In part 1 of this series, I outlined years of writing, thinking and speaking on the subject of legal issues and regulatory challenges facing the real estate industry. We continue our journey down dark paths with the second horseman of the housing apocalypse.

Let me note right at the outset that I am not an economist, and I am not a macro analyst working for big investment funds. But given the track record of actual economists, I guess I don’t feel that badly about doing my own analysis. And I think I have read or listened to as many of the macro analysts who have skin in the game as I could. So this is my industry-focused take on macroeconomics.

Please feel free to ignore everything I write here, or to challenge any of it. I don’t claim to be right; I claim to believe what I am writing.

On a Red Horse: Money Printer Go Brrrrr

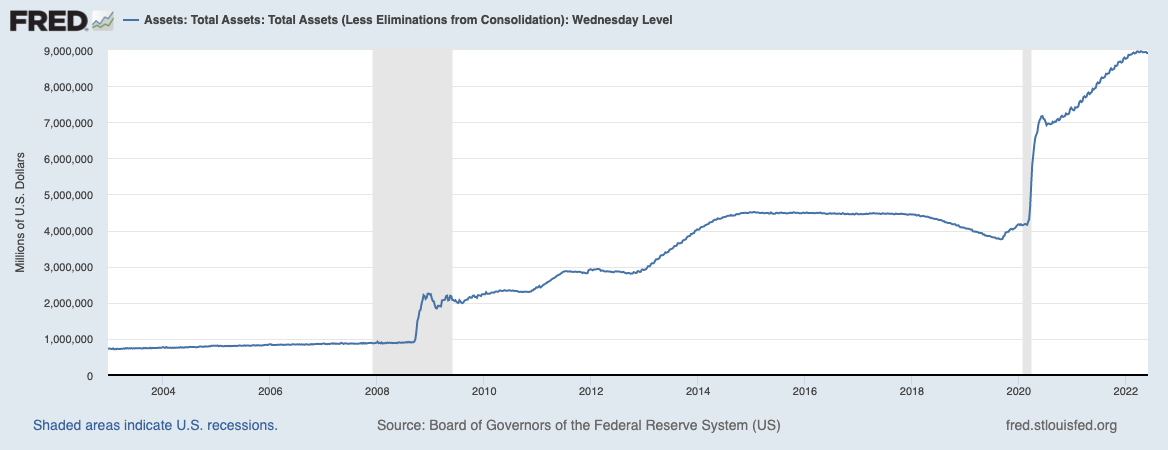

The second horseman of the apocalypse is inflation. More precisely, it’s the money printing that the Fed has been doing since the Great Recession, then juiced up to absolutely crazy levels during the COVID panic.

Back in January of 2021, I wrote this VIP post titled “The Most Important Chart from 2020“:

That’s money supply growth. A different chart shows that 35% of all US dollars ever were created in 2020:

Calliope 彡 on Twitter: “35% of all US dollars that have EVER printed were printed in the last 10 months pic.twitter.com/iBzHdFWYsi / Twitter”

35% of all US dollars that have EVER printed were printed in the last 10 months pic.twitter.com/iBzHdFWYsi

I do think this is likely the most important chart from 2020, especially for real estate, since the industry is 100% dependent on macroeconomic factors.

In that post, I talked about asset bubbles, and about money printing. But since writing it, I’ve found an excellent explanation of how Fed policy has led directly to an asset bubble in housing from Danielle DiMartino Booth of Quill Intelligence, who is a former Fed governor and knows Fed policies better than most human beings alive. Here’s the full video:

The key takeaway for us comes at the 22:55 mark. Booth straight up calls out the Fed monetary policy for causing housing asset bubble. Investors with easy access to a flood of cash have driven up the price of housing… because money is worth less (dollar devaluation) and real assets, especially physical assets like real estate, are worth more relative to devalued dollars.

