One of the recurring problems of the real estate industry is that it is almost entirely reactive when it comes to problems. We continually look backwards, rather than forwards, then wonder why things don’t improve.

A good example is the latest recommendation from Victor Lund of the WAV Group, who promotes Redfin’s idea that IDX policy require linking back to the listing broker. The goal is to drive more traffic to brokerage (and agent) websites by providing more Google-juice via authorship and canonical URL information. This, he (they) believe would let brokers fight off the portals like Zillow and Realtor.com:

As much as any other company, Redfin sees where real estate search has gone. The overwhelming majorities of consumers visit advertising websites rather than broker websites. In his opinion, this is a challenge for real estate brokerages and a tax on consumers who ultimately pay for the advertising costs agents bear to appear on other websites, and it is getting worse.

This is a classic example of fighting the last war. What’s worse, should the industry go along with this suggestion, not only would it not help brokers and agents, it would actually make things worse if your brokerage is not named Redfin.

Let me explain.

IDX Policy Does Not Affect Portals

Let’s just get this out of the way first.

IDX policy does absolutely zip to the portals like Zillow and Realtor.com seeing as how they don’t use IDX in the first place.

Should IDX policy change requiring all of these things, all that means is that brokers and agents have to put all that information in, which likely helps Redfin more than anybody else (more on this below). To require the same of Zillow and Realtor and any other syndication-based portal, the various MLSs and brokers and franchises must change the existing data contracts.

So there’s that.

Based on what I heard at the ARMLS meeting last month from Glenn Kelman, CEO of Redfin, I believe that what Redfin wants is not just IDX but all listing data feeds including the syndication feeds that Zillow and Realtor.com use. (Although, it’s not clear that Realtor.com uses the normal syndication feed, due to the Special Relationship with NAR… but what Redfin wants is this link-back, authorship, and canonical source info required for everybody.)

But let’s assume that we’re talking about modifying the syndication feed, not the on-its-face-useless modification of IDX. Then what?

Talking SEO in the Age of Mobile

Even if the industry were to somehow convince every MLS, all brokers, all franchises, etc. to require the portals link back to the listing broker, it isn’t all that clear how much of an impact that would have. Why?

Because we’re talking about Google juice and SEO in an age where mobile is becoming more and more important. And the whole “mobile web” vs “mobile apps” debate appears to be more or less settled in 2017, doesn’t it?

