[Note: I advised Zillow on its communication plan for rolling out the program I discuss herein. I do not have an ongoing relationship with Zillow.]

I assume that by now anybody who is reading Notorious is aware of the big announcement from Zillow:

Zillow Group, Inc. (NASDAQ:Z) (NASDAQ:ZG), which houses a portfolio of the largest and most vibrant real estate and home-related brands on mobile and the web, will expand Zillow Instant Offers™ to Phoenix this month. With this expansion, Zillow® plans to participate in the marketplace, buying and selling homes with Premier Agent® partners in the Phoenix and Las Vegas markets.

I further assume that you’ve seen Inman’s coverage of it, the various videos put out by Zillow (which I can’t embed here, so just find them here on Inman), and the reactions from the industry.

You don’t come to Notorious to find regurgitations of what everybody else is saying. Since I am writing about Zillow, presumably I have something to say that hasn’t been said yet. Well, I hope not to disappoint you.

There are indeed some things to note about this zBuyer program that I think are profoundly interesting. Let’s get into them.

Something Feels Different This Time

The first observation is that the reaction from the real estate industry feels different this time.

Remember when Zillow first launched Instant Offers? The reaction then was fast and furious. I have to imagine Jay Thompson earned combat pay during those couple of weeks.

A few typical comments from that time:

“By the comments I’ve read today, I would say the response is a big middle finger.”

“I agree with Roland in that Zillow seems to want to bite the hand that feeds them.”

“Zillow has a right to run their business they way they want to, and so do I. Zillow has already built their business by using our listings. My response? BOYCOTT ZILLOW. They aint gonna get a dollar of advertising money out of me.”

“Zillow disgusts me. Every agent should stop buying leads now. Where is our protection from state regulators and our real estate boards who take our money every year???? Oh wait they are the ones Zillow pays for the info.. They are in on the cash train. Makes me sick. We need to come together and create our own portals. Time to unite.”

And of course, we all remember the Stop Zillow movement, which has over 5,500 Likes on its Facebook page, and raised over $320K. Granted, $320K is probably less than what Zillow spends on fresh fruit, LaCroix waters and free lunch Fridays at its headquarters, but still… it’s kinda sorta impressive.

This time around? Crickets (comparatively speaking).

Sure you do see a few Zaterade drinkers come out with the same-old-same-old. But they would boycott Starbucks if Zillow bought Starbucks, so… it’s kind of difficult to take them seriously.

Instead, we see responses like these:

“This is really interesting. There are going to be a lot of opinions on this, but as an agent, think about this… in some cases here, ZILLOW would be your buyer and/or seller client. That’s a client with a very large pocketbook, the ability to invest necessary $ to get the property to sellable quality, the ability to close on the buy side, and no emotional ties to the property. Depending on the commission structure, it seems like a possible slam dunk for Premier Agents.”

“I readily concede this is a space that can have big gains, for both Zillow as well as the agents representing Zillow and/or the sellers, it is a commodity style model that could go either way with downturns etc. I’m a fan of their innovation.”

“I don’t see too much of a downside to this for agents or Zillow. The point is that this activity is already going on and investors are nabbing these properties, rehabing/flipping for a profit and agents are barely involved and when they are they take significant commission hits. Zillow is now becoming the investor so they make money while feeding the buyer and seller commissions to their premier agents so they get more out of their advertising spend. Zillow is going to be using premier agents (I’m thinking they probably have some qualifiers) to buy and sell homes as an investor. What am I missing? I think it’s great, I’d rather get more for my advertising spend. I hope I can be a part of the early testing on it because I LOVE rehabing homes- spreadsheets of cost estimates, what to do with the properties for highest gains for sellers while satisfying buyers’ needs too. #allgoodIMHO”

Maybe it’s just me and I don’t hang out in places where the fires are raging, but I’m just not getting the sense of outrage and anger and fury that I’ve seen in the past.

One of three things are happening here:

- The real estate industry has accepted Zillow as a natural part of the ecosystem;

- The industry hasn’t accepted Zillow per se, but they’re freaked out by Opendoor, Offerpad, Knock, and the other iBuyer companies and Zillow is the lesser evil;

- The angry mob is spent from having bashed on NAR over #Logogate just days before the Zillow announcement.