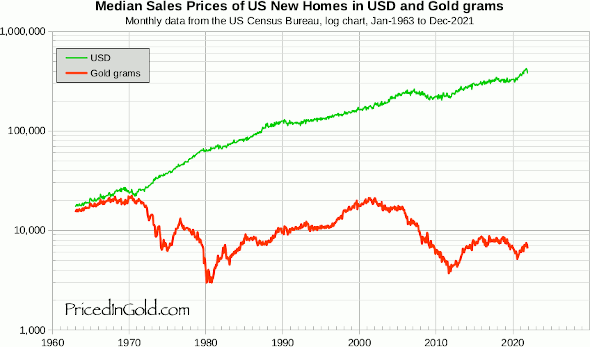

Booth is hardly the only analyst who has been pointing out what’s going on with housing prices, relative to dollar devaluation. One chart I have used before and I still love comes from PricedInGold.com, a site that tracks the value of various goods and assets when priced in ounces of gold:

The Case-Shiller Index in gold, available only to about 2018 shows that it was at about 1984 levels in terms of price.

So the money printing has led directly to home prices getting out of control. I wasn’t sure then what the impact of money printer going brrrr would be on consumer inflation. As an aficionado of Austrian economics as well as Milton Friedman, I was pretty certain that it would rise since inflation is always and everywhere a monetary phenomenon:

Since CPI itself might not be heavily impacted, at least for a while, there is no reason to think that we’ll see mortgage rates spike up.

However, it also seems reasonable to think that so much money being printed cannot but help have an impact on CPI inflation at some point. Maybe not soon, maybe not in 2021, but at some point. Because again, we didn’t produce 66% more stuff; just 66% more money. People who are wealthy enough to think about buying houses in the first place are also usually smart enough to make financial decisions based on what they think will happen.

Sunny and I recently had this exact discussion: is it still smart to save? Or do we want to buy more “assets” like houses, stocks, bonds, gold, etc.? I suspect we’re not the only people having that conversation over dinner. Normally, smart people avoid debt; with what’s happening in the money supply, is it perhaps stupid to avoid debt in 2021 (with a fixed interest rate)?

The reasonable expectation, then, seems to be that home prices will continue to rise rapidly. In fact, as the increase in money supply filters through the economy, they’ll skyrocket.

With the benefit of hindsight, home prices have in fact skyrocketed. And in 2022, it seems pretty obvious to everybody who do things like drive cars, eat food, and pay rent that oh yeah, inflation is here all right. It is hardly necessary to talk about inflation, since it’s all anyone can talk about these days. I’ve been writing about and talking about inflation and money printing for a while now, so I’ll invite you to go check those out, and frankly, to go read or listen to some of the macro analysts from big funds who have real skin in the game.

The Fed is Acting

So now, we have the Fed raising rates, and talking tough. Mortgage rates have almost doubled, and demand is getting crushed. Brokers and agents are reporting that the insanely hot housing market of 2020 and 2021 are cooling… to merely super hot, and in some cases, very hot. As my friend Mike Simonsen of Altos Research said on Twitter, if you’re going 90MPH on the highway and step on the brakes to go 75 MPH, you’re still going really, really fast.

Quite a few voices, many of them economists and experts with a far longer track records than yours truly, are suggesting that the housing market will cool down very fast to a “more balanced” market. A few are suggesting that housing market will crash and burn, and that this is Real Estate Bubble 2.0.

I wrote a post in December of 2021 taking a contrarian position to the idea that housing market will cool because of higher rates. I haven’t changed my mind yet, so in relevant part:

But note that the steep decline from May’s 25.8% YOY change still represents a 15.1% YOY increase in median home sale price. Real estate is still getting more expensive — just not as fast.

To be fair, home price growth might come in far lower in 2022 because it is clear that the American consumer is near the end of his rope. He can’t afford anymore, because his wages haven’t been going up 20% YOY, and it wasn’t like he was doing great before the government shut down the economy because of COVID. Rate increases means greater likelihood of recession, meaning layoffs, meaning banks being more skittish about lending. So buyer demand (or at least buyer capability) will be impacted.

I think that gap from consumer demand gets filled by institutional investors. Yeah, those hedge funds and pension funds and insurance companies and sovereign wealth funds who used to buy RMBS… a lot of them are going to just buy the underlying asset: the house itself. If the dollar is losing 15% a year in purchasing power (aka, inflation), then you have to park it someplace that can offset that loss. US residential housing makes perfect sense, especially with rents on the rise again. And those guys couldn’t care less what the mortgage interest rate was; they’re paying cash, then levering up afterwards with high-yield corporate debt.