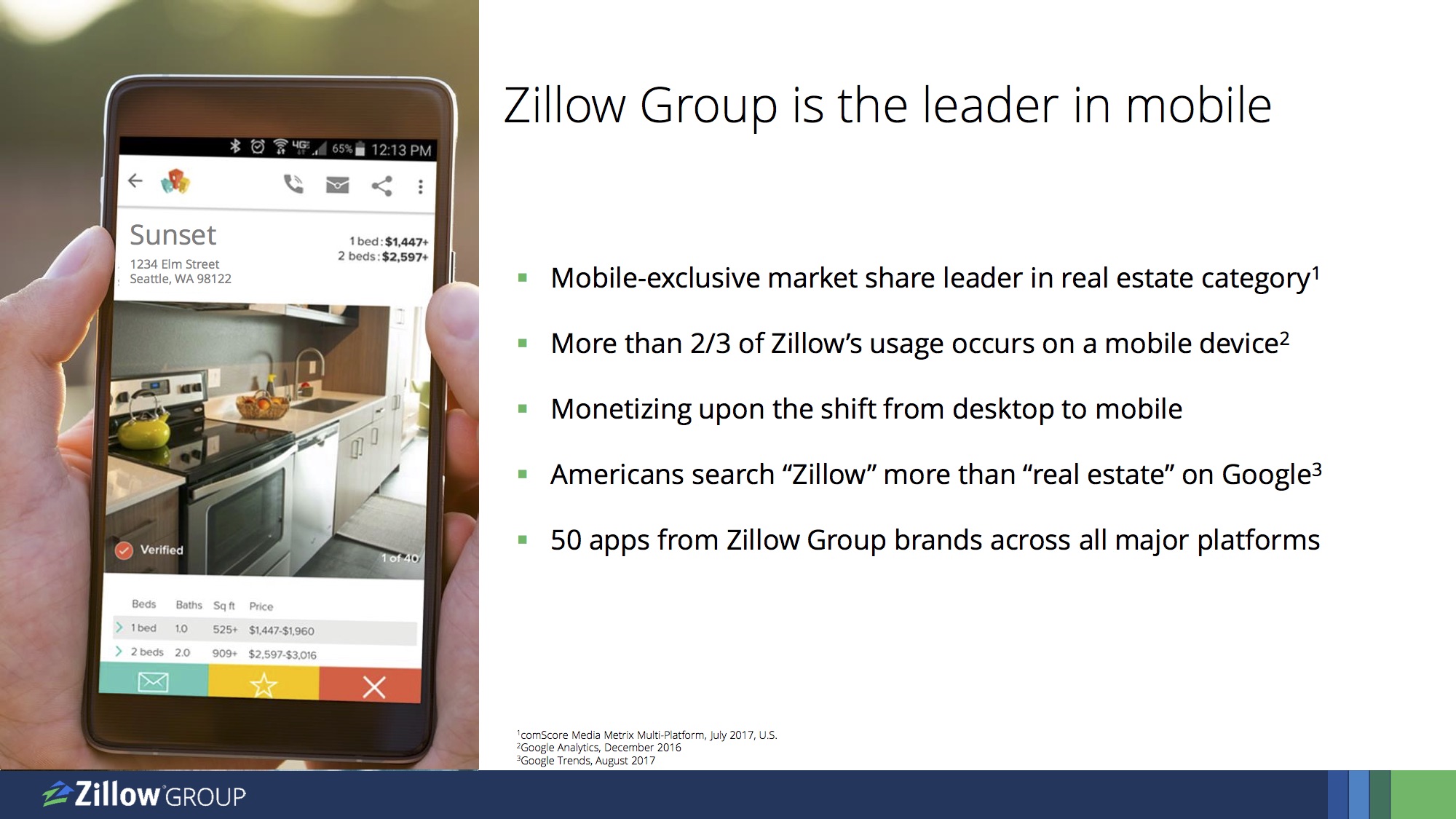

Consider this: in the latest Q3/2017 Investor Presentation, Zillow revealed that more than 2/3 of its usage comes from mobile devices.

And as you can see from that slide, people search for “Zillow” more than they do for “real estate” keyword.

So precisely when Zillow is busy monetizing the shift from desktop web to mobile, and has 50 mobile apps across major platforms, the real estate industry is talking about SEO and Google juice. Even though the Zillow brand is stronger in the consumer’s mind than the generic “real estate.”

If that’s not fighting the last war, I don’t know what is.

The proposal from Redfin and WAV Group might have been all kinds of interesting in say… 2007. In 2017? Not so much.

The Problem Can’t Be Solved with Traffic

But let’s go a step further.

It isn’t as if SEO/SEM is totally unimportant in 2017. Mobile is taking over, but Google is still very important. So sure, requiring link-back, authorship, canonical URL, etc. etc. might help. Let’s even assume that by some sequence of events that brokerages start driving massive traffic to their websites and that they build mobile apps that don’t get crappy reviews from consumers. So brokerages everywhere start getting huge amounts of traffic.

That doesn’t solve the problem of brokerages in 2017.

The core problem of brokerages in 2017 is that they are no longer in the real estate business, but in the recruiting and retention business. And their offerings to agents are undifferentiated commodities (except for a few small boutique shops).

The consequence of that is something we all have known for decades: brokerages make less money from productive agents than they do from not-so-productive agents. In many cases, brokerages actually lose money on the producers, and try to make it up from the new, inexperienced, high-split agents.

If that weren’t enough of a problem, we have new competitors who leverage technology to offer 100% commission, transaction-fee only brokerages to productive agents everywhere. (And before them, the capped-commission, profit-sharing model of Keller Williams.) The fastest growing companies in real estate today are all low-cost models: Realty One, HomeSmart, Charles Rutenberg, Keller Williams, NextHome, and on and on.

How in the world does more traffic to the brokerage website help that core problem?