I’m not sure I’d go so far as #1; there’s still plenty of suspicion and distrust and hatred of Zillow. #2 and #3 are possible explanations.

But therein lies the fascinating transformation of Zillow and of the industry.

Zillow, NAR and the Industry

The logic here might be a bit hard to follow, so I’ll go step by step.

For over a hundred years, NAR has more or less represented the industry. It has a video series called Voice for Real Estate. It lobbies the federal government on behalf of the real estate industry, while its state and local affiliates lobby the statehouse and the local government respectively. NAR makes policies that govern all sorts of things, from the local MLS to standards of practice.

In more recent years, NAR’s mission statement has been:

The core purpose of the National Association of REALTORS® is to help its members become more profitable and successful.

With the selection of Bob Goldberg as CEO, that mission statement was elevated, with Goldberg saying that it isn’t National Association of REALTORS but the National Association for REALTORS. I took issue with that, as longtime readers know.

Nonetheless, NAR has recently come out with the S.M.A.R.T. Initiatives (which comes with a $30 dues increase, mind you). One of its key goals is:

- Ensure the role of the REALTOR® is essential to the consumer

Bob Goldberg has said time and again that he wants to keep the REALTOR at the center of the real estate transaction. So one would expect to see some kind of an initiative that does just that. Well, REALTORS will get zipForms and zipTMS (for $7.5 million a year, collectively); if you recall, I had some questions about all of that.

You could make some kind of an argument, that requires writing semi-fictional narrative, about how giving REALTORS zipForms (which most of them already have through local/state Association or MLS) and a transaction management platform (which most of them already have, or can purchase easily in the open market) keeps them “essential to the consumer.” It’ll be difficult to convince me — or anybody else with functioning rational thought processes — but you could make the argument.

In contrast, you have Zillow making one of the biggest announcements in its history, in which they leave behind their media roots and become an active participant in the real estate market. In the video interview with Inman, Errol Samuelson, Zillow’s Chief Industry Development Officer, says:

The key difference between what we’re doing and what most iBuyers are doing is, we’re keeping the agent and the brokerage community central to the transaction.

Huh. Sounds familiar, doesn’t it?

Except that Zillow is actually going to keep the agent and the broker in the middle of the iBuyer transaction, paying “full traditional commissions” (Errol’s words, not mine) on both ends of the deal. From the Inman article:

Samuelson told Inman. “Now, in the event that the homeseller decides they wish to go for the instant offer, we’ll be working with a local agent at a local brokerage in the market to represent us as the buyer of the home and we will also recommend that the seller work with the local agent,” Samuelson added. “In fact, we’ll introduce the seller to one of our Premier Agent customers.”

Represent us as the buyer, and recommend to the seller that he work with a local Zillow Premier Agent — that sounds like actually doing something that does in fact keep the agent essential to the consumer. When selling, Zillow will use a local Premier Agent to list the property, put it in the MLS, all that jazz, and again, likely recommend that the buyer use a local Zillow Premier Agent to represent them. That sounds like four transaction sides to me.

Sure, all of those involve Zillow Premier Agents — the guys and gals happily writing big checks to Zillow. Oh noes! The GREED!!!! But last I checked, Zillow isn’t running a charity, and not a single broker was operating a nonprofit 501(c)(3) either.

I mentioned that I advised Zillow on the communication rollout plan, and with their consent, I am free to tell you some of my experience with that.

At least the men and women I worked with were and are genuine in their desire to protect brokers and agents from what they see as the potential automated future of unnamed competitors, including one whose name may or may not rhyme with Deadspin. Maybe there are Zillow executives in back rooms rubbin’ up their mittens for the future in which they get rid of all real estate agents (who generate 70% of Zillow’s revenues, but still!). If so, they kept those people far away from me.

“How do we keep the agent central to the transaction” was a frequent theme and concern. Now, again, take it for granted that the unspoken second part of that is, “…so they can continue to pay us,” but like I said, ain’t nobody running nonprofit brokerages in real estate I know of.

Take it, leave it, tell me to shove it — but that’s what I saw and heard. Zillow really wants to keep cash money flowing to brokers and agents… even if they have to be paying one half of that money flow in 10% of the cases.

Raising the Bar, One Premier Agent At a Time

The other angle to the zBuyer program is one I haven’t seen anywhere else just yet.

