At last, we come to the end of this dismal series. While it has been dismal, some of your emails and private messages have been very kind and encouraging. Dark these thoughts may be, but some of you share them and there is a comfort in knowing we’re not alone. (Update: but see below in Wrapping Up….)

So let’s conclude the Four Horsemen series by looking at what all of these things mean for the real estate industry.

There is a reason why I named this series the Four Horsemen of the Housing Apocalypse. Combining all of the mega trends together likely means that the residential real estate industry in the United States will be severely disrupted and look nothing like what it has for years, if not decades. All of the companies and institutions we think of as essential and unassailable may be like two vast and trunkless legs of stone standing in the desert. Much of what we all know to be true about real estate and housing may be upended. Because our economy, our society, and our politics are all about to be upended.

Ultimately, I remain very optimistic about the world and about humanity, which means I remain optimistic about real estate and housing in the United States. I know that’s hard to believe given all of the horrible things I am describing, but I think fundamentals do not change so rapidly. And housing is about as fundamental as things get. Under all is the land, after all.

The Four Horsemen Summarized

Let us take a moment and summarize and synthesize the four horsemen of the housing apocalypse.

- NAR and the MLS system that it rules over is under relentless attack. Litigation gets the headlines, but regulation is the more likely threat.

- NAR will lose its civil antitrust lawsuits.

- The FTC will promulgate significant regulations on NAR.

- Absolutely batshit crazy money printing, both monetary and fiscal, caused unprecedented inflation.

- We saw it first in real estate because asset bubbles inflate first from money printing (thanks to the Cantillon Effect) and then consumers get their hands on the money, creating consumer inflation.

- The predictable response by the Fed is to tighten the money supply, raising rates and threatening to engage in quantitative tightening.

- The Fed cannot keep raising rates, because the United States is basically insolvent with true interest payments at over 100% of tax receipts. To keep funding the government, the U.S. must keep borrowing; and since fewer and fewer private parties care to own guaranteed negative yielding bonds, the Fed must print the money and buy them.

- However, significant damage can and will be done before the Fed capitulates to reality and starts easing again… which will bring inflation roaring back.

- Hawkish Fed policy results in a recession. This is not a bug but a feature of fighting inflation.

- Recession will drive unemployment up, and wages down. Again, that is not a bug but a natural feature of recessions.

- The run-up in housing prices was not caused by consumer speculation and robust natural demand. It was caused by money printing.

- The fall in consumer demand will be matched by a rise in investor demand, as real estate remains one of the bright spots for generating actual yield and return on investment for those with cash.

- As consumers get priced out of ownership, rents will rise because housing is not a discretionary spending item. It is a necessity.

- Caught between the twin evils of inflation on one hand and recession on the other hand, the country is turning more and more populist.

- The younger generations suffer disproportionately from both inflation and recession and they have lost, are losing, or will lose faith in the pseudo-capitalist system we have today.

- Housing was the proximate cause for radicalization, both of young socialists and of young crypto-libertarians.

- Radicalization and populism feed off of inability to get the necessities of life, not the luxuries. Food, energy, and housing are three key necessities.

Obviously, this is as quick and dirty a summary as I can make it. Please go re-read earlier parts if you have any questions.

The Housing Market and the Impact on the Industry

For starters, some good news. Well, short-term good news anyhow.

Prices Remain High

I do not believe home prices will actually decline. Since I wrote Part 2 and Part 3, I posted a little Quick Take with an interesting bit of data. Here it is reproduced:

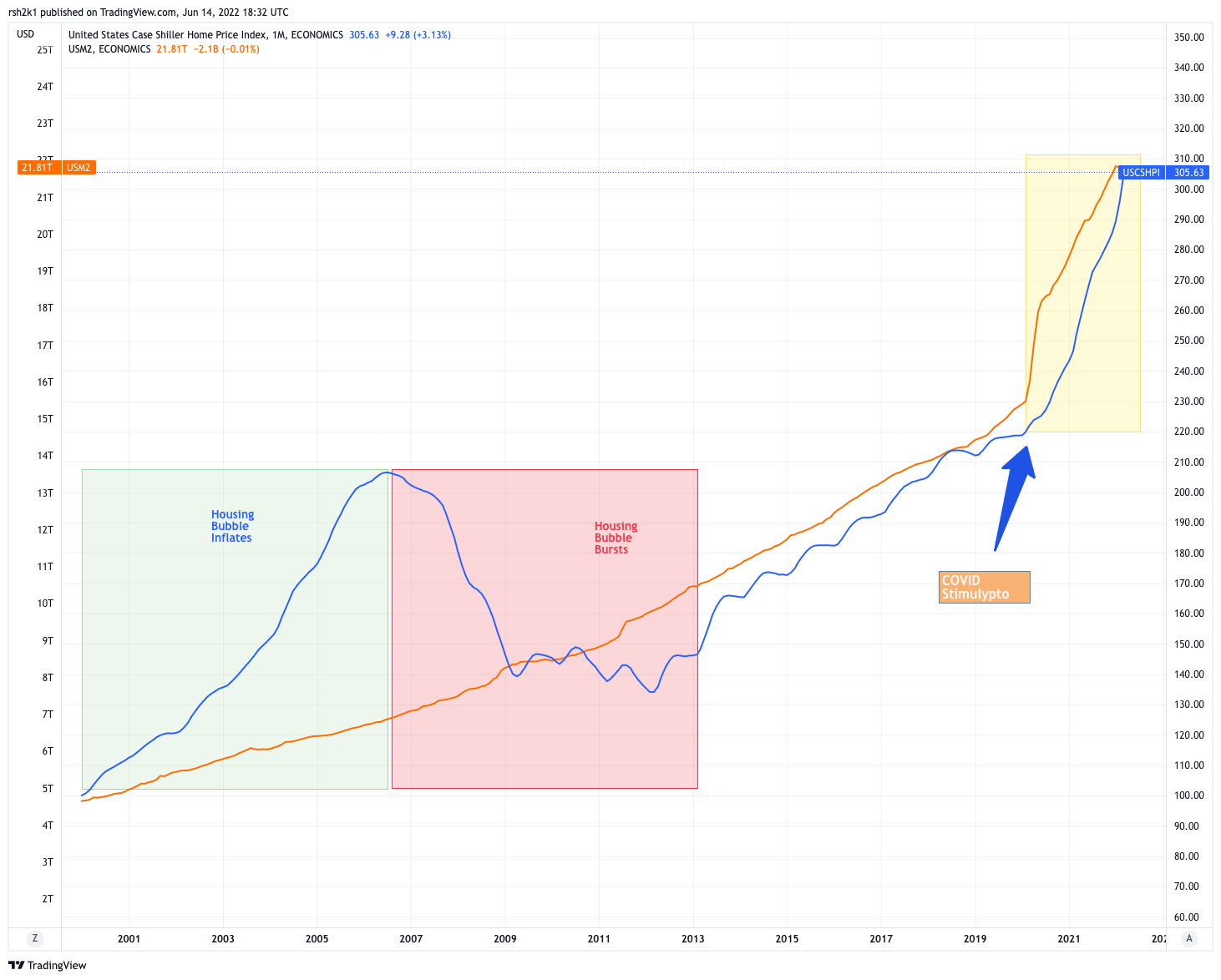

That’s the Case-Shiller Home Price Index laid on top of the US M2 Money Supply. As you can see, home prices diverged sharply from the money supply from 2000 to 2007, when the Housing Bubble inflated. The Bubble burst, and home prices fell off a cliff, then fell even as the money supply increased from 2010 to 2013 or so. Since then, it has more or less tracked the growth of the money supply, including going parabolic after the COVID Stimulypto in 2020.

I’m in the midst of some debates with other finance and economics minded folks who think that housing is vastly overpriced, and that prices have to come down now with mortgage rates north of 6% and heading to 7%, the start of a recession, and housing affordability as bad as it has ever been.

However, as we have already addressed, the Fed cannot actually shrink the money supply much further without forcing the United States government to default on its debt (an unthinkable financial catastrophe) or default on its entitlement promises (no more Social Security, Medicare, EBT, etc.). There is no reasonable scenario that I have seen from anybody, even the biggest fans of the Fed, where the Fed will remove some $6 trillion from the economy. But that’s what is needed just to bring the money supply back down to 2019 trends.

What cannot be done will not be done, so the Fed will reverse its hawkish stance fairly soon bringing the money printer back online.

Home prices in the short-term might slow their meteoric rise, but I do not think they fall. If they do decline, it will be a slight decline at best, more or less tracking with the money supply.

So the good news for the industry is that prices will remain elevated, commission checks will remain large, and a lot of agents will make a fortune.

#RenterNation

However, that’s not the end of the story. Because while prices will remain elevated, the nature of the demand will change from consumers to investors. It won’t happen immediately, of course, because the thing about investors is that they don’t actually have to buy the houses. They’re not living there and raising a family. But it will happen, because all other asset classes for investment are horrible in comparison.

Bonds have negative real yield (aka, guaranteed losses). The stock market is tanking and hard. Crypto is tanking and hard. Gold would be rising, except that its prices are manipulated. Meanwhile, real estate is returning 47%. Rent growth is not slowing down even with Fed action. Indeed, one might say that Fed action results in rents going up. If people can’t buy, they have to rent.

A few things to think about from the industry’s perspective here.

One, investors do not need the same kinds of services from real estate agents. They are mathematical and logical, not visual and emotional. They won’t care that there is Italian marble in the bathroom, unless that Italian marble lets them charge more in rent. They don’t need an agent to tour homes, nor do they really need the agent to do a lot of negotiating on their behalf.

Two, investors want to pay less because real estate is a business for them. For sure that means they don’t want to overpay for some “dream house” because they don’t have dream houses. They have assets that either pencil out, or do not. But for another it means they’re not paying the full commission if they’re doing any kind of volume. If they’re not doing much volume, some of them will literally go get a real estate license just for their own investment activities. Paying 6% in transaction fees often make a deal non-viable for investors. Consumers don’t have these issues, because they’re buying their family home.

Three, investors do and can access off-market inventory in ways that the average consumer do not and cannot. The most obvious example would be the build-to-rent communities where investors can buy out the entire development before any of it sees the MLS. A less obvious example might be purchasing slow-moving inventory from homebuilders or iBuyers.

Four, investors don’t want to do a lot of work they don’t have to do. In this case, it means needing to manage multiple agents to represent them in their activities. They would rather work with one solid agent or team that they can trust to get shit done, rather than hire a dozen agents to show them a dozen homes.