Especially when in 2017, producing agents are forming agent teams to make sure that they monetize buyer leads from their listings, not the brokerage…. I’m trying to imagine the brokerage trying to tell its listing agents that they have to pay a 30% override on buyer leads that came off of their own listings. If you can see it happening, then you have a far better imagination than I do.

Where brokerages could get some traction might be helping their agents do the non-web, non-mobile lead generation: sphere communication and geographic farming. Maybe they could do something with predictive analytics as my friend Andrew Flachner of RealScout seems to believe. Maybe they can investigate business models that actually solve their problem. But of course, those are hard to do. Mucking around with IDX policy or syndication feeds does absolutely zero for those things, but at least it’s easy to do.

Until brokerages solve the problem of agent-centric recruit-and-retain business models, nothing else much matters. That’s the next war, today’s problem, not the last war and yesterday’s problems.

So… Why This Proposal? Why Now?

Given all of the above, one might ask why Glenn Kelman is pushing this proposal so hard. I mean, he’s one of the smartest guys in not just in the real estate industry, but in the technology industry as well. The guy just took a brokerage with less than 1% market share public, and that company is now worth $2.2 billion (as of this writing). He understands technology, and specifically understands SEO/SEM, Google-fu, and all of that better than pretty much all of us.

So what gives?

Obviously, I don’t know, because I haven’t spoken to the man. But I can speculate.

Seems to me that Glenn knows that he has solved the core problem of brokerage, because Redfin doesn’t do recruit-and-retain and worry about agent splits. They hire agents as employees. Consequently, they make more money from producing agents and less money from non-producers.

And it is clear that Redfin’s revenue growth is directly tied to its traffic growth. So for Glenn, the real competition isn’t some random brokerage website. As Victor Lund pointed out in his post, Redfin’s traffic is two or three times larger than its closest brokerage/franchise competitor’s. Glenn’s not worried about Coldwell Banker overtaking him; he’s worried about making up ground vs. his real competition: Zillow and Realtor.com. He’s not going to catch Zillow anytime soon, but Realtor.com is within striking distance.

Should whatever policy come about that brings Google juice back to the listing agent and listing broker, Glenn knows that he can take advantage of that far better than any of his brokerage/franchise competitors. Think about it. How many SEO experts work at Redfin? How many work at brokerages and franchisors? Glenn spent $35 million on technology last year, and that wasn’t with a constellation of vendors; how much did HomeServices of America spend on technology in-house? What about the thousands upon thousands of brokerages who aren’t giant corporations? What would they do with all this wonderful Google juice, except maybe call some SEO vendor who’s doing the exact same thing for all of his clients?

I have to admit that the strategy is absolutely brilliant: convince a whole lot of brokers and agents to give a leg-up to Redfin’s traffic growth strategy, while harming its principal competitors. I’m just not as sure why they would go along with it. What’s in it for them?

More traffic that doesn’t solve their problem? I guess….

Likely to be Popular

Given my past experience, I suspect that the “Modernize IDX” thing is going to be pretty popular in the industry. Because it’s easy, it sounds sexy-techie, and it allows all kinds of folks to vent their hatred of all things Zillow.

But what’s right is rarely what is popular.

What’s right is to look at the real problems of brokerage and think of solutions to those. Sorry to be a party pooper, a debbie downer, a nattering nabob of negativity, but fighting over SEO and IDX is not it.

-rsh

28 thoughts on “Please Stop Fighting the Last War”

And so my recommendation to the industry Rob. All those that continue to play the broken record of “data that has left the barn” and “the loss of global dominance and control in real estate because of Zillow” need to do this now. Write a book entitled, “What happened” and all of you go on a giant nationwide book tour. And the result? Not one consumer will show up – as in none – and other than possibly some portion of the 1.2 million Realtors – not one book will be sold. And I can assure you that this book will not even get an honorable mention on the NYT Best Sellers list. Why? Because as you have stated what this industry has “looked back at” and whined about for years has become a real value for those people we serve that want to get massive exposure in order to sell their properties. Get with it, look forward, think “consumer centric” or those same homeowners will find a way to love to work with the things that we seem to hate so much. And then my friends, if that ever happens, it gets really interesting.

I’m so busy I didn’t really have time to read the article, but so interested I forced myself to run through it as fast as I could in about three minutes. I don’t know what Redfin does, but if they’re another national real estate site screw them along with Zillow, Trulia and Realtor.com.