Back in 2015, I wrote a post called The Future of Real Estate, According to Zillow. In it, I noted that Spencer Rascoff, Zillow’s CEO, said some very interesting things during the Q2/2015 earnings call. I then wrote that the long game for Zillow, and the future of real estate, is concentration of power:

Zillow has read the tea leaves and has decided to bet the farm on the top 5-10-15% of the producing agents, who have no trouble spending $5,000 per month on Zillow because they have the systems, staff, technology, and the expertise to turn that $5,000 investment into $50,000 in income. The rest of the industry — franchises, brokerages, Associations, MLSs — continue to try and preserve headcount-based business models.

When the entire economic model of real estate is a zero-sum game, where the number of homes sold and the prices of those homes have nothing to do with the industry and everything to do with macroeconomic factors that no one (besides maybe the Federal Reserve) controls… productivity gains for the Best of the Best have to come from somewhere.

For all the Raise the Bar hoopla of the real estate industry over the past decade or so, maybe it’ll ultimately be Zillow that does it for us, over our objections, over much weeping and gnashing of teeth, as the bottom 60-70% of the agent population find themselves completely locked out of the Top Producing Agents Club because they can’t afford the investment it will take to compete with the big boys and big girls. [Emphasis added]

Think about Zillow’s incentives for a moment here.

As a media company, Zillow is happy to sell advertising to anybody who can write a check. Sure, they’ll focus on the top 5-15% of the agents who can afford to write $5,000/mo checks, and of course Zillow would love to have those advertisers see 10X ROI so they keep writing big checks to Zillow. But really, at the end of the day, whether those agents convert those leads or not doesn’t matter to Zillow. Whether the Premier Agent is a top notch solid gold pro or a part-timer with too much money on her hands, Zillow does not care as long as the check doesn’t bounce.

That incentive changes completely once Zillow is an actual participant in the deal.

Zillow thinks that it will have purchased 300-1,000 homes in the Instant Offers markets of Orlando, Phoenix and Las Vegas by the end of 2018. The median price of listed homes across all three markets is $275K. That means Zillow has as much as $275 million in inventory risk, as well as enormous upside if they can buy at $260K and sell at $290K.

Now, Zillow cares very much whether the Premier Agent they are using to buy and sell those properties actually gets shit done or not. The risk isn’t only on the Premier Agent as the advertiser; in fact, Zillow has most of the risk now as the homebuyer and as the homeseller.

I’m willing to bet that Zillow will be picking and choosing very carefully who gets to represent them either on the buy side or the listing side. I’m certain that they will look at factors way beyond “how much is she spending on Zillow?” because they simply can’t take that risk.

In fact, I’m willing to bet that Arik Prawer, the new Chief Business Development Officer, might butt heads with Greg Schwartz, who oversees Premier Agent program, from time to time. But there’s no way that Prawer takes the risk on some agent whose track record sucks just because she happens to be a big advertiser. It’s not how corporate chieftains work.

Now think, what’s the value of 300 new Zillow-owned listings a year to a top notch agent? Not just from the listing-side commissions, but just from having 300 new listings a year? In this market?

If you said, “concentration of power” then congratulations, you win the Notorious C.I.G.A.R. He that hath, gets is a universal law; it’s even in the Bible.

The effect of that kind of concentration of power is a natural raising of the bar. It just is.

And the effect is far-reaching, even outside the few Premier Agents who will be tapped by Zillow because they’re the best at their craft. If you know that you need to hit a certain level of competency and sophistication to qualify to sell Zillow listings, you know you’re going to try to hit that. Hundreds of listings, with all of the buyer leads they generate and the name recognition and the sign traffic and all of that, are at stake!

All kinds of brokers and agents are going to up their games in order to qualify for that river of listings. Watch — it’s going to happen. If they don’t up their games, then they eventually go out of business because he that hath, gets.

While Zillow is doing that, NAR is doing… what exactly?

Once again, we turn to the S.M.A.R.T. Initiative. Another one of NAR’s important goals is:

- Define measurable increases in professionalism

To do that, NAR will spend some fraction of $2 million a year… on Commitment to Excellence, a voluntary aspirational program.

To counterbalance the laughable spend, however, all kinds of NAR leaders are going to talk loudly and often about the importance of professionalism, the critical need to Raise the Bar, and to do more at some point any day now real soon-like.