Fact is that the vast majority of the 1.6 million REALTORS are not well-suited or well-trained to serve the investor client. Most have been trained and have spent their careers working with individual buyers and sellers. The few who can cross over, who can talk the language of investment finance, will find enormous opportunity… but the bulk of agents will be competing for the increasingly shrinking slice of the pie that are financially-secure consumers.

Consider this: among the publicly traded large real estate companies, not one has a significant property management division. Among large private independent brokerages, such as Howard Hanna or HomeSmart or @Properties, not one has a significant property management division. Most real estate brokers and agents look at property management with disdain.

Yet, most investors who purchase investment property will need property management unless they already have it in-house. Over in the commercial real estate world, it’s a given that a brokerage firm can also handle property management for the client — a one-stop shop. In residential? Very, very rarely do we see that fusion.

The rotation out of consumers and into investors will have deep-reaching effects on the winners and losers in the real estate game.

The Macro Conditions and Organized Real Estate

One thing to consider is that the macroeconomic conditions could lead to organized real estate having a couple of banner years. Why?

In the industry, we know that most real estate agents are on their second or third career by the time they enter real estate. A few people, usually from real estate families, go into real estate right out of high school or college. But a majority take up real estate after spending time doing something else in a different industry.

We know that for many people, real estate with its flexibility and the possibility of high income is a very attractive career, especially if they’ve been downsized out of a job. So with recession either here or coming soon, one might wonder if we might not see REALTOR ranks swell with people who have been laid off, who don’t want to go on unemployment or welfare, and who decide to get their license as an alternative.

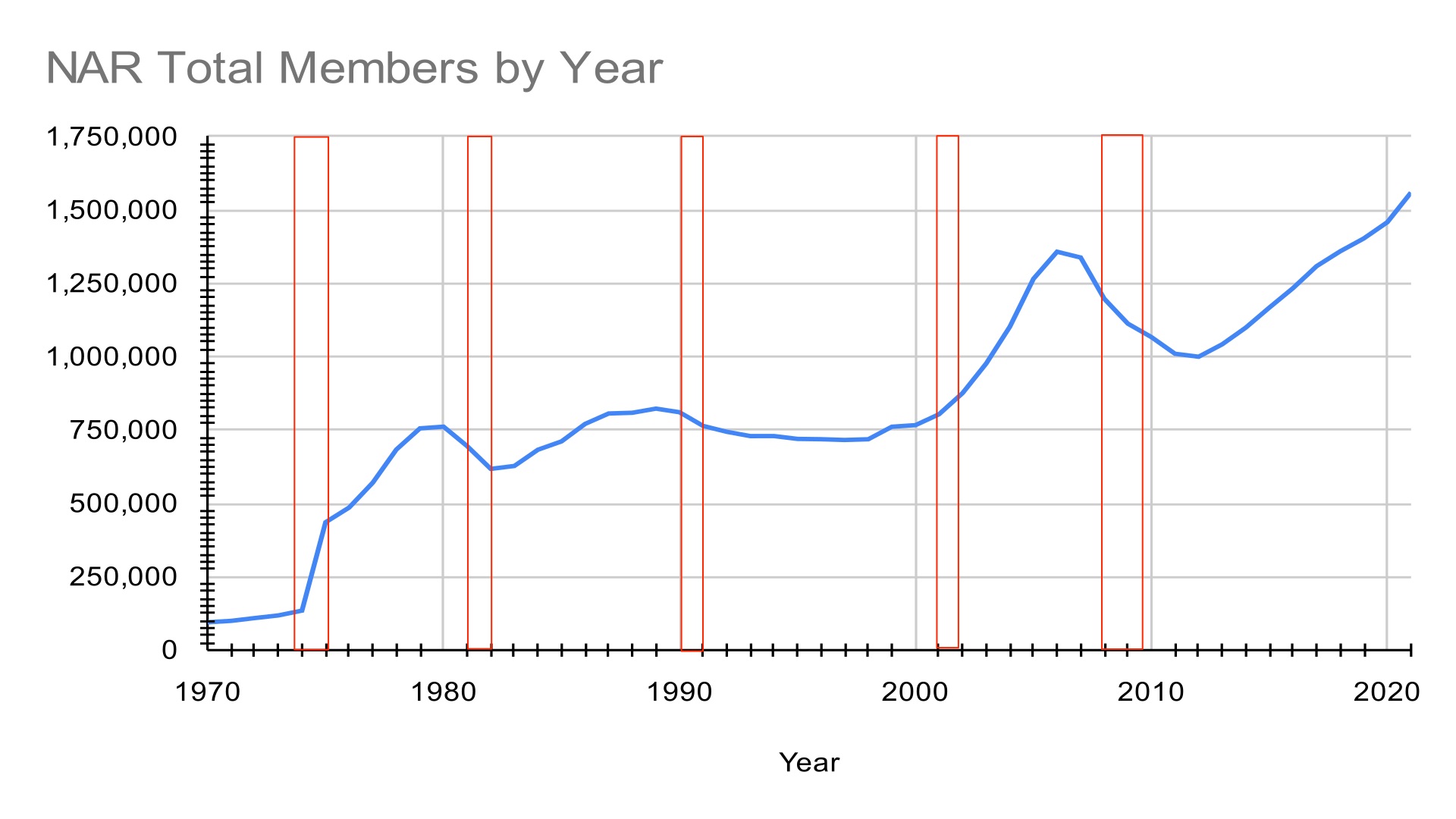

The trouble with this line of thinking is that if there is a recession, the housing market might also suffer, making the 100% commission-based real estate career not as attractive even for those who are already in it. So here’s NAR’s membership numbers from 1970 to 2021. The red boxes are official recessions.