1.) Yes, Redfin’s idea does seem like fighting the last war. But during that last war we lost the singlemost proprietary piece of intellectual property we own – the data. It is necessary to fight the last war again to take the data back. Realtor.com and Zillow.com (or any other national threat) need to be forbidden any syndication of that data. You don’t see Zillow leaking their data to people. It was a stupid thing to have ever let the data out. It needs to be brought back in. All organizations have the right in the USA to protect the intellectual property they own that makes them profitable.

2.) It’s not about traffic. It’s about the data. Sure, seo is good, traffic is good, but content is king. Customers are looking for great websites/apps as secondary. What they’re looking for first and foremost is DATA – they want to see the houses for sale. I’ll visit a crappy local brokerage website that has the freshest listings and all the homes for sale long before I would a fancy site with stale or scant data. Local boards need to restrict syndication of data to local participants only. No syndication of data to any non-participant that is not conducting business in the jurisdiction of the local board.

Before you say I’m wrong, let me show you where it’s working. Do a search for homes on Toledo Bend Lake in Louisiana on both Zillow and Realtor. You’ll see a lot of listings, but you won’t see all of them. No sir. To see what’s for sale you’re going to need to search on Google for Toledo Bend real estate Louisiana. When that comes up you’re going to see a how of local broker website that have some really good listings that in many cases can’t be found anywhere else. Two such examples are:

http://www.lbrooksrealestate.com

http://www.bodowdenrealty.com

I would venture to say that the two website above are what everybody is referring to when we say “crappy websites”. But they do have the one thing everybody is looking for – data! They have property listings that can’t be found anywhere else. If you aren’t looking on these sites then you aren’t seeing all the properties for sale.

Realtors need to learn from these aforementioned successful licensed real estate agents, who are not Realtors. Take the damn data back.

Sigh.

Here, read this: https://notoriousrob.com/2013/05/words-matter-the-case-against-listing-data/

It’s not data; never was, never will be.

“It is necessary to fight the last war again to take the data back. Realtor.com and Zillow.com (or any other national threat) need to be forbidden any syndication of that data.”

The data is out of the bag. There’s no putting it back. An agent’s JOB is to sell the home. Period. Sellers expect their homes to be advertised everywhere buyers might see it. I still have never heard an argument I understand to a seller as to why their home should not be on Zillow, Trulia, etc.

“You don’t see Zillow leaking their data to people.”

I managed the Zillow API program from 2007-2010 — and I can say with certainty we wanted our data (and brand) distributed wide and far. My job existed to do exactly that. The amount of data Zillow releases is stil considerable, they just take a smart strategic approach (such as the fact that partner sites can’t use Zestimates in mobile apps, but websites can)

“It was a stupid thing to have ever let the data out. It needs to be brought back in. All organizations have the right in the USA to protect the intellectual property they own that makes them profitable.”

Home owners own the “data”. Not agents.

Thank you fr the reply. I was beginning to think I wasn’t going to get any engagement. What if local boards forbid to syndicate data to Zillow from this point forward? Zillow wouldn’t have all the homes for sale, and people would figure that out pretty quick, would they not?

If I’m not mistake brokers own the data, not homeowners.

“What if local boards forbid to syndicate data to Zillow from this point forward? Zillow wouldn’t have all the homes for sale, and people would figure that out pretty quick, would they not?”

Zillow would still have listings – just not as many – because they have the buyers. Many (most) agents want their listings on any website buyers are using to find homes for sale — and would give Zillow listings manually. Keep in mind, Zillow is not irrelevant without listings. They (we at the time) had 4 million monthly visitors without a single listing on the site.

“If I’m not mistake brokers own the data, not homeowners.”

Technically, maybe that’s true. But think about it practically. Have you told a seller you own the data about their home? What would/do they tell you? Do you really think telling a seller “I’m not going to syndicate your listing to Zillow because I’m tired of them charging me for inquires from buyers?” is going to go over well?

Yanking listings wouldn’t honestly have much of an impact on Z’s SEO.