But first, a new logo! Oops.

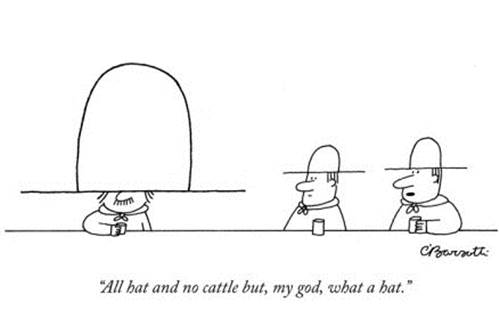

No Hat, Lots of Cattle

The transformation of Zillow is absolutely remarkable, if you think about it.

Back in the day, when I was advising Zillow on strategy, one of my recommendations was to position Zillow as the “defender of the industry against true disruptors.” [I got permission to discuss this with y’all, because I keep my clients’ confidences.] I thought then that the real estate industry could not possibly handle some of the disruption I saw coming, whether from Big Tech (and I mean, real big tech like Amazon and Facebook) or AI or driverless cars or virtual reality or any of the big game-changing technology shifts. The industry didn’t have the money, didn’t have the tech, and didn’t have the willpower to protect itself from real disruption.

I thought Zillow did, and given its reliance on real estate brokers and agents to keep paying them, would if given the chance.

I don’t know that they’ve been given the chance, but with this zBuyer program, seems to me that Zillow proved that they have the money, the tech, and the willpower to do so anyway.

“Big hat, no cattle” is a Texas expression which means exactly what it sounds like. Well then, Zillow is “No hat, lots of cattle.” They’re not out there talking up a big game about Raising the Bar, or keeping the REALTOR essential to the transaction. They’re just doing shit that results in both — and makes them a fortune besides.

The irony, of course, has always been that the industry loves to hate on Zillow. It’s become a strange sort of fixation.

But maybe the zBuyer announcement, and the relatively tame response to it, marks a real turning point. Maybe the industry — or at least parts of it — are starting to realize that Zillow is here to stay, isn’t going anywhere, and are actually doing things that others (notably NAR, but there are many others) just talk about doing.

Maybe that explains why the most vitriolic comments I’ve seen so far seem to focus on NAR, on the MLS, on the Association. Or maybe it’s just that #Logogate is still fresh on people’s minds.

I don’t know. I don’t read minds. I wish I did, though. Would come in handy. And lucrative.

But what is clear, to me at least, is that somehow, Zillow has transformed into both the defender of and reformer of the industry. Time will tell if the transformation sticks. And yes, I’m fully aware of just how difficult this may be to wrap your head around. It’s as if Megatron suddenly became Optimus Prime… but that’s where we are in 2018.

Now the challenge is on the other powers that be in real estate, most notably NAR, but not limited to them by any means. All of the others who have been talking the talk for years and years about all kinds of stuff they’re going to do to help brokers and agents, all kinds of actions they’re going to take to increase professionalism, all kinds of things they need to do to be more “consumer-centric” are going to have to start walking the walk.

Because Zillow just did.

-rsh

PS: The music video features the main entertainment for NAR’s Annual Convention, Fall Out Boy.

30 thoughts on “No Hat, Lots of Cattle: In Which Zillow Transforms”

It’s noble that Zillow plans to pay 4 sides to agents but if the iBuyer competitors are only paying 1 side (the co-brokerage on the sale) doesn’t that give them an advantage?

“Got an offer from Zillow? Upload it to our app and we’ll beat it by $5,000 or we’ll give you a free cruise to Bora Bora AND pay all your closing costs!”

It’ll be interesting to see how Opendoor and the others counter this move.

I think incumbent iBuyers have a lot of advantages, including operational experience. Plus, they’ll be paying two sides if they’re Opendoor or Offerpad (assuming they use in-house employee agents for buying/selling for themselves).

You’re probably right, but I don’t relish going head to head with a $10 billion category leader no matte what. Opendoor has the talent and access to deep pockets to compete, and I don’t know Knock or Offerpad well enough to say, but some of the other players might decide to drop out instead.

My guess is the “in-house agent” is an employee with a license to get it on the MLS. If they can sell it via their app, it’s a bonus…but that could come with dual agency (or transaction brokerage in Florida.) Details.