While it is possible that we might see legislation and regulation that makes housing unattractive for investment (think, rent control, taxes on rental income, flat out bans, etc.), such things have unintended consequences, like making homebuilders question whether they can make any money building more houses in the U.S.

The result: home prices are not coming down… at least, denominated in dollars. Maybe they will after we have a reset of the entire U.S. financial system, but I suspect we’ll all be much more concerned about other things if a real reset happens. Like food supplies and ammo.

I still believe that Fed tightening will not lead to home prices actually coming down, as opposed to slowing its growth. I predict home prices still rising in dollar terms relative to 2021 and 2020, not because homes are more valuable now or because of strong consumer demand, but because of dollar devaluation.

The United States Is a Zombie Company

But I need to re-emphasize a very important part of that post, as it comes from one of the analysts I think is the most correct about the macro monetary situation, Luke Gromen of Forest For The Trees:

It’s a complicated story, so one that most Americans simply don’t understand. I know I barely understand it. But let me see if I can explain it as simply as possible.

- The U.S. Federal Government has some $28.6 trillion in debt at the end of Q3, 2021.

- The interest payments on this debt was $803.3 billion in Q3, according to the Bureau of Economic Analysis.

- What Luke Gromen points out is that if you take that interest payment, then add the current portion of legally required entitlements (think Social Security, Medicare, etc.), that amount comes to 111% of total tax receipts.

- As per the BEA, the U.S. had to borrow $2.2 trillion in the three months ending in September to keep things going. The average interest rate on this debt is about 1.54%.

- If the Fed actually raised rates by 0.75%, the interest payments that the U.S. government would need to pay would go up as well. And we’re already at 111% of tax receipts.

Furthermore, higher rates means money is more expensive, which means that stock market slows down. Maybe even tanks. From Forbes:

Higher market interest rates can have a negative impact on the stock market. When Fed rate hikes make borrowing money more expensive, the cost of doing business rises for public (and private) companies. Over time, higher costs and less business could mean lower revenues and earnings for public firms, potentially impacting their growth rate and their stock values.

Hey, guess what happens to things like payroll taxes, sales taxes, and even capital gains taxes if companies have lower revenues and earnings? Yep, they go down. And the U.S. government can’t really afford to take in less in taxes right now.

When I put all these pieces together (plus some other pieces besides), I can’t help but agree with Luke Gromen. He thinks the Fed might talk raising rates, and might even raise rates for a bit. But ultimately, they will have to pull back, go back down to zero, keep monetizing the debt, and keep printing money.

Please note that as I write this, the national debt is no longer $28.6 trillion. It’s $30.5 trillion, as of right now; it’ll be higher by the time you read this. We are at 130% of US National Debt to GDP ratio. This is unexplored territory. Here, there be dragons.

The simple fact you just can’t ignore or debate away is that the United States must borrow in order to stay in operation. Its tax receipts (i.e., revenues) are insufficient to cover expenses. That’s a zombie company.

A Quick Detour: Debt Monetization

In discussing this with friends, who are very smart people with deep business experience, I learned that most of us don’t know what “monetize the debt” means. It sounds complicated, and I’m sure it is in many respects, but in a way, it’s very simple.

Here’s Wikipedia:

Debt monetization or monetary financing is the practice of a government borrowing money from the central bank to finance public spending instead of selling bonds to private investors or raising taxes. The central banks who buy government debt, are essentially creating new money in the process to do so.