See my article here from a couple years ago: http://geekestateblog.com/what-would-happen-if-the-industry-yanked-all-their-listings/

Thanks again for the engagement. I read your article, and I agree with much of you said would happen. In fact what you described would happen is exactly what I wish would happen.

I think to extrapolate your prediction, Zillow would eventually fall off the map and become an unimportant website. Local boards would once again have something that is proprietary and profitable. They would once again have something that people want. I also think that the number of successful fsbo listings would decrease.

“Local boards would once again have something that is proprietary and profitable. They would once again have something that people want. I also think that the number of successful fsbo listings would decrease.”

Why should local boards have something profitable? Why should successful fsbo listings decrease? Please, don’t tell me “agents/local boards deserve to make money” (or anything of the sort). “Deserve” doesn’t have a place in the english language if you ask me.. http://www.drewmeyersinsights.com/2012/06/22/we-deserve-it/

Interesting thoughts. One thought I have about this – you say “What’s in it for them?/ More traffic that doesn’t solve their problem?” But if the traditional broker’s problem is recruiting and retaining agents, how does more traffic/leads NOT help solve that problem? Imagine a traditional brokerage that got as much traffic and lead flow as Redfin. I think recruiting and retention, for them, would be a whole lot easier.

I think you misread what the traditional broker’s problem is…

Hi Rob. Your words exactly: “The core problem of brokerages in 2017 is that they are no longer in the real estate business, but in the recruiting and retention business. And their offerings to agents are undifferentiated commodities (except for a few small boutique shops).”

My only comment is what’s to say they can’t differentiate by offering their agents a consumer-facing platform that competes with Redfin?

Sorry if I’m not understanding the point. I’ll admit I was interrupted a few times while reading this so go back and see what I missed.

Hi Eileen,

Now that I’m back on laptop, instead of mobile phone, longer response. It’s the NEXT few paragraphs you want, specifically:

The consequence of that is something we all have known for decades: brokerages make less money from productive agents than they do from not-so-productive agents. In many cases, brokerages actually lose money on the producers, and try to make it up from the new, inexperienced, high-split agents.

and

Especially when in 2017, producing agents are forming agent teams to make sure that they monetize buyer leads from their listings, not the brokerage…. I’m trying to imagine the brokerage trying to tell its listing agents that they have to pay a 30% override on buyer leads that came off of their own listings. If you can see it happening, then you have a far better imagination than I do.

The issue is that brokerages, being in the recruiting and retention business, are having their businesses eaten out from within by agent teams. Since they produce no listings of their own, all this “my own data” business is hand-waving; only listing agents produce listings. Those agents are not likely to allow the brokerage to monetize leads from those, seeing as how they all have their own buyer agents on their own teams.

Sure, having all the traffic lets brokerages recruit agents, until that agent becomes really productive, starts generating listings, then forms a team. Then brokerages start losing money on those, so have to go recruit more, less productive, newer, less experienced agents who can be on higher splits.

None of this IDX, “MY PRECIOUS DATAAAA!” and Zillow Hate solves the core problem of brokerages. But it lets people blame someone else for having 3% profit margins (or less).

Rob, all the huff and puff about the last war misses a fundamental fact: IDX is an agreeement between brokerages to display each other’s listings AND give attribution to the listing broker. How that attribution is done is dependent on which MLS(s) you subscribe to, which IDX vendor you use, and your own sense of fairness to the “co-opetition”. In order to get your competitors listings to show on your website, you have to tip your hat to their ownership of the listing content. Can’t get around that.

Redfin and Victor Lund are pushing the requirement that there be a “direct link” back to the listing broker on every IDX display. This IS a “next war” approach–getting no only exposure for your product, but forcing your competition to send the consumers they generate directly to the listing broker. It’s a win of epic proportion in their minds if they pull it off, because they get more leads. But they’re not likely to pull it off. And they should be careful what they wish for.