A $10B market cap isn’t the same as having $10B (or more) in cash…especially when your market cap can drop by $1B in a day when you announce you’re getting into the iBuyer game.

If a bigger player wanted to get into this, they buy Opendoor (or OfferPad or one of the others) and then Zillow becomes the underdog.

I’ll start the speculation game: Why not HomeDepot/Lowes?

I think it’s too soon to tell who has the advantage. Too few markets that the iBuyers and now Zillow are operating in, and based on all the research done so far, they are all operating at the lower end of the market.

I read somewhere that Zillow will likely charge a referral fee to agents who get the Zillow iBuyer leads. 30-35% on each side is much more profitable than their current revenue model for agent leads, even if it’s on a smaller scale starting out. And if I’m the agent (a Zillow Premier Agent?) receiving this “lead”, I have prior experience in working with Zillow leads and realize that this has a much better conversion rate than the regular Zillow lead. Good for the agent, good for the home seller.

If anyone has a chance to succeed in this iBuyer environment, it’s Zillow.

http://simonsaysrealestate.com/2018/04/11/is-zillow-the-devil/

Simon

Opendoor has little or no motivation or impetus to work with the industry. Further, Knock has already declared that they will not have IC agents, but employee specialists. That s not true of Zillow. To assure that they continue to grow their ad revenue, they need to work with their Premier Agents to fulfill their zBuyer program. That said, if you control the product (the listing), you control the transaction. This is true in the REO, relocation and new homes business. Each of these segments of the market have formatted processes that the industry must use or the business simply goes elsewhere. I would expect Zillow will be no different in managing their zBuyer program.

“Opendoor has little or no motivation or impetus to work with the industry.”

That doesn’t appear to be true: https://www.opendoor.com/w/agents/

First – love the FOB reference. Second – my problem is not with Z as the iBuyer or iSeller. It’s as how they’ll be picking (or making) the winners in a market. Think about Phoenix with hundreds of brokers SO they picked 3 brokers to work with. What about the other brokers/agents paying them money? Likely many of them are good or very good. Some are bad. But by picking 3 to use they are now creating the winners and are shunning some that may be excellent offices but not on their list. So yeah it’s RTB but we both know not every office chosen will have great agents who will end up representing zillow. They may be good offices but a subpar agent who lands a z listing. So RTB but only if they get a great agent on the brokerage roster.

What about the other brokers/agents paying them money?

As they say in the gaming world, “Get gud”. 🙂 That’s the point. Zillow as the buyer/seller doesn’t care how much ad dollars you’re paying them; they care about your performance, track record, skills, infrastructure, etc. — your ability to get it done for them as a client. Just like any other buyer or seller.

Zillow isn’t the government; Zillow isn’t even the Association. They will pick winners and losers in a market, if their own properties are involved. But that will #RTB, while the rest of the industry will just talk about #RTB and complain about Zillow.

Strange days we’re living in.

Rob don’t you think the bigger problem is that Zillow is basically declaring that their core advertising business is saturated i.e. there are hardly any agents left who don’t already advertise on Zillow. Bad sign for their core business?

I can’t say; I haven’t seen any public statement as to saturation or not. I’m certainly not going to talk about anything non-public about a publicly traded company. 🙂

But here’s what Spencer said on the last earnings call:

“In 2017, we estimate there was approximately $1.8 trillion in total U.S. transaction value for homes, up 7 percent over 2016. We estimate Premier Agents and Brokers earned roughly $6.5 billion in commissions from contacts that originated on a Zillow Group platform. We estimate this represents about 7.5 percent of the $87 billion total real estate agent commissions paid in the U.S. last year. We reported nearly $762 million in Premier Agent revenue in 2017. That’s still a small amount relative to total commissions, but an increase from 2016, when contacts from Zillow Group drove an

estimated $4.4 billion, or about 5 percent of all commissions.”

Have they saturated the market? Maybe. I report, you decide. 🙂

Interesting read, as always. Based on Zillow’s financial reporting, Premier Revenue of $762 million is up from 2016’s $604 million. But… Premier Revenue earnings as a percentage of Premier Agents’ estimated commissions (how much of their commissions agents spent) dropped – from 13.72% in 2016 to 11.72% in 2017.

