly to landlords. This will happen sooner rather than later, and with decentralization being a real force, we’ll see wide variation between states and even cities as to how much the governments will and will not allow rentals.

Combine all three, and I think it is reasonable to expect that residential housing will behave more like a durable good than an investment. Think cars, not bonds. The car is a necessary good for most of the country, and it is very expensive, and most people have to borrow money to buy one. But nobody thinks they’re going to buy a car as an investment. They all recognize that the value will drop over time, but they still need to get one because they need to have one.

Perhaps unique trophy properties, like unique trophy sports cars, will become investments. Otherwise, housing will become durable consumer goods.

Home Prices Will Plummet

The consequence is that the actual price of residential real estate will plummet. I don’t mean the “slower rate of appreciation” that we’re seeing today due to Fed action; I mean actual price (measured in hours of work) will fall back down to rational levels. Whether that happens through the price of the home falling or through real wages increasing, the end result is the same: more working people will be able to buy a home as the Price-to-Income ratio will be closer to 4:1 than it is to 10:1.

Using 2020 median household income from FRED of $67,521 (unadjusted for inflation), that implies the median home in the U.S. will be about $270K rather than the $428,700 it was in Q1 of 2022, or about a 40% drop.

More Construction, Less Resale

Since the world has transitioned into a real economy from a financialized economy, and housing has gone from an investment to a durable consumer good, we should see a good deal more construction and a good deal less resale of existing homes. To the extent that existing housing remains valuable, most of the value should be in the land as opposed to the structure since the structure ages, wears out, and needs updating. Location still matters and that doesn’t change all that quickly, but buildings wear out.

Think of used houses as we might used cars: apart from certain classics, used cars are worth less than new cars. Similarly, used buildings will be worth less than new buildings that have all of the latest technology and energy saving materials and design… unless we’re talking about some architectural classic worth preserving.

[One note here: I know Ivy Zelman and others have suggested that given America’s bad demographics (we ain’t having babies), we might actually have too much construction, rather than not enough. I was in that school of thought, and I could be convinced back into it, but today, I think American demographics improve post-apocalypse for a variety of reasons. Read Peter Zeihan for more on this change.]

New Institutions in Mortgage, Title, Escrow

As of this writing, the idea that we would have new institutions or new institutional arrangements post-apocalypse in things like mortgage, title and escrow seem beyond fanciful. The idea seems insane, actually.

However, in a world of sound money, decentralization, and populism, I rather think it likely that we’d see just that kind of rearrangement.

Title on the blockchain makes all the sense in the world, and has since blockchain was invented. But local governments control land registry and title, and they have no incentive to surrender that power and that income. Post-fiat currency, however, local governments may have strong incentives to reduce spending as all spending has to come from taxes, not from bond sales to the Fed.

Similarly, it seems likely that GSEs will not survive the transition to a post-fiat world; backstopping Fannie and Freddie in a post-fiat world means the government has to stockpile gold or Bitcoin or whatever. That’s not up to the government. Which means the GSEs are not long for this world, at least not as we know them. As we saw from the 19th century mortgages, we’ll still have mortgages, but they won’t be like anything we have had since FDR. So new institutions there.

Escrow will almost definitely have new institutions or new arrangements simply from the march of technology. It’s already undergoing a quiet revolution since automation, smart contracts, and digital payment technology are reducing the need for an escrow agent… but the post-apocalypse world will tend to punish activity that doesn’t produce real stuff.

The Real Estate Industry After Things Settle

Speaking of economic activity that doesn’t produce real stuff, the real estate industry will almost certainly be dramatically transformed.

A definancialized economy still has needs for services. It isn’t as if there weren’t real estate agents and lawyers and clerks in the 18th and 19th centuries; there were. But the service must be truly value-add. What does that mean in the buying and selling of houses, especially when those houses are no longer investments but durable goods?

Agents

Even when the home is a mere 4 times a family’s annual income, the buyer will want expert advice and guidance and reassurance that he’s doing the right thing by buying 123 Main Street instead of 456 Broad Avenue. The buyer will still want an expert to tell him how much to pay and why. The seller will still want an expert to help market the home and to get the most money with the least amount of time and effort, because the house might be a durable good, but it’s still 4 times the median household income. So there will always be a need for real estate agents. There is no substitute for human beings to working with other human beings on something as important as buying a house.

However, since services must be truly value-add in a real stuff economy, the future real estate agent will need to be true subject-matter experts who earn their fees from rendering professional advice, not from being middlemen in the transaction.

Again, think cars. There are crappy car salespeople (most of them, truth be told) but then there are a few who are real experts. They’re gearheads, who really love cars in general, and the brand they’re selling in particular. I’ve met Porsche salespeople who are Porsche lovers first and foremost, and could tell you all kinds of shit about the differences with the steering of a 996 generation vs 991. They could talk about, and if they’re honest, properly advise you on whether you should consider the Cayman over a 911 and what models and why.