No broker is likely to give their hard-won consumer eyeballs to a competitor just because that competitor’s content was the eye-candy that captured the imagination of the consumer. The competition is getting free exposure, why do they need more? And if Redfin was successful in getting such a policy passed, it could quickly unravel the WNTIRE IDX scheme (“you can’t make me send my consumers to THEM”), which would leave only the aggregators as the source of complete listing data. Oops…

IDX is a delicate balancing act, much like the MLSs. Competitors find a mutual business interest, create a mechanism by which mutual benefit is achieved (while preserving stiff competition), and the consumer is well served. Too much self interest from any one corner can cause the balance to shift, perhaps in minor ways, perhaps in catastrophic ones. Is ending IDX and creating hundreds of thousands of websites with just a little content worth the fight for a direct link rather than just attribution? I wonder.

Winning the next war may be a win, but if the earth has been scorched beyond use, what’s the point?

Now where’s that whiskey?

Hi Rob. Gotcha. And I completely understand your point. I suppose the way I look at it is if the brokerage can provide enough value (whether it be in web traffic, leads, or some other form), the brokerage holds the bargaining chip with the top producers again, and the consequence that you outline below, is diminished. What if that top producer on a 95% split had a good enough reason to drop to a 90 or 85% split again?

Let’s flip it and reverse it. What if Redfin did a complete 180 and dropped their W2 based model and started hiring contractors, but at a slightly lower “top producer split” than the other traditional brokerages like KW, CB, etc? Do you think some of the top teams in the country would consider moving to Redfin given their backend tools and web dominance?

Hi Eileen,

Yes, IF the brokerage can provide enough value, then maybe they can negotiate a better split. As I mentioned, there may be a role in using sphere or geographic farming or data mining or something to do just that. But internet leads is not that thing.

As for Redfin, I don’t know — maybe top producers would want to join Redfin on a better (70/30?) splits just to have access to the tools and leads, but I don’t think so. Plus, Redfin would happily put them on as Partner Agents but not as one of their own. They understand the power of having employee agents; it’s a real advantage. Why would they give that up?

I agree with Rick Harris – this is the next…and last war. Once the consumer gets linked back to the listing agent, we will be charging $1,000 or less for the listing side just to get the most listings and exposure. It will help to turn the business into single agency or a transactional service, which Redfin would love. Scorched earth indeed – it will commoditize the real estate business once and for all, and Amazon will walk in and clean up.

Hi Rick, Jim –

I’m not sure what you guys are saying. Are you saying that Redfin’s plan destroys IDX, and that’s bad because… ???

And I’m not sure if you guys understand/agree what the next war is. I said: “Until brokerages solve the problem of agent-centric recruit-and-retain business models, nothing else much matters. That’s the next war, today’s problem, not the last war and yesterday’s problems.”

I just don’t get how IDX link-back vs. attribution or whatever affects THAT problem in the least bit.

OK, hang with me.

I know it seems like the next war is brokerages solving the recruitment model, but that war is only temporary. The big-box companies have done nothing to lead the industry, be innovative, or even separate themselves from the rest of the pack. They just collect their checks from the new agents who stumble in. It is a death sentence.

Why? Because from now on, agents are going to have to prove why they deserve the business. Or else Redfin will win, because they have the best website.

Once an agent can prove they are better than Redfin, they don’t need the big-box brokerages to lean on. Because the big-box brokers are lazy and won’t step up to the microphone to differentiate their brand from the rest, their good agents will flee to the 100% shops because they are left to fight the prove-it-to-the-consumer battles by themselves.

The IDX evolution could be the trojan horse. I thought the same thing about Zillow’s Premier Agents, with them being the only agent advertised on their listings, but buyer agents still exist today. But how much longer nobody knows.

Short-sighted brokerages will jump at the chance to have an IDX link back to their listing agents, or back to the up desk because they might think it could be a recruiting tool. But once it is out of the box, the broker cooperation system which we have enjoyed for the last 60-80 years will be over, and it will be dog eat dog, just like the commercial brokers who will cooperate with an outside agent only if they can’t sell their listings to any of their own buyers.

We are already further down this road than most people realize. The ‘coming soons’ and the ‘sold before processing’ listings that the listing agents don’t think twice about publicizing everywhere – including the inputting into the MLS after the fact – even though they are the antithesis of broker cooperation.

Agents have signed an Association of Realtors agreement to share their listing with all agents on the MLS, but the minute they have a hot one, they sandbag it to their friends first. It is well known that new listings are shopped around the listing office before MLS input, and managers encourage off-market deals.