In three of the five official recessions, REALTOR numbers fell. In two, they went up. The minor blip in 2001 is just that: fairly minor, and it was coming at the start of the Bubble inflating, which is why we see the enormous growth in membership numbers from 2000 to 2006.

It is the recession from 1973 to 1975 that is most interesting. First, membership numbers go parabolic, from 134,000 REALTORS at the end of 1974 to 435,000 in 1975. Second, the 1970s recession was pretty unique. From Wikipedia:

The 1973–1975 recession or 1970s recession was a period of economic stagnation in much of the Western world during the 1970s, putting an end to the overall post–World War II economic expansion. It differed from many previous recessions by being a stagflation, where high unemployment and high inflation existed simultaneously.

Among the causes were the 1973 oil crisis, the deficits of the Vietnam war under President Johnson, and the fall of the Bretton Woods system after the Nixon Shock.[2] The emergence of newly industrialized countries increased competition in the metal industry, triggering a steel crisis, where industrial core areas in North America and Europe were forced to re-structure. The 1973–74 stock market crash made the recession evident.

Stagflation. Oil crisis. Enormous government deficits. War. Huge shift in global monetary system. Big stock market crash.

If housing prices fall in the midst of all that, then we should see REALTOR numbers stay steady or go down, as it did in other recessions. But in 1970s, home prices more than doubled: “In the 1970s, the median home price rose from $23,000 to $55,700, an average annual gain of 9.9%.” In the past two years, annual gain in the median home price has been as high as 20%; we’ll see what Fed action brings, but I’ve already laid out why home prices are not likely to actually decline.

Ergo, REALTOR numbers won’t fall in the 2020s recession. I think they rise, and rise fairly significantly. The 1970s saw nearly a tripling of REALTOR membership numbers. I don’t know if we see that, since 4.8 million REALTORS sounds crazy even to me, but I do think we see a substantial rise in numbers.

So on one hand, macro factors point to a very healthy even robust real estate market. Sure, the highs will be off the highs of 2020 and 2021. Sure, the market won’t be absolutely crazy; it’ll be moderately insane. Sure, there will be a redistribution of business and revenues and income away from some and to others, but as a whole, the industry should be all good.

On the other hand… we have no choice but to confront the elephant in the room: legal, regulatory and political disruption.

Law and Politics

In part 1, I laid out most of the major lawsuits and regulatory challenges coming at the real estate industry. I have already laid out why I think the industry loses those cases, but the lawsuits are not the main theatre of action: regulations are.

In more normal times, the power of NAR as a political entity would go a long way towards ensuring that any regulations are mild in impact and any litigation will be tied up and result in a political settlement.

For instance, were these more normal times, I would expect that the commission lawsuits would drag on and on for years, while NAR would craft a settlement that all of us in the industry could live with. Perhaps we’d see a national settlement scheme, as was done for tobacco and asbestos, and the banks involved in the Bubble of 2007. Maybe NAR and various companies (and their insurance companies) would pay billions into some kind of a Real Estate Settlement Trust, then limit all other damages and lawsuits. Sure it would be expensive, but it wouldn’t be overnight bankruptcies for every single REALTOR Association, every MLS, and every real estate company in the United States.

We would also see some kind of a settlement with the DOJ or FTC where NAR eliminates all of its rules around cooperation and compensation, but get some kind of relaxation of GSE rules around rolling real estate commissions into the mortgage, then a legal requirement that all consumers must use a real estate agent. No more FSBO and self-help, in the name of consumer protection.

In much the same way that the NAR-DOJ settlement of 2008 resulted in precisely zip in terms of disruption, we’d have this huge hullabaloo about REALTOR commissions, but it would end up being much ado about nothing in the end. Business would continue as it always has, with some minor changes.

Alas, these are not normal times. I do not expect to see that kind of a mild outcome because of the other three horsemen.

The Politics of Envy

Essentially, we have a situation where money printing has driven home prices to record highs… while wages have not kept up at all. According to Business Insider, home affordability is at an all-time low:

The housing market may be slowing down, but that doesn’t mean buying a home has become any more affordable.

Across the country, hopeful buyers are eagerly waiting for home prices to fall — especially as buyer competition continues to fizzle out. However, despite waning demand, prices are still rising and that could mean prospective buyers are betting on a pipe dream.

Except that article was written on June 8th, and a week later, the Fed raised rates by 75bps and sent the mortgage rates even higher. Affordability is absolutely cratering, not that many consumers care because they’re suffering from having to spend more on things like gas and groceries and rent.

As I laid out in part 4, politics in the United States is becoming both more radical and more populist. That’s happening on both the Left and the Right. Since politicians respond to political incentives, we can expect them to behave in relatively predictable fashion by looking at those political incentives.

In a word, the politics of the 2020s will be the politics of envy.

I think that’s a more succinct way to talk about the Optimates vs. the Populares in the 21st century world. So what does that portend for us in the industry?