Two questions:

1. There seems to be a “good business” rule of thumb that an agent spend approximately 10% of revenue on generating new business. What are your thoughts on agents spending all of that (and a little more) on a single lead generation source?

2. Why do you think agents spent less of their revenue in 2017?

The NAR’s bet on the industry is far more risky than Zillow’s. In contrast to Zillow, the NAR is betting on the 70 to 80% of its membership that do little or nothing. Those same people who are empowered by the governance of organized real estate to “have an equal vote” in governing the business they really know nothing about or produce little of. My bet is doing things to assist the growth of the top 20 to 30% of the industry is not a bet at all, it is a sure thing. These are the professionals that know what they are doing and are good at it. But these are the same people that would likely think a dues raise of $30 per year should really be a $3000 per year to “clean out the old rusty, clogged up NAR pipes.” So my cheer as it relates to the “zBuyer” program aligning with the elite agents in this business is – go Zillow.

Zillow often plays a role in making inventory available to me, when some MLSs fail to do so. Unfortunately we still have some MLSs that are stuck in a time warp. They refuse to share data with neighboring MLSs, in the misguided belief that they are keeping “outsiders” from selling “their” inventory. One can only hope that the DOJ will someday take these backward MLSs to task for cheating those poor people trying to sell their properties.

As long as we have Neanderthals running some of our MLSs, Zillow will play an important role.

So ZG is a “flipper” now, and they insist on having an agent represent them on both sides of their projects. I see a business model conflict. Real “flippers”, the pros that are in it as a career, want as much fat (commission) out of a deal as possible – it’s their business to cut fat where and when they can – more money for them, which is the objective.

Flippers best outcome is when a seller calls them directly. Remember these flippers are pros. They have bought so many properties they can do what’s required in their sleep (negotiate price, fill out a contract, get it to the lawyer or whomever to close). The flipper makes more money (their objective) when there is no buyer’s agent commission.

The same thing goes for the sell side. A flipper would prefer to sell directly to a buyer mid-project. The last thing a good flipper wants is to have to put the market-ready house on the market (MLS) and pay out some of their profit.

So, in which class at Harvard do they teach about adding expense to increase profits?

#makesyathink 🙂

Brian

I’m breaking my own rule by commenting on my own comment….but, I just wanted to rephrase the above and see if someone can answer what should be the most obvious question.

What would be the reasoning for starting a new business and out-of-the-gate conceding 10-12% of the potential profit margin. How can the entity compete in that environment? Isn’t a typical profit margin for a “flipper” around 10/15%?

Either the “flipping” business in Orlando, Las Vegas, Phoenix etc. is so fragmented, lucrative and large that no ones has to compete for business…….or something else is going on. The math simply doesn’t work – or does it?

#istilldontgetit

Thanks,

Brian

I imagine it’s called “alternative revenue stream” from the 90% of homeowners who choose to list with the Premier Agent instead. At some point, Zillow is going to start charging an arm and a leg for those.

So it’s a loss leader?

This was a very smart take.

Thank you Joe!

We would do well to view this latest move by Zillow through the prism of the Team model. The future of the industry looks to be a Team model over the existing (and broken) Broker model. In that view, the question of whether or not Zillow will enter real estate is over. They have. They are the Team model writ large. They provide leads to agents on their “team.” In return, the agents pay a fee rather than a split of commission. A rose, by any other name…

This may be part of why we hear only crickets. I’m not sure most brokerages could identify the why, but they know that Zillow is in the business.

One of the benefits of the Team model is that it does raise the bar, in every way. To that end, Zillow’s very diffused “team” should raise standards, but not to the degree we will see among actual, local Teams where reputation is paramount. Both are good for the industry, despite being bad, as Rob points out, for the majority of agents.

All great views – but has anyone checked on the sale of Quicken Loans or some other lending identity? Consider Zillow does everything they say without any changes except also becomes the lender. Speed up the transaction not to mention own the real estate transaction? 9 Billion is seven years will be chump change.

My take is that Zillow as another “we’ll buy your house fast and for cash” is nothing more than a back-door way to get potential sellers to raise their hands. For this to make ANY kind of fiscal sense for Zillow they would have to purchase the home at such a large discount to market value that most seller will balk. Every market has the “we buy houses cash” guys who are really experts on ARV and what price the home needs to be bought at to be worth the risk. Zillow, even with a local “expert” providing assistance does not have that expertise. The ploy as I see it is to sell agents on getting the “seller lead” once they turn down Zillows low offer.