There are real estate agents who are true subject matter experts. Many of them come out of construction backgrounds, or have deep experience from their years in the business. They know and can tell you why this kind of siding is superior to that kind of siding, or why you might want to choose this house over that one because of the builder who built them.

Since buy-side compensation mostly disappeared during the apocalypse, and top producers and team leaders are all strong listing agents, the implication is a new kind of agent team forming post-apocalypse that looks a lot more like a commercial team or perhaps a small law firm than the lead-distribution organizations that we have today. We should see greater specialization within teams, with different agents bringing different strengths to the client or to the deal, and a great deal more intra-team cooperation and collaboration. Maybe Amy knows everything about environmental regulations in the county and how that will affect the backyard, while Joe knows how plumbing and HVAC work in the area, Susan knows every town council and school board election going back 25 years and knows what streets are great and what streets to avoid, and George is a master negotiator who can somehow make impossible deals work. Who knows what the particular combination of strengths and talents will be, but we can surmise that such a service would be truly value-add and buyers and sellers will both gladly write checks to get it.

We will see true price differentiation as well. More experienced true experts can charge what brand new apprentices cannot. Teams with long track records of success will be able to charge more, while teams that can’t get shit done might not be able to stay in business for long.

Brokers

It is unclear to me what the value-add service of a broker would be post-apocalypse.

If we assume that state licensing laws remain in place, which is far from a given, then I suppose agents will need a broker to meet legal requirements. But that isn’t really value-add, which implies that the price of such legal sign-off services will approach zero.

Every brokerage I know of emphasizes training and coaching, but if agents are no longer paid a commission to do a deal but hourly rates for advising the client, it isn’t clear to me that brokerages will be able to transition into teaching new agents how to become subject matter experts. Well, some will be great at it, so let’s put it as… it isn’t clear to me how many brokerages will be able to help newbies become experts.

In such a world, the most important value of a brokerage will be its brand. But real estate must re-learn (or learn for the first time) what brand actually is: a promise to customers. Delivering on that promise requires a level of control over agents that today’s 1099-based brokerages simply do not have.

The implication then is that we will see new institutions or new arrangements where the brokerage gets that level of control in order to deliver on the customer promise, which will be its most important value-add service to its agents. Training will be an important part of maintaining that brand, of course, and different brokerages will go at that in different ways. But the ones that succeed will be really good at not just the skills and real estate subjects, but at establishing and enforcing a common culture.

In my mind, perhaps because of my bias, I’m thinking of significant law firms or investment firms who have built a brand, maintained that brand, and enforced that brand. Think Cravath, Swaine & Moore or Goldman Sachs. I think the only brokerages that remain post-apocalypse are one of these kinds of companies, and the institutional arrangement will be completely different from what we have today.

Again, if you’ve read my work over the years on brokerage, I think you’ll know my biases are clear. And that’s all this could be: personal bias.

MLS & Associations

I’ve already written in Part 5 that I think most MLSs and most REALTOR Associations will disappear post-apocalypse. The ones that remain will be new institutions or new arrangements.

Thing is, I’ve already said that the country doesn’t need 500+ small MLSs; four or five or one will do. But that goes counter to the idea of decentralization. How do we square that circle?

Short answer: I don’t know. Longer answer: the information might become more centralized, but the control will become decentralized.

That is, there may be one or two new institutions we’ll call the MLS, which centralizes the information and the data because actual market participants want all of the information in one place, but the control over these institutions will be more along DAO lines (see above, re: Google) and less along REALTOR Association Board of Directors lines.

I do not believe that REALTOR Associations cease to exist. There’s just too much good in the vision and the ideals of the REALTOR movement as contained in the Preamble to the Code of Ethics. But I do think we see new arrangements.

First, the membership numbers will be a fraction of what they are today, simply because a broker or an agent will no longer need to be a REALTOR to access the MLS.

Second, those who remain will be true believers who pursue (a) professionalism of the practitioner, and (b) public influence on behalf of their respective communities, because under all is the land. That part (b) in a decentralized society implies that more of the action will be at local and state levels, and less of it will be at the national level. Given what I think is the trend towards decentralization, I think it not crazy to think that Houston Association of REALTORS will be more powerful and more important than the Texas Association of REALTORS which will in turn be far more important and powerful than the National Association of REALTORS. Where the important policies are being made in the post-apocalypse world is the City, then the State, then the Nation.

Third, changes to both the economy (definancialization) and politics (populism) imply that the future REALTOR institutions will themselves be far more populist than they are today. Future REALTORS won’t be quite as heavily involved with “defending property rights” as they are with “acquiring property rights.” After all, if the home is a durable good rather than an investment, then the action will be with buyers and potential buyers, not sellers.

New Institutions in Residential Real Estate

I think it highly likely that we’ll have at least one new institution (or new-ish, if you’ve been paying attention).