Rent Control

I have written in part 4 that rent control is all but inevitable. Because once monetary policy doesn’t work, and fiscal policy is politically impossible, then the only thing left in the government’s toolbox is price controls.

I thought I’d expand on those thoughts based on more recent developments.

First is a segment that has been going viral. It’s from Last Week Tonight with John Oliver, an enormously influential HBO show. I’ve already posted videos from YouTube channels, like The Young Turks. This is now going beyond YouTubers. This is television, and today, I would argue that HBO has as much reach as does CNN or ABC News, if not more reach, especially with the younger audience. Watch the whole thing:

Rent: Last Week Tonight with John Oliver (HBO)

John Oliver discusses why rent has become increasingly unaffordable, what we can do to combat a system that is stacked against tenants, and, of course, Dakota Johnson’s complex relationship to limes. Connect with Last Week Tonight online…

Again, love him or hate him, you cannot ignore the impact that Oliver will have on his audience. Expect the chorus of “Housing is a Human Right” to get louder and louder over the coming months.

Second, I think politicians will try to make institutional landlords into the villains-du-jour, put all kinds of restrictions on them, do some backroom deals that most people can’t understand to assuage their concerns, and hope that’s the end of it. They’re not going to want to do more than that.

Unfortunately for politicians, and unfortunately for the rest of us, just going after institutional landlords who make up a tiny 2% or so of homeowners/landlords, won’t cut it with the voters. Why not?

Jim Gamble on Twitter: “I own 14 rental doors. So do thousands of small investors. / Twitter”

I own 14 rental doors. So do thousands of small investors.

The vast, vast majority of rental units are owned by thousands (tens of thousands? hundreds of thousands? millions?) of small investors. You can go after institutions all you want, but they don’t own enough to make a difference. If you want to “do something” for people struggling with skyrocketing rents, you have to go after the small investor, whether they own 2-4 units or 14 units.

Add in some of what John Oliver rants about — things like changes to eviction laws and government-provided tenant representation — and the landscape is about to get significantly worse for all real estate investors, large or small.

I do not believe, at this time, that we’ll see federal rent control. I do think we see local and state level rent control, with strong rhetorical support from national politicians.

The REALTOR Party Post-Apocalypse

As I wrote above, were these normal times the second most powerful lobby in the country, the National Association of REALTORS, would spring into action and defend the private property rights of investors. And I suspect that NAR would be very successful in convincing Congress and the regulatory agencies to stay off things like rent control, changes to eviction law, or whatever else John Oliver is calling for.

But these are not normal times. What’s more, NAR has spent at least the last ten years either alienating or ignoring the younger generations… who are either the majority of voters today, or the majority of voters very soon. Because contrary to what Bob Dylan sang (and after him Rod Stewart and Alphaville), Boomers will not stay forever young.

We’ve already gone over the politics of younger generations in Part 4. Let’s take a look at how the REALTOR Party did or did not handle the most obvious political trend in history.

In the past, I have called upon YPN to make Millennials and affordable housing a top (actually, their only) priority. I recorded a video with Nicole Lopez, a Millennial REALTOR from Houston urging the industry to take this issue seriously:

Truth About Millennials and Housing with Nicole Lopez

A conversation with a Millennial REALTOR from Houston, Nicole Lopez about why the stereotypes about her generation are simply wrong.

Last I checked, YPN was talking about how “YPN’s Presence is Stronger Than Ever“. Really, that’s the name of the article. There’s a whole section on Advocacy:

Advocacy

The young and young at heart in YPN have strong representation in the association and their presence is felt through advocacy. The YPN board said it is committed to the long-term future of advocacy at the local, state, and national association levels.

They have ongoing efforts to ensure their presence continues to grow, as reported by board member Danny Fredricks of Region 13. The network is already exceeding its advocacy participation goals for 2022.

CTRL-F for “Affordable housing” has returned zero results from the page. Same goes for “Affordability”. But hey, YPN exceeded the goal of starting 12 new YPN chapters by having 13 chapters start. Woohoo! Victory for young REALTORS!

If only these young REALTORS gave a flying fuck about their peers, the young consumers whose homeownership rate remains below 50% despite them no longer being all that young…

If only these young REALTORS had spent the past decade or so seriously advocating for #GenerationScrewed, so that Millennial and Gen-Z voters could reasonably believe that young REALTORS are actually on their side, instead of on the side of the wealthy Boomer landlord class…

If only YPN had made talking to young people about why housing is so unaffordable a priority, educating them on complex issues from monetary policy to banking regulations to local zoning and NIMBYism so they could understand why they can’t afford to buy a home and it isn’t the fault of REALTORS…

If only YPN had made a concerted effort to not just participate in REALTOR advocacy, but actually tried to change what it is that REALTORS advocate for…

Then there might be some reason to believe that these young YPN chapter members would be able to sway public opinion amongst their peers. Maybe YPN and the young REALTORS would be the best avenue for the real estate industry to do outreach and education into the younger generations, to get them on to TV shows and podcasts and YouTube channels of influencers, so the narrative doesn’t devolve into a Them Optimates vs. Us Populares politics of envy.

Since YPN has done none of those things, since young REALTORS have zero track record of advocating for, caring about, or even alerting the industry to the plight of younger voters, I think that time is now past.

Ask yourself, ask your neighbors, and ask anyone you meet in public: “Do you think that REALTORS care more about the working class or the rich?” See what answer comes back.