I agree with everything you said, except the word “ploy”. That implies some sort of hidden agenda.

If you actually watch the videos that Zillow released, they come right out and tell you over and over again that the game for them is seller lead generation.

For example, Errol says that out of everyone who submits a request for an Instant Offer, 1/3 sell their house within 90 days. That’s about as highly qualified as listing lead as one can get.

He then says that 90% of them choose to list with the Premier Agent who sent them a CMA. That’s where the money is for Zillow. They come right out and admit it. That’s hardly a ploy; that’s the whole point.

The remaining 10% who want to take an investor’s offer is where Zillow is getting directly into the iBuyer game. On that one, that seller is going to take an investor’s offer, no matter what the agent brings to the table; they want out of the house right now and have the certainty right now, even if they’re leaving money on the table. Who knows why? Maybe they’re relocating and can’t take the time. Maybe they don’t want to deal with the hassle. Maybe they bought a house already and don’t want to keep paying double mortgages.

I imagine the agents who are not getting paid on those deals at all are pretty happy about Zillow’s entry into the market. Whether Zillow makes a profit or not is completely immaterial to the agents who are now going to get paid commissions on those “I want to sell right the hell NOW!” homeowners.

What I don’t understand is why there isn’t a parade for Zillow down Las Vegas Blvd. organized by all of the brokers and agents who ought to be jumping up and down for joy.

“You want to make sure I get paid? SCREW YOU! BOYCOTT NOW!” seems like a really odd reaction to me.

I did not know ZG stated the purpose was lead gen, all I read was Zillow is becoming an iBuyer and I wasn’t buying it.

https://www.youtube.com/watch?v=OjYoNL4g5Vg

Thanks,

Thanks for the insight Rob…But I still think that the word “ploy” is accurate especially in the context of this statement: “they come right out and tell you over and over again that the game for them is seller lead generation.” Bait and switch comes to mind. We will buy your house cash…but we are not really serious about it…

No local WE BUY HOUSES CASH guys have an underlying goal and incentive to generate seller leads…they want to buy and flip homes. Although perhaps I should reach pout to the dozens of those guys here in my area and become a “premier agent” for them!

And don’t get me wrong, I don’t hate Zillow. They take what is given them and make millions off of it. Capitalism rewards people/business who do that. The ones who couldn’t/didn’t are left to complain.

That makes sense Steve….the offering is something other than actually buying and flipping homes. Your lead gen theory is the most logical one I’ve heard to date…..and it’s a good one 🙂

Thanks,

Brian

So after the we buy ugly houses “non ploy”, they are off to calling expired listings lol, then Craigslist FSBO.

From Fortune Technology: MAY 8, 2018

Experiments are fun and interesting. The real estate advertising company Zillow should know. It’s running a real-time experiment with its business that can be characterized as anything from courageous (its management’s position) to reckless (the reaction of its shareholders.)

Looking merely at the numbers, Zillow reported a fine quarter Monday. The Seattle company doesn’t make money. But it does grow quickly on top of a billion-dollar-plus annual-revenue clip. It is worth more than $10 billion and is the winner of its category, having absorbed competitor Trulia and outlasted others.

Yet Zillow isn’t satisfied. It is starting a new home-flipping business using its own balance sheet to buy, touch up, and sell homes. Wall Street hates the idea, wondering why a perfectly respectable online business would wade into the messy and highly variable world of investing real money in actual houses.

Zillow management is undeterred. “We are taking our biggest swings yet,” CEO Spencer Rascoff wrote in prepared remarks for Zillow’s earnings call with analysts. Zillow’s hoped-for profit from its “Instant Offers” business is shockingly small. Rascoff sees Zillow making $3,500 on a $250,000 home, a puny 1.4% profit. But it’s a huge market. He says 5% of the volume would be 275,000 transactions, or a “nearly $1 billion profit opportunity annually.”

RBC analyst Mark Mahaney calls the audacious plan the “father of all total addressable markets” but nevertheless cites high execution risk in downgrading Zillow’s stock.

Big bets are so much more interesting than playing it safe. Especially when someone else’s money is involved.

Adam Lashinsky

@adamlashinsky

adam_lashinsky@fortune.com

Comments are closed.