In Fortune, we get this story about 40 regional housing markets that are super overvalued where home prices might fall over the next year:

Among those “overvalued” housing markets, which ones are actually likely to see home prices fall? In order, Zandi points to these “juiced-up” regional housing markets: Boise; Colorado Springs, Colo.; Las Vegas; Coeur d’Alene, Idaho; Tampa; Atlanta; Fort Collins, Colo.; Sherman, Texas; Jacksonville; Idaho Falls, Idaho; Lakeland, Fla.; Greeley, Colo.; Longview, Wash.; Charleston, S.C.; Albany, N.Y.; Denver; Clarksville, Tenn.; Greensboro, N.C.; and Charlotte.

I wanted to write on this, because I went on Twitter recently and asked:

Robert Hahn on Twitter: “Question: When folks say housing is overpriced, what are they using as the metric for being overpriced? Price to income? Historical trends? Local REALTOR feelings? https://t.co/zAW4yBbDz7 / Twitter”

Question: When folks say housing is overpriced, what are they using as the metric for being overpriced? Price to income? Historical trends? Local REALTOR feelings? https://t.co/zAW4yBbDz7

From the Fortune article, we get an answer of sorts. It appears that at least Mark Zandi from Moody Analytics thinks a market is overvalued relative to local income. Historically, the median home price was 2.6 times the median income. So if the median price is over 2.6, we’re in overvalued territory; under 2.6 and we’re in undervalued territory.

Presumably then, when we say (or Zandi says) that Boise is 73% overpriced, it is in reference to that 2.6 Median-Price-to-Median-Income ratio. So if the median house in Boise is going for 3.56 times the median income in Boise, then we can conclude that it is 73% overpriced.

I can’t think of any other way to arrive at such precise “overvalued by” figures, so that must be it. If you know differently, please let me know in the comments.

The Great Migration 2.0 Changes This

Thing is, when the COVID lockdowns first started, I wrote this piece titled “Silver Lining from Pandemic, #3: The Rise of Exurbs.” In it, I kind of anticipated the Work From Home movement:

We currently have millions of white-collar workers working from home, using tools that have long been available. We have known for years that someone whose labor is primarily on a computer and telephone doesn’t actually have to be physically sitting at the cubicle next to you in order to get her job done. But the business culture — especially on the part of the Boomer bosses — dictated that you got up, drank your coffee, put on professional attire, got into your car, and drove to the office.

Sure, there is no substitute for physically meeting face to face, especially for large team meetings and such. But the entire country is working from home using video, using Slack, using telephones and laptops, and making it work. The real productivity killer isn’t the fact that Joe from Accounting is not two floors up, or that Sally in Marketing is not down the hall. The real productivity killer (if it does indeed kill productivity) is that these stay-at-home workers are having to take care of their kids, homeschool them, feed them, and keep them occupied — assuming they have kids at home on lockdown as well. I haven’t seen any stats or studies yet, but I’d be willing to bet that those remote workers without kids at home (the majority of younger workers) are just as productive as they were while sitting in cubicle #425 next to the copy machine.

Ergo, I thought that there was a very good chance that the exurbs would see a boom as these virtual workers decided that they wanted the wide open spaces and larger homes available in the “countryside” which could be a mere 90 minutes away from downtown.