The Blame Game, 2020s Edition

Voters, especially the younger voters, will be told by populist politicians that the investors are to blame, that landlords are to blame, and oh yeah, those REALTORS driving around in their luxury cars and living the high life charging 6% commissions on a “human right” like housing are to blame. In fact, let’s not take my chicken little word for it.

John Wake on Twitter: “National Association of Realtors (NAR) is a top lobbyist fighting for real estate investor tax breaks.When you choose a Realtor to be your real estate agent you’re, indirectly, supporting higher investor-ownership of houses and lower home ownership by families and individuals. / Twitter”

National Association of Realtors (NAR) is a top lobbyist fighting for real estate investor tax breaks.When you choose a Realtor to be your real estate agent you’re, indirectly, supporting higher investor-ownership of houses and lower home ownership by families and individuals.

He ends the thread with:

Thank NAR and your local Realtors(tm) for putting real estate investors ahead of live-in home owners, and for skyrocketing investor purchases of single-family houses and house prices.

I initially pushed back on that tweet, because I thought it was super unfair. It was precisely the kind of villanization of REALTORS that I worried about. But John brought receipts of how NAR does in fact lobby for pro-investor policies. For example:

REALTOR® Magazine on Twitter: “NAR’s Shannon McGahn says eliminating 1031 exchanges would have a devastating effect on small investors and the economy. https://t.co/GgN51Qkc2x / Twitter”

NAR’s Shannon McGahn says eliminating 1031 exchanges would have a devastating effect on small investors and the economy. https://t.co/GgN51Qkc2x

Again, it really doesn’t matter that NAR is correct about this issue. Eliminating 1031 exchanges would harm small investors and devastate the economy. Think politics, not economics or logic.

Raise your hand if you think this kind of messaging will play with the populists of the Left and the Right whose members are young people utterly disillusioned with our current system because they can’t buy food, can’t afford gas, and can’t ever think of buying a house… and their rent is going sky-high. Think they’re going to be like, “Oh yeah, we didn’t consider the small investors and the domino effect on the economy?”

Especially when those small investors own 14 rental properties. They can’t buy one house, but some investor has fourteen of them? That ain’t gonna play in Ohio. Or Baltimore. Or anywhere.

Bankers Already Got Theirs; Whose Turn is It This Time?

In the last real economic crisis, caused by the collapse of the housing bubble, NAR and REALTORS avoided any of that shit landing on them because banks and mortgage companies were a far more convenient villain. The narrative became, “greedy bankers taking advantage of poor unsuspecting borrowers” never mind that some of these unsuspecting buyers were speculators buying a dozen homes with liar loans. The narrative of the greedy banker held, and so we got Dodd-Frank, we got CFPB, and the mortgage industry got smacked to hell and back.

This time around, who is left for the politicians to blame? Private equity funds, hedge funds, bigass investment firms all make for convenient targets. But as so many people point out, institutional investors make up a tiny percentage of single family residence buyers. Plus, all of the Congresscritters, all of the FTC regulators, all the HUD regulators, all the Congressional staffers would really like to end up working at Black Rock and State Street after leaving DC. They’re not being offered multi-million dollar jobs at RE/MAX and Compass, after all. It’s one thing to virtue signal like you’re really angry at Big Wall Street, but it’s a whole different thing to truly bite the hand that will *fingers crossed* feed you.

Who does that leave as a convenient scapegoat to villainize and to build a narrative of greed and evil around?

Especially when these are the facts:

6% commissions on $164,762 is $9,886. 5.5% commissions (“Commission rates have been lowered due to perfect competition,” says NAR) on $403,856 is $22,212. Most Americans may not be all that financially astute, and many don’t pay much attention, but I assure you that even minimally-educated people can do that kind of basic math. I assure you that populist politicians will make hay with “Your paycheck went up by a measly $4K over a decade; those greedy REALTORS saw their commissions more than double!”

Go ahead; you try to come up with a response that your neighborhood teacher or cop will accept.

And in case you missed it, Greg and I talked about this on a recent Industry Relations podcast. Real estate agents are not exactly held in high esteem by the public. They like their own REALTOR, but REALTORS as a whole? Agents in general? It’s like Congress, actually. Everybody hates Congress, but thinks their own Congresscritter is different somehow.

Friends of Convenience in High Places

Given this abnormal political reality, when REALTORS make a fantastic scapegoat for all things wrong with the housing market in 2022, politicians will do what they can to distance themselves from the “housing lobby.” Rising populism on the Left and on the Right demands it.

So as the FTC regulation hammer hits, as the lawsuits come to horrible conclusions, NAR and its state affiliates will find it tough slogging to get much in the way of reprieve from legislators. They have elections to win, and just right now, you really don’t want to be seen as being in the pocket of the housing lobby due to populist anger over housing issues.

Let me give you an example.

Say you’re Frank Pallone, Congressman from NJ. He’s in a very safe seat, winning the last three elections by over 60% of the votes. Republicans may as well not run a candidate in that district. Now, say he gets a primary challenger in 2024. Pallone is a member of the House Progressive Caucus, and has rock solid credentials as a leftist Democrat.

If you’re running against him as a Left populist, what is Pallone’s biggest weakness?