It will be the death of us. Our own desperation will kill us, and kill the broker cooperation which has served agents and consumers so well.

Thanks for the detailed comment, Jim. This is good stuff, and the kind of discussion that Notorious exists to encourage. A few thoughts in response.

First, Redfin isn’t going to win because it has the best website. It’s going to win because it has solved the recruit-and-retain problem and can deliver a CONSISTENT consumer experience., aided by its technology. It’s the same reason that agent teams are killing it: consistent consumer experience, due to their tight control over the team.

Second, that agents are fleeing to 100% brokerages is a fact. The fastest growing companies are not NRT and HomeServices; it’s RealtyOne and HomeSmart and others like them. For the reason you mentioned.

Where I differ with you slightly is that changing IDX (and therefore killing it off) is going to end broker cooperation. I rather think the fact of incompetence among Realtor ranks (that’s not me being an asshole; that’s NAR’s DANGER Report conclusion A1) is what’s going to end broker cooperation.

And that mass incompetence has, at its core, the problem of brokerages being forced into the recruit-and-retain and headcount-at-all-costs models, thanks to the financial incentives that have been set up.

That’s not a temporary problem. That’s the next big war.

Just to confirm that I’m reading it right, your next big war is this: Until brokerages solve the problem of agent-centric recruit-and-retain business models, nothing else much matters.

I don’t think that the big-box brokerages will ever solve this problem. As a result, they will go out of business.

Don’t expect me to feel sorry for them. In fact, I can’t wait for it to happen.

Here’s what the big-box brokerages do to our business:

1. Keep hiring marginal agents, and refuse to give them ample training to be good agents. Of course, their incentive is to keep their agents less productive, so they make better commission splits off them.

2. They allow unethical practices by encouraging in-house deals prior to MLS input. It is so bad that most agents don’t think it’s unethical to deprive their seller of open-market exposure.

3. They never provide any public leadership for the industry, or push N.A.R. to lead us. They are lazy – it’s been too easy for management to take their 3% margins and go home to their martini every night.

4. They still do nothing to stop outsiders from raiding our industry.

5. The MLS is a disaster. It is 2017 and we don’t have a national MLS paired with a fantastic public portal? Not only do we not have it, we’re not going to have it either – Zillow and others are too far ahead for us to catch up now.

The big-box brokerages don’t care about agents, or our future. They have been bamboozling their agents and customers into thinking that their brand name brings value, but slowly we are all getting to see behind the curtain.

Some of the most unethical acts that I’ve seen have been perpetrated by agents who work at brand-name brokerages. Consumers probably have a preconception that going with a big name would prevent that – but it is the opposite. Unethical agents can hide out under the big name, and management needs the money so they look the other way.

Their in-house escrow, title, and mortgage companies suck too. Why? Because management can’t/won’t spend the right money, and instead operates with over-worked, under-paid staff.

For the record, I’ve been a realtor since 1984, and have operated as an independent broker since 2003. I’ve never recruited an agent, I just sell houses.

I don’t want to hijack your whole thread here, but your belief that anybody in real estate can deliver a consistent consumer experience needs to be examined. It may look consistent to those looking in from the outside – to guys like Glenn looking at their spreadsheets – but on the street it is wildly inconsistent.

ROB, IDX is the architect of Z, R.com, Redfin and MANY of the successful agent-centric businesses because of the massive lead generation that comes from aggregating listing content and widely distributing it. Killing IDX leaves ONLY the portals in charge of broad spectrum lead gen (since they have built other pipelines to aggregate), and as Jim says, will be the death of the rest of us. No consumer wants to go to hundreds of sites to find all the listing inventory. Without IDX, that’s what they’d have to do. Really, if you would get out of the ivory tower and get on the ground to watch it work, you would see it.

IDX is not a “bad thing”–it’s the goose (or black swan) that laid the golden egg. If it goes, so goes the egg. This isn’t theoretical. It’s everyday.

IDX is going to die, no matter how you look at it. At least the “IDX software vendor industry” is going to see mass casualties imho — it’s simply too expensive to compete for traffic acquisition. Eventually agents will realize it’s a total waste of money to keep paying for a fancy (or not fancy) search experience that no one uses.