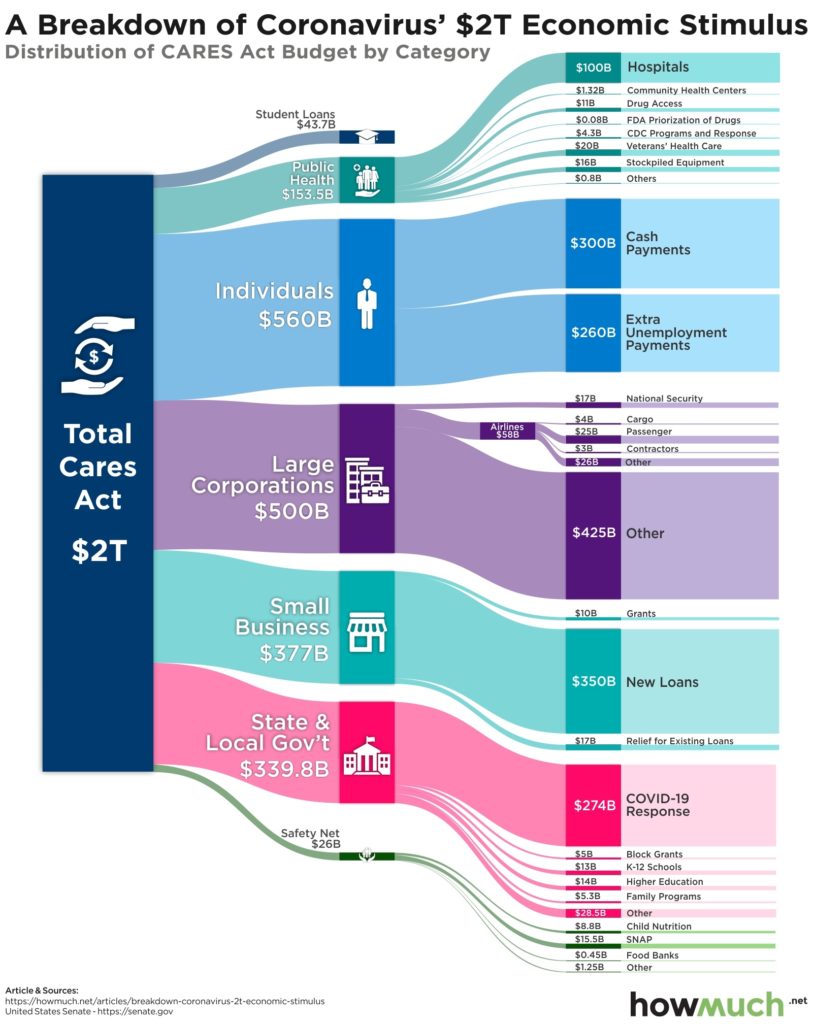

But that’s boring and doesn’t really explain what’s going on. I think this chart, from the COVID days, is far more explanatory:

This is what macro analysts call “fiscal stimulus” which just means the government spending money directly. This is far more powerful than the “monetary stimulus” which is the Fed cutting rates, which incentivizes banks to make more loans.

So in this chart, we see that Uncle Sam sent $560 billion to American families, and $500 billion to Big Business, and $377 billion to Small Business, and $340 billion to state and local governments.

Two questions here: Where did this $2 trillion come from? And where did the money go?

As to where the $2 trillion came from, it came from the Fed:

See that huge spike in 2020? That’s from emergency COVID relief spending. The US Treasury did not go around collecting an additional $2 trillion in taxes in order to send out $2 trillion in relief checks. They tried to sell a bunch of treasury bonds (aka, promises to pay back money with interest), except that there weren’t any real takers in the private capital markets… so the Federal Reserve bought them all. How does the Fed do that?

Well, since the US Treasury has an account at the Federal Reserve Bank, like you and I have checking accounts at Chase or the local credit union or whatever, the Fed simply put $2 trillion into that account, and then put $2 trillion in US Treasury bonds onto its books as “assets”. Voila! Money for the Federal government to send out.

That is debt monetization. Simple, really.

But where did all this money go?

Ultimately, most of that money went into the pockets of consumers.

Consider the $500 billion sent to Big Business. What did they do with that money? Some of it probably ended up being parked in some bank somewhere. But for the most part, they paid their bills, since the government shut down the economy with lockdowns. They paid their employees, suppliers, vendors, etc. Then the employees of those supplier and vendors got paid. Okay, so what did those employees do with this money? They did what they’ve always done: go grocery shopping, paid the rent, paid their bills, etc. The economy, such as it was, kept going.