- In 2008, Pallone voted for TARP — yeah, the bank bailouts that has young people turning Socialist, and

- Pallone took a lot of money from REALTOR PAC: the maximum $10K from RPAC in 2016, 2018, 2020. He took $8K in 2010, 2012 and 2014. So far, in 2022, Pallone took $3K from RPAC.

If his primary opponent tries to tie Pallone to being in the pocket of the “real estate lobby,” the congressman is going to have to distance himself from all that REALTOR money he took over the years. It’s the logic of politics.

Rashida Tlaib and Ilhan Omar, the two members of The Squad to take money from RPAC should consider how that’s going to play with their supporters in 2024.

If you’re a Democrat politician, you really don’t want your name mentioned on John Oliver’s show or The Young Turks as someone who supported investors and the “housing lobby.” If you’re a Republican politician, you don’t want Tucker Carlson going ham on you for the same reason.

So rather than support from their friends in high places, REALTORS will see politicians falling over themselves to virtue signal like crazy, condemn “high commissions” and give stump speeches about how REALTORS help evil landlords take homes away from working families, and about how NAR is a monopoly and SomethingMustBeDone(tm). It’ll all be annoying and stupid and counterproductive and politically popular — just like Dodd-Frank and CFPB.

Bankers still got bailed out though, right? So maybe REALTOR organizations will also get bailed out after the multi-billion dollar judgments start getting handed down. But that might be about it.

Counting on the government to Do the Right Thing is a dicey proposition in the best of times. In this political environment, that’s going beyond optimism.

It is unlikely that Congress passes some kind of legislation to help out NAR and the real estate industry on tough issues like preserving cooperation and compensation, rolling commissions into the mortgage, or even preserving the independent contractor status of real estate agents. They can’t touch anything helping landlords, who are about to be near-criminalized going by John Oliver’s propagandistic treatment of property investors.

Immediately After the Apocalypse

Let us then assume that the regulatory asteroid hits the industry. It will not be the mild variety, but the stronger one, such as prohibiting the sharing of commissions and making the steering of buyers into a federal violation. Congress will not be of much help. What does that look like?

Agents

For starters, some enormous percentage of real estate agents get wiped out. Overnight.

The concentration of power and market share in the hands of the top producers has been going on for decades. COVID accelerated that trend. Most of those top producers are strong listing agents. They’ll be fine.

Newer agents, lower producers, and mid-level producers all depend on buyer agency business to stay afloat. Most of that income is going away.

Even if NAR somehow manages to get buyer commissions rolled into mortgages, it makes no sense for buyers to pay their agents a percentage of the sale price of what they’re buying. Buyers have zero reason to incentivize their representative to drive the price up. So buyer agents will need to:

(a) convince the buyer to pay them in the first place; and

(b) charge by the hour, by a flat fee, or by the transaction

Quite a few buyers will simply elect to go unrepresented because they can’t afford representation, and most will just pay by the hour.

Furthermore, even among the top producers, there will start to be a gap opening up between those agents who are comfortable with finance and investment and those who are not. As buyer demand rotates away from consumers and towards investors, those agents who can talk to investors have an advantage over those who can’t.

I think a 30% drop in agent count is conservative; on the DOOOM! side of things, we could see agent counts drop by 70%. “List to Last” has always been a thing in the industry, and it’s going to take on new significance post-apocalypse.

Brokers

If agents get wiped out, then brokers also have to get wiped out. Those are their customers, after all.

In addition, most brokers make precious little profit from the top producers because of the prevailing compensation structures in the industry. Things like commission caps, 90/10 splits, etc. are real. Most brokers make what profits they make from the lower producers and mid-level producers who are on 70/30 splits with no concessions. Those agents make their money primarily from representing buyers. That business is about to (a) decrease significantly, and (b) pay much, much less.

On top of that problem, changes in the market means that the ancillary businesses for brokerages where they make their real profits have to suffer. Investors don’t need purchase mortgages as much as consumers do. Institutions don’t necessarily care about title insurance the way consumers do. Home insurance might be a thing for investors, but they might have commercial-grade insurance for that.

MLS

I don’t think we need to spend too much time here, since the end to cooperation and compensation means the MLS is just a database of listings that has no way to enforce their rules.

Since there is some value in having accurate data, the MLS won’t disappear post-apocalypse. But most of them will disappear, because the country and the economy post-apocalypse don’t need 500+ MLSs. They need maybe 10. Maybe 4. Maybe one.

The remaining MLSs will not be monopolies, and won’t be about guaranteeing compensation. They’ll be about data, about some kind of utility to brokers and agents, and be much, much larger.

REALTOR Associations

While the MLS will survive in some form, the REALTOR Associations might not survive at all.

The most obvious reason is that all of the REALTOR organizations put together cannot pay the damages from any of the big antitrust civil action lawsuits. They’ll all be bankrupt overnight from those damages. Their insurance companies can’t cover the tens of billions in damages either. They’ll also go bankrupt if they have to.

But let’s assume they survive that somehow, because Congress crafts some sort of settlement.

Once the MLS is no longer a real thing, and certainly not controlled by the REALTOR Associations, why would brokers and agents pay annual dues to join voluntary trade organizations? It’s unlikely to be for the discounts on Hertz rental cars.

A few diehard true believers will remain, and that’s probably for the best. We’ll see a return to the National Association OF REALTORS that truly gives a damn about things like property rights and Under All is the Land, from today’s National Association FOR REALTORS. Maybe that Association will be a major part of the housing affordability conversation going forward, post-apocalypse.