“The consequence of that is something we all have known for decades: brokerages make less money from productive agents than they do from not-so-productive agents. In many cases, brokerages actually lose money on the producers, and try to make it up from the new, inexperienced, high-split agents.”

While I can neither confirm or deny if this is true today, I also have not seen any independent study this is true on a widespread basis AS IT IS PRESENTED by large brokerages and now woven into the fabric of the conversation about compensation.

Yes, on a PER TRANSACTION basis a brokerage makes less on a top producer. However, with volume comes savings and the ability to support a business structure with a variety of revenue sources and level of production from independent contractors.

Brokerages necessarily want this to be the mantra and the belief at the agent level. It creates the impression high production increases the importance of these brokers and rewards both their ego and their pocketbook.

It sets a standard for less productive agents to strive for.

Just these points, let alone the many others to be made, seem to fly in the face of this assumption when you examine the out come.

Why, if brokerages are being killed by teams and high splits, do brokerages actively encourage and support this trend if it is not, at the end of the day, rewarding financially?

Perhaps this is more myth than fact?

Here’s the thing: people lie, but numbers do not. (Statistics do, but those aren’t real numbers anyhow….)

The two numbers that matter are Company Dollar and Net Profit Margin. Since nobody publishes those on a regular basis (except Realogy and now Redfin), it’s hard to know what’s what. But I’ve looked at quite a few brokerage P&L statements, and it’s shocking.

Let me give you one real, but anonymous (for obvious reasons), example:

A brokerage with 40 agents, doing $194 million in closed volume, $4.86 million in GCI revenues, ends up with 875K company dollar (18% gross margin). After all expenses, it has Net Income of 30K. That’s 0.6% of revenues, or 3.5% of company dollar.

How in the world is that a sustainable business? The typical agent team, in the meantime, is at about 25% profit margin — that’s Net Income, after all the splits and expenses, to the team owner.

As for the fact that brokerages lose money on the top agents and make it up with new and inexperienced high-split agents… that’s not me saying that, or some random broker getting up at Inman and saying that. That’s Richard Smith of Realogy saying it on an earnings call with Wall Street — misrepresentation there carries jail terms, so I don’t think he’s BS’ing anybody. (Not that he would, because Richard is the straightest shooter out there.)

Why do brokerage actively encourage and support teams? Because they have to if they’re going to stay in the recruit & retention game. And the hope is that the agent teams will drive at least some leads over to affiliated businesses of mortgage, title, and escrow, which is where the “brokerage” makes all of its money.

You don’t have to believe me. Go ask the brokers in your market to see if it’s myth or fact. Ask them what their profit margin is on brokerage (not on affiliated businesses, but on brokerage).

Rick –

IDX is not the architect of Z, R.com, Redfin, etc. It’s the other way around. R.com is the architect (or at least the motivation) behind IDX.

Brian Larson, the Father of IDX, wrote up some history on it here: http://www.larsonskinner.com/2009/07/search-engines-idx-part-vi-purpose-of-idx-and-broker-expectations.html

Note that HomeStore (later Move) was already working with NAR in the early/mid-90s and the whole issue of listings on the internet was already being dominated by third party aggregators.

And Rick, what ivory tower am I stuck in? I’m not advocating the end of IDX, nor am I promoting the IDX “link-back” as Victor Lund and Redfin are. I rather think the “modernize IDX” thing is a trojan horse, as should be obvious.

My point was, and remains, that IDX does not solve the problem of brokerages. More web traffic does not solve the problem of brokerages.

I mean, you’re a broker of a CB franchise in Ashland — though with only 8 agents, and you yourself still selling (it appears from your website) you might be more like an agent team but still… — are you saying that traditional brokerages across the country are not dealing with margin pressure, effect of agent teams, endless recruit-and-retain cycles, etc. etc.?

As I said to Jim Klinge above, a company with 0.6% profit margin is not a sustainable business. How is more web traffic going to change that, especially since your listing agents are not going to look kindly on your sending buyer leads from their listings to some other agent in the office (if said listing agents have a team of buyer agents under them)?

That also is not theoretical; that’s everyday. Brokerages are hurting, and we’re fighting the last war instead of looking to solve their real problems.

Comments are closed.