Thing is… through this fiscal stimulus (government spending), we Americans got an additional $2 trillion in our bank accounts. We did not create $2 trillion worth of additional bread, chickens, gasoline, or new houses. We produced either the same amount of goods, or because of lockdowns, we produced far fewer goods. Think about new cars and how supply chain disruptions have stalled that out significantly. Did farmers plant tons more wheat? Did they raise millions more chickens?

If not, the law of supply and demand dictates that shit is gonna cost more as more dollars chase fewer goods.

You can layer on complexity after complexity and explanation upon explanation, but I’m not well educated enough in economics to ignore simple truths like supply and demand. Same or lower production + lots and lots more dollars = shit costs more.

From the middle of 2020, when the housing market went absolutely batshit crazy, I’ve been suggesting that home prices have not gone up. The dollar has been devalued. I think the evidence so far tends to support my take on things. Here’s Mark Yusko, CEO and CIO of Morgan Creek Capital Management, making the same point but with more authority than I have.

The Fed is Bullshitting

Where things get interesting and complicated is that many very smart people, like Gromen and Yusko and others, think that the Fed is not really acting as much as it is playacting. The Fed is shoveling tons of bullshit and hoping that somehow, jawboning will get the markets to cool down and tame inflation so they don’t have to do much more.

Luke Gromen, I think, has been the most vocal about this and for the longest. The Fed’s choices break down to one of these two options:

- Keep the United States solvent, or

- Break inflation.

You can’t do both. As Gromen puts it, you can’t keep riding two horses with one ass.

Just the interest payments on the national debt plus legally required pay-as-you-go portions of entitlements are over 100% of total tax receipts. So to fund things like defense, national parks, the FBI, the courts, highways, customs offices, border patrol… you know, all the things that we voters think of as “government”… the government has to borrow money. In fact, to keep paying out things like Social Security, Medicaid, and other entitlements, the government has to borrow money.

Raise the interest rates on that, and we’re talking about dramatically increasing the amount of money the government has to pay to borrow the money, money that it doesn’t really have in the first place. The government is close to borrowing money to make interest payments on money it already borrowed.

I talked about that in this Musings podcast:

Go to about 14:00 mark where I start discussing Luke Gromen’s appearance on the Daniel Scrivner podcast. Let me quote from the transcript of that podcast:

Luke Gromen

I think everyone has always known, “Well, yeah, rates can never rise because it will blow up everything. It will blow up the government, it will blow up every government.” But now it’s actually gotten to the stage where it’s actually critical. One data point we always highlight in our research is what I call the US government’s true interest expense, which is treasury spending, plus the pay as you go portion of entitlements. Those went over 100% of tax receipts in the aftermath of COVID.

And that’s the point where either you tell baby boomers, sorry, we can’t pay you everything we promised you, or you default on treasuries, or you slash other treasury spending, which you really can’t because they’re helping support the economy, or you have the Fed print the difference. That was always the…

In 2015 that number, which is over 100% of tax receipts today was more like 60. So the speed at which this has gone from, “Well, yeah, eventually that might happen if a number of things go bad, to holy crap, we’re now in the rear-view mirror of that key threshold.” It took six years, five years. [Emphasis and line breaks added]

I’m trying to imagine a scenario where Biden gets on TV and tells Americans that they’re not going to get their EBT payments or subsidized rent payments because the government is out of money. That’s how you get burning cities and widespread death and destruction. Or after 2020, “mostly peaceful protests.” Alternatively, imagine Nancy Pelosi and Chuck Schumer on CNN telling American seniors that there won’t be Social Security or Medicaid payments because we’re out of money. That’s how you get a supermajority of Republicans in both the House and the Senate. Ergo, neither of those things will happen. And this isn’t about Democrats and Republicans; there is no political scenario if the GOP were in power where they go on TV and fall on their swords to save the country. Our so-called leaders are not built of such stern stuff.

I’m also trying to imagine a scenario where the United States defaults on its debt. We’re talking global financial meltdowns the likes of which we have never seen. It would make the Great Recession look like a picnic. That won’t happen, because it can’t happen… until it’s the only thing that can happen.