Tech Companies

The answer here depends on what kind of tech and what kind of company. I have no actual statistics to prove this, but I would estimate that the vast majority of proptech companies provide some kind of technology to agents so they can (1) acquire customers, and (2) help buyers buy homes. Most of their customer base is about to go poof. Most buyer agents just won’t have the kind of money to spend on technology when their per-transaction income goes from $22K on average to maybe something more like $50 per hour x 10 hours.

Most proptech will be decimated. A few will survive and thrive post-apocalypse.

Big Winners, Big Losers

The big winners from the apocalypse are those companies whose business model has nothing to with real estate agents, and has little to do with home prices.

Zillow is in big trouble; BIG trouble. I mean, what’s the value of Premier Agent if you have to convince the buyer to pay you at all, and then to pay you some kind of a flat fee for helping them? On a Zillow Flex model, where the agent pays 35% referral fees, that’s awesome for Zillow when the 35% is on $22K buy-side commission. It’s significantly less awesome for Zillow if they’re getting 35% of $500 flat fee. For the same reasons, Realtor.com, Redfin, and all of the portals are big losers as well.

IDX companies, agent website companies, lead generation companies are all big losers for similar reasons.

All of the brokerages are in big trouble, because of their reliance on buyer commissions. Those with unusually strong listing business, who are somehow able to get the listing agents to cough up more of the GCI, will be fine… but I honestly can’t think of a single brokerage in the industry today who can get strong listing agents to cough up 20-30% of the GCI for whatever services they as a brokerage are providing.

In contrast, Opendoor is a big winner; they’re market makers who can buy low and sell high no matter what the price. They don’t rely on buyer commissions; in fact, they don’t rely on seller commissions either. So Opendoor (and others like them, like Offerpad) will be a big winner post-apocalypse.

Companies like Ribbon and Flyhomes may end up as big winners, as the changing market conditions make cash purchases even more important. And they’re not relying on either buyer agent commissions or on home prices to be profitable.

There are others, but let’s leave that for future discussions. This is getting far too long.

Wrapping Up

I said at the beginning of the year that I’m done criticizing NAR, criticizing organized real estate, criticizing the MLS, because I felt that all of that was falling on deaf ears. This post is not criticism; I do not expect NAR or YPN to change. I do not expect brokerages and real estate companies to change. I am simply describing what I see happening.

The Four Horsemen of the Housing Apocalypse are big trends that are predictable. They are, if you will, grey geese. What is not predictable are Black Swan events that none of us can even think to contemplate. The United States defaulting on its debt might be such a Black Swan. We can’t even conceive of it. Outbreak of nuclear war in Europe is a Black Swan event that we can’t actually contemplate because of its horrors.

If there is a call to action here at all, I think there are two.

One, as I’ve been saying for about a decade now, those in senior leadership positions at MLS, REALTOR Associations, brokerages, real estate conglomerates, proptech companies, and other organizations need to engage in strategic contingency planning. I’m a consultant, so of course I’ll say that; but you don’t have to use me. Use your own consultant, your own staff, your own strategic thinkers. But it is an imperative that you start thinking about what you will need to do post-apocalypse.

Two, engage in public conversations and debates. I hope you’d do that with me, and make arguments as to why I’m wrong, what I’m missing, facts I’m overlooking, or wrong conclusions I am drawing. Show me the many ways in which I am wrong, because I would love to be wrong about the Four Horsemen.

We are on the verge of systemic reset, when the foundation of the industry will shift. Central institutions we all have relied on for years if not decades will disappear and be replaced by new institutions. It is as Ray Dalio and others have described for years: the end of the current order doesn’t mean the end of the world. It means the end of the world we have come to know, the world we live in today, to be replaced by a new world order. Sing dirges in the dark and say bye, bye Miss American Pie.

We’ll see it everywhere soon enough, but we’ll see it first in real estate because real estate is a unique combination of physical reality, of a necessary good for life, and financialization of the economy. It is the sector of the economy that has been broken the longest, so it will break first before other sectors.

Finally, my original intent was for this series to be five parts: the Four Horsemen plus this Industry Impact piece. But more than one of you readers have reached out and asked if I could give my thoughts on what happens after the apocalypse longer term. The immediate impact might be horrible, but after things settle down, what comes next? If companies engage in strategic contingency planning, what should they be thinking about, focusing on, and considering doing?

So there will be a Part 6: the new age. Even the Book of Revelations ends not with eternal damnation but a New Jerusalem, a new heaven and a new earth. As I am actually remarkably optimistic about our longterm future, I’ll put that together next.

-rsh

Home Free – American Pie ft. Don McLean (Official Music Video)

“American Pie” by Home Free Ft. Don McLean is out now! 🇺🇸🥧 Plus, our Making Of American Pie episode at https://www.youtube.com/watch?v=BNsBjr86eDE ► Thanks for watching y’all! If you liked this, then you’ll love seeing us live ➡️ https://homefreemusic.lnk.to/tourYT ► Free Concert Tickets Monthly and Sneak Peek of Our New Videos: https://homefreemusic.lnk.to/patreonYT ► Keep In Touch, Dang It!

1 thought on “Four Horsemen of the Housing Apocalypse, Part 5: What It All Might Mean”

Comments are closed.