I wrote in Part 5 that I think Opendoor and others like it will be big winners. I think this is especially true if housing becomes a durable good.

Market making in residential housing, which most people think is stupid today, will seem incredibly useful and value-add in the post-apocalypse, sound money, housing-as-durable-good world.

There is a scenario where the agent, who is now an advisor and consultant rather than a middleman, simply works with market makers for the actual transaction itself and adds value through directly advising the buyer or the seller on what they should be doing. It may look remarkably similar to how financial advisors earn their money today; not because they can execute a trade on NASDAQ, but because they can advise clients on which trade to execute on NASDAQ.

Another new institution we are likely to see is a new kind of house flipper. Instead of simply buying a house, slapping some paint and new countertops on it, then selling it for huge gains, we may see companies that buy a used house, then more or less gut it and rebuild it to contemporary specs so as to compete with new construction. It’ll be a bit like “teardowns-as-flipping” because if houses are durable goods, then the value is in the land (which dictates location), and there will be real value in putting up a new energy efficient, latest-technology, super-convenient building on land that is very close to downtown.

There are likely to be numerous other new institutions and new institutional arrangements, but this is getting long already. Just think about what global sound money + populist politics + real stuff economy could mean for the ultimate in real stuff: land, real property, and housing.

The White Pill: New Jerusalem

Though it might not seem like it at first, this future is incredibly positive. It is why I keep saying that I am white pilled when it comes to real estate and the United States.

Most of our problems with housing can be traced to the fiat money system that leads to corruption of capitalism. Restore sound money, and that removes most of the problems with corrupt capitalism.

What’s more, I believe that most of our social ills are caused by a broken housing market. I have written that I think housing is the cause of systemic racism:

Most of the protests today — and some of the responses to them — are protests against systemic or institutional racism. The protests aren’t about one bad cop: it’s about disparities in treatment of Black people by police everywhere.

Terms like “white privilege” are attacking not a particular white person’s actual privilege, since quite a few of my white friends grew up in environments that could be called anything but privileged, but the entire system that sets up whites for success and non-whites for failure.

Let’s be honest about this: systemic racism is one of the most divisive socio-political theories in America today. There are millions of well-intentioned people who believe it fervently, and there are millions of well-intentioned people who dispute it just as fervently.

Thing is… whether systemic racism exists or not in policing, in politics, in employment, in healthcare, in education, etc. can actually be debated. But it can’t really be debated in housing. There is no doubt that systemic racism exists in housing in the United States.

Furthermore, to the extent that systemic racism exists in other areas, it exists because of systemic racism in housing.

I am not alone in thinking that housing is the cause of most of our social, political, and economic problems. After all, under all is the land.

This is a video that went viral earlier this year, with over 774K views on a channel with only 197K subscribers:

The Housing Crisis is the Everything Crisis

Dude, where’s my affordable housing? CHAPTERS: 0:00 Introduction 2:28 The Problem 5:06 Solving Poverty 7:34 Solving Homelessness 8:27 Helping the Environment 11:06 Improving Public Health 15:07 Improving the Economy 16:59 Helping Families 19:43 !!!Lightning Round!!!

I find the video entertaining as hell, even if I don’t agree with everything BritMonkey says. But “Solve the housing crisis and you solve all the other problems” I agree with 100%. Watch the whole video, and he makes a very compelling case how fixing housing solves problems as disparate as environment to health to demographics to security to politics.

Fix the money, and we fix housing. Fix housing, and we fix the world.

That is the future ahead of us. Short term pain, but long term, incredible gain. Not just for society, or the working class, but for the real estate industry itself as well.

1.6 million REALTORS competing to sell roughly 6 million homes a year makes no sense for anybody, not even the REALTORS, whose average income is below that of Starbucks baristas. 200,000 professional subject matter experts making $150 an hour advising 12 million buyers and sellers because homes are not 10 times median income, but 4 times median income, is better for those professional advisors. And all of us connected to the real estate industry — brokers, tech companies, MLS, even REALTOR Associations and yes, strategy consultants — win big once we adjust to the new environment and learn how to add value in a real stuff economy.

The apocalypse is not the end. It is the beginning. It is the death of a broken system that hurts everyone but the very few, and the rebirth of a new world order. I’m certain that new world order will come with its own problems, because the world is an imperfect place until the actual Revelations happens one day. But at least we’ll have some new problems to tackle, instead of banging our collective heads against the wall over and over and over and over again.

Here’s to hope then. The next phase might be hell, but afterwards, it’ll be a new heaven and a new earth. Inshallah.

-rsh

Matisyahu – Jerusalem (Out Of Darkness Comes Light) (Video)

Matisyahu’s official music video for ‘Jerusalem’. Click to listen to Matisyahu on Spotify: http://smarturl.it/MatisyahuSpotify?IQid=MatisJer As featured on Playlist: The Very Best of Matisyahu.

Rob, these 6 episodes have been superb. Thank you for all the deep thinking you do here.