Let us together imagine the government slashing “other treasury spending” which means everything else that we think of as government. Once again, I’m imagining Biden on TV announcing the closure of all national parks, furloughing the entire U.S. military, laying off hundreds of thousands of government workers who aren’t doing entitlements, no more highway funding, no more FEMA, etc. etc. There’s no scenario where that happens.

The only option, when you think about it, is to keep printing money. The only politically viable option for anybody in a decision making position is to have the Fed keep buying US Treasuries to keep the whole system going.

Which means continuing to raise rates to fight inflation is not going to happen. The Fed is playacting and talking tough, but it cannot help but fold and soon.

And all of that is before we get into even more complex topics like what happens to US tax receipts when the stock market tanks, reducing the amount of capital gains taxes it can take in, or reduced consumer spending resulting in lower sales tax revenues for all kinds of states and municipalities, resulting in greater need for federal funding, resulting in more federal spending, and so on and so forth.

It’s complicated and stupidly boring, which is why none of us pay much attention to macroeconomics. But at the core, we have simple facts:

- The United States is broke, and must borrow to keep making payments.

- Fail to make those payments, and everyone in power gets voted out, and we might have bloody riots in the streets.

- The only source of “money” to keep making those payments is the Federal Reserve.

- Raise rates much further, and the United States can no longer afford to keep borrowing to keep making payments.

- Ergo, rates cannot go up much further.

I found a macro analyst who makes some of these points, and says straight up that the Fed is engaged in a charade. If you’re interested, watch this interview:

As Larry McDonald says, “The whole thing is bullshit.”

Enter Ray Dalio

This seems like an appropriate time to quote from Ray Dalio’s book, The Changing World Order, because we’ll return to this in future parts of this series. Since most people don’t love to read, you can get most of what Dalio writes about from this wonderful video he put together:

The relevant point for this second part that Dalio makes here and elsewhere is that in every long term debt cycle, governments always, always, always print money. Start around the 15:00 mark if you want to skip the history lessons.

That means low rates, monetizing the debt, and devaluation of the currency… until the entire thing collapses vis-a-vis revolution and political change.

The Housing Apocalypse

Inflation itself is not directly related to housing. But money printing is.

The insane housing market of the past decade or so, and especially of the last two years, can be laid directly at the feet of the Federal Reserve and its monetary policies. That’s Danielle DiMartino Booth’s take, and who the hell am I to gainsay a former Fed governor?

The recent Fed actions, raising rates and nearly doubling the mortgage rates, to “cool off housing” are, I think, the opening chapters of a charade. They’re talking tough, and want to be seen as taking action… but they really don’t have any options left other than printing money.

So the money printing shall recommence in short order. Those who are expecting a housing collapse are, I think, mistaken. It’s understandable since history has been on their side for so long. Recessions have caused home prices to drop. The last Great Recession saw the housing market tank. We should see things change from a seller’s market to a buyer’s market.

However, that won’t happen this time around because we don’t have a rising housing market. In fact, we haven’t had a rising housing market for quite some time now. What we’ve had is dollar devaluation, and wage growth and productivity growth simply have not kept up with dollar devaluation. We see this most clearly in the housing market, as home prices increase 19% YOY, 15% YOY, and in some markets, 45% YOY… and of course, salaries are not going up 15% YOY never mind 45% YOY.

Our analysis of the housing market, which real estate brokers and agents learn from real estate economists and then repeat to their consumers, might be incorrect. If what we’re dealing with is not the normal ups and downs of the housing market, but the slow (and now sudden) devaluation of the dollar stemming from the money printer going brrrrr… there is no good time to sell, and the best time to buy was yesterday. People who think “ooh, we’ve hit the top of the housing market” and sell now in a panic, or wait to buy because “top of the market” will be sadly disappointed in a couple of years when home prices keep skyrocketing in dollar terms, because the dollar keeps falling in real terms.

Consumer demand for buying houses has been, is, and will be crushed. But since having a roof over your head is a fundamental requirement for life, consumer demand for housing cannot be crushed. That sets up the third horseman of the Apocalypse, which we’ll deal with in the next part.

Because money ain’t a thang in 2022.

-rsh