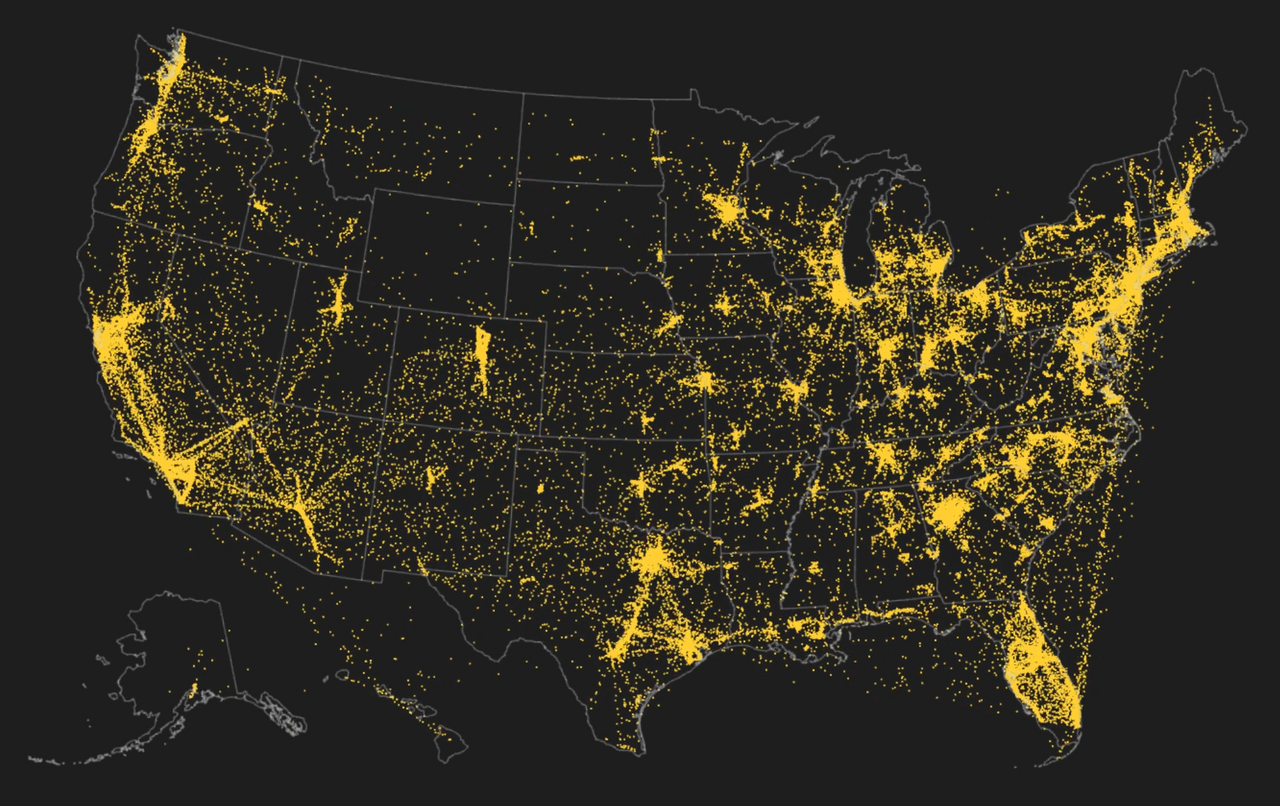

I don’t know that we saw the migration to the exurbs as company after company embraced WFH. What we did see, however, was the Great Migration 2.0 from dense metropolises to smaller cities, and from hard lockdown blue states to more open red states.

The Fortune article from May kind of acknowledges this reality:

The most overvalued being Boise, where home prices are 73% above what fundamentals would support. The fact Boise is “overvalued” relative to local incomes isn’t surprising given the influx of California expats who bought there during the pandemic.

Maybe Boise being 3.5 times local median income makes it 73% overvalued… but 3.5 times local median income is dirt cheap for Californians from Silicon Valley. The same goes for just about every city/region on the list above.

They are all overvalued relative to local income, but it wasn’t the locals buying homes and driving up the prices. It was geographic arbitrage by people from outside the state (at least city, like Fort Collins vs. Denver). The local incomes are irrelevant then.

My home city of Las Vegas is on the list, and it’s the perfect example. Nobody thinks that home prices in Las Vegas are up 42% over long-term price trends because blackjack dealers really wanted to buy houses in 2021. It’s all Southern Californians invading:

The Las Vegas housing market is on fire in 2022. Sales of single-family homes are up from last year, and prices are reaching new highs. Month after month, inventory is depleting and cannot keep up with demand. People continue to flock to Las Vegas from more expensive areas, particularly Southern California, putting more pressure on housing demand. This trend has accelerated during the pandemic, according to industry experts, with home sales in the area reaching their highest level in 14 years.

Local income ain’t got nothing to do with median homes prices in Las Vegas. The term “overvalued” loses its meaning if the metric isn’t local median income, but the median income of out-of-state buyers, particularly those who are selling their 3BR/2BA starter homes in Orange County for $2 million and paying cash for their 4BR/3BA mini-mansion in Las Vegas. It’s Californication all the way up.

Fed Action, Recession, and Migration

The question then is whether Fed action, which will spike mortgage rates even further, will actually stall out Great Migration 2.0.

Now that mortgage rates are north of 6% and heading higher, is that more likely or less likely to make Angelenos move to Las Vegas? Or Boise?

Will New Yorkers stop moving to Lakeland, FL and choose to stay put in their $5,000 per month apartment in Brooklyn because of recession and higher rates?

“Hey babe, so gas is $7 a gallon, and we can’t afford to both eat and pay rent, so let’s stay put here in Chicago, cuz I’m probably gonna get laid off next month,” said no one ever.

If anything, I can see the “overvalued” markets becoming hotter still as rents go through the roof, jobs become scarcer, and income gets hammered, while everything costs more, more, more. Those (relatively) high-income workers from the big metropolitan areas might find it even more compelling to move to tier-two and tier-three cities in search of cheaper housing. Household income of $150K in New York City means you’re struggling to make ends meet; it makes you top 5% in some of these other cities.

If those “overvalued” markets on the list become less desirable, it has to be because those markets have already gotten unattractive for the second and third waves of migrants from high-cost deep blue cities. Las Vegas might already be priced out for you if you’re a renter from Los Angeles and don’t have a million dollar bungalow you can sell; you might need to look at Pahrump instead.

Californication

From that perspective, I guess overvalued housing markets fall if their prices are too high relative to the median income of the Laptop Class from high-income areas. If prices in Las Vegas go above 3 or 4 times the median income of white collar professionals in Los Angeles, then yeah, Las Vegas market has to cool. If home prices in Tampa get close to what an investment banker in New York City has to pay for a sweet 3BR condo in Manhattan, then yeah, Tampa prices have to come down.

Why would prices fall until then?

The only civil way I see these “overvalued markets” actually cool is if more companies follow Elon Musk’s latest order to report to the office, or find another job. The Great Migration 2.0 was caused by overreaction to COVID; if that’s behind us as a society, then perhaps Work From Home’s time is done as well. When the cost of moving from an expensive urban metro to a low-cost city or town includes having to find a new job, then local values will follow local incomes more closely.

Until then, we should continue to expect Californication of “local” housing markets.

-rsh

Red Hot Chili Peppers – Californication (Official Music Video) [HD UPGRADE]

Watch the official music video for Californication by Red Hot Chili Peppers from the album Californication. 🔔 Subscribe to the channel: https://youtube.com/c/RedHotChiliPeppers/?sub_confirmation=1 Californication available here: http://smarturl.it/getrhcpcalifornica “Californication” is the Red Hot Chili Peppers’ fourth single and sixth track from their 1999 seventh studio album, Californication.

Our market in Bellingham ( a migration destination) slowed considerably in the last downturn mainly because the folks who wanted to move here were having trouble selling their home in their relatively expensive market.